Welcome to our Credit Administrator Resume Example article. Here we will provide you with valuable information and tips on how to create an effective resume for a Credit Administrator. We'll provide some key points and examples to help you highlight your skills and experience, as well as how to get the most out of each section. By the end of this article, you should be well on your way to creating a complete and professional resume.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Credit Administrator do?

A Credit Administrator is responsible for overseeing the credit department of an organization. They handle the credit granting process, credit risk analysis, and credit management. They also review customer credit applications, evaluate customer creditworthiness, and negotiate credit terms with customers. Other duties may include setting and monitoring credit limits, monitoring accounts receivable, and working with other departments to ensure customer payments are received on time.

- Credit Administrator Resume Sample

- Business Analyst Resume Sample

- CFO Resume Sample

- Credit Manager Resume Sample

- Finance Manager Resume Sample

- Actuary Resume Sample

- Claim Specialist Resume Sample

- Finance Officer Resume Sample

- Account Administrator Resume Sample

- Account Analyst Resume Sample

- Accounting Analyst Resume Sample

- Accounting Assistant Resume Sample

- Accounting Associate Resume Sample

- Accounting Auditor Resume Sample

- Accounting Consultant Resume Sample

- Accounting Coordinator Resume Sample

- Accounting Manager Resume Sample

- Accounting Specialist Resume Sample

- Audit Director Resume Sample

- Banking Consultant Resume Sample

What are some responsibilities of a Credit Administrator?

- Review and approve credit applications for new clients

- Monitor existing clients' credit accounts

- Review credit reports and financial statements

- Maintain credit and collection policies and procedures

- Work with sales team to ensure credit policies are followed

- Ensure compliance with all applicable credit regulations

- Manage collection efforts for past due accounts

- Prepare reports and analyze credit trends

- Provide recommendations to reduce credit risk

- Negotiate payment terms with customers

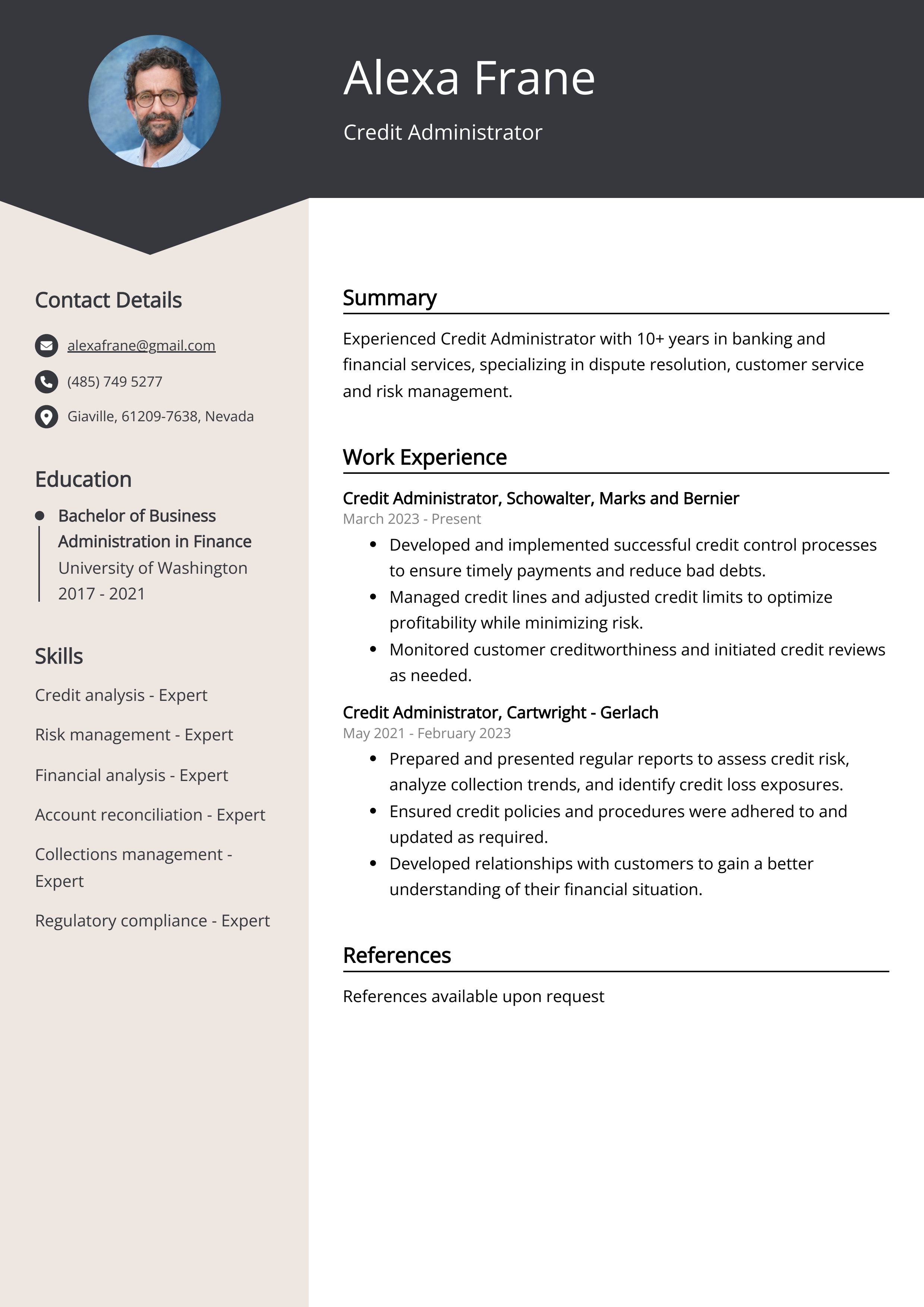

Sample Credit Administrator Resume for Inspiration

Name: John Doe

Address: 123 Fake Street, Anytown, USA

Phone: (123) 456-7890

Email: johndoe@example.com

Experienced Credit Administrator with a background in financial services and knowledge of the banking industry. Possesses excellent communication skills and ability to work under pressure in a fast-paced environment. Proven track record of managing numerous banking functions and providing exemplary customer service.

Work Experience- Credit Administrator, Bank of America, Anytown, USA (2012-Present)

- Developed credit policies and procedures for the organization.

- Analyzed customer credit history and created individualized credit plans.

- Prepared reports and documents such as credit applications and credit agreements.

- Credit Analyst, ABC Bank, Anytown, USA (2007-2012)

- Reviewed financial statements and credit reports.

- Analyzed credit risks and evaluated credit worthiness of customers.

- Advised customers on financial decisions and credit options.

- B.A. in Finance, Anytown University, Anytown, USA (2007)

- Financial Analysis

- Risk Management

- Credit Analysis

- Account Management

- Customer Service

- Certified Credit Analyst (CCA) (2013)

- English (Fluent)

- Spanish (Basic)

Resume tips for Credit Administrator

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Credit Administrator resume tips.

We collected the best tips from seasoned Credit Administrator - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight relevant work experience and qualifications.

- Include a clear summary of your experience and qualifications.

- Include a list of any relevant certifications, licenses, or credentials.

- Include details of any relevant software experience and the ability to use any credit management software.

- Make sure your resume is tailored to the specific job you are applying for.

Credit Administrator Resume Summary Examples

A credit administrator resume summary or resume objective is a great way to make a strong first impression with potential employers. It serves as a snapshot of your qualifications, experience and skills and is usually the first thing employers will read when reviewing your resume. It should highlight your experience in credit administration, financial analysis, customer service, and/or risk assessment, as well as any relevant certifications and education you may have. With a well-crafted summary or objective, you can quickly demonstrate your potential value to a potential employer, setting you apart from other candidates.

For Example:

- Highly experienced Credit Administrator with 12 years of experience in managing accounts receivable and collections.

- Proficient in utilizing credit management software, overseeing financial operations and creating reports.

- Adept at handling customer inquiries, resolving disputes and minimizing bad debt.

- Knowledgeable in developing credit policies, minimizing financial risk and administering credit accounts.

- Capable of quickly and accurately assessing credit worthiness of potential customers.

Build a Strong Experience Section for Your Credit Administrator Resume

A strong experience section on a credit administrator resume is important because it gives potential employers a comprehensive overview of a candidate’s qualifications and background. It allows employers to see exactly what the candidate is capable of, from their past experience and accomplishments. It also helps employers decide whether or not the candidate is the right fit for the position. Additionally, a strong experience section can give employers insight into the candidate’s work ethic, communication skills, and overall qualifications.

For Example:

- Managed the day-to-day operations of a credit department for a medium-sized business.

- Managed a team of credit administrators and provided guidance and technical support.

- Performed credit analysis and made decisions based on creditworthiness of applicants.

- Conducted credit checks and evaluated customer's financial information.

- Developed and implemented credit policies and procedures to ensure compliance with legal requirements.

- Analyzed financial statements and credit reports to assess risk.

- Established and maintained relationships with customers and vendors.

- Ensured accurate and timely invoicing and collection of accounts receivable.

- Assisted in resolving customer disputes and chargebacks.

- Coordinated and monitored the financial performance of customer accounts.

Credit Administrator resume education example

The exact education requirements for a Credit Administrator vary depending on the employer and the specific job requirements, but most positions require at least a bachelor’s degree in finance, accounting, business, or a related field. In some cases, a master's degree may be preferred or required. Additional certifications, such as those from the Credit Research Foundation or the National Association of Credit Management, may also be beneficial.

Here is an example of an experience listing suitable for a Credit Administrator resume:

- Bachelor of Science in Business Administration (BSBA), Finance, University of California, Los Angeles (UCLA), 2017

- Associate of Arts in Business Administration (AABA), Accounting, Pasadena City College, 2015

- Certified Public Accountant (CPA), California Board of Accountancy, 2016

- Certified Credit Analyst (CCA), Institute of Credit Management, 2018

Credit Administrator Skills for a Resume

Adding relevant skills for a Credit Administrator Resume is critical to demonstrate an applicant's ability to handle the demands of the role. It is important to focus on skills related to evaluating credit applications, managing accounts receivable, and resolving customer disputes. Additionally, including hard and soft skills, such as knowledge of banking regulations, communication, and problem-solving, can help to demonstrate an applicant's ability to work in a fast-paced environment and handle a wide variety of tasks.

Soft Skills:

- Detail-oriented

- Organizational

- Analytical

- Problem-solving

- Time-management

- Multi-tasking

- Interpersonal

- Communication

- Negotiation

- Accounting

- Credit Analysis

- Accounting

- Financial Reporting

- Risk Management

- Data Analysis

- Credit Evaluation

- Budgeting

- Loan Origination

- Compliance Regulations

- Collection Strategies

Common Mistakes to Avoid When Writing a Credit Administrator Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Credit Administrator resume

- Highlight experience in banking, finance, or credit-related fields.

- Demonstrate knowledge of credit laws, policies, and procedures.

- Showcase ability to analyze creditworthiness of potential clients.

- Detail ability to evaluate credit applications and make credit decisions.

- Display strong customer service, problem-solving, and communication skills.

- Demonstrate proficiency with computer programs, such as MS Office.

- Mention experience monitoring and managing customer accounts.

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.