Looking for a new job as an insurance processor? A well-written CV is crucial for standing out in a competitive job market. Our Insurance Processor CV example provides a comprehensive guide on how to structure and format your CV, as well as what information to include. Whether you're an experienced insurance processor or just starting out in the industry, our example CV will help you create a strong and professional document to impress potential employers.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Insurance Processor do?

An insurance processor is responsible for reviewing and processing insurance applications and claims. They verify the accuracy of information, check for necessary documentation, and ensure that all required information is complete and accurate. They also communicate with clients and insurance company representatives to resolve any issues or discrepancies. Additionally, they may assist with data entry, maintaining records, and generating reports. This role requires attention to detail, excellent communication skills, and a thorough understanding of insurance policies and procedures.

- Mortgage Originator CV Sample

- Processor CV Sample

- Account Assistant CV Sample

- Private Banker CV Sample

- Inventory Assistant CV Sample

- Loan Servicing Specialist CV Sample

- Accounts Payable Clerk CV Sample

- Billing Analyst CV Sample

- Energy Auditor CV Sample

- Loan Analyst CV Sample

- Budget Officer CV Sample

- Revenue Analyst CV Sample

- Accounts Payable Analyst CV Sample

- Senior Finance Manager CV Sample

- Financial Services Manager CV Sample

- Bank Examiner CV Sample

- Senior Accountant CV Sample

- Tax Director CV Sample

- Investment Officer CV Sample

- Trust Officer CV Sample

What are some responsibilities of an Insurance Processor?

- Reviewing insurance applications and policy documents

- Verifying accuracy and completeness of information

- Processing insurance claims

- Communicating with customers, agents, and insurance companies

- Updating and maintaining insurance records

- Assisting with underwriting and policy issuance

- Adhering to regulatory and compliance requirements

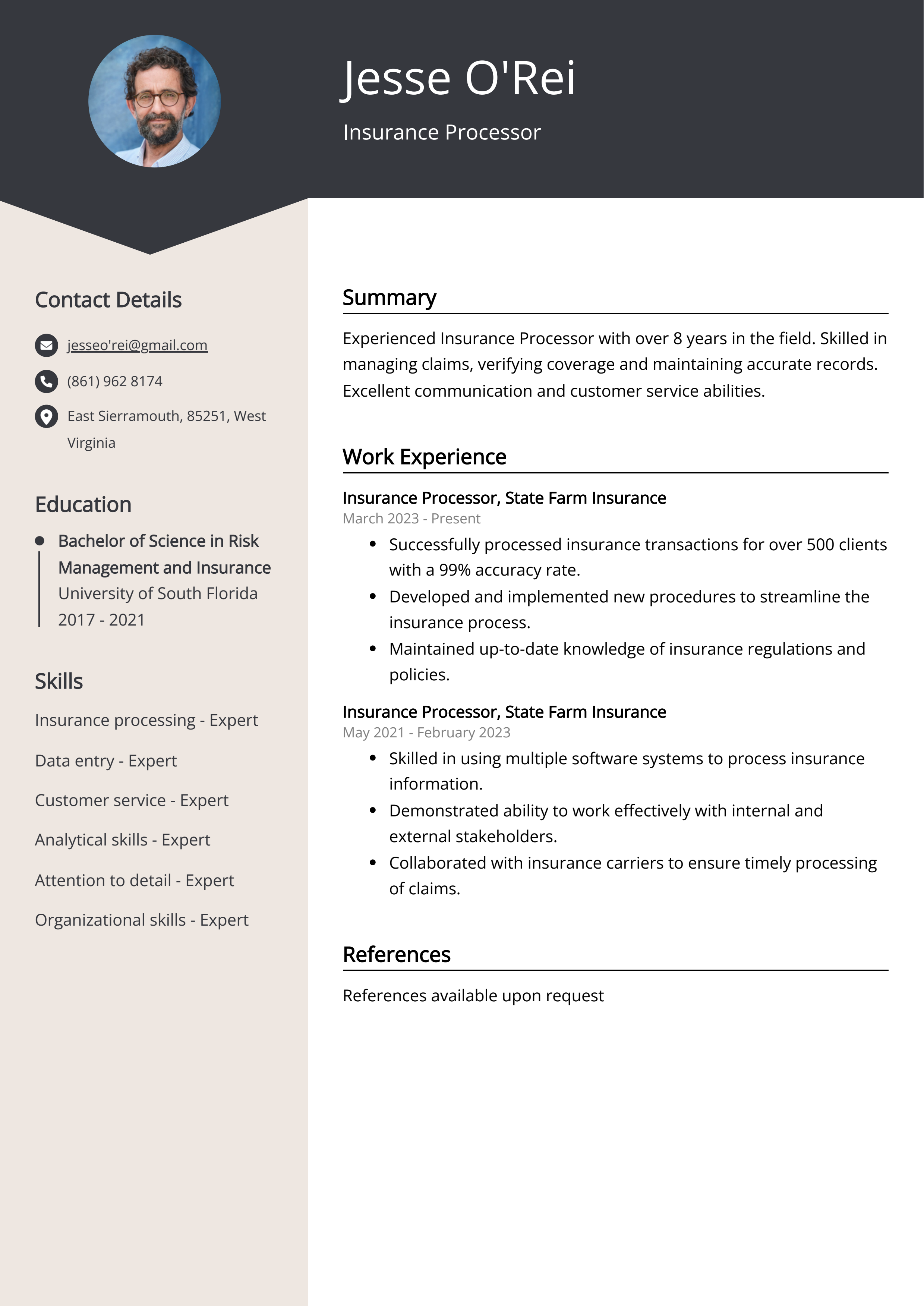

Sample Insurance Processor CV for Inspiration

Personal Details

- Name: John Smith

- Date of Birth: January 1, 1990

- Email: johnsmith@email.com

- Phone: 123-456-7890

Summary

John is an experienced Insurance Processor with a proven track record of accurately processing insurance claims and maintaining client satisfaction. He is highly skilled in analyzing insurance applications, preparing policy documents, and communicating with clients and insurance companies.

Work Experience

- Insurance Processor at ABC Insurance - 2015 to present

Responsibilities:- Process insurance applications and policy renewals

- Analyze and review insurance documents for accuracy

- Communicate with clients to gather necessary information

- Submit claims and follow up with insurance companies

- Insurance Assistant at XYZ Insurance - 2012 to 2015

Responsibilities:- Assisted in processing insurance applications and claims

- Maintained client records and answered inquiries

- Prepared insurance quotes and policy documents

Education

- Bachelor's Degree in Business Administration - 2012

University of ABC

Skills

- Proficient in insurance processing software

- Strong attention to detail and accuracy

- Excellent communication and customer service skills

- Ability to prioritize and multitask in a fast-paced environment

Certifications

- Licensed Insurance Processor - State of XYZ

- Insurance Industry Compliance Certification

Languages

- English - Native proficiency

- Spanish - Conversational proficiency

CV tips for Insurance Processor

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Insurance Processor CV pointers.

We've curated top-notch advice from experienced Insurance Processor individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

```html

- Include a summary of your relevant experience at the top of your CV

- Highlight specific skills such as data entry, customer service, and knowledge of insurance policies

- Showcase your attention to detail and ability to work in a fast-paced environment

- Include any certifications or training related to insurance processing

- Use quantifiable achievements to demonstrate your success in previous roles

Insurance Processor CV Summary Examples

Using an Insurance Processor CV summary or objective can help to quickly showcase your relevant skills and experience to potential employers. A well-crafted summary or objective can grab the attention of hiring managers and emphasize your qualifications for the role. It can also help to tailor your application to the specific job you are applying for, making it more personalized and targeted. This can increase your chances of securing an interview for the position.

For Example:

- Experienced insurance processor with strong attention to detail and proficiency in processing insurance claims.

- Skilled in data entry, documentation, and collaborating with insurance agents to ensure accuracy and compliance.

- Familiar with insurance software and committed to delivering high-quality customer service.

- Proven ability to prioritize and manage multiple insurance claims efficiently and effectively.

- Demonstrated proficiency in verifying and updating insurance information, and resolving any discrepancies.

Build a Strong Experience Section for Your Insurance Processor CV

Building a strong experience section for a Insurance Processor CV is crucial because it showcases your expertise and qualifications in the insurance industry. It allows potential employers to see the depth of your experience, the types of insurance you have worked with, and the specific skills you have developed. A well-crafted experience section can make you stand out as a strong candidate and increase your chances of landing the job.

For Example:

- Processed new insurance policies and endorsements accurately and efficiently

- Reviewed insurance applications and documents for accuracy and completion

- Handled customer inquiries and provided assistance with insurance policy changes

- Collaborated with insurance agents and underwriters to resolve policy discrepancies

- Verified insurance coverage and processed claims for policyholders

- Updated and maintained client information and policy documentation in database systems

- Prepared reports and documentation for underwriting and claims departments

- Assisted in the evaluation and approval of insurance applications

- Participated in team meetings and training sessions to stay informed about industry changes

- Maintained a high level of professionalism and confidentiality in handling sensitive insurance information

Insurance Processor CV education example

An Insurance Processor typically needs a high school diploma or equivalent, and some employers may require an associate's degree or relevant certification. Coursework in business administration, finance, or insurance may be beneficial. Additionally, on-the-job training or internships may be provided by employers to ensure that Insurance Processors are knowledgeable about insurance policies, procedures, and industry regulations. Continuing education and professional development may also be necessary to stay current in the field.

Here is an example of an experience listing suitable for a Insurance Processor CV:

- Bachelor's degree in Finance, Business Administration, or related field

- Certification in insurance processing or related field

- Continuing education courses in insurance laws and regulations

Insurance Processor Skills for a CV

It is important to add skills for an Insurance Processor CV in order to showcase one's ability to effectively handle insurance claims, process policy information, and accurately manage customer information. These skills highlight the candidate's familiarity with insurance industry standards and regulations, as well as their proficiency in utilizing insurance software and efficiently handling various administrative tasks. Additionally, including skills can help the employer gauge the candidate's overall competency for the position.

Soft Skills:

- Attention to Detail

- Interpersonal Communication

- Time Management

- Problem-Solving

- Customer Service

- Teamwork

- Adaptability

- Organization

- Decision Making

- Conflict Resolution

```html

- Policy evaluation

- Underwriting analysis

- Claims processing

- Regulatory compliance

- Risk assessment

- Document management

- Database utilization

- Customer service

- Microsoft Office proficiency

- Problem solving

Common Mistakes to Avoid When Writing an Insurance Processor CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Insurance Processor CV

- Highlight your experience processing insurance claims and applications

- Showcase your strong attention to detail and accuracy in data entry

- Demonstrate your knowledge of insurance policies and regulations

- Emphasize your ability to effectively communicate with clients and insurance agents

- Include any software or technical skills relevant to insurance processing