Are you looking for a job as a debt collector? If so, you'll need to develop a professional CV that showcases your experience and qualifications. This article provides an example of a Debt Collector CV that you can use as a template when creating your own CV. It includes an overview of the job duties, key skills, and experience. We also provide tips on how to write an effective CV. With this information, you can create a CV that will catch the attention of potential employers and help you get the job you want.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Debt Collector do?

A Debt Collector is someone who is employed by a bank, credit card company or other lender to collect payments from borrowers who have fallen behind on their payments. They may contact borrowers by phone, letter, email or even in person in order to collect the money owed. They may also negotiate payment plans or settlements with borrowers in order to make the debt more manageable.

- Corporate Financial Analyst CV Sample

- Cost Accountant CV Sample

- Cost Accounting Manager CV Sample

- Cost Estimator CV Sample

- Credit Assistant CV Sample

- Credit Officer CV Sample

- Debt Collector CV Sample

- Derivatives Analyst CV Sample

- Energy Auditor CV Sample

- Entry Level Accountant CV Sample

- Environmental Analyst CV Sample

- Equity Analyst CV Sample

- Equity Research Analyst CV Sample

- Equity Research Associate CV Sample

- Equity Trader CV Sample

- Exchange Engineer CV Sample

- External Auditor CV Sample

- Finance Administrator CV Sample

- Financial Accountant CV Sample

- Financial Administrator CV Sample

What are some responsibilities of a Debt Collector?

- Contact debtors by telephone, mail, or email to request payment.

- Negotiate payment arrangements with debtors.

- Keep accurate records of collection activity.

- Assist with filing legal documents.

- Provide customer service and answer questions related to debt.

- Research accounts for accurate information.

- Write reports with collection activity and status.

- Follow up on delinquent accounts.

- Generate invoices and statements.

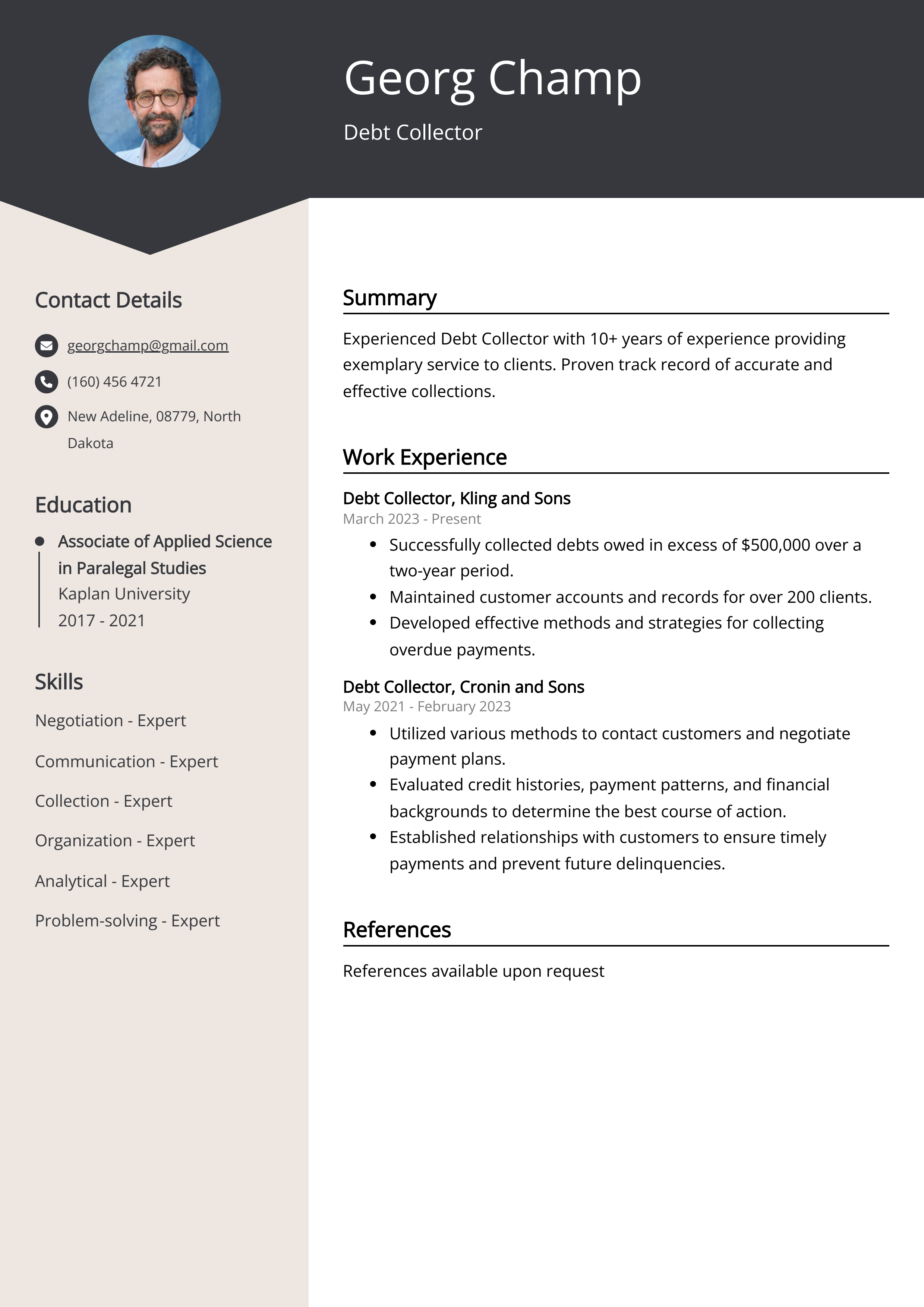

Sample Debt Collector CV for Inspiration

Personal Details:

- Name: Mary Smith

- Date of Birth: 5th May 1985

- Address: 123 Main Street, Anytown, ST 12345

- Phone: (123) 456-7890

- Email: marysmith@example.com

Summary: Mary Smith is a highly experienced Debt Collector with more than 10 years of experience in the field. She has extensive knowledge of debt collection laws and regulations, as well as strong customer service and communication skills. Mary is committed to recovering debts in a professional and ethical manner.

Work Experience:

- Debt Collector, ABC Debt Collection Agency, Anytown, ST, 2016 - Present

- Develop and implement debt collection strategies for individual accounts.

- Negotiate payment arrangements with customers in order to maximize collection of delinquent accounts.

- Ensure all collection activities abide by applicable laws and regulations.

- Debt Collector, XYZ Debt Collection Agency, Anytown, ST, 2011 - 2016

- Recovered delinquent accounts with minimum customer complaints and maximum results.

- Provided excellent customer service while collecting debts.

- Prepared and submitted weekly reports on collection activities.

Education:

- Bachelor of Business Administration, Anytown University, Anytown, ST, 2010

Skills:

- Debt Collection

- Customer Service

- Negotiation

- Regulatory Compliance

- Data Analysis

- Report Writing

Certifications:

- Certified Professional Collector, ABC Collection Agency, Anytown, ST, 2016

- Certified Debt Collector, XYZ Collection Agency, Anytown, ST, 2012

Languages: English (native), Spanish (conversational)

CV tips for Debt Collector

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Debt Collector CV pointers.

We've curated top-notch advice from experienced Debt Collector individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your ability to remain professional and courteous when communicating with customers.

- Detail any experience you have in sales and customer service.

- Showcase your ability to prioritize and manage your workload.

- Provide examples of how you have successfully recovered debts.

- Mention any experience or qualifications you have in the financial or legal field.

Debt Collector CV Summary Examples

Using a Debt Collector CV Summary or CV Objective is important for two reasons. First, it helps employers quickly identify the key skills and experience that you possess that are applicable to the role they are trying to fill. Second, it highlights your professional qualifications and experience with debt collection, which could be the deciding factor when considering your application for the role.

For Example:

- Highly organized Debt Collector with 5+ years of experience in accounts management and customer service.

- Experienced Debt Collector with a proven track record of reducing bad debt and increasing cash flow.

- Results-driven Debt Collector with a commitment to providing excellent customer service and increasing client satisfaction.

- Resourceful Debt Collector with excellent problem-solving skills and an in-depth understanding of debt collection regulations.

- Motivated Debt Collector with a strong background in customer relationships and collections management.

Build a Strong Experience Section for Your Debt Collector CV

Building a strong experience section for a debt collector CV is important for several reasons. First, it allows potential employers to gain insight into the types of debt collection tasks you have completed in the past and how you have handled them. This helps to demonstrate your knowledge and proficiency in the field. Second, it gives potential employers an idea of the level of experience you have in this area, which can be a deciding factor when it comes to hiring decisions. Finally, it can help to highlight any special skills or qualifications that you possess which might be of use to the prospective employer. Having a strong experience section on your CV can help ensure that you stand out from the competition and get the job you're after.

For Example:

- Responsible for recovering delinquent debt and processing payments for a variety of clients.

- Handled high-volume customer accounts, with a focus on quality customer service.

- Collected past due accounts via telephone, email, and mail correspondence.

- Processed payments, initiated payment arrangements, and reduced bad debt.

- Trained and mentored junior debt collectors.

- Developed and implemented strategies to reduce delinquent accounts.

- Negotiated payment plans with customers in order to settle overdue accounts.

- Accurately maintained accounts receivable records and performed reconciliation.

- Researched and resolved discrepancies related to billing and payments.

- Handled customer complaints and updated customer information in the system.

Debt Collector CV education example

Debt collectors typically need at least a high school diploma or equivalent. Some employers may prefer applicants who have completed postsecondary courses in business or finance.

Here is an example of an experience listing suitable for a Debt Collector CV:

- High School Diploma, ABC School, 2008

- Certificate in Debt Collection, XYZ College, 2009

- Certified Debt Collector, Professional Association of Debt Collectors, 2011

Debt Collector Skills for a CV

Adding skills to a Debt Collector CV is important because it allows employers to quickly identify the candidate's qualifications and see if they are a good fit for the position. Skills are essentially keywords that indicate the candidate's abilities and experience in areas relevant to the job, such as negotiation, problem-solving, communication, customer service, and financial analysis. By including skills on a CV, potential employers can quickly ascertain which candidates possess the right skills to fulfill the position.

Soft Skills:

- Negotiation Skills

- Communication Skills

- Conflict Resolution

- Time Management

- Organizational Skills

- Problem Solving

- Attention to Detail

- Patience

- Empathy

- Interpersonal Skills

- Debt Negotiation

- Account Reconciliation

- Financial Analysis

- Data Entry

- Collections Laws

- Risk Management

- Customer Service

- Problem Solving

- Time Management

- Organizational Skills

Common Mistakes to Avoid When Writing a Debt Collector CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Debt Collector CV

- Highlight any experience in debt collection or customer service.

- Include any relevant certifications or training.

- Mention any special skills that are related to debt collection, such as debt negotiation.

- Highlight any experience working with customer databases or software.

- List any awards or recognition you have achieved.

- Mention any experience in dispute resolution.

- Highlight any knowledge of legal regulations regarding debt collection.

- Demonstrate excellent communication and interpersonal skills.

- Showcase your ability to work independently as well as part of a team.

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.