As a credit officer, your expertise in evaluating and managing credit risks is essential for a company's financial health. Our Credit Officer Resume Example article provides a comprehensive guide to crafting a standout resume that showcases your skills and experience in the field. From highlighting your knowledge of financial analysis to demonstrating your ability to make sound credit decisions, this article will help you land the credit officer role you desire.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Credit Officer do?

- Review and process credit applications

- Analyze financial information and credit reports

- Determine credit worthiness of applicants

- Set credit limits and terms

- Monitor and manage credit accounts

- Work with customers to resolve payment issues

- Collaborate with other departments to ensure compliance with credit policies

- Compliance Analyst Resume Sample

- Assistant Account Executive Resume Sample

- Lease Analyst Resume Sample

- Analyst Resume Sample

- Accounts Receivable Coordinator Resume Sample

- General Ledger Accountant Resume Sample

- Accounting Administrator Resume Sample

- Senior Business Analyst Resume Sample

- Securities Analyst Resume Sample

- Accounts Receivable Analyst Resume Sample

- Financial Aid Counselor Resume Sample

- Accounting Consultant Resume Sample

- Accounting Associate Resume Sample

- Account Officer Resume Sample

- Personal Financial Advisor Resume Sample

- Accounts Payable Coordinator Resume Sample

- Derivatives Analyst Resume Sample

- Financial Systems Analyst Resume Sample

- Finance Director Resume Sample

- Financial Accountant Resume Sample

What are some responsibilities of a Credit Officer?

- Evaluating creditworthiness of potential clients

- Analyzing financial statements and credit reports

- Setting up and managing credit lines

- Reviewing and approving loan applications

- Maintaining and updating credit files

- Monitoring repayment of outstanding debts

- Resolving any credit-related issues or disputes

- Keeping up to date with industry regulations and best practices

- Communicating with clients and other departments within the organization

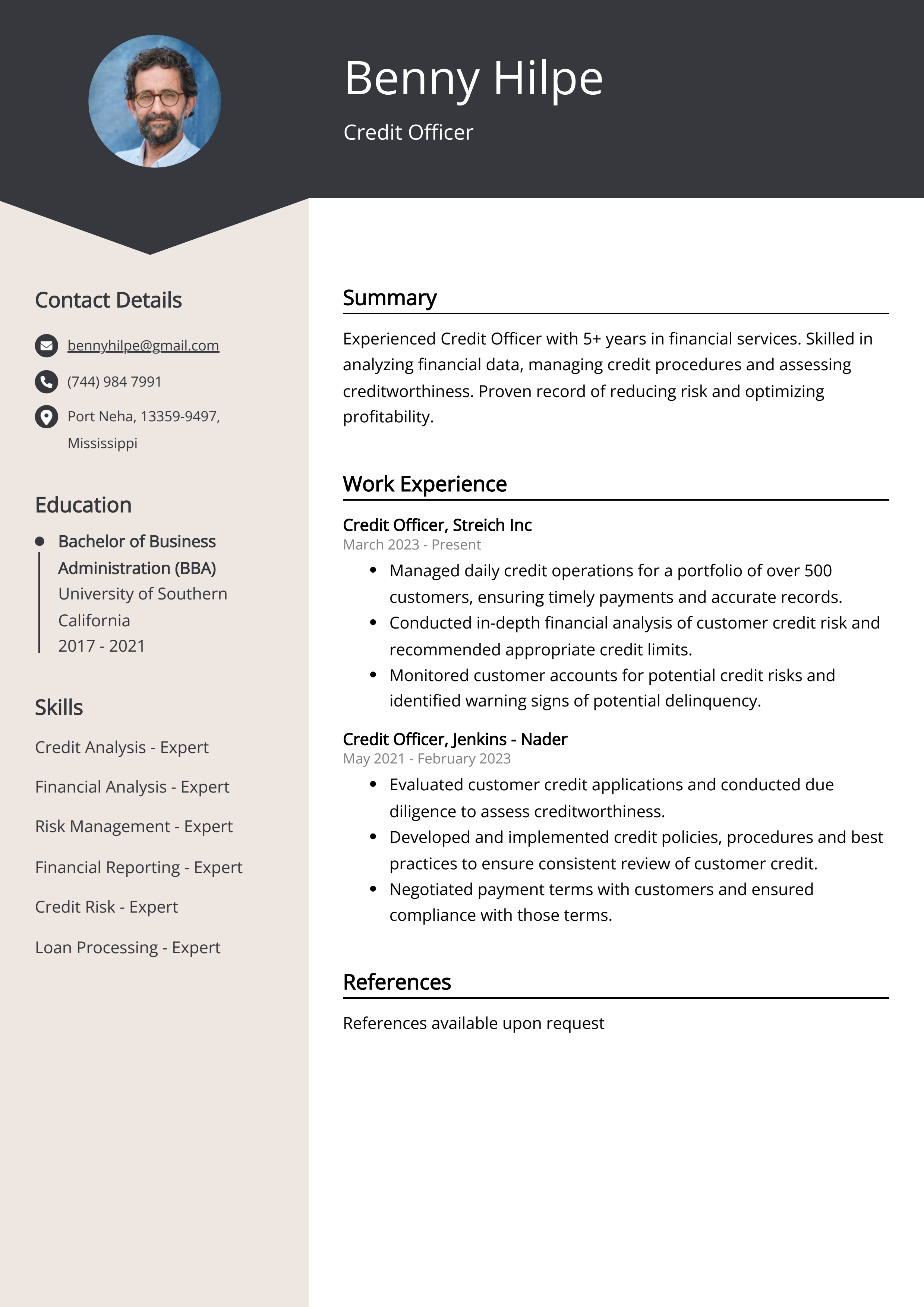

Sample Credit Officer Resume for Inspiration

John Doe

123 Main Street, City, State, 12345

Email: johndoe@email.com | Phone: (123) 456-7890

Summary:

John is an experienced Credit Officer with a strong background in assessing credit risks, analyzing financial statements and managing loan portfolios. He is skilled in providing excellent customer service and ensuring compliance with regulatory requirements. John is seeking a challenging role in a reputable financial institution to utilize his expertise in credit analysis and risk assessment.

Work Experience:

- Credit Officer, ABC Bank, City, State | 2015 - Present

- Assess creditworthiness of individual and business loan applicants

- Analyze financial statements, credit reports, and other relevant documents

- Manage loan portfolios and monitor repayment activities

- Ensure compliance with regulatory requirements and internal credit policies

- Provide exceptional customer service and address customer inquiries and concerns

- Loan Processor, XYZ Credit Union, City, State | 2012 - 2015

- Processed loan applications and verified applicant information

- Reviewed and evaluated credit reports and financial documents

- Assisted in underwriting and approving consumer loans

Education:

- Bachelor of Science in Finance

- University of City, State | Graduated 2012

Skills:

- Proficient in credit analysis and risk assessment

- Excellent understanding of financial statements and credit reports

- Strong knowledge of regulatory requirements and compliance standards

- Good communication and interpersonal skills

- Ability to work efficiently in a fast-paced environment

Certifications:

- Certified Credit Professional (CCP)

- AML/KYC Certification

Languages: English (Fluent), Spanish (Conversational)

Resume tips for Credit Officer

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Credit Officer resume tips.

We collected the best tips from seasoned Credit Officer - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in assessing the creditworthiness of individuals and companies.

- Showcase your skills in financial analysis and risk assessment.

- Include any relevant certifications or training in credit analysis and lending practices.

- Detail your ability to communicate effectively with clients and colleagues.

- Quantify your achievements, such as successful loan approvals or reductions in delinquent accounts.

Credit Officer Resume Summary Examples

A Credit Officer Resume Summary or Resume Objective is essential for grabbing the attention of potential employers. It provides a brief overview of your skills, experience, and career goals, making it easier for recruiters to gauge your suitability for the role. A well-crafted summary or objective can help you stand out from other candidates and increase your chances of landing an interview.

For Example:

- Experienced Credit Officer with a proven track record of assessing and managing risk for loan applications

- Skilled at analyzing financial statements, conducting credit investigations, and making sound lending decisions

- Strong knowledge of credit policies, regulations, and industry best practices

- Excellent communication and negotiation skills when working with clients, colleagues, and external stakeholders

- Able to work efficiently in a fast-paced and deadline-driven environment, while maintaining high accuracy and attention to detail

Build a Strong Experience Section for Your Credit Officer Resume

Building a strong experience section for a credit officer resume is essential to showcase your expertise in evaluating and managing credit risks. It provides evidence of your ability to assess loan applications, negotiate terms, and mitigate financial risks. A robust experience section can set you apart from other candidates and demonstrate your proficiency in analyzing financial data and making sound credit decisions, making you a valuable asset to potential employers.

For Example:

- Managed credit and collection activities for a portfolio of over 200 clients

- Analyzed financial statements to assess credit risk and determine appropriate credit limits

- Negotiated payment terms with delinquent accounts and resolved customer disputes

- Implemented credit policies and procedures to minimize risk and maximize efficiency

- Performed credit reviews and monitored account activity for potential issues

- Collaborated with sales and finance teams to evaluate credit applications and make informed decisions

- Provided credit recommendations to management based on comprehensive analysis and assessment

- Conducted credit investigations and gathered information to make accurate credit decisions

- Maintained accurate and up-to-date credit files for all accounts

- Managed relationships with external credit reporting agencies and vendors

Credit Officer resume education example

A Credit Officer typically needs a bachelor's degree in finance, business administration, economics, or a related field. Some employers may also require a master's degree in a related field for senior-level positions. Additionally, obtaining certifications, such as the Chartered Financial Analyst (CFA) or Certified Credit Professional (CCP) designation, can enhance job prospects and demonstrate expertise in credit analysis and risk management. Strong analytical, communication, and interpersonal skills are also essential for this role.

Here is an example of an experience listing suitable for a Credit Officer resume:

- Bachelor's degree in Finance, Business Administration, or related field

- Certification in credit analysis or risk management

- Participation in relevant workshops or training programs related to credit assessment and lending practices

Credit Officer Skills for a Resume

Adding skills to a Credit Officer resume is important because it allows potential employers to gauge the candidate's ability to assess risk, analyze financial data, and make sound lending decisions. Skills such as attention to detail, communication, and customer service are also essential for this role. Including a range of relevant skills on a resume can help a candidate stand out and demonstrate their suitability for the position.

Soft Skills:

- Communication

- Problem-solving

- Customer service

- Teamwork

- Time management

- Attention to detail

- Adaptability

- Negotiation

- Critical thinking

- Empathy

- Financial Analysis

- Risk Assessment

- Credit Evaluation

- Underwriting Guidelines

- Loan Processing

- Cash Flow Analysis

- Regulatory Compliance

- Debt Service Coverage

- Credit Scoring

- Collateral Evaluation

Common Mistakes to Avoid When Writing a Credit Officer Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Credit Officer resume

- Proficient in evaluating and analyzing creditworthiness

- Experienced in reviewing and approving loan applications

- Skilled in conducting credit investigations and risk assessments

- Knowledgeable in financial statement analysis and credit scoring

- Effective in communicating with clients and other stakeholders

- Compliance with lending policies and regulations

- Ability to make sound and objective credit decisions

- Strong attention to detail and accuracy

- Proven track record of maintaining low delinquency rates

- Proficient in using credit evaluation software and tools

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.