Looking for a new opportunity as an Accounts Receivable Analyst? Our CV example and writing tips can help you stand out to potential employers and secure the job you want. The role of an Accounts Receivable Analyst is crucial to the financial health of a company, requiring strong analytical skills and attention to detail. Use our example to highlight your relevant experiences and qualifications in a way that will impress hiring managers.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Accounts Receivable Analyst do?

An Accounts Receivable Analyst is responsible for managing the company's accounts receivable functions. This includes monitoring and analyzing customer accounts, processing payments, resolving billing discrepancies, and coordinating with various departments to ensure accurate and timely payments. They may also be involved in developing and implementing procedures to improve the accounts receivable process and reduce outstanding balances. Additionally, they may generate reports and provide financial analysis to support decision-making within the organization.

- Finance Administrator CV Sample

- Commercial Lender CV Sample

- Financial Analyst CV Sample

- Bank Teller CV Sample

- Commodity Trader CV Sample

- Collection Specialist CV Sample

- Collections Specialist CV Sample

- Universal Banker CV Sample

- Accounts Payable Accountant CV Sample

- Revenue Agent CV Sample

- Financial Coordinator CV Sample

- Income Tax Preparer CV Sample

- Cost Estimator CV Sample

- Underwriting Assistant CV Sample

- Investment Advisor CV Sample

- Consumer Loan Officer CV Sample

- Real Estate Analyst CV Sample

- Loan Officer Assistant CV Sample

- Processor CV Sample

- Investment Executive CV Sample

What are some responsibilities of an Accounts Receivable Analyst?

- Responsible for monitoring and collecting accounts receivable

- Analyzing and resolving billing and payment discrepancies

- Managing customer credit limits and terms

- Generating aged receivable reports and conducting aging analysis

- Posting and reconciling daily deposits

- Communicating with customers to resolve outstanding issues

- Assisting with month-end closing activities

- Participating in audits and providing necessary documentation

- Implementing and maintaining accounts receivable processes and procedures

- Collaborating with other departments to improve collections processes

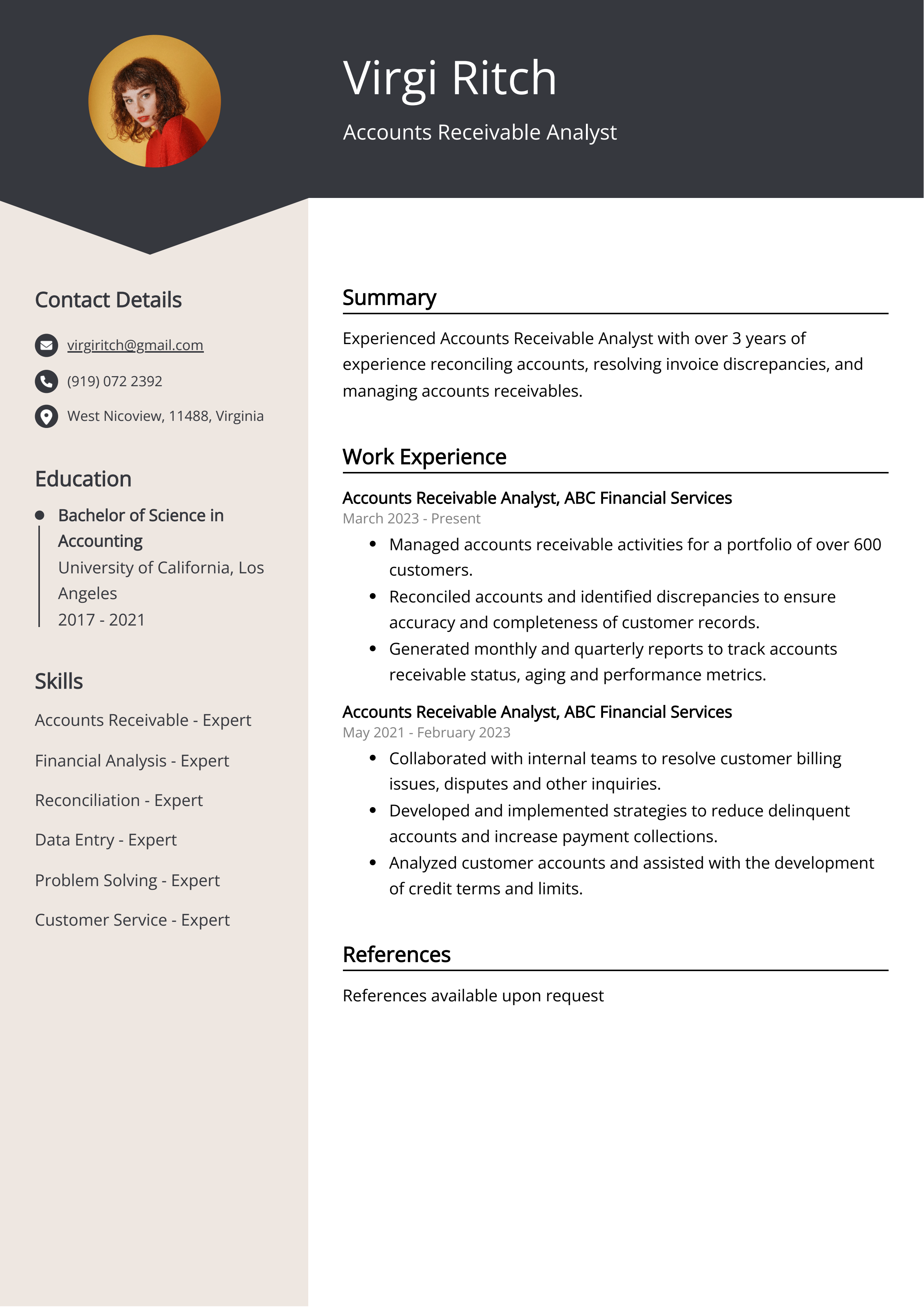

Sample Accounts Receivable Analyst CV for Inspiration

John Doe

Email: johndoe@email.com | Phone: 123-456-7890 | LinkedIn: linkedin.com/johndoe

Summary

Detail-oriented and highly analytical Accounts Receivable Analyst with 5 years of experience in financial analysis and reconciliation. Proven track record of improving collection processes, reducing outstanding balances, and maintaining positive client relationships. Possess strong communication and problem-solving skills to effectively collaborate with cross-functional teams and drive financial success.

Work Experience

- Accounts Receivable Analyst | XYZ Company | May 2018 - Present

- Responsible for managing accounts receivable activities, including processing invoices, conducting collection calls, and reconciling customer accounts.

- Implemented new collection strategies resulting in a 15% reduction in overdue payments.

- Collaborated with sales and customer service teams to address billing inquiries and resolve payment discrepancies.

- Junior Financial Analyst | ABC Corporation | August 2016 - April 2018

- Assisted in the preparation of financial reports, analysis of variances, and forecasting of revenue and expenses.

- Supported the Accounts Receivable team in conducting credit checks and monitoring customer credit limits.

- Participated in internal audits to ensure compliance with financial regulations and company policies.

Education

- Bachelor of Science in Accounting

- XYZ University | May 2016

Skills

- Financial analysis

- Reconciliation

- Collection management

- Microsoft Excel

- Financial reporting

- Problem-solving

Certifications

- Certified Accounts Receivable Specialist (CARS)

- Financial Analysis Professional (FAP)

Languages

- English (Native proficiency)

CV tips for Accounts Receivable Analyst

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Accounts Receivable Analyst CV pointers.

We've curated top-notch advice from experienced Accounts Receivable Analyst individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your relevant experience in accounts receivable and collections

- Showcase your proficiency in using accounting software and data analysis tools

- Demonstrate your understanding of credit management and risk assessment

- Quantify your contributions in reducing outstanding receivables and improving collection processes

- Emphasize your communication and negotiation skills when dealing with clients and resolving payment issues

Accounts Receivable Analyst CV Summary Examples

Using a Accounts Receivable Analyst CV summary or CV objective can help highlight your skills, experience, and career goals to potential employers. It provides a brief overview of your qualifications and can help grab the attention of hiring managers. A well-crafted summary or objective can effectively communicate your value as a professional and set the stage for the rest of your CV.

For Example:

- Managed a high volume of customer accounts and reduced delinquent accounts by 20% through effective collection strategies

- Performed detailed analysis of customer payment trends and developed targeted collection plans for delinquent accounts

- Utilized financial software to reconcile accounts and generate accurate aging reports to track outstanding balances

- Collaborated with sales and customer service teams to resolve billing discrepancies and improve customer satisfaction

- Implemented new policies and procedures to streamline the accounts receivable process and reduce outstanding balances

Build a Strong Experience Section for Your Accounts Receivable Analyst CV

Having a strong experience section on your Accounts Receivable Analyst CV is crucial because it showcases your relevant skills, expertise, and accomplishments in the field. It provides potential employers with a clear understanding of your capabilities and the value you can bring to their team. A robust experience section also helps you stand out among other candidates and increases your chances of securing interviews and job offers in the competitive job market.

For Example:

- Performed account reconciliations and resolved outstanding invoice issues

- Managed daily cash applications for multiple clients

- Worked collaboratively with the collections team to expedite payments

- Generated monthly financial reports and analysis

- Collaborated with sales and customer service teams to resolve billing discrepancies

- Processed credit card payments and refunds

- Reviewed and analyzed delinquent accounts to identify collection opportunities

- Assisted in the implementation of new accounts receivable software

- Participated in regular meetings with management to discuss accounts receivable performance

- Provided support for audits and compliance with accounting standards

Accounts Receivable Analyst CV education example

An Accounts Receivable Analyst typically needs a bachelor's degree in accounting, finance, or a related field. Some employers may require a master's degree or professional certification such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA). In addition to formal education, strong analytical, communication, and problem-solving skills are essential for success in this role. On-the-job training or experience in accounts receivable and financial analysis is also valuable.

Here is an example of an experience listing suitable for a Accounts Receivable Analyst CV:

- Bachelor's degree in Accounting, Finance, or related field from an accredited institution

- Certification in Accounts Receivable or related field (e.g. CRP, ACPA) is a plus

- Completed coursework in financial analysis, auditing, and taxation

- Attended seminars or workshops on current accounting and receivables best practices

Accounts Receivable Analyst Skills for a CV

Including skills for an Accounts Receivable Analyst CV is important because it demonstrates the candidate's proficiency in key areas of the role. This can help employers quickly assess the candidate's suitability for the position. Additionally, showcasing specific skills related to analyzing financial data, managing accounts, and utilizing relevant software can set the candidate apart from other applicants and highlight their ability to excel in the role.

Soft Skills:

- Communication

- Organization

- Attention to detail

- Time management

- Problem-solving

- Teamwork

- Adaptability

- Customer service

- Critical thinking

- Analytical skills

- Account reconciliation

- Financial analysis

- Excel proficiency

- Data management

- Invoice processing

- Billing expertise

- Credit control

- Payment processing

- Cash application

- GAAP knowledge

Common Mistakes to Avoid When Writing an Accounts Receivable Analyst CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Accounts Receivable Analyst CV

- Demonstrate proficiency in financial analysis and reporting

- Showcase experience in reconciling accounts and resolving discrepancies

- Highlight knowledge of accounting software and ERP systems

- Emphasize effective communication and relationship-building skills with clients and internal teams

- Outline ability to streamline and improve processes for the accounts receivable function

- Provide examples of successful cash flow management and collections strategies

- Exhibit strong attention to detail and accuracy in maintaining financial records

- Illustrate ability to generate and analyze aging reports and credit risk assessments