Are you looking for a Loan Coordinator Resume Example to help you craft your own winning resume? Look no further! A Loan Coordinator plays a crucial role in the loan process by coordinating the various steps involved in securing a loan for clients. We have put together a comprehensive example that highlights the necessary skills, qualifications, and experience to help you stand out in the job market. Check out our Loan Coordinator Resume Example for inspiration and guidance.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Loan Coordinator do?

- Organizes and coordinates loan application process

- Communicates with borrowers, lenders, and other parties involved in the loan process

- Collects and verifies borrower's financial and personal information

- Ensures all required documentation is completed and submitted accurately and on time

- Tracks the progress of loan applications and provides updates to all parties

- Assists in resolving any issues or obstacles that may arise during the loan process

- Financial Consultant Resume Sample

- Asset Management Analyst Resume Sample

- Audit Associate Resume Sample

- Cost Accounting Manager Resume Sample

- Payroll Technician Resume Sample

- Finance Director Resume Sample

- Purchasing Analyst Resume Sample

- Collection Analyst Resume Sample

- Accounts Payable Accountant Resume Sample

- Purchasing Specialist Resume Sample

- Securities Analyst Resume Sample

- Accounts Receivable Specialist Resume Sample

- Enrolled Agent Resume Sample

- Tax Preparer Resume Sample

- Real Estate Salesperson Resume Sample

- Bookkeeper Assistant Resume Sample

- Credit Analyst Resume Sample

- Accounting Coordinator Resume Sample

- Aml Analyst Resume Sample

- Tax Associate Resume Sample

What are some responsibilities of a Loan Coordinator?

- Communicating with clients and lenders to gather necessary documents and information

- Organizing and preparing loan files for underwriting

- Coordinating the loan approval process between clients and lenders

- Assisting clients with loan application forms and documentation

- Ensuring all loan documents are accurate and complete

- Coordinating the closing process and ensuring all necessary paperwork is in order

- Providing support to loan officers and processors

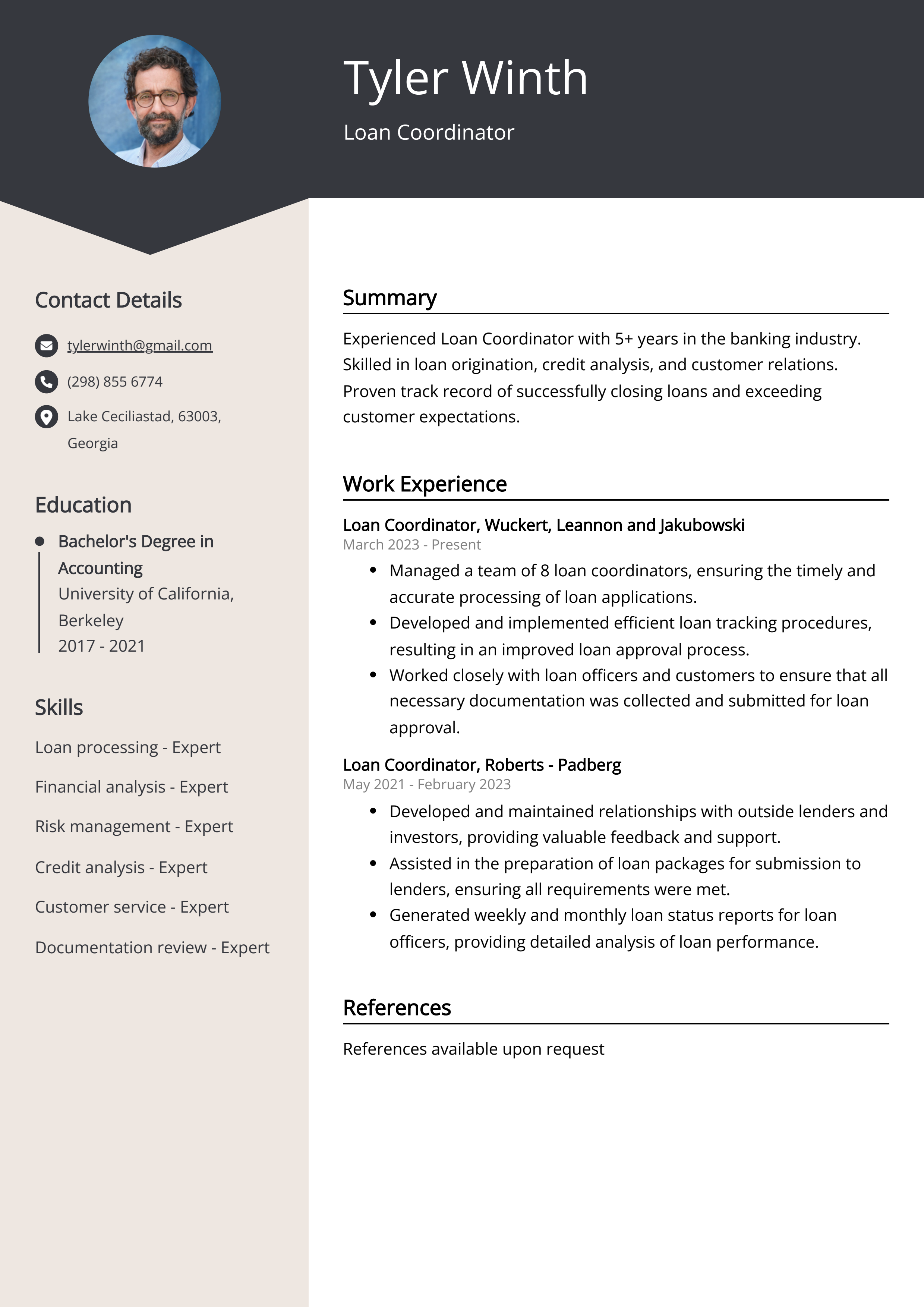

Sample Loan Coordinator Resume for Inspiration

Personal Details:

- Name: John Smith

- Email: john.smith@email.com

- Phone: 123-456-7890

- Address: 123 Main St, City, State, Zip

Summary:

John Smith is a motivated and experienced Loan Coordinator with a proven track record of successfully coordinating and processing loan applications. He is dedicated to providing exceptional customer service and ensuring smooth and efficient loan processing from start to finish. John is skilled in organization, communication, and attention to detail, making him a valuable asset to any lending team.

Work Experience:

- Loan Coordinator, ABC Lending - City, State | 2016-Present

- Loan Processor, XYZ Mortgage Company - City, State | 2014-2016

- Loan Assistant, 123 Bank - City, State | 2012-2014

Education:

- Bachelor's Degree in Business Administration, University of XYZ - City, State | 2012

Skills:

- Loan processing and coordination

- Customer service

- Attention to detail

- Organization

- Communication

Certifications:

- Certified Loan Processor (CLP)

- Notary Public

Languages:

- English - Native

- Spanish - Conversational

Resume tips for Loan Coordinator

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Loan Coordinator resume tips.

We collected the best tips from seasoned Loan Coordinator - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Utilize strong communication skills to effectively interact with clients and internal teams

- Demonstrate strong organizational and multitasking abilities to handle multiple loan applications simultaneously

- Showcase proficiency in loan processing software and other relevant tools

- Highlight experience in reviewing loan documents and ensuring all necessary information is accurate and complete

- Exhibit knowledge of loan regulations and guidelines to ensure compliance with industry standards

Loan Coordinator Resume Summary Examples

A Loan Coordinator resume summary or objective is necessary to grab the attention of potential employers and highlight your qualifications and career goals. It provides a brief overview of your skills, experience, and career objectives, giving the employer an idea of what you can bring to the role. A strong summary or objective can help you stand out from other applicants and increase your chances of landing an interview.

For Example:

- Managed the loan application process from initial inquiry to closing, ensuring all documentation and requirements were met

- Coordinated with clients, loan officers, and underwriters to gather necessary information and expedite the loan approval process

- Reviewed and verified loan documents for accuracy and completeness, and communicated any missing information to relevant parties

- Maintained detailed records of loan files and updated clients on the status of their applications regularly

- Provided exceptional customer service and answered inquiries regarding loan terms, rates, and eligibility requirements

Build a Strong Experience Section for Your Loan Coordinator Resume

The experience section of a loan coordinator resume is crucial because it showcases your relevant skills, knowledge, and accomplishments in the industry. A strong experience section can demonstrate to potential employers that you have the expertise and understanding necessary to excel in the role. It also provides context for your career trajectory and shows that you have a history of success in similar positions. A well-crafted experience section can make your resume stand out and increase your chances of landing a job interview.

For Example:

- Managed a high-volume loan pipeline, providing exceptional customer service to clients and guiding them through the loan process

- Ensured timely and accurate completion of all loan documents, coordinating with lenders, title companies, and clients

- Performed detailed financial analysis and reviewed credit reports to determine loan eligibility and risk assessment

- Communicated regularly with borrowers, real estate agents, and loan officers to gather necessary information and resolve any issues

- Assisted in the preparation of loan packages and documentation for underwriting and closing

- Maintained up-to-date knowledge of mortgage lending regulations, compliance requirements, and industry best practices

- Collaborated with internal teams to streamline processes and improve overall efficiency in loan origination and processing

- Played a key role in coordinating and facilitating the loan approval and funding process

- Resolved loan-related problems and discrepancies, providing solutions to ensure successful loan closings

- Participated in training and mentoring new loan coordinators to ensure consistency and quality in loan processing

Loan Coordinator resume education example

A Loan Coordinator typically needs a high school diploma or equivalent to enter the field. Many employers also prefer candidates with some college coursework or a degree in finance, business administration, or a related field. Additional training or certification in mortgage lending, financial services, or loan management may also be beneficial for advancing in this career. Strong analytical, communication, and organizational skills are also essential for success in this role.

Here is an example of an experience listing suitable for a Loan Coordinator resume:

- Bachelor's degree in Finance or related field

- Certification in Mortgage Banking

- Completed coursework in Business Administration

Loan Coordinator Skills for a Resume

It is important to add skills for a Loan Coordinator Resume because it demonstrates the candidate's qualifications and ability to perform the necessary tasks and responsibilities for the role. Including relevant skills such as communication, attention to detail, financial analysis, and customer service can help showcase the candidate's capabilities and make them stand out to potential employers.

Soft Skills:

- Communication skills

- Attention to detail

- Problem-solving ability

- Time management

- Customer service

- Teamwork

- Adaptability

- Organizational skills

- Interpersonal skills

- Negotiation skills

- Financial Analysis

- Credit Assessment

- Loan Processing

- Regulatory Compliance

- Documentation Review

- Risk Management

- Customer Service

- Underwriting Skills

- Loan Origination

- Excel Proficiency

Common Mistakes to Avoid When Writing a Loan Coordinator Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Loan Coordinator resume

- Excellent organization and time management skills

- Strong attention to detail and accuracy

- Ability to multitask and prioritize deadlines

- Proficient in loan processing and documentation

- Knowledge of banking and lending regulations

- Effective communication and customer service skills

- Experience with loan software and computer proficiency

- Ability to work independently and in a team environment

- Strong problem-solving and decision-making abilities

- Understanding of loan products and services

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.