Looking to break into the world of equity research? Our Equity Research Associate Resume Example article provides a valuable guide to crafting a strong resume that will help you land that dream job. Whether you're a recent graduate or making a career transition, our sample resume and expert tips will give you the edge you need to impress potential employers and secure your place in this competitive industry.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does an Equity Research Associate do?

- Conduct research and analysis on companies and industries

- Assist in building financial models and valuations

- Prepare reports and presentations for clients

- Stay updated on market trends and developments

- Support Senior Analysts in their research and client interactions

- Collaborate with the sales and trading teams to provide insights and recommendations

- Equity Analyst Resume Sample

- Experienced Real Estate Agent Resume Sample

- Senior Analyst Resume Sample

- Accounting Consultant Resume Sample

- Pricing Specialist Resume Sample

- Real Estate Salesperson Resume Sample

- Mortgage Broker Resume Sample

- Accounts Receivable Supervisor Resume Sample

- Accounts Payable Assistant Resume Sample

- Trading Analyst Resume Sample

- Financial Project Manager Resume Sample

- Broker Resume Sample

- Aml Analyst Resume Sample

- Insurance Analyst Resume Sample

- Claims Auditor Resume Sample

- Credit Manager Resume Sample

- Teller Resume Sample

- Audit Associate Resume Sample

- Payroll Manager Resume Sample

- Accounts Receivable Analyst Resume Sample

What are some responsibilities of an Equity Research Associate?

- Conduct financial and industry analysis

- Assist in writing and producing equity research reports

- Perform market and competitor research

- Attend company meetings and industry conferences

- Help in generating investment ideas and recommendations

- Communicate with clients and other stakeholders

- Support senior research analysts in their work

- Maintain and update financial models and databases

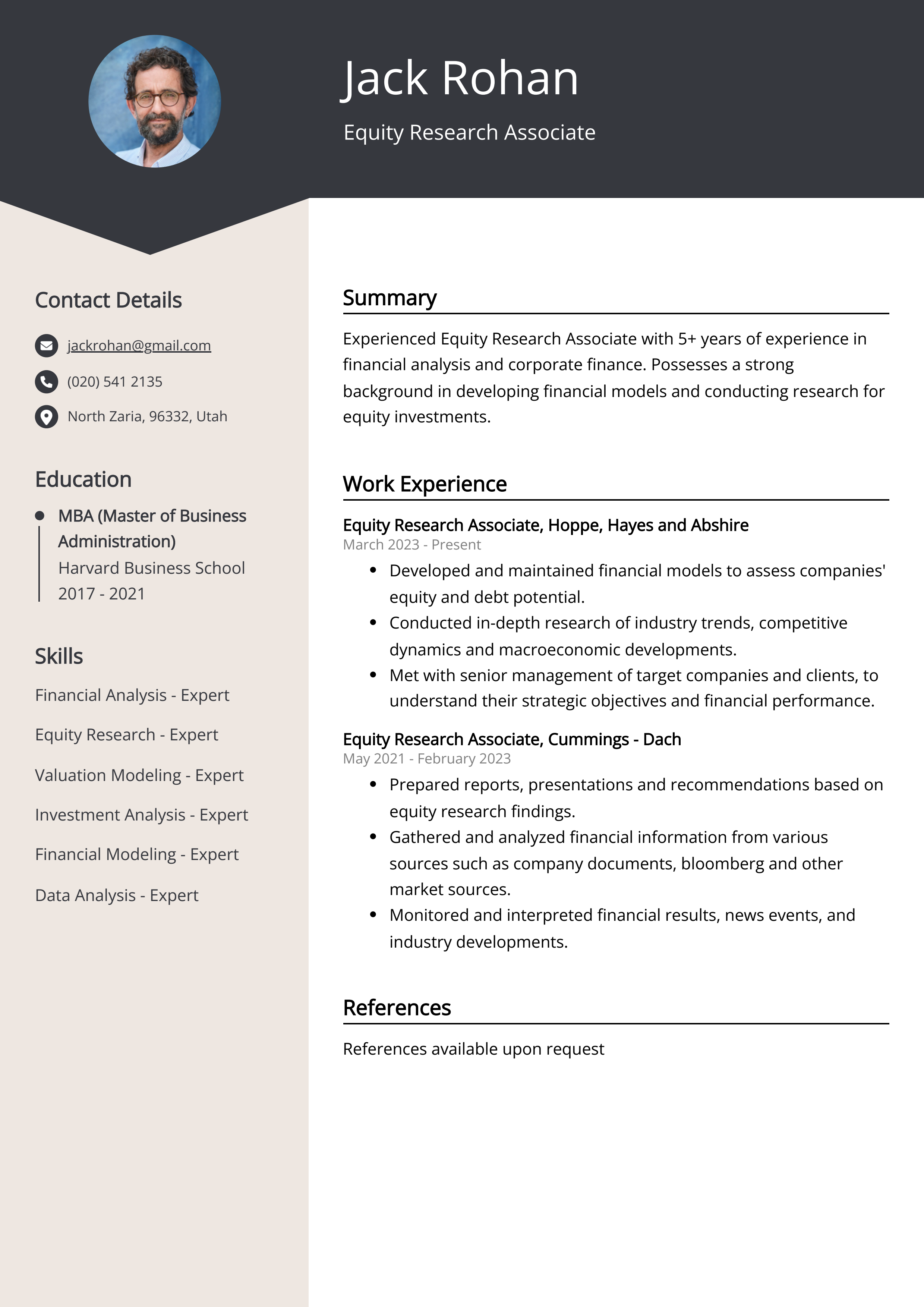

Sample Equity Research Associate Resume for Inspiration

Personal Details:

- Name: John Smith

- Email: johnsmith@email.com

- Phone: 123-456-7890

- Address: 123 Main Street, City, State

Summary:

John Smith is a dedicated and detail-oriented equity research associate with 5 years of experience in financial analysis and equity research. He has a strong understanding of financial markets and a proven track record of providing accurate and actionable investment recommendations to institutional clients.

Work Experience:

- Equity Research Associate at ABC Capital (2017-present) - Conduct fundamental research and financial analysis on public companies, build financial models, and prepare investment reports for institutional investors

- Financial Analyst at DEF Investments (2015-2017) - Assisted senior analysts in equity research, performed due diligence on potential investment opportunities, and contributed to portfolio management decisions

Education:

- Bachelor's degree in Finance from XYZ University

- Master's degree in Business Administration with a concentration in Finance from XYZ Business School

Skills:

- Financial modeling

- Equity valuation

- Company analysis

- Industry research

- Excel and Bloomberg proficiency

Certifications:

- CFA (Chartered Financial Analyst) designation

- Series 7 and 63 licenses

Languages: English, Spanish

Resume tips for Equity Research Associate

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Equity Research Associate resume tips.

We collected the best tips from seasoned Equity Research Associate - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your relevant skills and experience, including financial analysis, industry research, and report writing.

- Showcase your educational background, including any degrees in finance, economics, or related fields.

- Emphasize your ability to work in a fast-paced, high-pressure environment and meet tight deadlines.

- Include any relevant certifications, such as the Chartered Financial Analyst (CFA) designation.

- Showcase your attention to detail and strong analytical abilities through specific examples or achievements in previous roles.

Equity Research Associate Resume Summary Examples

A resume summary or objective for an Equity Research Associate is essential to quickly showcase your skills and career goals to potential employers. It provides a concise overview of your background, experience, and aspirations in the field, helping recruiters to understand your value proposition. A well-crafted summary or objective can capture the attention of hiring managers and increase your chances of landing an interview.

For Example:

- Performed financial modeling and analysis to support equity research team

- Conducted industry research and prepared reports on potential investment opportunities

- Assisted in the development of investment theses and recommendations

- Collaborated with senior analysts to gather data and information for research projects

- Participated in client meetings and presentations to discuss research findings

Build a Strong Experience Section for Your Equity Research Associate Resume

Building a strong experience section for a Equity Research Associate resume is crucial because it highlights your relevant skills, knowledge, and accomplishments in the field. It gives potential employers a clear understanding of your capabilities and how you can contribute to their organization. A strong experience section also sets you apart from other candidates and increases your chances of securing an interview for the job.

For Example:

- Conducted financial analysis and modeling for various industries, including technology, healthcare, and consumer goods.

- Assisted in preparing and presenting investment recommendations to portfolio managers and institutional clients.

- Performed company and industry research, analyzing financial statements and market data to identify investment opportunities.

- Collaborated with senior analysts to create and maintain financial models and valuation metrics.

- Participated in conference calls and meetings with company management to gather information for research reports.

- Developed and maintained relationships with industry contacts, such as industry experts, suppliers, and competitors.

- Contributed to the writing and editing of equity research reports, providing insights on key trends and market developments.

- Assisted in tracking and monitoring the performance of stock recommendations and providing updates to clients.

- Participated in due diligence processes for potential investment opportunities and mergers and acquisitions.

- Supported the team with ad-hoc projects and tasks, including data gathering and analysis, as required.

Equity Research Associate resume education example

An Equity Research Associate typically needs a bachelor's degree in finance, accounting, economics, or a related field. Some employers may also prefer candidates with a master's degree or professional certification such as the Chartered Financial Analyst (CFA) designation. Strong analytical and quantitative skills are essential, as well as knowledge of financial modeling, valuation techniques, and industry research. Additionally, experience with financial analysis and investment research is often required.

Here is an example of an experience listing suitable for a Equity Research Associate resume:

- Master of Business Administration (MBA) in Finance - University of Southern California, Los Angeles, CA (2015)

- Bachelor of Science in Economics - University of California, Berkeley, CA (2012)

- Chartered Financial Analyst (CFA) Level I Candidate

Equity Research Associate Skills for a Resume

It is important to add skills for an Equity Research Associate Resume because it demonstrates the candidate's capabilities and experience in conducting financial analysis, industry research, and tracking market trends. These skills are crucial for effectively evaluating investment opportunities and providing valuable insights to clients and colleagues in the financial industry. Additionally, highlighting relevant skills can increase the candidate's chances of being selected for an interview.

Soft Skills:

- Attention to detail

- Analytical thinking

- Effective communication

- Problem solving

- Teamwork

- Time management

- Critical thinking

- Adaptability

- Leadership

- Emotional intelligence

- Financial Analysis

- Data Modeling

- Valuation Techniques

- Industry Knowledge

- Company Due Diligence

- Financial Reporting

- Forecasting Skills

- Statistical Analysis

- Excel Proficiency

- Financial Statement Analysis

Common Mistakes to Avoid When Writing an Equity Research Associate Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Equity Research Associate resume

- Demonstrated ability to conduct thorough and accurate financial analysis

- Proficient in preparing financial models and forecasts

- Proven track record of effective communication with senior management and key stakeholders

- Skilled in conducting industry and company research

- Strong understanding of financial markets and investment strategies

- Ability to work collaboratively in a team environment

- Expertise in using financial databases and software

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.