This Claims Investigator Resume Example provides a comprehensive overview of the duties and responsibilities of a Claims Investigator and outlines the key qualifications and experience required for the job. The article includes an example resume for a Claims Investigator, highlighting the most important sections and detailing the qualifications and professional experience necessary for success in this role. With this guide, potential candidates can get an idea of the skills and qualifications needed for the job, as well as an example of a professional resume to get started.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Claims Investigator do?

A Claims Investigator is responsible for investigating claims of insurance fraud. This involves examining documentation, conducting interviews, and researching the validity of claims. The goal of a Claims Investigator is to determine if a claim is valid and if any fraudulent activity has taken place. They may also be responsible for recommending corrective action and providing evidence to support their findings.

- Attorney Resume Sample

- Defense Attorney Resume Sample

- Experienced Lawyer Resume Sample

- Legal Advisor Resume Sample

- Legal Assistant Resume Sample

- Legal Secretary Resume Sample

- Litigation Assistant Resume Sample

- Litigation Attorney Resume Sample

- Litigation Legal Assistant Resume Sample

- Senior Paralegal Resume Sample

- Tax Attorney Resume Sample

- Funeral Director Resume Sample

- Claims Examiner Resume Sample

- Claims Investigator Resume Sample

- Bankruptcy Paralegal Resume Sample

- Contract Attorney Resume Sample

- Court Reporter Resume Sample

- District Attorney Resume Sample

- Bankruptcy Specialist Resume Sample

- Contract Negotiator Resume Sample

What are some responsibilities of a Claims Investigator?

- Gather evidence and perform interviews to document facts of a case

- Review claims to determine validity and potential fraud

- Analyze medical records, financial records, and other documents to assess claims

- Conduct research to locate witnesses, review facts, and gather additional evidence

- Prepare reports to summarize findings

- Keep up to date with relevant laws, regulations, and standards

- Maintain confidentiality of information

- Communicate with clients, claimants, and other parties as necessary

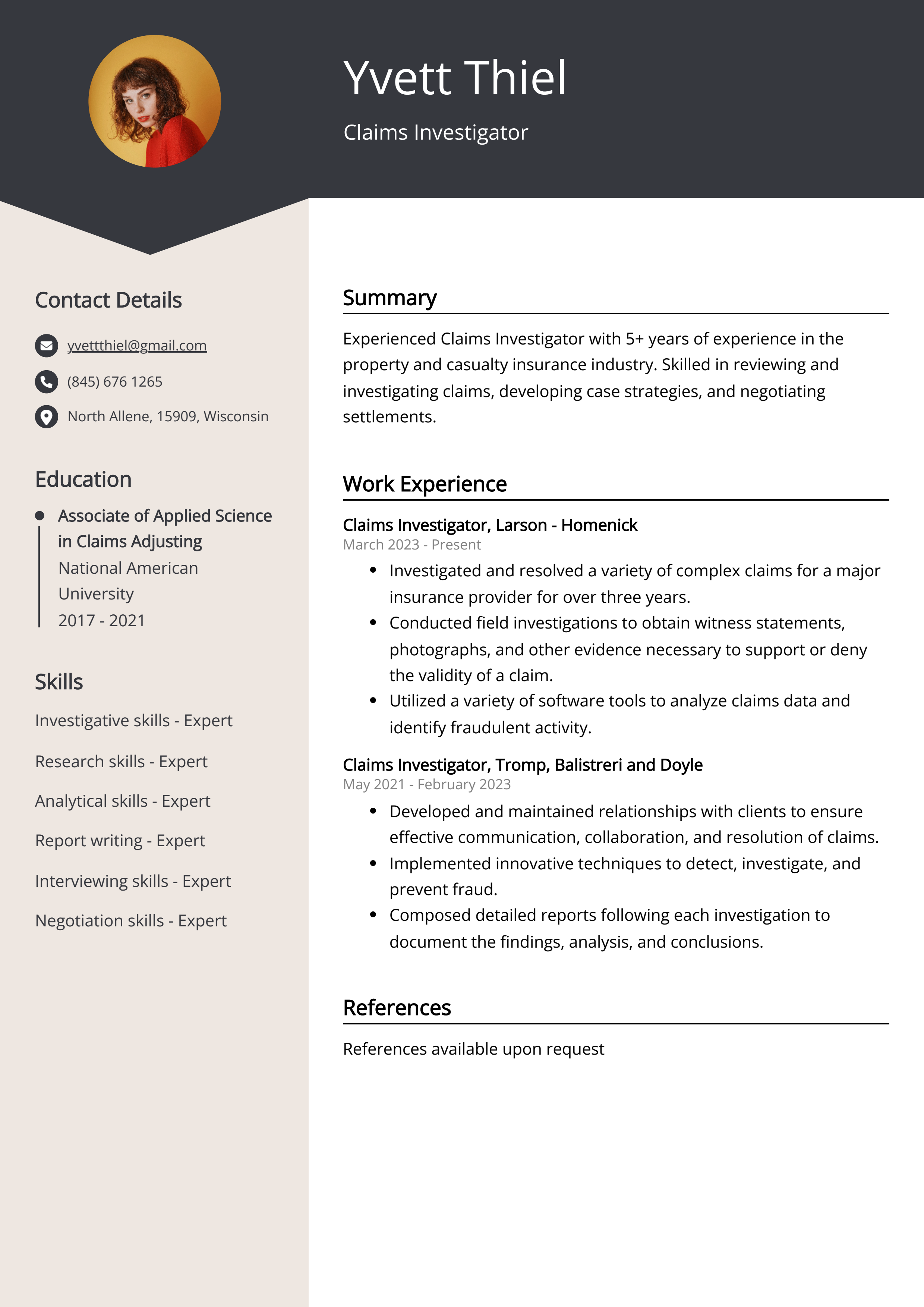

Sample Claims Investigator Resume for Inspiration

Claims Investigator

Name: Jane Doe

Address: 123 Main Street, Anytown, State, 12345

Phone: (123) 456-7890

Email: janedoe@email.com

Highly organized and detail-oriented Claims Investigator with 8+ years of experience in analyzing insurance claims and determining benefits. Proven ability to investigate and resolve complex claims in a timely fashion. Experienced in working with a variety of insurance companies, providers and clients.

Work Experience

- ABC Insurance Company, Claims Investigator, Anytown, State (2015-Present)

- Conduct comprehensive investigations into various types of insurance claims, including property, liability and auto.

- Analyze claims for accuracy and completeness and determine the appropriate benefit amounts.

- Provide claims status updates to customers and maintain accurate records of all investigations.

- Ensure compliance with applicable state and federal insurance regulations.

- XYZ Financial Services, Claims Investigator, Anytown, State (2010-2015)

- Assessed and processed claims for life, health and disability insurance.

- Formulated clear and accurate reports on claim investigations and submitted them to the appropriate personnel.

- Provided customer service to clients and answered inquiries regarding claims processing.

Education

- Bachelor of Science in Business Administration, Anytown State University, Anytown, State (2006-2010)

Skills

- Insurance Claim Processing

- Data Analysis and Interpretation

- Report Writing

- Customer Service and Communication

- Regulatory Compliance

Certifications

- Certified Claims Investigator, ABC Corporation (2010)

Languages

- English (Fluent)

- Spanish (Proficient)

Resume tips for Claims Investigator

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Claims Investigator resume tips.

We collected the best tips from seasoned Claims Investigator - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your investigative and problem-solving skills.

- Include any specialized training or certifications.

- Showcase your communication and organizational abilities.

- Demonstrate your research and data analysis skills.

- Mention your experience with claims management software.

Claims Investigator Resume Summary Examples

A resume summary or resume objective can be a powerful tool for a Claims Investigator. It gives the employer a concise overview of your experience, qualifications, and skills that you can bring to the position. It also highlights your most relevant qualifications and accomplishments as they relate to the job you are applying for. It can be a great way to make a good first impression and stand out from the competition.

For Example:

- Experienced Claims Investigator with five years of experience in investigating and resolving insurance claims. Skilled in evaluating evidence and determining fault.

- Highly organized Claims Investigator with 10 years of experience in claim investigations and dispute resolutions. Adept in gathering evidence, analyzing data, and providing accurate reports.

- Accomplished Claims Investigator with strong research and problem-solving skills. Proven track record of uncovering fraudulent claims and resolving disputes quickly and efficiently.

- Results-driven Claims Investigator with excellent interviewing and negotiation skills. Experienced in uncovering fraud and conducting thorough investigations.

- Knowledgeable Claims Investigator with comprehensive understanding of insurance laws. Proficient in resolving disputed claims and providing timely feedback to customers.

Build a Strong Experience Section for Your Claims Investigator Resume

Building a strong experience section for a claims investigator resume is important for a few reasons. First, it will demonstrate to potential employers that you have the skills, knowledge, and experience necessary to be successful in the role. It also helps to give employers a clear understanding of your past job responsibilities and achievements, which can be used to determine if you would be a good fit for the company. Finally, a strong experience section can help to show employers that you are organized, detail-oriented, and adept at problem-solving and critical thinking.

For Example:

- Investigated medical, bodily injury, and property damage claims in line with company policy.

- Developed claim investigations by obtaining and evaluating evidence, and interviewing witnesses.

- Determined the validity of claims submitted by customers and communicated findings in both written and verbal format.

- Negotiated and settled claims with claimant, attorney, or other parties.

- Analyzed claim data and identified patterns of fraudulent activity.

- Developed and maintained effective working relationships with internal and external customers.

- Performed all aspects of claim administration including setting reserves, making payments, and closing files.

- Researched and resolved difficult claims disputes to achieve settlement.

- Reviewed existing policies and procedures to ensure compliance with applicable laws and regulations.

- Prepared and presented reports to management on the status of investigations.

Claims Investigator resume education example

A Claims Investigator typically needs a minimum of a high school diploma or equivalent, although some employers may require a college degree. Professional certifications in fraud investigation, such as those offered by the Association of Certified Fraud Examiners, may also be beneficial. In addition, employers may require a valid driver's license, as well as experience in investigative work or law enforcement.

Here is an example of an experience listing suitable for a Claims Investigator resume:

- Bachelor of Science in Criminal Justice, ABC College, Anytown, USA, 2011

- Associate's Degree in Business Administration, XYZ College, Anytown, USA, 2009

- Certification in Fraud Investigation, Anytown College, Anytown, USA, 2012

Claims Investigator Skills for a Resume

Adding relevant skills to a Claims Investigator Resume is important because it helps employers identify the candidate’s qualifications and abilities. It also gives employers a better idea of how well the candidate is suited for the role. Skills should include areas such as investigation techniques, interviewing, surveillance, data analysis, report writing, and strong communication skills. Examples should not be included in the resume as employers will want to hear about the skills during the interview.

Soft Skills:

- Critical Thinking

- Investigative Skills

- Organizational Skills

- Communication Skills

- Time Management

- Report Writing

- Problem Solving

- Attention to Detail

- Interpersonal Skills

- Research Skills

- Investigation Techniques

- Data Analysis

- Report Writing

- Interviewing Skills

- Claims Processing

- Documentation Skills

- Risk Management

- Liability Assessments

- Legislation Knowledge

- Case Management

Common Mistakes to Avoid When Writing a Claims Investigator Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Claims Investigator resume

- Demonstrate experience in handling claims investigations.

- Highlight knowledge of insurance laws and regulations.

- Showcase organizational and problem-solving skills.

- Mention the ability to review and analyze medical records.

- Display proficiency in using computer software and databases.

- Detail strong verbal and written communication abilities.

- Provide evidence of effective interviewing techniques.

- Emphasize a professional and ethical conduct.

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.