Actuaries are highly sought-after professionals who use mathematical and statistical models to analyze financial risks and uncertainties. This article provides an example of an Actuary Resume that highlights the professional's experience, skills, and qualifications to help them stand out from the crowd. It also provides helpful tips on how to write an effective resume for the actuarial profession. We hope this article will help you create a winning resume that will get you the job you want.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does an Actuary do?

Actuaries use mathematics, statistics, and financial theory to analyze and assess the risks associated with certain events, such as death, injury, disability, illness, and property damage. They use their analysis to develop strategies to reduce or manage the risk and to create insurance policies that provide protection against the potential losses due to these events. Actuaries also use their skills to develop pension and health plans, analyze the financial costs of proposed legislation, and advise businesses on mergers and acquisitions.

- Credit Administrator Resume Sample

- Business Analyst Resume Sample

- CFO Resume Sample

- Credit Manager Resume Sample

- Finance Manager Resume Sample

- Actuary Resume Sample

- Claim Specialist Resume Sample

- Finance Officer Resume Sample

- Account Administrator Resume Sample

- Account Analyst Resume Sample

- Accounting Analyst Resume Sample

- Accounting Assistant Resume Sample

- Accounting Associate Resume Sample

- Accounting Auditor Resume Sample

- Accounting Consultant Resume Sample

- Accounting Coordinator Resume Sample

- Accounting Manager Resume Sample

- Accounting Specialist Resume Sample

- Audit Director Resume Sample

- Banking Consultant Resume Sample

What are some responsibilities of an Actuary?

- Analyze and calculate financial risks, using mathematics, statistics, and financial theory.

- Examine historical data to forecast the probability and likely cost of future events.

- Create models to calculate the financial impact of certain risks and help clients develop strategies to minimize or manage those risks.

- Develop and recommend products to help clients reduce or manage risk.

- Consult with clients on a variety of issues, such as pricing, product design, and underwriting guidelines.

- Monitor and analyze changes in the economy, legislation, and regulations that may affect the risk of clients.

- Provide advice on how best to manage and invest assets to maximize returns and minimize risk.

- Work with other professionals, such as lawyers and accountants, to ensure compliance with applicable regulations.

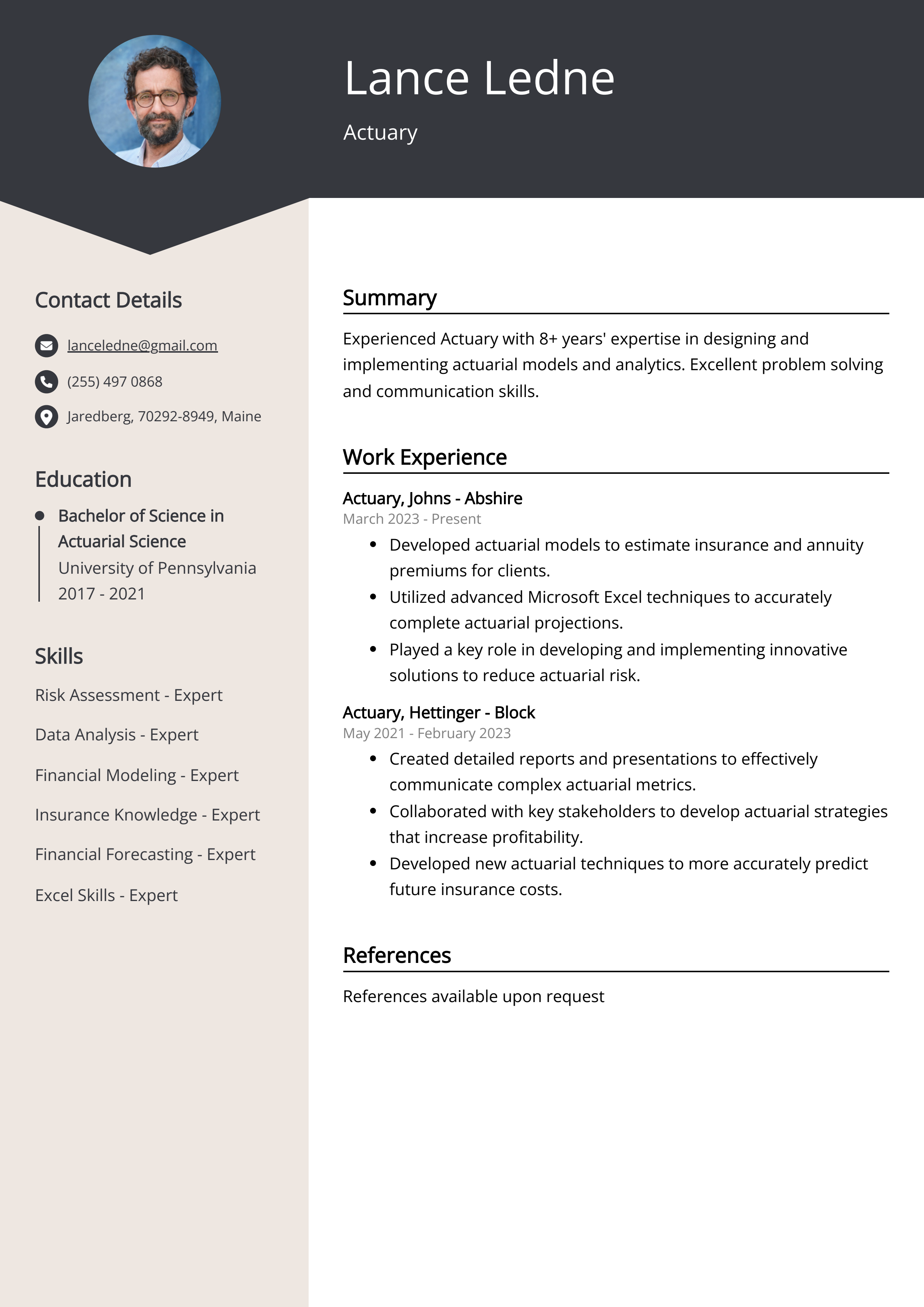

Sample Actuary Resume for Inspiration

Personal Details

- Name: John Smith

- Address: 123 Main Street, Anytown, USA

- Email: john.smith@example.com

- Phone: 123-456-7890

Summary

John Smith is an experienced Actuary with a passion for solving complex problems and helping people understand their financial future. He has a strong background in mathematics, data analysis, and risk management, and is highly proficient in Excel, MATLAB, and other analytical software. He is a certified Actuary and speaks fluent English and Spanish.Work Experience

- Actuarial Analyst, ABC Company, Anytown, USA (2010-Present)

- Analyzed customer data to determine appropriate insurance rates

- Developed new actuarial models for pricing and risk management

- Created and maintained actuarial databases for data analysis

- Provided actuarial advice to internal and external stakeholders

Education

- Bachelor of Science in Mathematics, Anytown University, Anytown, USA (2006-2010)

Skills

- Mathematical modeling

- Data analysis

- Risk management

- Software development

- Excel

- MATLAB

Certifications

- Associate of the Society of Actuaries (ASA)

Languages

- English (Fluent)

- Spanish (Fluent)

Resume tips for Actuary

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Actuary resume tips.

We collected the best tips from seasoned Actuary - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience with quantitative analysis, data analysis and risk management

- Include any relevant certifications, such as the Associate of the Society of Actuaries (ASA) or Fellow of the Society of Actuaries (FSA)

- Showcase any specializations or expertise, such as in pension actuarial calculations or employee benefits

- Mention any software programs you are proficient in, such as Excel, Access and SAS

- Demonstrate your technical writing and communication capabilities by including any relevant presentations or publications

Actuary Resume Summary Examples

A resume summary or objective is an important tool for actuary job seekers. This statement allows an employer to quickly understand an applicant's relevant experience and qualifications. It should be concise and highlight the skills, qualifications, and experience that are most relevant to the desired position. A resume summary or objective also serves as an introduction to the rest of the resume and helps the employer to determine if the applicant is a good fit for the position.

For Example:

- Actuary with 5+ years of experience in risk management and insurance. Skilled in data analysis, financial modeling, and problem solving.

- Highly organized Actuary with 7+ years of experience in claims analysis, financial modeling, and risk assessment. Proven track record of success.

- Professional Actuary with 8+ years of experience in forecasting, data analysis, and financial modeling. Adept at balancing client needs with company objectives.

- Experienced Actuary with 10+ years of experience in financial modeling and risk management. Possesses excellent organizational and data analysis skills.

- Expert Actuary with 20+ years of experience in financial forecasting and project management. Adept at working with teams to develop innovative solutions.

Build a Strong Experience Section for Your Actuary Resume

Building a strong experience section for an actuary resume is important because it showcases the candidate’s skills and qualifications to potential employers. It should include any relevant experience related to the position, such as past actuarial or finance roles, as well as any volunteer or extracurricular activities that demonstrate the candidate’s problem-solving and analytical skills. This section should also include any internships or apprenticeships that the candidate has completed. The experience section should be concise and organized in reverse chronological order to emphasize the most recent and relevant positions. This section should also include any certifications or licenses the candidate has earned.

For Example:

- Performed detailed analysis of pension funds and insurance policies to determine long-term financial requirements.

- Conducted actuarial valuations of pension funds to ensure compliance with relevant regulation.

- Designed and implemented sophisticated actuarial models to quantify financial risk.

- Reviewed and interpreted actuarial reports and financial documents to identify areas of financial risk.

- Developed retirement models to predict future liabilities and adjust for changes in the economic environment.

- Provided expert advice on actuarial and financial issues to senior management.

- Created actuarial models to evaluate the potential impact of new legislation on company finances.

- Analyzed financial and insurance data to identify trends and suggest improvements.

- Prepared reports and presentations for senior management on actuarial issues.

- Educated clients on the principles of actuarial science and the importance of financial planning.

Actuary resume education example

An actuary typically needs a bachelor's degree in actuarial science, mathematics, statistics, or a related field. In addition, the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS) require that individuals pass a series of exams to become a fully qualified actuary.

Here is an example of an experience listing suitable for a Actuary resume:

- Bachelor of Science in Mathematics, University of Texas, Austin, TX - Expected Graduation May 2021

- Certificate in Actuarial Science, Society of Actuaries, Chicago, IL - June 2019

Actuary Skills for a Resume

Adding skills to an Actuary Resume is important because it allows employers to quickly assess your competency and knowledge. It gives employers a clear understanding of your abilities and qualifications. Skills can also help you stand out from other candidates who may have similar educational backgrounds and experience. Examples of skills that are often included on Actuary Resumes include knowledge of actuarial mathematics, statistics, risk management, financial analysis, problem solving, and data modeling.

Soft Skills:

- Critical Thinking

- Analytical Skills

- Problem Solving

- Communication

- Organizational

- Leadership

- Attention to Detail

- Time Management

- Flexibility

- Interpersonal

- Statistical Analysis

- Financial Modeling

- Risk Analysis

- Data Analysis

- Mathematics

- Excel Modeling

- Programming

- Accounting

- Database Management

- Actuarial Science

Common Mistakes to Avoid When Writing an Actuary Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Actuary resume

- Highlight your knowledge of mathematics, statistics, and financial analysis.

- Showcase your problem-solving skills.

- Demonstrate your ability to create and interpret data.

- Include experience with risk analysis and forecasting.

- Highlight your ability to work with large amounts of data.

- Highlight your knowledge of insurance and financial regulations.

- Emphasize your communication skills.

- Be sure to include any relevant certifications.

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.