This article will provide you with an example of a professional resume for a Claim Specialist. We will cover all the key aspects of a successful resume, from a comprehensive summary to all the necessary skills and experience to make you stand out from the competition. We will also provide tips and tricks to ensure your resume is the best it can be. With this comprehensive guide, you will be one step closer to landing the job of your dreams.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Claim Specialist do?

A Claim Specialist is responsible for processing, investigating, and resolving insurance claims. This includes assessing the validity of the claim, gathering evidence and documentation, negotiating settlements, and paying out claims. They must also analyze patterns of claims and assess the risk for potential losses.

- Credit Administrator Resume Sample

- Business Analyst Resume Sample

- CFO Resume Sample

- Credit Manager Resume Sample

- Finance Manager Resume Sample

- Actuary Resume Sample

- Claim Specialist Resume Sample

- Finance Officer Resume Sample

- Account Administrator Resume Sample

- Account Analyst Resume Sample

- Accounting Analyst Resume Sample

- Accounting Assistant Resume Sample

- Accounting Associate Resume Sample

- Accounting Auditor Resume Sample

- Accounting Consultant Resume Sample

- Accounting Coordinator Resume Sample

- Accounting Manager Resume Sample

- Accounting Specialist Resume Sample

- Audit Director Resume Sample

- Banking Consultant Resume Sample

What are some responsibilities of a Claim Specialist?

- Investigate and process insurance claims

- Evaluate insurance policy coverage and determine the extent of the insurer’s liability

- Review and analyze relevant documents, such as police reports, medical records, and employment records

- Verify the accuracy of all claim information

- Negotiate with claimants, insurance companies, and legal representatives

- Develop and recommend settlement amounts

- Maintain detailed records of all claims and payments

- Provide prompt and courteous customer service

- Stay up-to-date on changes in insurance regulations and policy standards

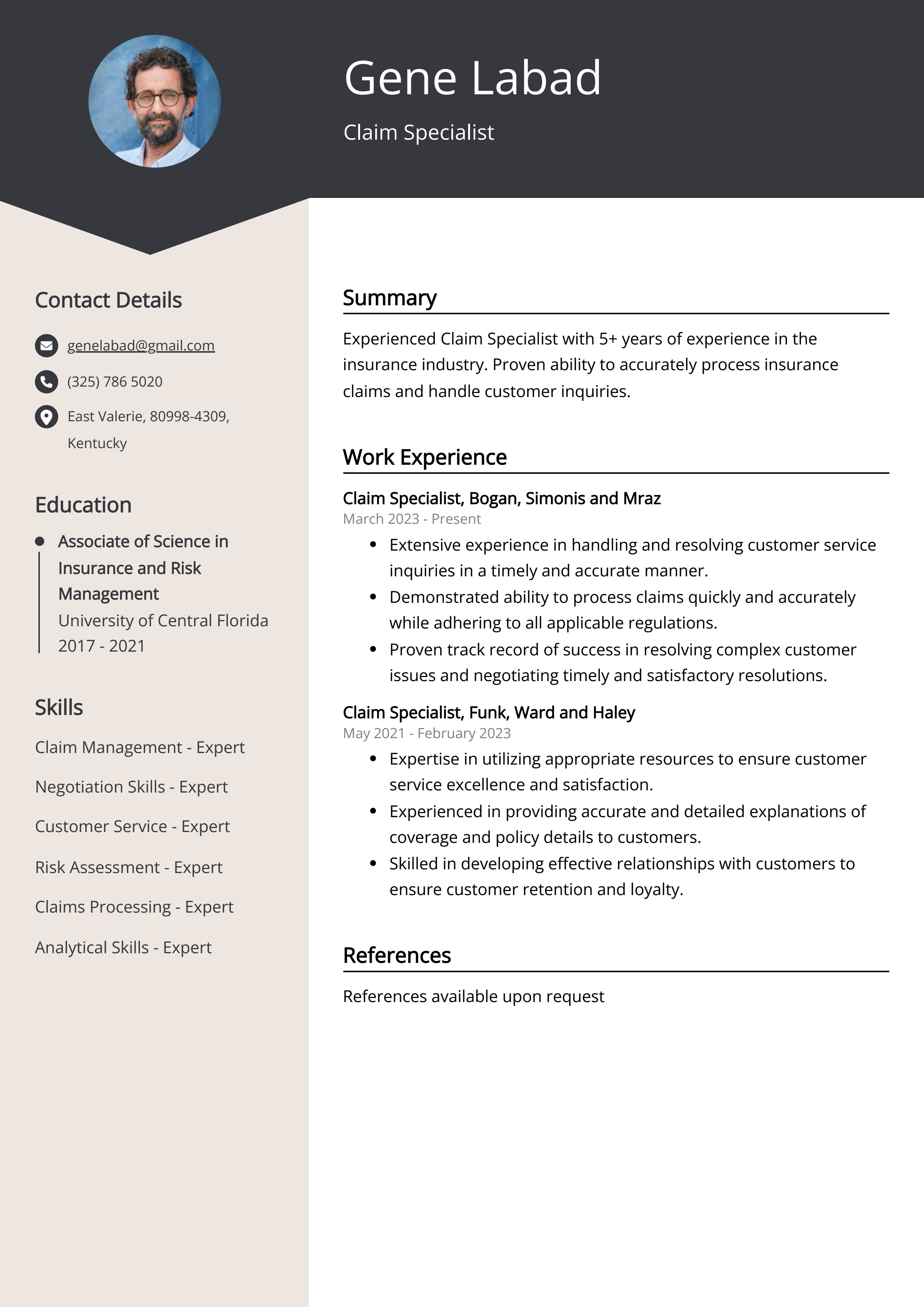

Sample Claim Specialist Resume for Inspiration

John Doe

Address: 123 Main Street, Anytown, USA

Phone: (555) 555-5555

Email: john.doe@example.com

Summary

John Doe is an experienced Claim Specialist with expertise in resolving customer complaints and resolving complex claims. He is detail-oriented, organized, and has an eye for accuracy. He has a commitment to excellence and is adept at providing efficient customer service.

Work Experience

- Claim Specialist, ABC Insurance Co. – Anytown, USA (2020 - Present)

- Manage customer complaints and disputes related to claims.

- Verify customer information and process claims.

- Identify fraudulent claims and resolve discrepancies.

- Provide customer assistance and answer inquiries.

- Claims Analyst, DEF Insurance Co. – Anytown, USA (2017 – 2020)

- Investigated and processed insurance claims.

- Reviewed policies and determined coverage.

- Ensured accurate data entry and compliance with regulations.

- Resolved customer complaints in a timely manner.

Education

Bachelor of Science in Business Administration, Anytown University – Anytown, USA (2013)

Skills

- Claims Processing

- Customer Service

- Data Entry

- Fraud Detection

- Insurance Regulation

Certifications

Certified Claim Specialist, Anytown Insurance Institute – Anytown, USA (2019)

Languages

English (Fluent)

Resume tips for Claim Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Claim Specialist resume tips.

We collected the best tips from seasoned Claim Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your customer service experience, as the primary purpose of a Claim Specialist is to provide excellent customer service.

- Include specific claims-related experience such as claims processing, handling customer inquiries and complaints, and resolving disputes.

- Showcase your technical and computer skills, as many employers now use automated systems to process claims.

- Detail your knowledge of relevant laws, regulations, and industry standards related to claims processing.

- Demonstrate your problem solving and conflict resolution ability, as Claim Specialists must be able to solve complex problems quickly.

Claim Specialist Resume Summary Examples

A resume summary or resume objective can be used to help a potential employer quickly assess the value a candidate can bring to the company. A summary or objective allows the employer to quickly identify the candidate’s experience and qualifications, and determine whether the individual is a good fit for the job. For a claim specialist, a resume summary or objective should concisely highlight the candidate’s experience as a claims adjuster, as well as any relevant education and certifications. This can help the employer quickly determine if the candidate has the skills necessary to be successful in the role.

For Example:

- Highly organized and detail-oriented Claim Specialist with 5 years of experience in the insurance industry. Skilled in assessing risk, tracking claims and maintaining accurate records.

- Experienced and reliable Claim Specialist with 7 years of expertise in the insurance industry. Adept at investigating and evaluating claims, resolving disputes and providing customer service.

- Dynamic Claim Specialist with 3 years of experience in the insurance industry. Skilled in evaluating and processing claims, resolving disputes and providing excellent customer service.

- Results-oriented Claim Specialist with 4 years of experience in the insurance sector. Skilled in assessing and evaluating claims, managing customer inquiries and ensuring accuracy of records.

- Industry-savvy Claim Specialist with 6 years of experience in the insurance industry. Proficient in evaluating risk, processing claims and resolving customer disputes.

Build a Strong Experience Section for Your Claim Specialist Resume

Having a strong experience section on a resume for a claim specialist is very important because it will demonstrate to potential employers your capabilities and qualifications for the position. This section should include a list of all previous claims specialist positions held, as well as any additional experience that is related to the position. Additionally, it should include information on any training or certifications you have received related to the field. Finally, this section should include any professional accomplishments that highlight your performance as a claims specialist. By providing this information, employers will have a better understanding of your qualifications and be more likely to invite you in for an interview.

For Example:

- Supported customer service operations for a large-scale health insurance provider, with a focus on claim processing, eligibility verification and customer service.

- Managed a team of 8-10 claim specialists, with responsibility for all customer service related issues.

- Developed and implemented customer service policies and procedures for the claims department.

- Analyzed customer feedback and identified opportunities for improving customer service operations.

- Resolved customer complaints in a timely and professional manner.

- Maintained up-to-date knowledge of the company's products and services.

- Provided training and support to new and existing claim specialists.

- Performed detailed analysis of customer service trends and metrics.

- Assisted with the development of customer service performance metrics and reporting.

- Assisted with the development of customer service strategies and initiatives.

Claim Specialist resume education example

A Claim Specialist typically needs a bachelor's degree in business, finance, accounting, or a related field. In addition, some employers may require certification in areas such as Fraud Examination, Insurance Adjusting, or Risk Management. Claim Specialists must also possess strong communication and problem-solving skills and be familiar with applicable laws and regulations.

Here is an example of an experience listing suitable for a Claim Specialist resume:

- Bachelor of Science in Business Administration, University of California, Los Angeles (UCLA) - 2016

- Certificate in Insurance and Risk Management, University of California, Los Angeles (UCLA) - 2017

- Certificate in Claims Management, Cornell University - 2018

Claim Specialist Skills for a Resume

Adding skills to a Claim Specialist Resume is important because it allows employers to quickly assess your qualifications. It also helps to highlight the abilities you possess that are relevant to the job position. Including skills on your resume can also demonstrate your knowledge and experience in the field. Examples of skills to include on a Claim Specialist Resume are: customer service, problem-solving, communication, data entry, attention to detail, research, organizational skills, and time management.

Soft Skills:

- Attention to Detail

- Problem-Solving

- Analytical Thinking

- Organizational Skills

- Interpersonal Communication

- Time Management

- Negotiation Skills

- Research Skills

- Adaptability

- Conflict Resolution

- Insurance Claim Processing

- Claim Resolution

- Claim Adjusting

- Investigation Techniques

- Data Analysis

- Risk Management

- Claim Documentation

- Claim Auditing

- Litigation Support

- Computer Proficiency

Common Mistakes to Avoid When Writing a Claim Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Claim Specialist resume

- Highlight your expertise in customer service and claims processing.

- Showcase your ability to handle customer inquiries and adjust claims.

- Display your knowledge of insurance regulations and policies.

- Mention your experience with developing and implementing procedures.

- Point out any computer skills you have related to claims processing.

- List any accomplishments you have achieved in the claims specialist field.

- Highlight any certifications or awards you have earned in the field.

- Discuss any relevant volunteer experience you have gained.

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.