Embark on your next career venture with confidence using our curated Accounts Payable Specialist Resume Example. This article serves as an invaluable resource for crafting a standout resume that not only highlights your skills but also captures the attention of potential employers in the finance sector. Ensure your professional footprint makes a lasting impression with an example that exemplifies expertise, efficiency, and precision in the field of accounts payable.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does an Accounts Payable Specialist do?

- Review and verify invoices and check requests for accuracy.

- Sort, code, and match invoices to prepare them for payment processing.

- Enter and upload invoices into the accounting system for tracking and payment purposes.

- Perform invoice and general ledger reconciliations to maintain accurate records.

- Monitor accounts to ensure payments are up to date and resolve invoice discrepancies.

- Process payment transactions, including checks, ACH, wire transfers, and credit card payments.

- Respond to vendor inquiries and maintain strong vendor relationships.

- Analyze expenses and update the expense database regularly.

- Assist with month-end closing procedures by providing relevant reports and support.

- Carry out internal controls and adhere to company financial policies and guidelines.

- Actuary Resume Sample

- Finance Officer Resume Sample

- Finance Director Resume Sample

- Senior Business Analyst Resume Sample

- Accounting Manager Resume Sample

- Accounts Receivable Analyst Resume Sample

- Experienced Mortgage Advisor Resume Sample

- Senior Analyst Resume Sample

- Audit Director Resume Sample

- Finance Assistant Resume Sample

- Billing Manager Resume Sample

- Accounts Payable Supervisor Resume Sample

- Assessor Resume Sample

- CFO Resume Sample

- Insurance Underwriter Resume Sample

- Credit Specialist Resume Sample

- Finance Analyst Resume Sample

- Budget Analyst Resume Sample

- Banking Assistant Resume Sample

- Billing Supervisor Resume Sample

What are some responsibilities of an Accounts Payable Specialist?

- Review and verify invoices for accuracy

- Code invoices with the correct general ledger accounts

- Enter and upload invoices into the accounting system

- Process invoices for payment and perform check runs

- Reconcile accounts payable transactions

- Prepare analysis of accounts

- Monitor accounts to ensure payments are up to date

- Research and resolve invoice discrepancies and issues

- Maintain vendor files and relationships

- Correspond with vendors and respond to inquiries

- Assist with month-end closing

- Provide supporting documentation for audits

- Maintain accurate historical records

- Manage company credit card transactions and payments

- Track expenses and process expense reports

- Assist with ad hoc projects as needed

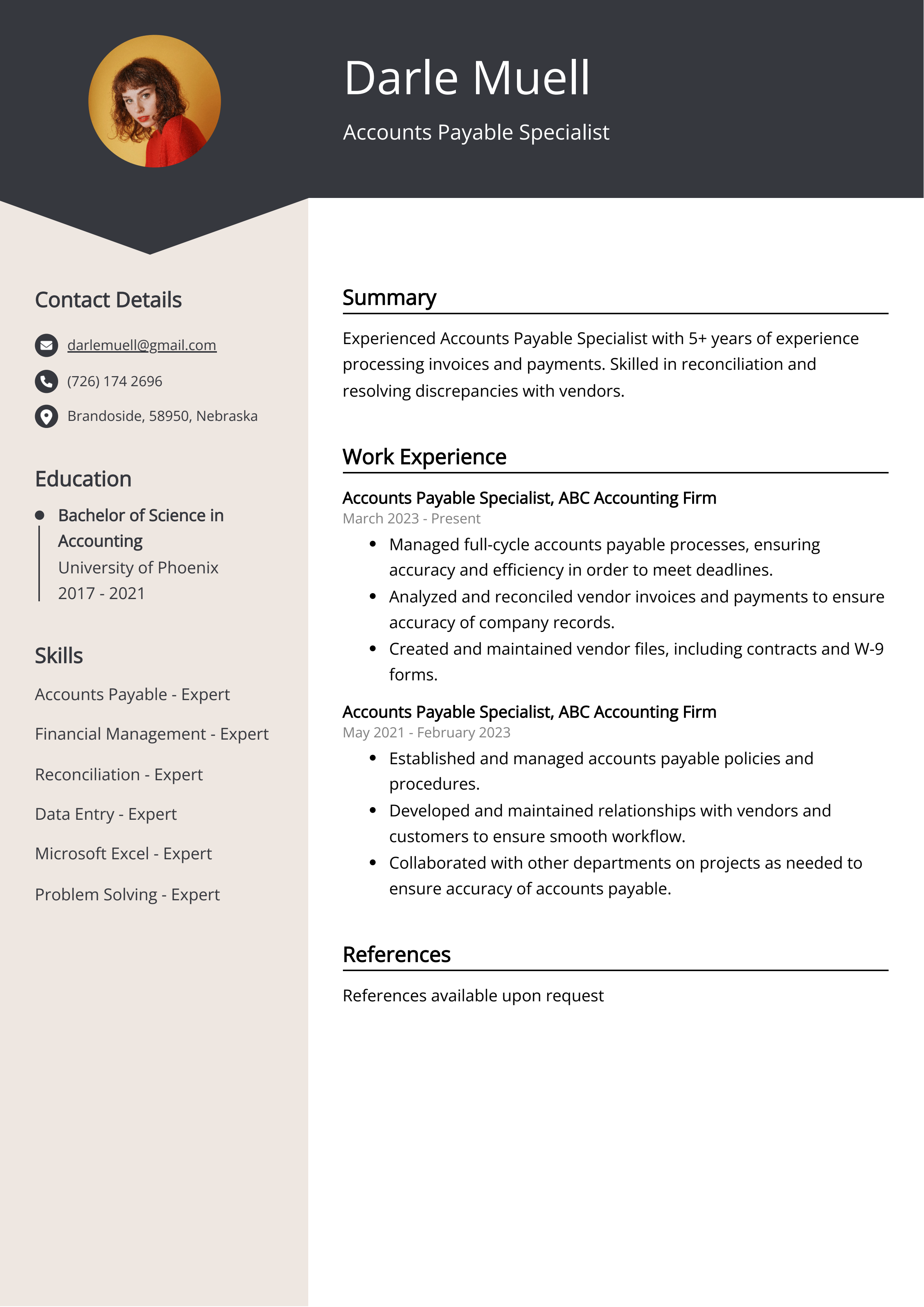

Sample Accounts Payable Specialist Resume for Inspiration

Jane Doe

123 Finance Street

Moneyville, SA 99999

Email: janedoe@email.com

Phone: (123) 456-7890

Summary

Jane Doe is an experienced Accounts Payable Specialist known for her excellent organizational abilities, attention to detail, and a strong commitment to company financial integrity. With over five years in the field, Jane has developed a keen expertise in managing vendor payments, reconciling financial records, and implementing payment processes that improve efficiency. She is recognized for her problem-solving skills and her capability to work under demanding deadlines.

Work Experience

- Senior Accounts Payable Specialist

XYZ Corporation, Moneyville, SA — August 2019-Present

- Manage the full cycle of accounts payable activities, including invoice processing, payment disbursement, and vendor communication.

- Implemented a new electronic payment system that reduced processing time by 30%.

- Reconciled monthly statements and transactions with a 99.9% accuracy rate. - Accounts Payable Clerk

ABC Inc., Finance City, MA — June 2016-July 2019

- Processed an average of 500 invoices per month and handled payment inquiries.

- Assisted with month-end closing procedures and provided support for audit requirements.

- Contributed to the development of the department's expense tracking and reporting system.

Education

- Bachelor of Science in Accounting

University of Finance, Moneyville, SA — Graduated May 2016

Skills

- Proficient in accounting software, including QuickBooks and SAP

- Expertise in invoice and payment processing

- Strong analytical and problem-solving abilities

- Excellent communication and interpersonal skills

- High level of accuracy and attention to detail

Certifications

- Certified Accounts Payable Professional (CAPP)

Languages

- English (Native)

- Spanish (Conversational)

Resume tips for Accounts Payable Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Accounts Payable Specialist resume tips.

We collected the best tips from seasoned Accounts Payable Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Showcase your proficiency with accounts payable software, such as QuickBooks or SAP, by including specific examples of how you optimized payment processes or improved invoice management in past roles.

- Highlight your attention to detail by mentioning instances where you successfully managed a high volume of invoices and maintained accurate records, reducing the error rate in payments.

- Demonstrate your understanding of financial regulations and compliance by citing experiences where you ensured adherence to relevant laws, such as tax requirements or data protection standards.

- Emphasize your ability to work collaboratively by giving examples of how you've effectively communicated with vendors, negotiated payment terms, or partnered with cross-functional teams to resolve discrepancies.

- Include any achievements that demonstrate your effectiveness, such as implementing cost-saving initiatives, streamlining payment cycles, or receiving recognition for exceptional performance in accounts payable roles.

Accounts Payable Specialist Resume Summary Examples

Using a resume summary or objective for an Accounts Payable Specialist position is essential because it succinctly highlights your most relevant qualifications, skills, and experiences right at the beginning of your resume, capturing the hiring manager's attention immediately. It sets the tone of your resume, indicating your career goals and demonstrating how you can add value to the employer, improving your chances of standing out and securing an interview.

For Example:

- Seasoned Accounts Payable Specialist with a sharp eye for detail and a track record of efficiently processing invoices and managing vendor relations.

- Detail-oriented professional with exceptional organizational skills, proficient in QuickBooks and SAP, with five years of accounts payable experience.

- Dedicated Accounts Payable Specialist, adept at reconciliations and issue resolutions, with strong analytical abilities and advanced Excel skills.

- Proactive team player with a strong understanding of accounting principles, skilled in streamlining processes to increase department efficiency.

- Results-driven individual with expertise in payment processing and financial reporting, committed to maintaining accurate accounts and reducing company expenses.

Build a Strong Experience Section for Your Accounts Payable Specialist Resume

Building a strong experience section for an Accounts Payable Specialist resume is essential as it showcases your hands-on expertise in managing financial transactions and maintaining accurate records. Your practical experience demonstrates your ability to handle invoice processing, vendor relationships, and payment reconciliations effectively. It reflects your proficiency with accounting software and adherence to financial policies, thus instilling confidence in potential employers about your competence in managing their accounts payable operations with precision and reliability.

For Example:

- Managed the timely processing of up to 500 invoices per month, ensuring accurate payment to vendors and suppliers.

- Reduced processing errors by 25% through the implementation of a new invoice tracking system, improving payment efficiency.

- Maintained accurate financial records by reconciling payable reports monthly, aiding in year-end financial audit with zero discrepancies.

- Coordinated with procurement and supply chain departments to resolve price discrepancies, resulting in a 15% decrease in overpayments.

- Processed weekly check runs, electronic funds transfers, and ACH payments, maintaining strong relationships with vendors by ensuring prompt payment.

- Assisted with the migration of accounts payable systems to a cloud-based platform, enhancing remote collaboration and productivity.

- Negotiated payment terms with suppliers, which improved cash flow management and deferred payments by an average of 30 days.

- Implemented a vendor self-service portal, reducing inquiry response time by 50% and increasing department efficiency.

- Conducted detailed expense report audits to ensure compliance with company policies, identifying and correcting numerous instances of non-compliant spending.

- Trained and supervised a team of 3 accounts payable clerks, fostering a culture of accuracy and accountability within the department.

Accounts Payable Specialist resume education example

An Accounts Payable Specialist typically needs at least a high school diploma or equivalent. However, many employers prefer candidates with an associate's degree in accounting or a related field. Some roles may require or prefer a bachelor's degree in accounting, finance, or business administration. In addition to formal education, knowledge of accounting software, bookkeeping practices, and relevant regulations is important. Certifications like the Certified Accounts Payable Associate (CAPA) can also be beneficial.

Here is an example of an experience listing suitable for a Accounts Payable Specialist resume:

- Bachelor of Science in Accounting, XYZ University, 2016–2020

- Associates Degree in Business Administration, ABC Community College, 2014–2016

- Certified Accounts Payable Professional (CAPP), Institute of Finance & Management, 2021

- Continuing Education: Advanced Excel for Accounting, Online Course, TechSkills, 2021

Accounts Payable Specialist Skills for a Resume

Adding skills to an Accounts Payable Specialist resume is important because it highlights the candidate's abilities to manage and execute the financial obligations of a company effectively. These skills demonstrate proficiency in processing invoices, maintaining accurate records, and ensuring timely payments, which are crucial in managing cash flow and maintaining good relationships with vendors and suppliers. Clearly presenting these competencies can differentiate a candidate in a competitive job market.

Soft Skills:

- Attention to Detail

- Problem-Solving Abilities

- Time Management

- Communication Skills

- Adaptability & Flexibility

- Team Collaboration

- Customer Service Orientation

- Organizational Skills

- Data Analysis

- Integrity & Confidentiality

- Invoice Processing

- Payment Reconciliation

- ERP Software Proficiency

- Financial Recordkeeping

- Vendor Management

- Account Coding

- Expense Reporting

- Data Entry Accuracy

- Regulatory Compliance

- Spreadsheet Proficiency

Common Mistakes to Avoid When Writing an Accounts Payable Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Accounts Payable Specialist resume

- Proficiency in managing accounts payable processes and maintaining accurate financial records

- Demonstrated ability to process, verify, and reconcile invoices efficiently

- Strong understanding of accounting principles, regulations, and procedures

- Expertise in using accounting software such as QuickBooks, SAP, Oracle, or Microsoft Dynamics

- Adept in handling vendor relations and negotiating payment terms

- Experience with preparing and performing check runs, electronic transfers, and payments

- Skilled in month-end closing procedures and assisting with financial audits

- Ability to manage expense reports, including verification and reimbursement processing

- Excellent organizational skills and attention to detail for handling high volume invoice processing

- Strong problem-solving abilities to resolve discrepancies in billing and payments

- Proficient in data entry and maintaining up-to-date records of accounts payable transactions

- Capability to work independently and collaboratively in a team-oriented environment

- Effective communication skills for interacting with suppliers and internal departments

- Education in accounting, finance, or a related field, along with relevant certifications (e.g., CPB or AIPB)

- Commitment to continuous improvement and professional development in the field of accounts payable

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.