Are you looking to land your dream job as a Loan Originator? A well-crafted resume can make all the difference. Our Loan Originator Resume Example provides a comprehensive guide on how to create a standout resume that showcases your skills and experience in the best light. From formatting tips to example bullet points, this article has everything you need to create a compelling resume that will catch the eye of potential employers.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Loan Originator do?

- Evaluate loan applications and determine the creditworthiness of applicants

- Assist clients in selecting the best loan products to meet their needs

- Obtain and verify financial documents such as pay stubs, bank statements, and tax returns

- Negotiate loan terms and conditions with borrowers

- Pull credit reports and review credit histories of applicants

- Work with underwriters to ensure that all loan documentation is accurate and complete

- Stay up-to-date on lending guidelines and regulations

- Advertising Sales Resume Sample

- Recruiting Assistant Resume Sample

- Brand Representative Resume Sample

- Sales Operations Analyst Resume Sample

- Enrollment Advisor Resume Sample

- Sales Agent Resume Sample

- Sales Director Resume Sample

- Technical Sales Manager Resume Sample

- Realtor Resume Sample

- Promoter Resume Sample

- VP Marketing Resume Sample

- VP Sales Resume Sample

- Promotions Assistant Resume Sample

- Sales Operations Manager Resume Sample

- Commercial Project Manager Resume Sample

- Sales Representative Resume Sample

- Broker Assistant Resume Sample

- Meeting Planner Resume Sample

- Traffic Coordinator Resume Sample

- Digital Marketing Manager Resume Sample

What are some responsibilities of a Loan Originator?

- Evaluating loan applications and determining applicant eligibility

- Gathering and analyzing financial information of applicants

- Explaining available loan products to customers

- Assisting customers with the application process

- Communicating with underwriters and other stakeholders

- Ensuring compliance with lending regulations and guidelines

- Building and maintaining relationships with clients and referral sources

- Providing guidance and support throughout the loan process

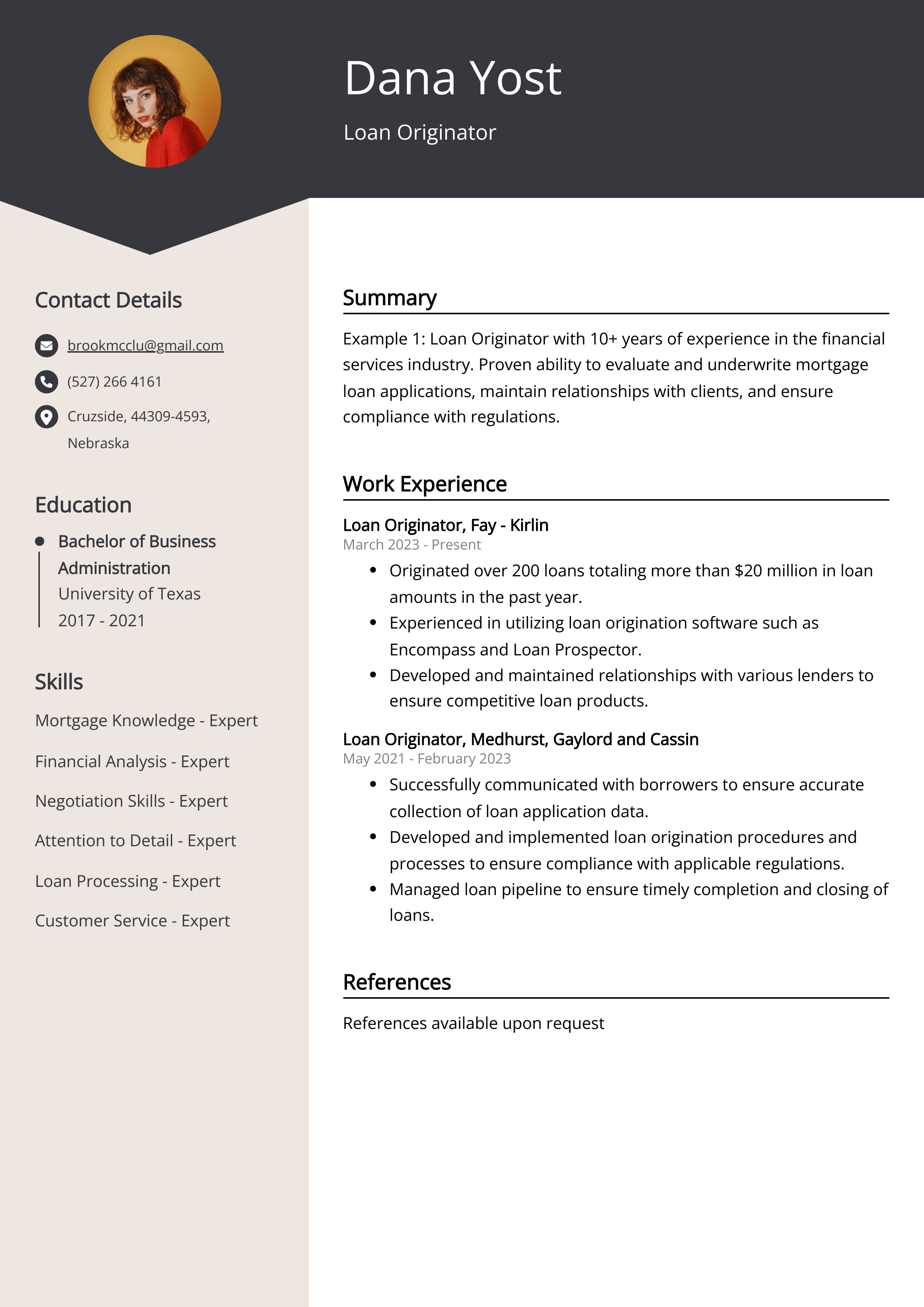

Sample Loan Originator Resume for Inspiration

Resume Personal Details

Name: John Smith

Email: johnsmith@email.com

Phone: 123-456-7890

SummaryJohn Smith is a highly skilled and motivated Loan Originator with 5 years of experience in the banking industry. He has a proven track record of success in generating new business and providing exceptional customer service. John is a dedicated professional with a strong understanding of loan products and industry regulations.

Work ExperienceLoan Originator - ABC Bank, City, State

- Generated and closed an average of 15 new loan applications per month

- Managed a portfolio of over 100 client accounts

- Provided financial counseling and guidance to clients

- Collaborated with underwriting and processing teams to ensure timely loan approvals

Bachelor's Degree in Finance - University XYZ, City, State

Graduated Magna Cum Laude

Skills- Excellent communication and interpersonal skills

- Strong knowledge of loan products and lending guidelines

- Proficient in mortgage origination software

- Ability to multitask and prioritize in a fast-paced environment

- NMLS Certification

- Certified Mortgage Planning Specialist (CMPS)

Fluent in English and Spanish

Resume tips for Loan Originator

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Loan Originator resume tips.

We collected the best tips from seasoned Loan Originator - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Use quantitative results to highlight your achievements, such as the number of loans originated or total dollar amount of loans funded

- Showcase specific skills relevant to the loan originator role, such as knowledge of industry regulations, strong communication abilities, and proficiency with loan origination software

- Highlight any relevant certifications, such as a Certified Mortgage Loan Originator (CMLO) designation

- Include any relevant experience in financial services or customer relations to demonstrate your ability to build relationships and close deals

- Tailor your resume to the specific company or position you are applying for, highlighting how your skills and experience align with their needs

Loan Originator Resume Summary Examples

A Loan Originator Resume Summary or Objective is important because it provides a concise overview of the candidate's skills, experience, and career goals. It helps to grab the attention of potential employers and showcases the candidate's qualifications for the position. A strong summary or objective can make a resume stand out and increase the chances of being selected for an interview.

For Example:

- 10+ years of experience in mortgage lending

- Proven track record of meeting and exceeding sales targets

- In-depth knowledge of loan programs and underwriting guidelines

- Strong communication and customer service skills

- Proficient in loan origination software and Microsoft Office

Build a Strong Experience Section for Your Loan Originator Resume

Having a strong experience section on a loan originator resume is crucial for demonstrating your expertise and skills in the field. It provides potential employers with a clear understanding of your background, accomplishments, and the value you can bring to their organization. A well-crafted experience section can set you apart from other candidates and showcase your ability to successfully originate and process loans, ultimately increasing your chances of landing a job in the industry.

For Example:

- Successfully originated and closed over 100 mortgage loans

- Developed and maintained relationships with real estate agents, attorneys, and other professionals in the industry

- Negotiated loan terms, conditions, and pricing with clients

- Ensured compliance with all state and federal regulations

- Analyzed financial data and credit reports to determine loan eligibility

- Advised clients on the different loan products and options available to them

- Assisted clients in completing the loan application and gathering required documentation

- Performed thorough analysis of client's financial situation to determine the best loan product for their needs

- Collaborated with underwriters and processors to ensure timely and accurate closing of loans

- Maintained a high level of customer satisfaction and retention through excellent communication and service

Loan Originator resume education example

A Loan Originator typically needs a high school diploma or equivalent to work in the field. Many employers prefer candidates with a bachelor's degree in finance, economics, or a related field. Some Loan Originators may also need to obtain a license, which typically requires completing pre-licensing education, passing an exam, and completing continuing education courses. Additionally, on-the-job training and real-world experience in the mortgage industry are valuable for success in this role.

Here is an example of an experience listing suitable for a Loan Originator resume:

- Bachelor's Degree in Finance, University of ABC, 2010

- Completed Mortgage Loan Originator Certification, XYZ Institute, 2012

- Continuing education in lending regulations and compliance

Loan Originator Skills for a Resume

It is important to add skills to a Loan Originator resume to showcase the candidate's ability to effectively analyze financial information, communicate with clients, and navigate the loan application process. Additionally, these skills can demonstrate the candidate's proficiency in sales, customer service, and compliance with lending regulations, ultimately making them a more attractive candidate to potential employers.

Soft Skills:

- Communication

- Problem-solving

- Customer service

- Time management

- Attention to detail

- Negotiation skills

- Adaptability

- Emotional intelligence

- Conflict resolution

- Teamwork

- Financial analysis

- Credit evaluation

- Loan underwriting

- Regulatory compliance

- Market research

- Sales techniques

- Mathematical proficiency

- Debt restructuring

- Documentation management

- Risk assessment

Common Mistakes to Avoid When Writing a Loan Originator Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Loan Originator resume

- Strong understanding of lending regulations and guidelines

- Proven track record of meeting and exceeding sales targets

- Excellent communication and customer service skills

- Ability to assess borrowers' financial situations and provide suitable loan options

- Proficient in using loan origination software and tools

- Experience in building and maintaining relationships with referral partners

- Ability to work efficiently in a fast-paced and deadline-driven environment

- Strong attention to detail and accuracy in loan documentation

- Proactive in staying updated on industry trends and changes in lending practices

- Proven ability to multitask and prioritize workload effectively

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.