Are you in the market for a new commercial lender role? Look no further! Our Commercial Lender Resume Example article is designed to help you create a winning resume that will stand out to prospective employers. Whether you are an experienced commercial lender looking to make a career move, or a newcomer to the industry seeking to break in, our resume example will provide you with valuable insights and tips to help you land your next role.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Commercial Lender do?

- Evaluates loan applications from businesses

- Analyzes financial statements and credit reports

- Determines the creditworthiness of potential borrowers

- Structures loan packages and negotiates terms

- Monitors and manages an existing loan portfolio

- Advises clients on financial strategies and options

- Develops and maintains relationships with business clients

- Reconciliation Analyst Resume Sample

- Mortgage Specialist Resume Sample

- Analyst Resume Sample

- Bookkeeping Clerk Resume Sample

- Real Estate Salesperson Resume Sample

- Finance Executive Resume Sample

- Financial Planning Analyst Resume Sample

- Accounting Associate Resume Sample

- Associate Accountant Resume Sample

- Project Control Analyst Resume Sample

- Actuary Resume Sample

- Junior Accountant Resume Sample

- Real Estate Associate Resume Sample

- Collection Analyst Resume Sample

- Account Director Resume Sample

- Accounts Receivable Manager Resume Sample

- Accounts Payable Assistant Resume Sample

- Financial Auditor Resume Sample

- Bookkeeper Assistant Resume Sample

- Aml Analyst Resume Sample

What are some responsibilities of a Commercial Lender?

- Evaluating and analyzing creditworthiness of potential borrowers

- Preparing and presenting loan proposals to credit committees or senior management

- Monitoring and managing the overall loan portfolio

- Developing and maintaining relationships with clients and businesses

- Adhering to regulatory and internal compliance policies

- Ensuring timely collection of payments from borrowers

- Assessing and managing risks associated with loan agreements

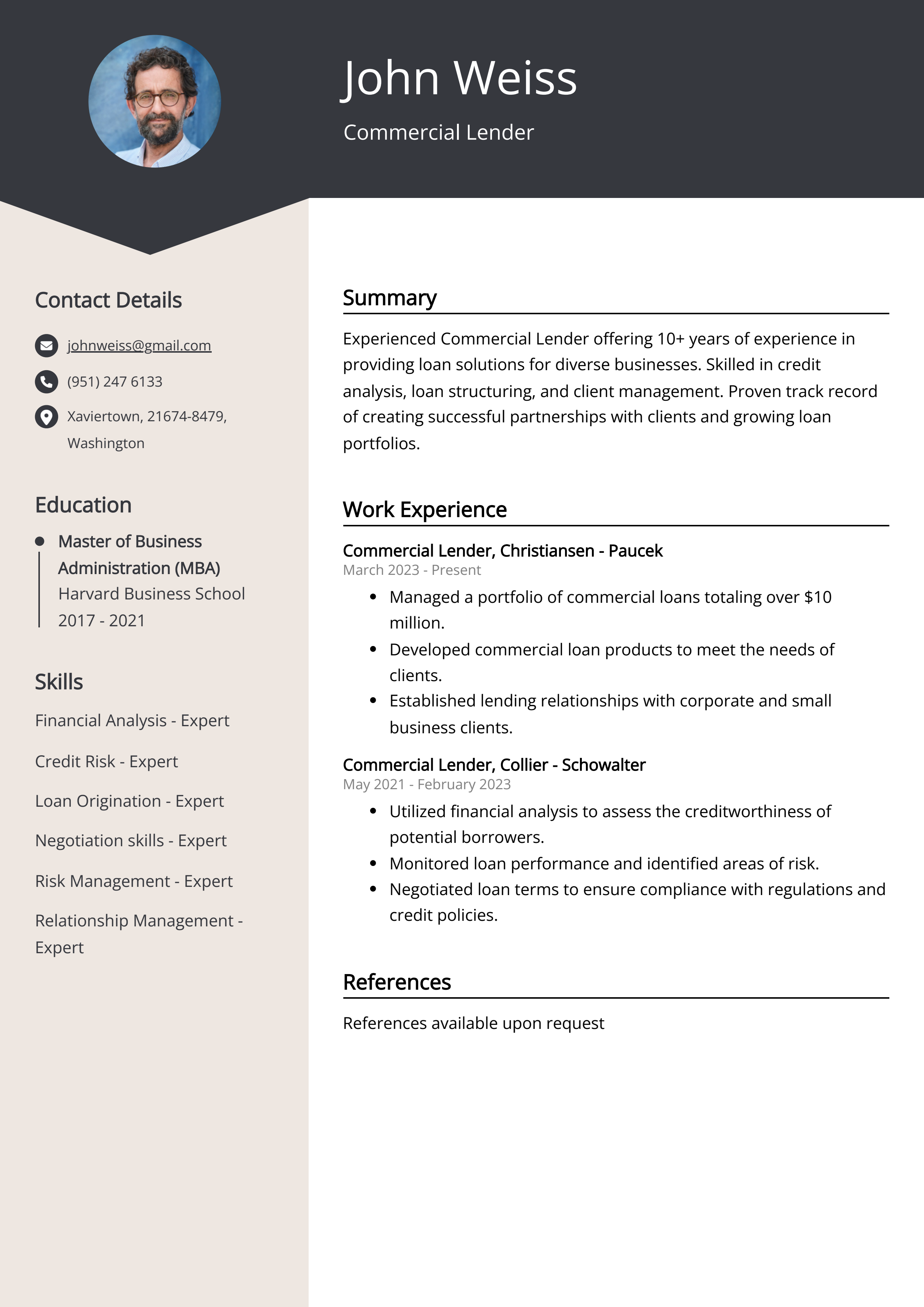

Sample Commercial Lender Resume for Inspiration

Personal Details:

- Name: John Smith

- Address: 123 Main St. Anytown, USA

- Email: johnsmith@email.com

- Phone: 123-456-7890

Summary: John Smith is a dedicated and results-driven Commercial Lender with over 10 years of experience in the financial industry. He has a proven track record of successfully managing client relationships, underwriting loans, and driving business growth. John is a skilled communicator with a strong attention to detail, and he is committed to providing exceptional service to his clients.

Work Experience:

- Senior Commercial Lender, ABC Bank (2015- Present)

- Managed a portfolio of commercial clients, exceeding sales targets by 20% annually

- Underwrote and closed over $50 million in commercial loans

- Developed and maintained strong relationships with business clients

- Commercial Lender, XYZ Financial (2011-2015)

- Originate and underwrite commercial loans for small to mid-sized businesses

- Analyzed financial statements, credit reports, and cash flow to determine creditworthiness

- Assisted in the development of marketing strategies to attract new business clients

Education:

- Bachelor of Business Administration in Finance, University of Anytown (2009)

- Certified Commercial Lender (CCL)

Skills:

- Strong analytical and financial modeling skills

- Excellent communication and negotiation abilities

- Proficient in underwriting commercial loans

- Knowledge of banking regulations and compliance

- Customer relationship management

Languages: Fluent in English and Spanish

Resume tips for Commercial Lender

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Commercial Lender resume tips.

We collected the best tips from seasoned Commercial Lender - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in underwriting and analyzing commercial loan applications

- Showcase your track record of successfully closing deals and generating new business

- Include any relevant certifications or licenses, such as a Certified Commercial Investment Member (CCIM) designation

- Detail your knowledge of financial regulations and lending guidelines

- Emphasize your strong communication and negotiation skills, as well as your ability to build and maintain client relationships

Commercial Lender Resume Summary Examples

A commercial lender resume summary or resume objective is a crucial part of a resume as it provides a quick overview of the candidate's skills, experience, and career goals. It helps the hiring manager to quickly understand the candidate's qualifications and what they can offer to the company. By including a strong summary or objective, the candidate can make a strong first impression and stand out from other applicants.

For Example:

- Experienced commercial lender with a strong track record of successful loan approvals and portfolio management

- Solid understanding of financial analysis and risk assessment to accurately evaluate loan applications

- Proven ability to build and maintain relationships with business clients to understand their financial needs

- Skilled in underwriting commercial loans and ensuring compliance with regulatory requirements

- Results-driven professional with excellent communication and negotiation skills to close loan deals

Build a Strong Experience Section for Your Commercial Lender Resume

Building a strong experience section for a commercial lender resume is essential as it showcases the candidate's expertise, skills, and accomplishments in the field. This section highlights the candidate's relevant work history, including specific achievements and results, which can demonstrate their capabilities to potential employers. A well-crafted experience section can make a strong impression on hiring managers and increase the candidate's chances of securing a job in the competitive field of commercial lending.

For Example:

Commercial Lender resume education example

A Commercial Lender typically needs a bachelor's degree in finance, economics, or a related field. Some employers may require a master's degree in business administration or finance. Additionally, a Commercial Lender should have strong mathematical, analytical, and communication skills. They may also benefit from obtaining certifications such as Certified Commercial Lender (CCL) or Chartered Financial Analyst (CFA) to enhance their expertise in commercial lending.

Here is an example of an experience listing suitable for a Commercial Lender resume:

- Bachelor's degree in finance, business administration, or a related field

- Completed courses in accounting, economics, and financial analysis

- Participated in professional development workshops and seminars on lending practices and regulations

- Holds relevant certifications such as Certified Commercial Loan Officer (CCLO) or similar

Commercial Lender Skills for a Resume

It is important to add skills for a Commercial Lender resume because it demonstrates to potential employers that the candidate possesses the necessary expertise to effectively carry out the responsibilities of the position. These skills will highlight both the technical knowledge and personal attributes that are essential for success in the role, and will make the candidate a more competitive candidate in the job market.

Soft Skills:

- Communication

- Problem-solving

- Negotiation

- Time management

- Teamwork

- Adaptability

- Empathy

- Attention to detail

- Critical thinking

- Customer service

- Financial Analysis

- Credit Risk Assessment

- Loan Structuring

- Underwriting

- Portfolio Management

- Customer Relationship Management

- Cash Flow Analysis

- Commercial Real Estate Evaluation

- Regulatory Compliance

- Market Research

Common Mistakes to Avoid When Writing a Commercial Lender Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Commercial Lender resume

- Strong ability to assess credit risk and make sound lending decisions

- Proven track record of developing and maintaining strong customer relationships

- Extensive knowledge of financial analysis, underwriting, and loan structuring

- Experience in identifying and pursuing new business opportunities

- Effective communication and negotiation skills

- Ability to work independently and as part of a team

- Demonstrated proficiency in managing a diverse portfolio of commercial loans

- Thorough understanding of industry regulations and compliance requirements

- Proficient in using relevant software and tools for loan processing and documentation

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.