In this article, we will provide you with an exemplary CV for an Insurance Manager position. This example is designed to help you understand the crucial elements that you need to include, such as your practical skills, relevant work experience, academic background, and achievements. The objective is to help you construct a comprehensive and compelling CV that can elevate your chances of securing the desired role. Whether you're an experienced professional or a motivated beginner, this Insurance Manager CV example can serve as your guide to building a strong professional profile.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Insurance Manager do?

An insurance manager oversees all aspects of an insurance business, including sale strategies, product development, and marketing. They manage the team of insurance agents or brokers, monitor their performance, set targets and ensure the profitability of the insurance business. They may also be responsible for dealing with policy renewals, claims, customer inquiries and complaints. Additionally, they often assess and manage risk, ensuring compliance with insurance laws and regulations.

- Financial Services Manager CV Sample

- Actuary CV Sample

- Benefits Analyst CV Sample

- Payroll Clerk CV Sample

- Mortgage Processor CV Sample

- Personal Financial Advisor CV Sample

- Cost Accounting Manager CV Sample

- Finance Administrator CV Sample

- Revenue Analyst CV Sample

- Private Equity Analyst CV Sample

- General Accountant CV Sample

- Mortgage Originator CV Sample

- Chief Accountant CV Sample

- Inventory Manager CV Sample

- Revenue Officer CV Sample

- Audit Supervisor CV Sample

- Loan Analyst CV Sample

- Collections Specialist CV Sample

- Bank Teller CV Sample

- Universal Banker CV Sample

What are some responsibilities of an Insurance Manager?

- Developing and implementing business strategies for the insurance department.

- Overseeing the hiring, training, and management of insurance agents and staff.

- Ensuring compliance with insurance laws and regulations.

- Maintaining up-to-date knowledge of insurance products and industry trends.

- Establishing and maintaining relationships with clients, insurance companies, and other stakeholders.

- Managing client claims, resolving disputes, and providing customer service.

- Conducting risk assessments and implementing risk management strategies.

- Preparing and presenting reports to higher management on performance, claims status, and other relevant details.

- Assisting in the development of budgets and financial plans.

- Negotiating and finalizing insurance contracts.

- Coordinating with sales teams to achieve targets and improve sales performance.

- Working closely with the underwriting team to assess the risk in insuring a particular person, asset, or establishment.

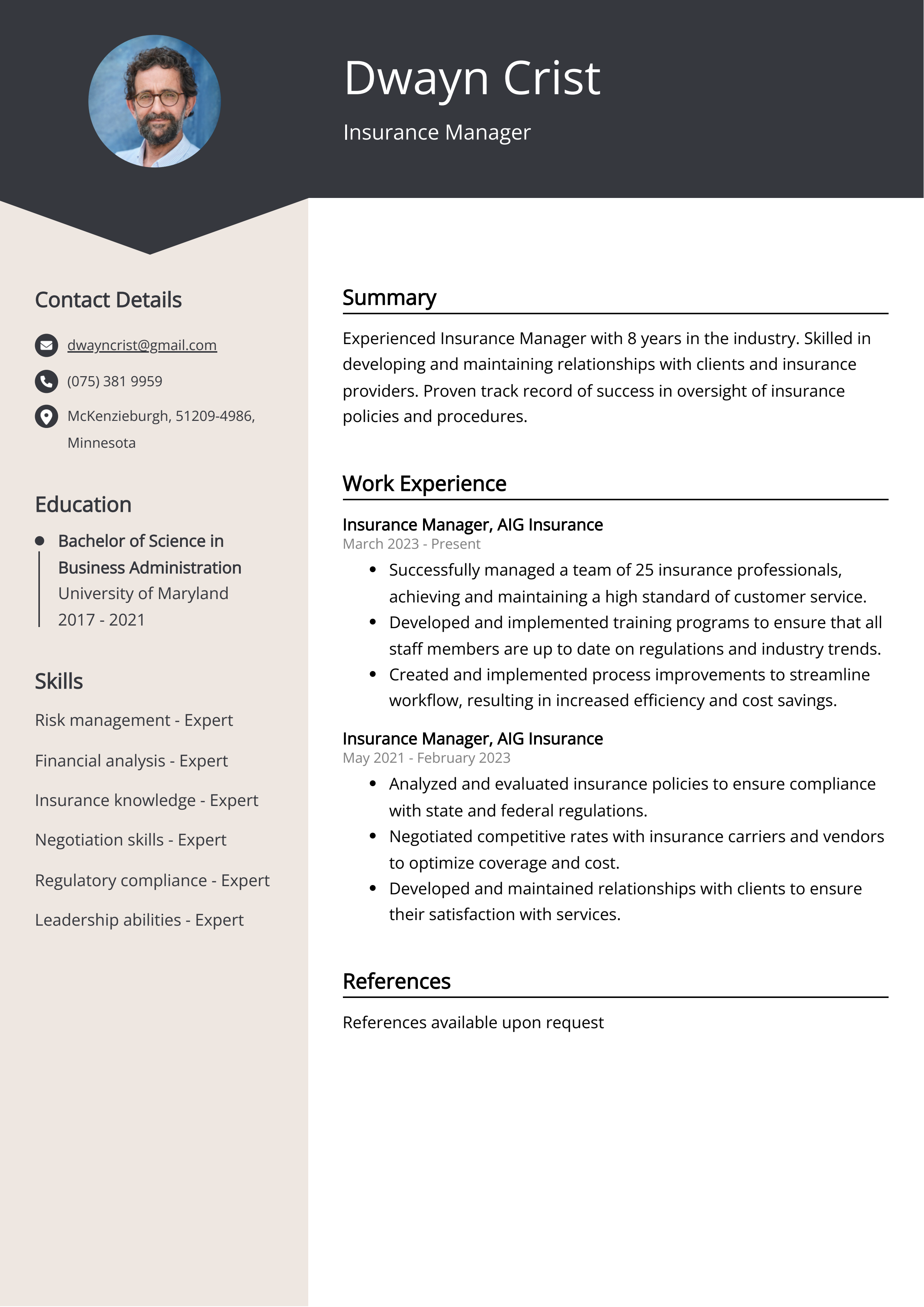

Sample Insurance Manager CV for Inspiration

PERSONAL DETAILS:

- Name: John Doe

- Address: 123 Birch Street, Big City, USA

- Email: johndoe@example.com

- Phone: +1 1234567890

SUMMARY:

John Doe is an accomplished Insurance Manager with over 10 years of experience in the insurance sector. He has a proven track record of refining company policies and introducing protocols resulting in increased efficiency and client satisfaction. Known for his analytical skills and ability to solve complex problems, John is adept at risk management while providing excellent customer service.

WORK EXPERIENCE:

- Insurance Manager, ABC Insurance Company (2013 – Present)

Overseeing daily operations, updating insurance policies, managing insurance claims, and developing team members for ongoing client satisfaction and company growth. - Assistant Manager, XYZ Insurance Company (2007 – 2013)

Assisted with insurance claim processing and policy updates. Successfully ensured timely and accurate claim settlement.

EDUCATION:

- Masters of Business Administration (Finance), Big City University (2005 – 2007)

- Bachelor of Commerce, Big City University (2002 – 2005)

SKILLS:

- Risk Management

- Insurance Policy & Claims Oversight

- Team Leadership

- Client Relationship Management

CERTIFICATIONS:

- Certified Professional Insurance Manager – National Association of Insurance Management (2012)

- Chartered Insurance Professional – Insurance Institute of Big City (2008)

LANGUAGES:

- English – Native/Bilingual proficiency

- Spanish – Professional working proficiency

CV tips for Insurance Manager

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Insurance Manager CV pointers.

We've curated top-notch advice from experienced Insurance Manager individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight Your Experience: Include detailed descriptions of your previous roles in the insurance sector. Mention your specific responsibilities, achievements and how you contributed to overall performance improvement in your organization.

- List Relevant Certifications: If you hold any certification related to insurance, management, or finance like Chartered Insurance Professional (CIP), Certified Insurance Counselor (CIC), or Certified Professional in Management (CPM), don't forget to list them. This will add credibility to your profile.

- Describe Your Skills: Mention key skills that make you the ideal candidate for the position. These can include, leadership skills, communication skills, analytical skills, knowledge of insurance policies and regulations etc.

- Quantify Achievements: Wherever possible, quantify your achievements. For instance, if you helped in reducing costs, mention the percentage of cost reduction. This helps in adding weightage to your CV.

- Add References: References can offer potential employers insights into your work ethic, personality, and attitude. If you have permission to share their contact information, including references from your past employers, colleagues or mentors is a good idea.

Insurance Manager CV Summary Examples

Using an Insurance Manager CV Summary or CV Objective is important for a number of reasons:

1. Showcasing expertise: This section allows you to highlight your key skills and areas of expertise in insurance management. It allows potential employers to quickly understand where your strengths lie.

2. Highlighting experience: The summary or objective can also be a space to outline your relevant experience in the field of insurance management, whether that be in specific industries, types of insurance, or management practices.

3. Career goals: It can also provide a snapshot of your career goals and ambitions. This can align you with companies that have the same outlook or can offer you the opportunities you're seeking.

4. Capturing attention: Given that this section is typically at the beginning of your CV, it's a chance to capture the attention of the hiring manager and encourage them to read the rest of your CV.

5. Positioning value: In a nutshell, a well-crafted Insurance Manager CV Summary or CV Objective will act as a brief and powerful statement that positions your value and relevancy for the specific role you're applying for.

For Example:

1.

- Experienced Insurance Manager with over 10 years of leading high-performing teams to exceed sales targets and customer satisfaction.

- Expert in risk assessment, insurance claims, and developing mitigation strategies to reduce policyholder losses.

- A detail-oriented Insurance Manager with extensive knowledge in creating customer-centric policies and insurance products.

- Strong financial acumen coupled with excellent communication skills for customer engagement and satisfaction.

- Dedicated Insurance Manager with experience in all facets of insurance operations.

- Proficient in underwriting, compliance, and risk management in a variety of insurance sectors.

- Proactive Insurance Manager experienced in strategic planning, policy development and negotiating contracts with clients and vendors.

- Adept at claims management, customer service, and building strong customer relationships.

- Seasoned Insurance Manager with proven track record in creating and implementing effective client acquisition strategies.

- Skilled in managing large teams, resolving disputes, and enhancing operational efficiency.

Build a Strong Experience Section for Your Insurance Manager CV

The Experience Section is one of the most important segments of an Insurance Manager CV because this is where you showcase your expertise in the field. Detailed descriptions of your previous work in insurance management particularly crucial tasks and achievements provide potential employers with a picture of what you have to offer.

1. Proven Track Record: It demonstrates that you have a confirmed history in the insurance sector and have effectively managed roles a similar organization may require.

2. Skills Validation: It validates the skills you have listed elsewhere on your CV. An employer can see where and how you applied these skills.

3. Knowledge and Proficiency: It confirms your practical proficiency in key areas like managing insurance claims, risk management, policy administration, etc.

4. Reflects Career Growth: It shows your career progression, especially if you have worked your way up from handling simpler tasks to managing more complex responsibilities.

5. Indicates Cultural Fit: Your past roles tell employers if you have experience in similar organizational structures, indicating suitability for the position or company.

6. Impacts on Business: It allows you to detail how your role played a part in the business, for instance, in processes improvement, cost savings, or increased profitability.

By constructing a strong experience section, you prove your ability to deliver in the position of an insurance manager, thereby increasing your appeal to employers.

For Example:

- Managed a team of 10 insurance agents, achieving a 20% increase in sales during my first year as insurance manager.

- Developed and implemented effective risk management strategies that reduced company losses by 15%.

- Initiated a comprehensive training program for new insurance agents, leading to a significant improvement in customer service scores.

- Led a special project to streamline insurance underwriting processes, resulting in decrease in time spent on policy issuance by 30%.

- Directed the reorganization of the company's claim settlement procedure, increasing customer satisfaction by 25%.

- Supervised the successful launch of three new insurance products, leading to a 15% increase in company revenue.

- Actively monitored market trends, ensuring the company's insurance offerings remained competitive and appealing to customers.

- Collaborated with marketing team to create a robust campaign which saw a significant boost in policy renewals by 22%.

- Successfully managed company's insurance portfolio, introducing analytics-based approach and increasing policy underwriting profitability by 18%.

- Coordinated with legal, finance and product teams to ensure all insurance products are compliance with regulatory requirements.

Insurance Manager CV education example

Most insurance managers have at least a bachelor's degree in business administration, finance, insurance, or a related field. Furthermore, several years of experience in the insurance field are typically required before someone can become an insurance manager. Knowledge in areas such as insurance policies, risk management, and sales are also often necessary.

Some positions may require a master's degree in business administration or a related field. Certification, such as the Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC), may also be beneficial or required for some positions.

In addition to formal education and experience, insurance managers also need strong leadership, problem-solving, communication, and analytical skills. They should be comfortable working with technology and data, as well as interacting with people, be it their team or clients.

Continued professional education is often necessary as well to stay updated with industry changes such as legal or technological advancements.

Here is an example of an experience listing suitable for a Insurance Manager CV:

- Bachelor's Degree in Business Administration - Yale University, New Haven, CT (2012-2016)

- Certified Insurance Service Representative (CISR) - The National Alliance for Insurance Education & Research (2017)

- Chartered Property Casualty Underwriter (CPCU) Certification - The Institutes (2018)

- Masters in Risk Management and Insurance - University of Pennsylvania, Philadelphia, PA (2018-2020)

Insurance Manager Skills for a CV

Adding skills to an Insurance Manager CV is important for several reasons.

1) Highlights your proficiency: The skills section showcases your proficiency in specific areas that are pertinent for the job role, boosting chances of passing initial screening processes.

2) Proves your competence: It provides evidence of your competence and readiness to handle the job's responsibilities.

3) Demonstrates relevant expertise: The skills you list help demonstrate your expertise in the insurance sector this may distinguish you from other candidates.

4) Influences employer’s decision: The skills mentioned play a significant role in influencing the employer’s hiring decision.

5) Customizes your CV: It helps you tailor your CV to the specific requirements of the job, making it apparent to employers that you're a suitable candidate.

6) Enhances keyword optimization: Certain skills can serve as keywords that can help your CV get picked up by electronic scanning systems typically used by larger companies.

Soft Skills:

- Decision-Making Abilities

- Effective Communication

- Leadership Skills

- Problem-Solving Skills

- Customer Service

- Negotiation Skills

- Teamwork Ability

- Organizational Skills

- Conflict Resolution

- Attention to Detail

- Data Analysis

- Risk Management

- Financial forecasting

- Policy Development

- Compliance Monitoring

- Claim Processing

- Insurance Underwriting

- Leadership Management

- Strategic planning

- Product knowledge

Common Mistakes to Avoid When Writing an Insurance Manager CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Insurance Manager CV

- An Insurance Manager CV should include solid experience in insurance, risk management, or a related field, attesting to the person’s ability to evaluate and manage risk, set premiums, and create policies.

- It's important to showcase a proven track record of developing, promoting, and implementing insurance products and services that meet customer needs.

- Outstanding leadership skills, with evidence of managing and motivating high-performing teams, should be evident in an Insurance Manager’s CV.

- These professionals should illustrate their ability to stay updated with insurance laws, regulations, and trends, as well as demonstrating their competency with related software and applications.

- Examples of strong analytical skills and attention to detail should be mentioned in the CV, as these are key traits for Insurance Managers when assessing risk and suitability of insurance plans.

- The CV should highlight good interpersonal and communication skills, as interaction with clients, insurers, and staff members is integral to the role.

- Having relevant certifications like FLMI (Fellow, Life Management Institute) or CPCU (Chartered Property Casualty Underwriter) can set a CV apart.

- An Insurance Manager’s CV should demonstrate their ability to implement strategies to retain existing business and grow the insurance portfolio.

- Lastly, the document should highlight negotiation skills and the ability to resolve complex insurance issues, as an Insurance Manager often serves as an intermediary between the insurance company and clients.

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.