Are you looking for a Credit Officer role? Our Credit Officer CV Example is the perfect guide to help you write your own professional CV. This article provides an overview of the Credit Officer role and outlines the key skills and experience you need to succeed in this role. We also provide some tips on how to make your CV stand out and an example of a well-written Credit Officer CV.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Credit Officer do?

A credit officer is responsible for managing a company’s credit policies and procedures. They review customer applications for credit, set credit limits, and track customer payments. They may also be responsible for approving loan requests, issuing letters of credit, and collecting overdue payments. Credit officers also monitor and analyze credit trends, assess credit risk, and develop strategies to reduce bad debt. They also provide advice and guidance to customers on their financial obligations.

- Corporate Financial Analyst CV Sample

- Cost Accountant CV Sample

- Cost Accounting Manager CV Sample

- Cost Estimator CV Sample

- Credit Assistant CV Sample

- Credit Officer CV Sample

- Debt Collector CV Sample

- Derivatives Analyst CV Sample

- Energy Auditor CV Sample

- Entry Level Accountant CV Sample

- Environmental Analyst CV Sample

- Equity Analyst CV Sample

- Equity Research Analyst CV Sample

- Equity Research Associate CV Sample

- Equity Trader CV Sample

- Exchange Engineer CV Sample

- External Auditor CV Sample

- Finance Administrator CV Sample

- Financial Accountant CV Sample

- Financial Administrator CV Sample

What are some responsibilities of a Credit Officer?

- Evaluating loan applications and creditworthiness of potential borrowers

- Determining risk levels associated with loan applications

- Assessing and verifying financial information of borrowers

- Researching market trends and regulations to stay informed of industry changes

- Developing and implementing credit policies and procedures

- Monitoring loan portfolios and payment histories of borrowers

- Maintaining contact with existing clients and establishing relationships with new customers

- Completing necessary paperwork and documentation related to loan applications

- Providing guidance and advice to customers on credit matters

- Making recommendations on loan amounts and repayment plans

- Ensuring compliance with banking regulations and laws

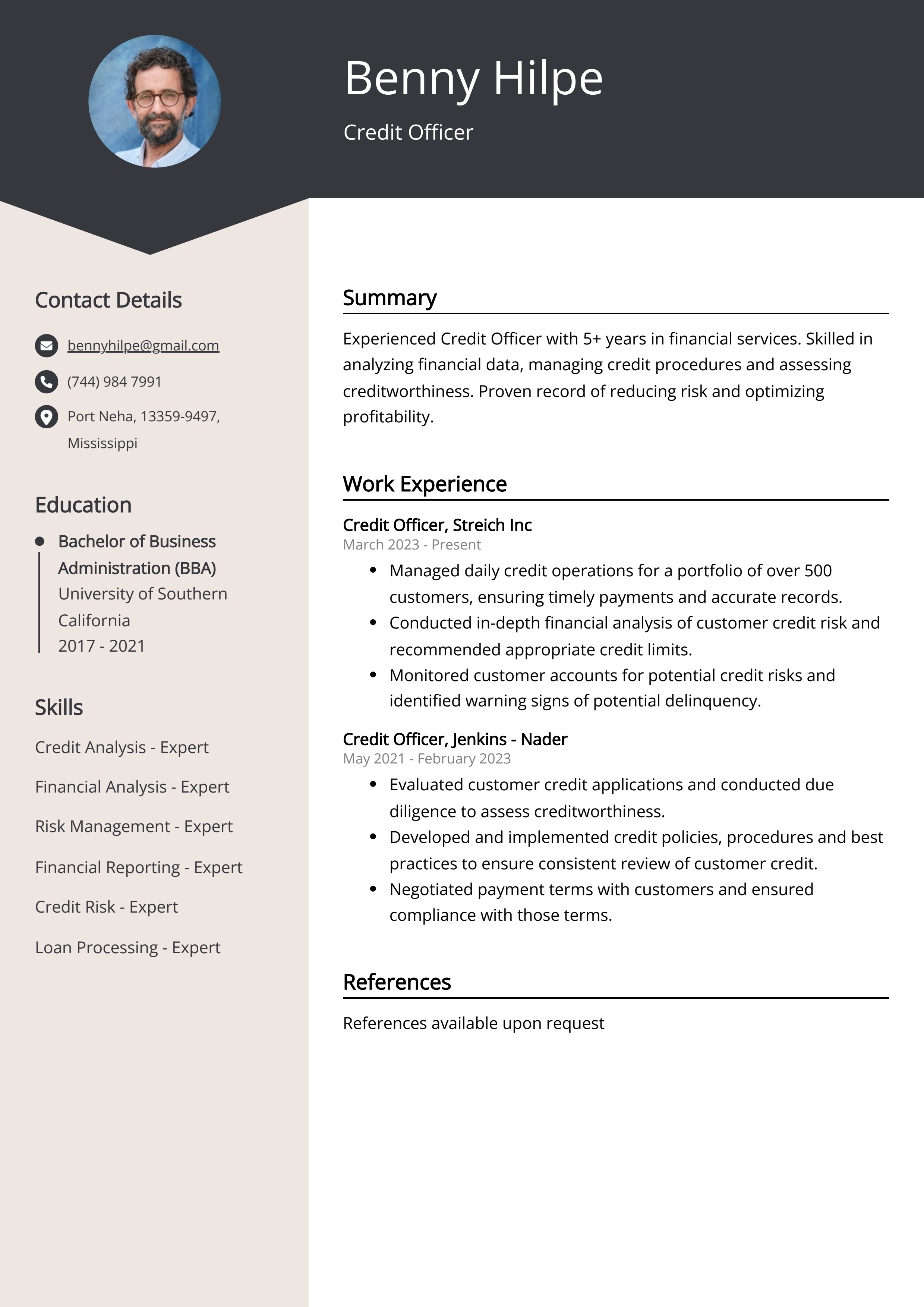

Sample Credit Officer CV for Inspiration

Personal Details

Name: John Doe

Address: 1234 Main St, Anytown, US

Phone: 123-456-7890

Email: john.doe@example.com

Summary

John Doe is a highly motivated Credit Officer with 6 years of experience in the banking industry. He is knowledgeable in credit investigations, loan processing, and financial analysis. He is reliable, organized, and has a strong work ethic.

Work Experience

- Credit Officer at Bank ABC, Anytown, US (June 2015 - Present)

- Manage and oversee all credit operations

- Analyze and evaluate customer creditworthiness

- Maintain and monitor credit reports

- Credit Analyst at Bank XYZ, Anytown, US (June 2013 - May 2015)

- Process loan applications

- Analyze credit data and financial statements

- Perform risk analysis

Education

Bachelor of Arts in Finance, Anytown State University, Anytown, US (2009 - 2013)

Skills

- Credit Investigation

- Financial Analysis

- Loan Processing

- Risk Analysis

Certifications

- Certified Credit Officer - Credit Officer Institute (2018)

Languages

English (Fluent), Spanish (Intermediate)

CV tips for Credit Officer

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Credit Officer CV pointers.

We've curated top-notch advice from experienced Credit Officer individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your experience as a credit officer by showcasing the most relevant information near the top of your resume.

- Include quantifiable results of successes in your previous positions to demonstrate your impact.

- Draw attention to any special certifications or licenses you hold in the field.

- Mention any specific software you have experience with (such as credit scoring programs).

- List any awards or recognition you have received for your work in the field.

Credit Officer CV Summary Examples

A Credit Officer CV Summary or CV Objective is an important tool for showcasing your professional qualifications and experience. It allows potential employers to quickly understand your qualifications, skills, and experience, and decide whether or not you are a suitable candidate for a credit officer role. A strong CV Summary or CV Objective can help you stand out from the competition and increase your chances of being selected for an interview.

For Example:

- Highly experienced Credit Officer, committed to upholding the highest standards of customer service. Expert in assessing credit applications and managing risk.

- Dynamic Credit Officer, offering over 5 years of industry experience. Highly knowledgeable in loan processes and credit control. Excellent communication and interpersonal skills.

- Credit Officer with a proven track record in credit analysis and managing customer accounts. Experienced in managing debt and developing appropriate strategies.

- Knowledgeable Credit Officer, offering 8+ years of experience in customer relations. Skilled in assessing creditworthiness and evaluating financial statements.

- Motivated Credit Officer, with comprehensive knowledge of risk management strategies. Experienced in issuing credit reports and monitoring accounts.

Build a Strong Experience Section for Your Credit Officer CV

Building a strong experience section for a credit officer CV is essential for showcasing your expertise in the field and your ability to perform well in the role. It can also demonstrate your commitment to the job and your willingness to take on additional responsibilities. By highlighting your past successes and showing off your relevant skills, you can prove to potential employers that you are the best candidate for the job. Additionally, the experience section can help you stand out from the competition and make your CV more memorable.

For Example:

- Managed credit control department for a large financial institution for five years.

- Developed and implemented strategies to reduce credit risk and increase cash flow.

- Monitored credit risk processes and procedures to ensure compliance with regulations.

- Analyzed customer accounts to identify potential risks and develop credit policies.

- Reviewed and approved customer credit applications and loan requests.

- Provided credit counseling and advice to customers on financial issues.

- Maintained customer credit files with accurate and up-to-date information.

- Performed collection activities on delinquent accounts and negotiated payment plans.

- Assisted in the preparation of financial statements and reports for senior management.

- Participated in credit training workshops and seminars to stay up to date with changes in the industry.

Credit Officer CV education example

A Credit Officer typically needs at least a bachelor's degree in finance, accounting, or a related field. Some employers may require or prefer a master's degree, or a professional certification such as a Chartered Financial Analyst (CFA). Credit Officers should also have excellent problem solving skills, a strong understanding of financial regulations, and strong communication and interpersonal skills.

Here is an example of an experience listing suitable for a Credit Officer CV:

- Bachelor of Business Administration, University of Maryland, College Park, MD

- Associate Degree in Financial Services, College of the Atlantic, Bar Harbor, ME

- Certified Credit Officer, Credit Union National Association, Washington, DC

- Advanced Credit Analysis and Risk Management, George Mason University, Fairfax, VA

Credit Officer Skills for a CV

Adding skills to a Credit Officer CV is important because it helps the hiring manager quickly identify the qualifications you have that are relevant to the job. Skills demonstrate your knowledge and experience in the credit industry, helping you stand out above other applicants. Examples of skills to include are credit analysis, financial analysis, risk management, customer service, problem-solving, and communication.

Soft Skills:

- Communication Skills

- Problem Solving

- Organizational Skills

- Interpersonal Skills

- Time Management

- Research Skills

- Risk Assessment

- Financial Analysis

- Credit Analysis

- Negotiation Skills

- Financial Analysis

- Risk Management

- Credit Analysis

- Data Analysis

- Credit Monitoring

- Loan Origination

- Accounting

- Regulatory Compliance

- Portfolio Management

- Credit Scoring

Common Mistakes to Avoid When Writing a Credit Officer CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Credit Officer CV

- Highlight relevant educational qualifications and certifications

- Emphasize experience in managing and assessing credit applications

- Detail strong analytical, problem-solving and communication skills

- Demonstrate the ability to stay up-to-date with relevant regulations and industry standards

- Show a commitment to professional development and continuous learning

- Show a track record of successfully meeting performance standards and goals

- Detail experience in using credit scoring systems and software

- Highlight experience in conducting credit checks and investigations

- Demonstrate the ability to handle customer inquiries and complaints

- Provide information on any awards or recognition received in the role

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.