This Investment Officer CV Example is a great starting point for anyone looking to build an impressive CV. It provides an outline of the key sections, skills, and qualifications that are necessary for a successful Investment Officer CV. With its helpful guidance, you can be sure that your CV will stand out from the rest and land you your dream job.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Investment Officer do?

An Investment Officer is responsible for researching and analyzing investments, developing financial models and strategies, and making recommendations for investments. They also monitor economic trends, develop financial forecasts, and track investment performance. Investment Officers must have a strong understanding of financial markets, macroeconomics, and investment products. They must also have strong analytical and quantitative skills, as well as excellent communication and organizational skills.

- Investment Officer CV Sample

- Investment Specialist CV Sample

- Junior Accountant CV Sample

- Junior Loan Processor CV Sample

- Junior Underwriter CV Sample

- Lead Auditor CV Sample

- Lending Manager CV Sample

- Loan Administrator CV Sample

- Loan Analyst CV Sample

- Loan Assistant CV Sample

- Loan Closer CV Sample

- Loan Coordinator CV Sample

- Loan Document Specialist CV Sample

- Loan Manager CV Sample

- Loan Officer Assistant CV Sample

- Loan Originator CV Sample

- Loan Processor CV Sample

- Loan Servicing Specialist CV Sample

- Loan Specialist CV Sample

- Loan Underwriter CV Sample

What are some responsibilities of an Investment Officer?

- Developing and maintaining comprehensive investment plans

- Identifying and evaluating potential investments

- Conducting financial and market analysis

- Conducting due diligence on prospective investments

- Staying abreast of changes in the investment climate

- Networking with potential partners and clients

- Managing portfolios of investments

- Monitoring investments and performance

- Developing strategies for portfolio diversification

- Recommending investment strategies to clients

- Preparing reports and presentations

- Explaining investment strategies to clients

- Ensuring compliance with all relevant regulations

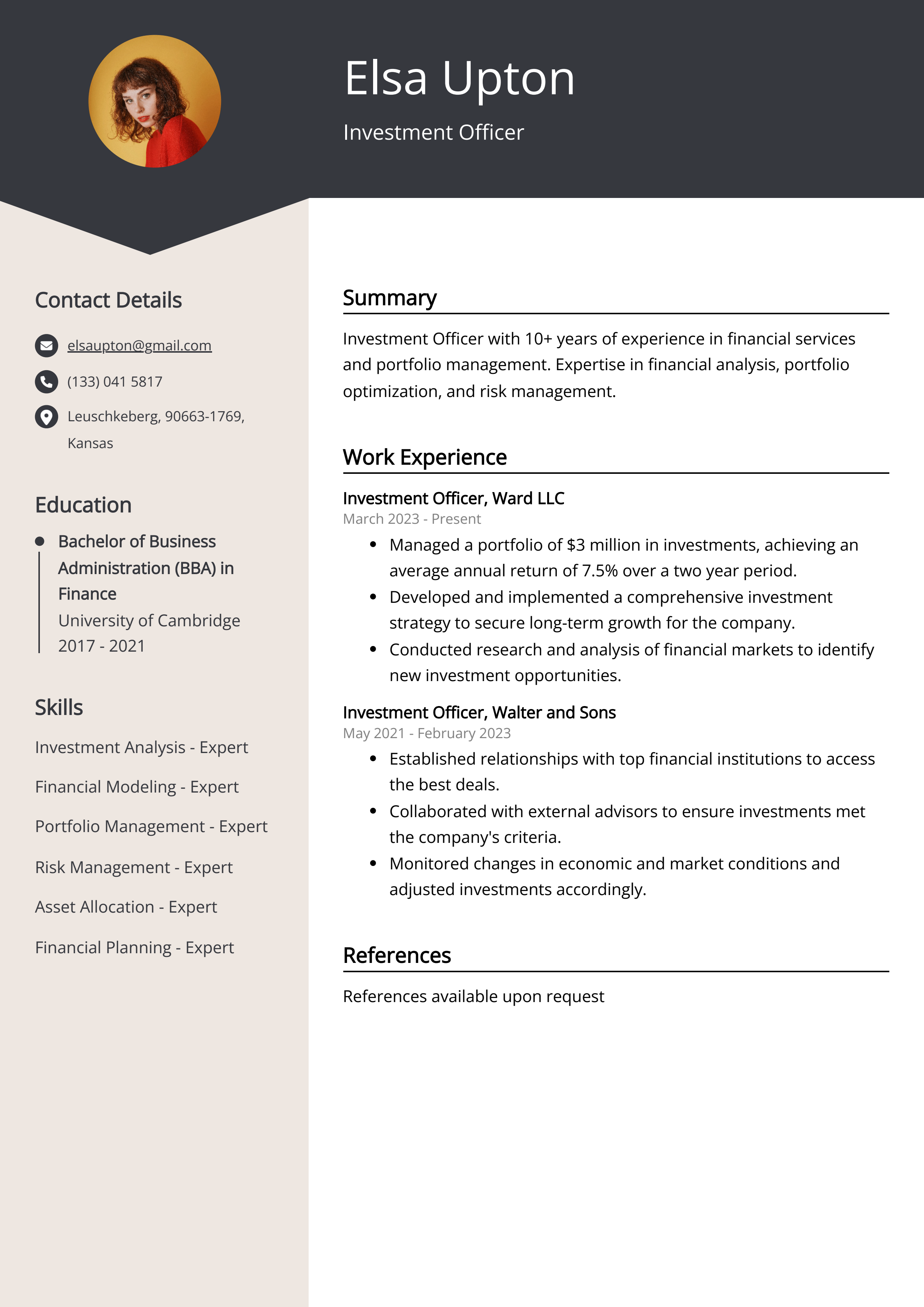

Sample Investment Officer CV for Inspiration

Investment Officer

Personal Details:

Name: John Doe

Address: 123 Happy Street, Los Angeles, CA

Mobile: 123-456-7890

Email: john@example.com

John Doe is a highly experienced Investment Officer with a strong financial background. He has over 5 years of experience in investment management, financial analysis and reporting. He has a proven track record of successfully managing complex investments and leveraging financial opportunities. John is an excellent communicator who excels at building relationships with clients, partners and team members.

Work Experience:

- Investment Officer, ABC Bank, 2015-2020

- Managed a portfolio of investments valued at over $200 million

- Developed and implemented investment strategies in line with corporate objectives

- Conducted investment research and analysis to identify opportunities in emerging markets

- Monitored investment performance and provided regular reports to senior management

- Financial Analyst, XYZ Group, 2010-2015

- Conducted financial analysis and research to identify potential investment opportunities

- Prepared financial models to evaluate investment performance and risk

- Provided timely advice to clients on investment strategies and portfolio performance

Education:

- MBA in Finance, University of California, Los Angeles, 2007-2009

- Bachelor of Arts in Economics, University of California, Los Angeles, 2003-2007

Skills:

- Investment Analysis

- Financial Modeling

- Portfolio Management

- Risk Management

- Client Relationship Management

Certifications:

- Chartered Financial Analyst (CFA) Level 3

- Financial Risk Manager (FRM)

Languages:

- English (native)

- Spanish (fluent)

CV tips for Investment Officer

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Investment Officer CV pointers.

We've curated top-notch advice from experienced Investment Officer individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight key skills and qualifications related to the Investment Officer role in your CV.

- Detail any relevant experience and qualifications such as financial analysis or risk management.

- Demonstrate your knowledge of the investment sector, including the latest trends and developments.

- Include a portfolio of your work, showcasing your investment ideas and strategies.

- Make sure to include any relevant certifications, such as Chartered Financial Analyst.

Investment Officer CV Summary Examples

A CV Summary or CV Objective is a great way to quickly and concisely highlight your qualifications and experiences that make you a great fit for a position as an Investment Officer. It can help to make your resume stand out from other applicants and give potential employers a better understanding of your unique skills and capabilities. Additionally, it may be the best way to show that you have the knowledge and experience needed to excel in the role.

For Example:

Example 1:

- Experienced Investment Officer with 10+ years in the finance industry.

- Strong background in asset management, portfolio analysis, and financial modeling.

- Extensive knowledge of regulatory requirements and market trends.

- Proven track record in driving revenue growth and creating sustainable value.

- Skilled communicator, negotiator, and problem-solver.

- Dynamic Investment Officer with 5+ years of international finance experience.

- Skilled in portfolio management, risk assessment, and financial analysis.

- Expert in developing and executing trading strategies to maximize returns.

- In-depth understanding of complex financial instruments and regulations.

- Excellent communication and relationship-building skills.

- Accomplished Investment Officer with 7+ years of capital markets experience.

- Proficient in securities trading, capital structuring, and market analysis.

- Strong ability to identify profitable investments and mitigate financial risks.

- Excellent research, problem-solving, and decision-making skills.

- Highly organized with a keen eye for detail.

- Highly motivated Investment Officer with 3+ years of experience.

- Specialized in financial analysis, budgeting, and portfolio management.

- Demonstrated ability to identify growth opportunities and reduce costs.

- Comprehensive knowledge of the global markets and regulations.

- Exceptional communication, relationship-building, and leadership skills.

- Seasoned Investment Officer with 12+ years of experience in financial services.

- Strong understanding of financial instruments and investment strategies.

- Excellent track record of identifying profitable investments and mitigating risks.

- Skilled in portfolio analysis, market research, and financial modeling.

- Excellent interpersonal and problem-solving abilities.

Build a Strong Experience Section for Your Investment Officer CV

Building a strong experience section for an Investment Officer CV is important for several reasons. First, it allows potential employers to quickly and easily understand the applicant's background and skills. Second, it provides concrete examples of the applicant's work history and accomplishments, which can demonstrate their capabilities in the field. Finally, it allows the applicant to highlight the most relevant and impressive aspects of their career, which can be a great way to stand out among other applicants.

For Example:

- Managed a team of 4 people to conduct due diligence on potential investments for a portfolio of $500 million.

- Analyzed financial and operational data for potential investments to assess risk and return.

- Evaluated new business opportunities and identified potential investments.

- Developed and maintained relationships with external investors and clients.

- Prepared investment presentations and reports for senior management.

- Monitored existing investments to ensure maximum returns.

- Gained knowledge and experience of the capital markets and investment products.

- Researched and identified new investment opportunities.

- Negotiated and executed complex investments.

- Provided guidance and advice on investment strategies.

Investment Officer CV education example

Most Investment Officers have a bachelor's degree in finance, economics, accounting, business administration, or a related field. Some may also have a master's degree in one of these fields. Investment Officers should have strong math and analytical skills, excellent communication skills, and the ability to research and analyze financial data. Knowledge of financial regulations and the ability to develop and implement investment strategies is also necessary.

Here is an example of an experience listing suitable for a Investment Officer CV:

- University of California, Berkeley: Bachelor of Science in Economics, May 2020

- University of California, Los Angeles: Master of Science in Finance, May 2022

- Chartered Financial Analyst (CFA) Level I, June 2021

- Financial Risk Manager (FRM) Level I, July 2021

Investment Officer Skills for a CV

It is important to add skills for an Investment Officer CV because it is the best way for potential employers to get an understanding of the candidate’s capabilities and qualifications. Skills should be tailored to the job role to demonstrate the specific knowledge and expertise required. Examples of skills for Investment Officers could include financial analysis, portfolio management, risk management, and investment research.

Soft Skills:

- Leadership

- Analytical Skills

- Organizational Skills

- Financial Management

- Communication

- Problem Solving

- Decision Making

- Strategic Thinking

- Time Management

- Risk Assessment

- Financial Analysis

- Portfolio Management

- Investment Strategies

- Risk Management

- Asset Allocation

- Data Analysis

- Equity Research

- Financial Modeling

- Tax Planning

- Regulatory Compliance

Common Mistakes to Avoid When Writing an Investment Officer CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Investment Officer CV

- Highlight relevant experience and qualifications

- Demonstrate expertise in research and analysis

- Show strong financial acumen and understanding of market trends

- Emphasize ability to develop and manage investment strategies

- Detail knowledge of investment regulations and compliance issues

- Mention any relevant awards and achievements

- Include computer and software skills

- Describe interpersonal skills such as communication and problem-solving

- Highlight interpersonal skills such as communication and problem-solving

- Highlight any additional certifications or licenses held

- Showcase organizational and project management skills

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.