Are you looking for a job as a collections agent? Look no further! Our collections agent resume example article will provide you with a solid foundation for creating a winning resume. From highlighting key skills and experience to showcasing your ability to effectively communicate with clients, our sample resume will help you stand out to potential employers. Whether you're just starting out in the industry or looking to advance your career, our resume example has got you covered.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Collections Agent do?

- Contact individuals or businesses with overdue payments

- Negotiate payment plans and arrangements

- Record and update account information

- Utilize collection software and databases to track accounts

- Report on collection activity and progress

- Comply with all laws and regulations regarding debt collection

- Retail Sales Consultant Resume Sample

- Retail Salesperson Resume Sample

- Spa Receptionist Resume Sample

- Clerk Resume Sample

- Retail Associate Resume Sample

- Fashion Consultant Resume Sample

- Retail Store Manager Resume Sample

- Retail Sales Assistant Resume Sample

- Showroom Manager Resume Sample

- Reservations Agent Resume Sample

- Slot Attendant Resume Sample

- Customer Support Analyst Resume Sample

- Dental Receptionist Resume Sample

- Director Of Customer Service Resume Sample

- Retail Specialist Resume Sample

- Salon Manager Resume Sample

- Bus Monitor Resume Sample

- Team Member Resume Sample

- Retail Pharmacist Resume Sample

- Customer Care Representative Resume Sample

What are some responsibilities of a Collections Agent?

- Contacting delinquent customers to secure payment

- Negotiating payment plans with customers

- Maintaining accurate and up-to-date account records

- Adhering to federal and state debt collection laws

- Providing excellent customer service

- Responding to customer inquiries and resolving any issues

- Meeting collection targets and goals

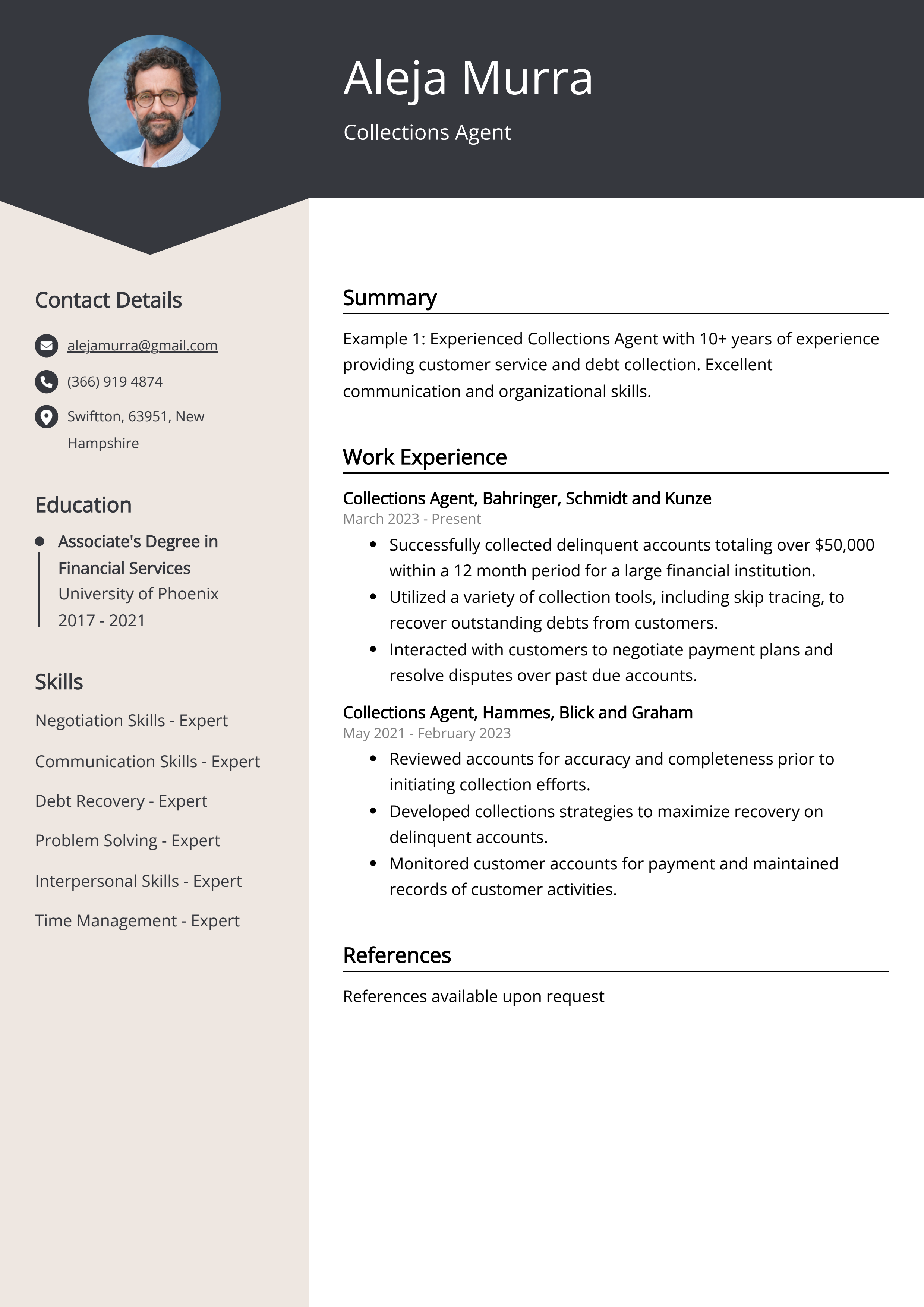

Sample Collections Agent Resume for Inspiration

Personal Details:

- Name: John Doe

- Email: johndoe@email.com

- Phone: 123-456-7890

- Address: 123 Main St, City, State, Zip

Summary:

John Doe is a dedicated and results-driven Collections Agent with five years of experience in effectively managing and recovering outstanding debts. Highly skilled in negotiation and communication, with a proven track record of meeting and exceeding collection targets. Possesses a strong attention to detail and the ability to work well under pressure.

Work Experience:

- Collections Agent at ABC Collections Agency (2017-2022)

Responsible for contacting debtors and negotiating payment plans, performing skip tracing, and accurately maintaining debtor records. Successfully met monthly collection targets and consistently received positive feedback from clients. - Assistant Collections Agent at XYZ Recovery Services (2015-2017)

Assisted senior collections agents in their duties, communicated with debtors to resolve outstanding balances, and provided support in administrative tasks. Contributed to achieving a 10% increase in collections within the first year.

Education:

- Bachelor's Degree in Business Administration

University of ABC, City, State

Skills:

- Excellent negotiation and communication skills

- Proficient in debt collection software and skip tracing techniques

- Strong attention to detail and ability to work under pressure

Certifications:

- Certified Debt Collection Professional (CDCP)

Languages:

- English (Native)

- Spanish (Intermediate)

Resume tips for Collections Agent

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Collections Agent resume tips.

We collected the best tips from seasoned Collections Agent - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in negotiating and collecting payments from delinquent accounts

- Showcase your strong communication and problem-solving skills

- Emphasize your ability to work independently and meet collection targets

- Demonstrate your knowledge of relevant laws and regulations pertaining to debt collection

- Include any relevant certifications or training in debt collection techniques

Collections Agent Resume Summary Examples

A resume summary or objective for a Collections Agent is essential because it provides a brief overview of your skills, experiences, and career goals. This helps to grab the attention of potential employers and gives them a clear understanding of what you can bring to the table. It also helps to tailor your resume to the specific job you are applying for, increasing your chances of landing an interview.

For Example:

- Experienced Collections Agent with 5 years of experience in effectively managing and recovering outstanding debts

- Demonstrated ability to negotiate payment plans and settlements with delinquent customers, resulting in successful debt recovery

- Proficient in using collection software and tracking systems to prioritize accounts and take appropriate action

- Excellent communication skills and proven track record of meeting or exceeding collection targets

- Strong understanding of regulations and compliance in debt collection, ensuring ethical and legal practices

Build a Strong Experience Section for Your Collections Agent Resume

Building a strong experience section for a collections agent resume is essential because it demonstrates your expertise and capabilities in negotiating payment arrangements, resolving delinquent accounts, and maintaining customer relations. It provides potential employers with a clear understanding of your relevant experience and skills, making you a more competitive candidate. A strong experience section can help showcase your ability to effectively collect on overdue debts and manage challenging customer interactions, leading to increased job opportunities and potential for career advancement.

For Example:

Collections Agent resume education example

A Collections Agent typically needs a high school diploma or equivalent. Some employers may require an associate's or bachelor's degree in finance, business administration, or a related field. Additional training and certifications in debt collection laws and techniques may also be beneficial for this role. Strong communication and negotiation skills are essential for success as a Collections Agent.

Here is an example of an experience listing suitable for a Collections Agent resume:

- Bachelor's Degree in Business Administration - XYZ University, 20XX

- Certification in Debt Collection - ABC Institute, 20XX

- Advanced Microsoft Excel and Word training - 20XX

Collections Agent Skills for a Resume

Adding skills to a Collections Agent resume is essential because it demonstrates the candidate's ability to effectively handle the responsibilities of the role. These skills showcase the candidate's expertise in negotiation, communication, problem-solving, and attention to detail, all of which are crucial in successfully managing collections activities and resolving overdue accounts. Including relevant skills on the resume can help impress potential employers and increase the chances of landing the job.

Soft Skills:

- Communication Skills

- Negotiation Skills

- Problem-Solving Ability

- Empathy and Patience

- Attention to Detail

- Time Management

- Adaptability

- Resilience

- Assertiveness

- Active Listening

- Negotiation skills

- Financial analysis

- Debt collection

- Skip tracing

- Legal process

- Data entry

- Customer service

- Risk assessment

- Credit analysis

- Call center operations

Common Mistakes to Avoid When Writing a Collections Agent Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Collections Agent resume

- Proven ability to effectively communicate with customers for debt collection purposes

- Strong negotiation and persuasion skills to reach favorable payment arrangements

- Experience in skip tracing and locating debtors

- Familiarity with relevant laws and regulations governing debt collection

- Proficient in using collection software and CRM systems

- Ability to remain calm under pressure and handle difficult situations professionally

- Strong attention to detail and accuracy in documenting collection efforts

- Proactive in identifying and escalating potential issues or risks in the collection process

- Ability to work independently and as part of a team to achieve collection targets

- Excellent time management skills and ability to prioritize tasks effectively

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.