This CV example provides an outline of the information you should include when submitting your CV as a Loan Administrator. It can serve as a useful guide to help you create a concise, effective document that will be sure to impress potential employers. Through the example, you will get an understanding of the best format, structure, and language to use when applying for loan administrator roles.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Loan Administrator do?

A loan administrator is responsible for managing the loan life cycle from origination to closure, including servicing and collections. This includes ensuring accurate loan data entry, verifying loan documents, overseeing payment processing, and resolving customer inquiries. Loan administrators may also be responsible for preparing reports, analyzing financial data, and monitoring compliance with lending regulations.

- Investment Officer CV Sample

- Investment Specialist CV Sample

- Junior Accountant CV Sample

- Junior Loan Processor CV Sample

- Junior Underwriter CV Sample

- Lead Auditor CV Sample

- Lending Manager CV Sample

- Loan Administrator CV Sample

- Loan Analyst CV Sample

- Loan Assistant CV Sample

- Loan Closer CV Sample

- Loan Coordinator CV Sample

- Loan Document Specialist CV Sample

- Loan Manager CV Sample

- Loan Officer Assistant CV Sample

- Loan Originator CV Sample

- Loan Processor CV Sample

- Loan Servicing Specialist CV Sample

- Loan Specialist CV Sample

- Loan Underwriter CV Sample

What are some responsibilities of a Loan Administrator?

- Manage loan origination process and loan documents

- Review loan applications and documents for accuracy and completeness

- Evaluate applicant’s creditworthiness and financial stability

- Verify employment and income information

- Manage loan servicing activities

- Communicate with lenders and borrowers regarding loan status

- Ensure compliance with applicable laws and regulations

- Initiate loan funding and closing processes

- Maintain loan database and records

- Perform loan portfolio analysis and reporting

- Resolve customer inquiries and complaints

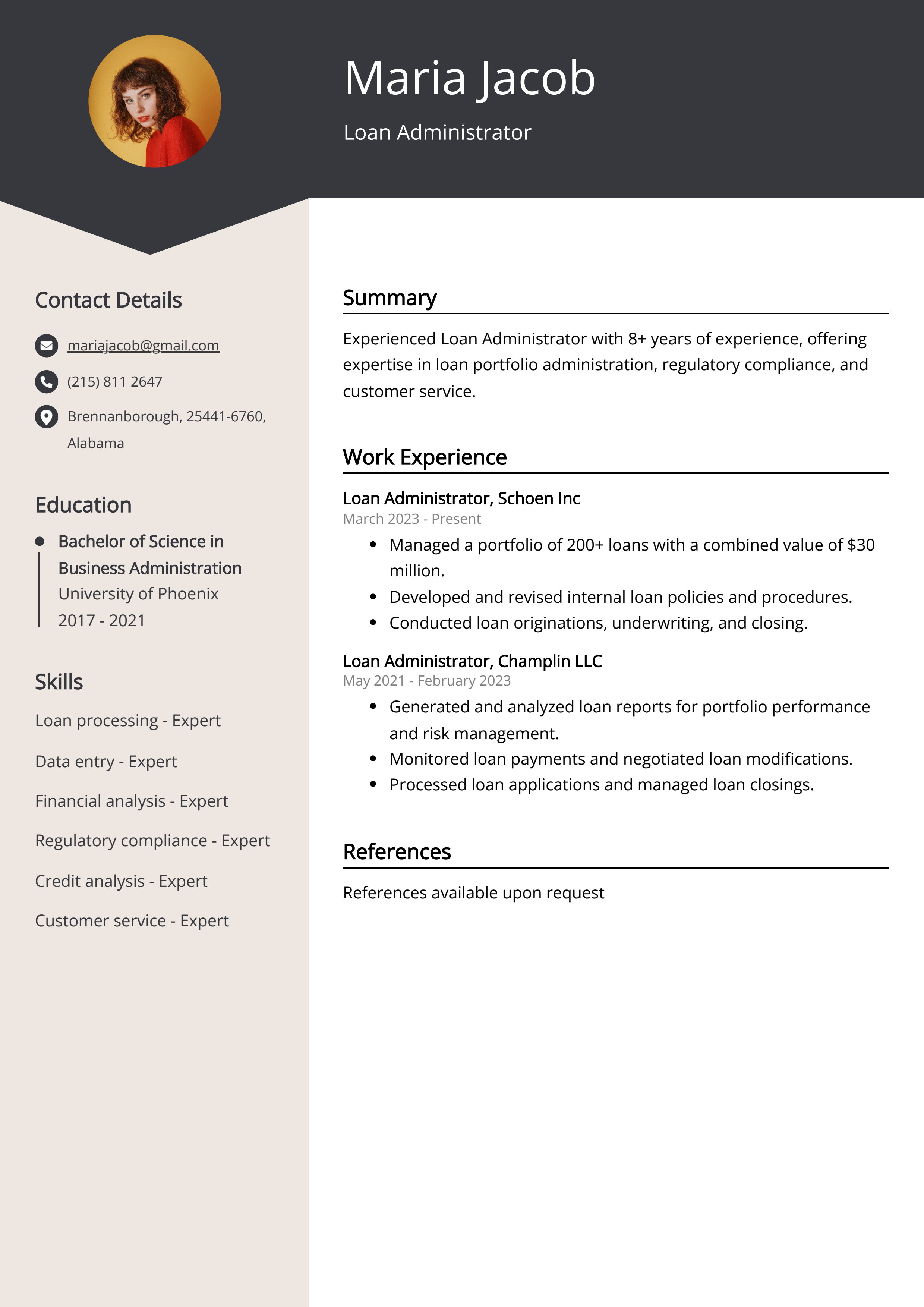

Sample Loan Administrator CV for Inspiration

Personal Details:

- Name: John Doe

- Address: 123 Main Street, Anytown, USA

- Phone: 555-555-5555

- Email: john.doe@example.com

Summary:

John Doe is an experienced Loan Administrator with 5+ years of experience. He is highly organized and detail-oriented with excellent customer service skills. He has a strong understanding of banking regulations and loan processes, and is adept at managing loan portfolios and tracking loan data.

Work Experience:

- Loan Administrator, ABC Bank, Anytown, USA (2018-present)

- Manage a loan portfolio of over 100 loans with a combined value of $1.2M

- Track and update loan data using the bank’s computer systems

- Analyze customer credit and financial information to determine loan eligibility

- Prepare loan documents and ensure accuracy of all information

- Assist customers with loan applications and answer questions

- Junior Loan Administrator, XYZ Bank, Anytown, USA (2016-2018)

- Assisted Loan Administrators in managing a loan portfolio of $500K

- Performed data entry to update and maintain loan records

- Processed loan payments and prepared monthly statements

- Researched customer credit and financial information to verify accuracy

Education:

- B.S. in Business Administration, Anytown University (2012-2016)

Skills:

- Loan Management

- Data Entry

- Financial Analysis

- Customer Service

- Regulation Compliance

Certifications:

- Certified Loan Administrator (CLA)

Languages:

- English (Fluent)

CV tips for Loan Administrator

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Loan Administrator CV pointers.

We've curated top-notch advice from experienced Loan Administrator individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight any specialized skills you possess that make you suitable for the role of Loan Administrator.

- Be sure to include any relevant education and/or certifications related to the role.

- Make sure to include any relevant experience you may have in the banking or finance industry.

- Demonstrate that you have strong problem-solving skills, as this is a key attribute for a successful Loan Administrator.

- Mention any special awards or recognition you have received for your work in the banking or finance industry.

Loan Administrator CV Summary Examples

A Loan Administrator CV Summary or CV Objective is important because it provides employers with a quick overview of your qualifications and experience related to the loan administrator role. It also gives employers a better understanding of your professional goals and how you could contribute to their organization. Your summary or objective should be tailored to the specific role and should include a statement about your core qualifications and relevant experience. This can help your CV stand out from the competition and increase your chances of getting an interview.

For Example:

- Experienced Loan Administrator with 5+ years in banking and financial services. Expertise in loan processing, customer service, and compliance.

- Highly organized Loan Administrator with 8+ years of experience in loan management and customer service. Skilled in problem solving and conflict resolution.

- Motivated Loan Administrator with 10+ years of experience in loan processing and customer service. Skilled in meeting deadlines and managing client relationships.

- Accomplished Loan Administrator with 3+ years of experience in loan origination and customer service. Proficient in data entry and loan documentation.

- Seasoned Loan Administrator with 6+ years of experience in loan servicing and customer service. Knowledgeable in banking regulations and loan approval process.

Build a Strong Experience Section for Your Loan Administrator CV

A strong experience section is essential for any loan administrator CV because it allows potential employers to quickly and easily see the candidate’s relevant work history. It also helps employers assess the candidate’s ability to handle the loan administration duties they will be expected to perform. A strong experience section should include detailed information about the candidate’s past work, including the type of loans they have administered, any special certifications or qualifications they have obtained, and any unique challenges they have faced in their loan administration career. It should also include any awards or accolades the candidate has received for their work in the field. By providing this information, employers can quickly and easily ascertain the candidate’s qualifications and experience in loan administration.

For Example:

- Successfully administered over 500 loans for corporate and individual clients in a timely and accurate manner.

- Maintained a portfolio of up to 150 loan accounts while ensuring compliance with banking regulations.

- Assisted customers in the loan application process, providing support and guidance when needed.

- Developed and implemented loan policies and procedures to ensure compliance with applicable regulations.

- Analyzed, reviewed and approved loan documents to ensure accuracy and completeness.

- Monitored customer accounts for compliance and identified potential issues in a timely manner.

- Developed strong working relationships with clients to ensure their needs were met.

- Negotiated loan terms and conditions with customers in order to secure the best possible outcome.

- Researched and resolved any customer disputes efficiently and effectively.

- Assisted in developing and maintaining loan tracking systems and reports.

Loan Administrator CV education example

A Loan Administrator typically needs a minimum of a high school diploma or equivalent, though some employers may require a college degree in finance, business administration or a related field. Additionally, it is beneficial for a Loan Administrator to have a few years of experience in banking or loan processing. Knowledge of loan regulations, banking procedures, and experience with loan software is also helpful.

Here is an example of an experience listing suitable for a Loan Administrator CV:

- Bachelor of Business Administration, ABC University, 2017

- Certificate of Loan Administration, XYZ College, 2019

- Advanced Loan Administration Course, PQR Institute, 2020

- Financial Management Course, XYZ Institute, 2020

Loan Administrator Skills for a CV

Adding skills to a Loan Administrator CV is important as it helps to demonstrate to potential employers that the applicant has the knowledge and experience necessary to succeed in the role. It also serves as a way to highlight the candidate's strengths and accomplishments, making them stand out amongst other applicants. By including the right skills, the applicant can show that they understand the complexities of the loan industry and can apply their knowledge to help the company meet its goals. Examples of skills for a Loan Administrator CV could include knowledge of loan processing, customer service, credit analysis, and financial analysis.

Soft Skills:

- Time Management

- Organizational Skills

- Problem Solving

- Communication

- Leadership

- Interpersonal Skills

- Adaptability

- Attention to Detail

- Teamwork

- Critical Thinking

- Loan Processing

- Credit Analysis

- Data Entry

- Risk Management

- Compliance Monitoring

- Financial Modeling

- Regulatory Knowledge

- Account Reconciliation

- Underwriting Skills

- Customer Service

Common Mistakes to Avoid When Writing a Loan Administrator CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Loan Administrator CV

- Strong knowledge of loan processing and administration

- Excellent communication and customer service skills

- Ability to prioritize tasks and manage time efficiently

- Proficient in using loan servicing software

- Ability to handle multiple tasks simultaneously

- Extensive knowledge of applicable laws and regulations

- Experience in customer service, sales, and loan origination

- Ability to problem solve and troubleshoot loan issues

- Excellent organizational and analytical skills

- Able to work independently and as part of a team

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.