This resume example for a Tax Clerk position provides a helpful starting point for job seekers looking to enter the tax preparation and accounting fields. It gives a snapshot of the candidate's qualifications and experience, and offers valuable insight into how to maximize the impact of a resume. The example also offers helpful tips on what to include in a resume and how to best showcase relevant skills. With the right approach, this resume example can be used as a guide to create a winning resume for your job application.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Tax Clerk do?

A Tax Clerk is responsible for helping customers understand and comply with state and federal tax laws. They are responsible for preparing tax returns, assisting in audits, and providing tax information. They also help customers with filing taxes, collecting taxes, and providing advice on tax-related matters. Tax Clerks must stay up-to-date on changes in tax laws and regulations.

- Director Of Accounting Resume Sample

- Billing Manager Resume Sample

- Chief Investment Officer Resume Sample

- Compliance Analyst Resume Sample

- CFO Resume Sample

- Risk Management Specialist Resume Sample

- Financial Project Manager Resume Sample

- Teller Resume Sample

- Appraiser Resume Sample

- Experienced Real Estate Agent Resume Sample

- Financial Data Analyst Resume Sample

- Accounting Auditor Resume Sample

- Accounts Receivable Coordinator Resume Sample

- Account Analyst Resume Sample

- Accounting Specialist Resume Sample

- Mortgage Analyst Resume Sample

- Financial Business Analyst Resume Sample

- Finance Analyst Resume Sample

- Finance Officer Resume Sample

- Financial Consultant Resume Sample

What are some responsibilities of a Tax Clerk?

- Calculate taxes owed according to prescribed rates

- Maintain accurate records of taxes paid and collected

- Prepare and submit reports to the appropriate authorities

- Ensure compliance with tax legislation and regulations

- Advise clients on tax-related matters and provide assistance with filing tax returns

- Respond to inquiries from clients, the public and government agencies

- Investigate discrepancies in tax records and take corrective action

- Process payments and refunds as required

- Perform audits and reviews of tax records

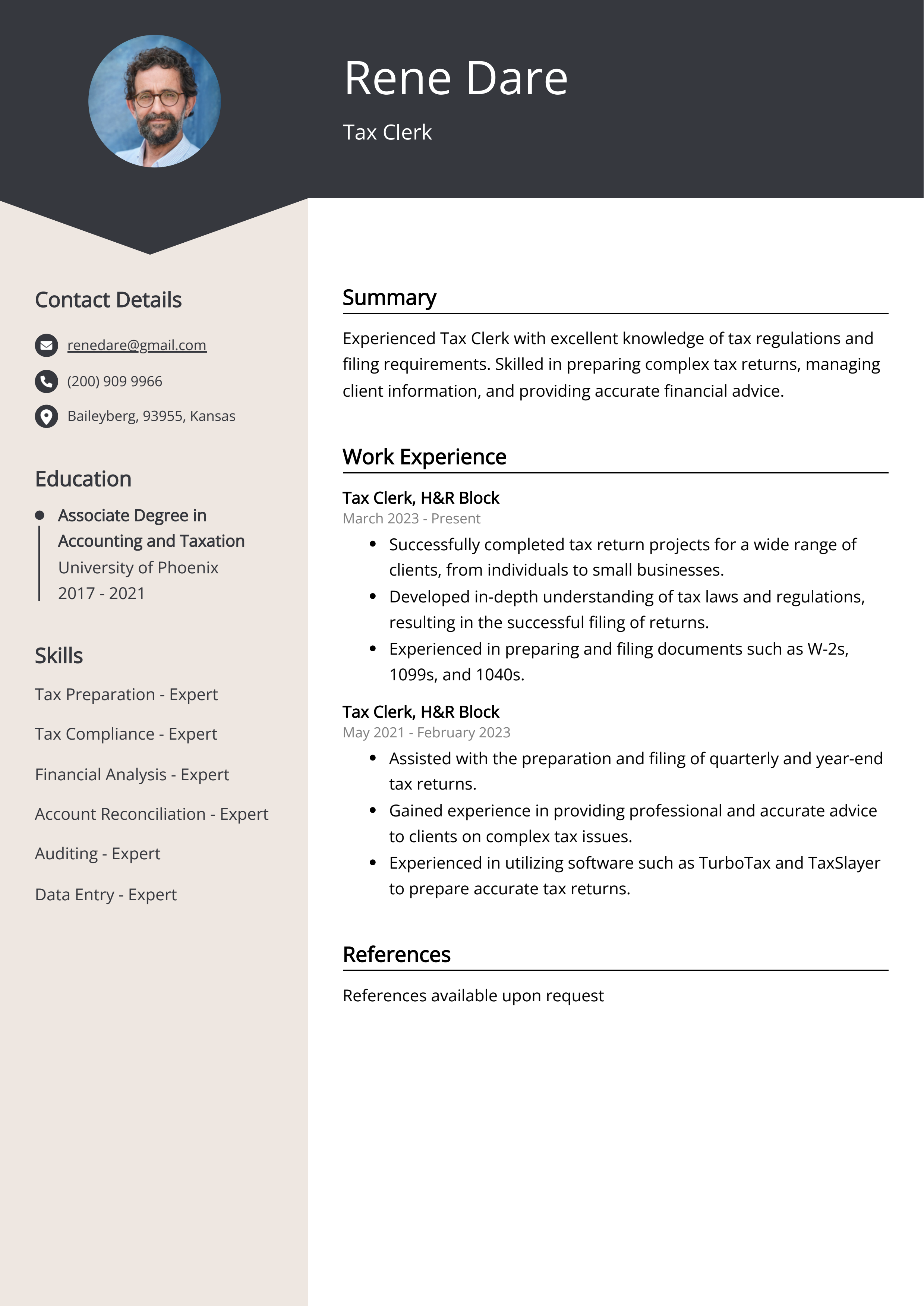

Sample Tax Clerk Resume for Inspiration

John Doe

Address: 123 Main St. City, State, ZipCode

Phone: (123) 456-7890 Email: john.doe@email.com

Summary

Tax Clerk with 6+ years of experience in preparing, filing, and auditing various tax documents. Highly organized and detail oriented with a strong attention to detail. Possess excellent customer service skills and the ability to multi-task in a fast-paced environment.

Work Experience

- Tax Clerk, Tax Services – City, State, 2017-Present

- Examine and audit tax documents to ensure accuracy

- Prepare and file numerous taxes, including federal, state, and local taxes

- Provide customer service by answering inquiries and resolving customer complaints

- Gather relevant financial information from clients

- Assist with the preparation of financial statements and spreadsheets

- Tax Clerk, Tax Company – City, State, 2010-2017

- Compiled and analyzed financial information to be used in the preparation of taxes

- Prepared and filed federal, state, and local taxes

- Provided customer service to clients regarding tax questions and concerns

- Assisted with the preparation of financial statements and spreadsheets

Education

- Bachelor of Science in Accounting, University of City, State, 2009

Skills

- Tax Preparation

- Financial Analysis

- Data Entry

- Customer Service

Certifications

- Certified Public Accountant, State Board of Accountancy, 2016

Languages

- English

- Spanish

Resume tips for Tax Clerk

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Tax Clerk resume tips.

We collected the best tips from seasoned Tax Clerk - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight the most relevant experience and qualifications.

- Include keywords related to the tax clerk role.

- List any specialized training or certifications.

- Include knowledge of relevant software packages.

- Provide clear and concise references.

Tax Clerk Resume Summary Examples

A Tax Clerk Resume Summary or Resume Objective can be used to showcase a candidate’s knowledge, experience and qualifications in dealing with tax preparation, filing, and compliance. It can help employers quickly and easily identify the most important and relevant information about the candidate, such as their skills in tax accounting, customer service, and problem-solving. This type of summary or objective can also help to demonstrate the candidate’s commitment to accuracy and professionalism.

For Example:

- Highly organized Tax Clerk with 5+ years of experience in financial record keeping and tax filing. Proven ability to accurately maintain financial records and ensure compliance with tax regulations.

- Detail-oriented Tax Clerk with a strong background in accounting and tax preparation. Proficient in QuickBooks and Microsoft products. Experienced in reconciling accounts and preparing tax documents.

- Motivated Tax Clerk with 7+ years experience in preparing, filing, and analyzing tax returns. Skilled in building relationships with clients and ensuring compliance with state and federal regulations.

- Experienced Tax Clerk with a Bachelor's degree in Accounting and 3+ years of experience. Possesses strong organizational and problem-solving skills. Proven track record of providing accurate tax filings.

- Tax Clerk with 5+ years of experience in preparing returns and maintaining records. Adept in utilizing various software programs, such as QuickBooks and Microsoft products, to ensure accuracy of returns.

Build a Strong Experience Section for Your Tax Clerk Resume

Building a strong experience section for a tax clerk resume is important because it gives potential employers a clear picture of your qualifications and experience. It also gives them an idea of your level of knowledge and understanding of the tax laws and processes. It also shows them that you have the ability to handle complex calculations and data entry tasks. Lastly, it demonstrates that you are a reliable and organized individual who can handle the daily tasks associated with the job.

For Example:

- Provided tax advice to individual and corporate clients.

- Assisted in the preparation of tax returns for individuals and corporate entities.

- Performed research to identify potential deductions and exemptions for clients.

- Reviewed financial documents and prepared tax summaries.

- Maintained accurate records of all tax payments and filings.

- Calculated tax liabilities and payments for both individuals and businesses.

- Processed payments for clients and ensured they were accurately applied to their accounts.

- Communicated with clients regarding their tax obligations and answered their questions.

- Prepared complex tax forms and provided recommendations for tax planning.

- Assisted in the preparation of tax audits and provided guidance to clients.

Tax Clerk resume education example

Tax clerks typically need at least a high school diploma or equivalent. Additionally, some employers may require tax clerks to have a certificate or associate degree in accounting, taxation, or a related field. Relevant certifications such as Certified Tax Preparer and Registered Tax Return Preparer may also be helpful in obtaining a tax clerk position.

Here is an example of an experience listing suitable for a Tax Clerk resume:

- Completed a Diploma in Accounting and Finance from ABC University in 2016

- Pursuing Bachelor's degree in Accounting from XYZ college, expected to graduate in 2021

- Attended the Tax and Business Law training course at ABCD Institution in 2017

- Successfully completed the Tax Preparation and Advisory course from EFG Institute in 2018

- Attended the Tax Planning and Compliance workshop at GHI Institute in 2019

Tax Clerk Skills for a Resume

Adding skills to a Tax Clerk resume is important because it showcases your abilities and knowledge in the field. It also reflects your qualifications that are necessary for a Tax Clerk position. Skills may include knowledge and understanding of tax laws, regulations, and procedures; experience with accounting software; the ability to calculate and file taxes accurately and efficiently; and strong customer service skills. Examples are not necessary.

Soft Skills:

- Organizational Skills

- Time Management

- Attention to Detail

- Problem Solving

- Interpersonal Skills

- Analytical Thinking

- Accounting Knowledge

- Research Ability

- Communication Skills

- Data Entry Skills

- Tax Preparation

- Auditing

- Accounting

- Data Entry

- Financial Analysis

- Bookkeeping

- Budgeting

- Compliance

- Payroll Processing

- Tax Reporting

Common Mistakes to Avoid When Writing a Tax Clerk Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Tax Clerk resume

- Highlight relevant accounting and finance experience

- Mention certifications and qualifications

- Include proficiency in tax preparation software

- Demonstrate strong organizational and communication skills

- Show knowledge of federal, state, and local tax regulations and filing procedures

- Detail knowledge of IRS regulations

- Highlight problem-solving and analytical skills

- Show ability to work independently and as part of a team

- Provide examples of successful tax filing experiences

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.