Are you a skilled Consumer Loan Officer looking for a new opportunity? Crafting a strong resume is essential to getting noticed by hiring managers. Our Consumer Loan Officer resume example provides key tips and guidance on how to create a standout resume that showcases your experience, skills, and accomplishments in the best light. Use our sample resume as a guide to land your next Consumer Loan Officer position.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Consumer Loan Officer do?

- Evaluates loan applications and determines the creditworthiness of applicants

- Assists customers in understanding the loan application process and available loan options

- Collects and verifies financial information from applicants

- Analyzes and verifies the accuracy of financial documents

- Reviews and approves or denies loan applications based on established lending guidelines

- Provides guidance and support to customers throughout the loan approval process

- Ensures compliance with lending regulations and policies

- Manages loan portfolios and identifies potential loan opportunities

- Property Accountant Resume Sample

- Credit Analyst Resume Sample

- Financial Data Analyst Resume Sample

- Accounting Manager Resume Sample

- Payroll Processor Resume Sample

- Claim Specialist Resume Sample

- Retention Specialist Resume Sample

- Accounts Payable Supervisor Resume Sample

- Finance Specialist Resume Sample

- Controller Resume Sample

- Investment Banker Resume Sample

- Lease Analyst Resume Sample

- Broker Resume Sample

- Mortgage Loan Closer Resume Sample

- Finance Administrator Resume Sample

- Financial Accountant Resume Sample

- Senior Tax Accountant Resume Sample

- CFO Resume Sample

- Accounts Payable Administrator Resume Sample

- Financial Services Manager Resume Sample

What are some responsibilities of a Consumer Loan Officer?

- Evaluating loan applications and determining the creditworthiness of applicants

- Interviewing loan applicants to gather personal, financial, and employment information

- Reviewing and verifying applicants' financial documents, such as income statements and credit reports

- Explaining loan options and terms to applicants, and helping them choose the most suitable loan products

- Assisting applicants in completing loan applications and obtaining required documentation

- Negotiating loan terms and conditions with applicants

- Ensuring compliance with all applicable regulations and guidelines

- Managing loan portfolios and monitoring repayment activities

- Providing ongoing customer service and support to loan recipients

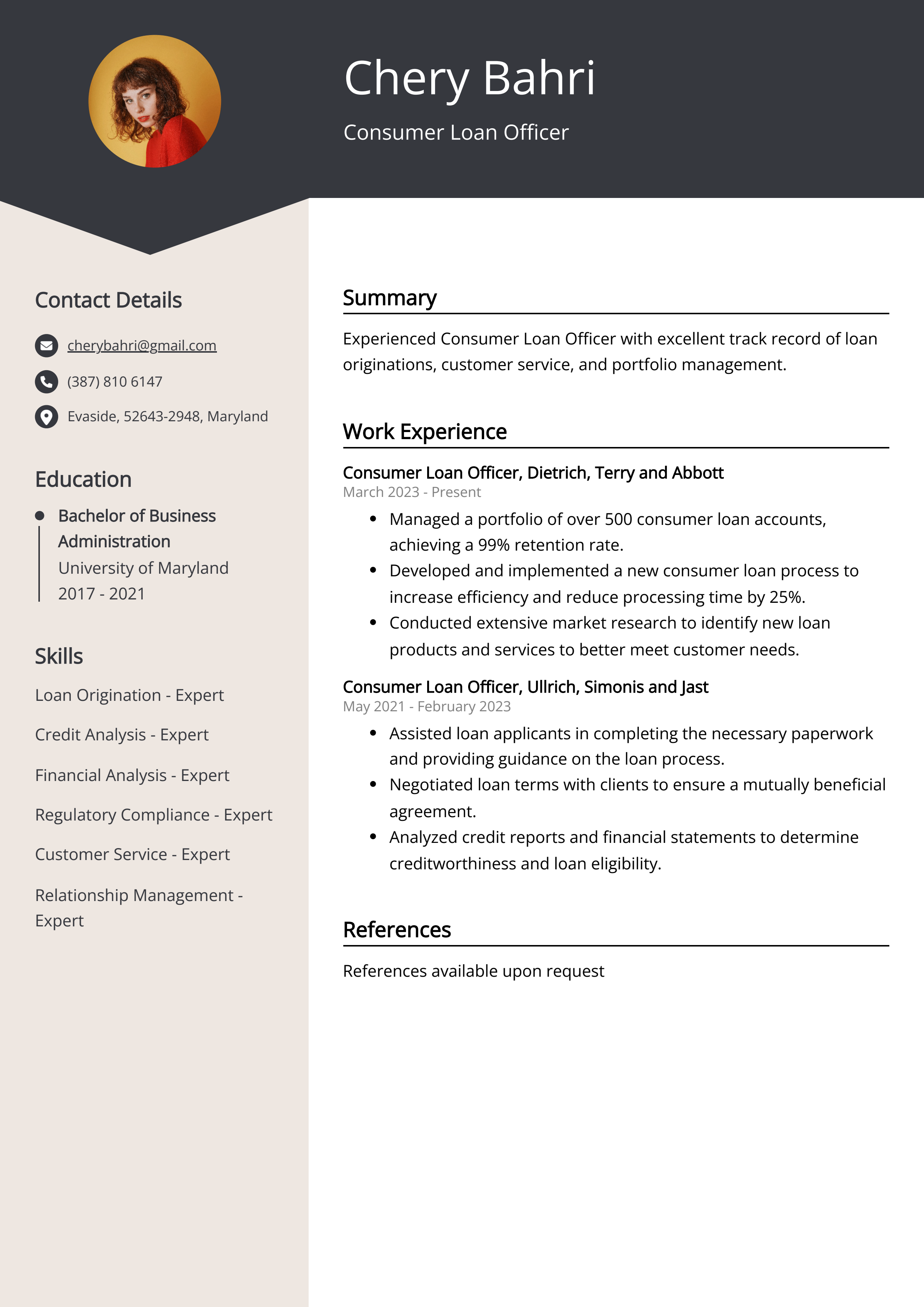

Sample Consumer Loan Officer Resume for Inspiration

Personal Details:

- Name: John Doe

- Email: johndoe@email.com

- Phone: 555-555-5555

- Address: 1234 Main St, Anytown, USA

Summary:

John Doe is an experienced Consumer Loan Officer with a proven track record of successfully assisting clients with their financial needs. He has a strong understanding of credit products and the ability to guide clients through the loan process, ensuring their satisfaction and financial well-being.

Work Experience:

- Consumer Loan Officer, ABC Bank, Anytown, USA

- Assistant Loan Officer, XYZ Credit Union, Somewhere, USA

Education:

- Bachelor's Degree in Finance, University of Anytown, Anytown, USA

Skills:

- Excellent communication and customer service skills

- Knowledge of loan products and regulations

- Ability to analyze financial information and assess risk

- Strong attention to detail and accuracy

Certifications:

- Certified Consumer Loan Officer (CCLO)

Languages:

- English (native)

- Spanish (proficient)

Resume tips for Consumer Loan Officer

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Consumer Loan Officer resume tips.

We collected the best tips from seasoned Consumer Loan Officer - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in consumer lending and knowledge of lending regulations and policies.

- Showcase your ability to analyze credit reports and financial statements to evaluate loan applications.

- Demonstrate strong communication and interpersonal skills, emphasizing your ability to build rapport with customers.

- Include any achievements related to loan volume, customer satisfaction, or loan quality improvement.

- Emphasize your proficiency in using loan origination software and other relevant technologies.

Consumer Loan Officer Resume Summary Examples

A well-crafted Consumer Loan Officer resume summary or resume objective can help to effectively showcase your skills, experiences, and accomplishments. This can grab the attention of potential employers and set you apart from other candidates. A strong summary or objective can also provide a quick overview of your qualifications and career goals, making it easier for hiring managers to determine if you are a good fit for the position.

For Example:

- Over 8 years of experience in consumer lending

- Proven track record in sales and loan origination

- Expert in analyzing credit reports and financial statements

- Strong communication and interpersonal skills

- Demonstrated ability to meet and exceed sales targets

Build a Strong Experience Section for Your Consumer Loan Officer Resume

Building a strong experience section on a consumer loan officer resume is crucial as it demonstrates the candidate's proven track record of success in the industry. A strong experience section showcases the candidate's ability to effectively assess and mitigate risk, build strong client relationships, and successfully close loan deals. It also gives employers confidence in the candidate's ability to effectively manage loan portfolios and drive business growth.

For Example:

- Managed and analyzed loan applications and credit reports

- Evaluated customers' creditworthiness and determined loan eligibility

- Developed and maintained strong relationships with customers to ensure customer satisfaction

- Assisted customers with loan options and tailored loan products to meet their financial needs

- Provided clear and accurate information to customers about loan terms and conditions

- Processed loan applications and ensured all necessary documentation was completed accurately and in a timely manner

- Negotiated loan terms and conditions with customers

- Reviewed and verified customers' financial information to make informed loan decisions

- Adhered to all lending regulations and company policies

- Collaborated with team members to meet sales targets and contribute to overall company success

Consumer Loan Officer resume education example

A Consumer Loan Officer typically needs a bachelor's degree in finance, business administration, or a related field. Having a background in economics, accounting, or a similar discipline can also be beneficial. Some employers may require or prefer candidates with a master's degree in finance or a related field. Additionally, obtaining certifications such as the Certified Consumer Credit Counselor (CCCC) or Certified Credit Counselor (CCC) can enhance a candidate's qualifications.

Here is an example of an experience listing suitable for a Consumer Loan Officer resume:

- Bachelor's Degree in Finance, XYZ University, 2010

- Certification in Consumer Lending, ABC Institute, 2012

- Continuing education in consumer credit analysis and risk assessment

Consumer Loan Officer Skills for a Resume

It is important to add skills to a Consumer Loan Officer Resume to demonstrate the ability to effectively assess and approve loan applications, communicate with clients, and analyze financial documents. These skills show reliability and proficiency in making sound lending decisions while also providing excellent customer service. Additionally, showcasing these skills can highlight the capacity to manage risk and adhere to lending regulations.

Soft Skills:

- Communication

- Problem-solving

- Empathy

- Adaptability

- Attention to detail

- Time management

- Customer service

- Negotiation

- Critical thinking

- Teamwork

- Loan application processing

- Credit analysis

- Risk assessment

- Loan underwriting

- Regulatory compliance

- Financial analysis

- Loan documentation

- Customer relationship management

- Loan product knowledge

- Database management

Common Mistakes to Avoid When Writing a Consumer Loan Officer Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Consumer Loan Officer resume

- Proven track record of successfully originating and approving consumer loans

- Strong knowledge of consumer lending regulations and compliance

- Excellent communication and customer service skills

- Ability to analyze creditworthiness and assess risk

- Experience in promoting and cross-selling loan products

- Demonstrated ability to meet and exceed loan origination targets

- Familiarity with various loan products and their features

- Proficiency in loan underwriting and documentation processes

- Strong attention to detail and accuracy in loan processing

- Ability to collaborate with loan processors and underwriters to facilitate loan approvals

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.