This Registered Representative Resume Example provides an effective and easy-to-follow guide for writing a comprehensive resume that will help you stand out among other applicants. We have included tips for creating a powerful resume summary, highlighting your key qualifications, and including relevant experience and accomplishments. Furthermore, our examples are designed to show you how to properly format and present your information in a way that is both highly professional and visually appealing. With this guide, you can create a resume that will make a lasting impression and help you get the job of your dreams.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Registered Representative do?

A Registered Representative (also known as a stockbroker) is a professional who is licensed to buy and sell stocks, bonds, mutual funds, and other securities on behalf of their clients. They are responsible for providing advice on investments, conducting research, and managing the buying and selling of securities. They must adhere to the regulations of the Financial Industry Regulatory Authority (FINRA).

- Field Sales Manager Resume Sample

- Business Development Representative Resume Sample

- Public Relations Manager Resume Sample

- Executive Personal Assistant Resume Sample

- Category Manager Resume Sample

- School Director Resume Sample

- Digital Marketing Manager Resume Sample

- Commercial Project Manager Resume Sample

- Senior Vice President Resume Sample

- Security Analyst Resume Sample

- Advertising Coordinator Resume Sample

- Director Of Marketing Resume Sample

- Merchandising Manager Resume Sample

- Advertising Manager Resume Sample

- Campus Recruiter Resume Sample

- Real Estate Sales Agent Resume Sample

- Sales Agent Resume Sample

- Store Assistant Manager Resume Sample

- Import Manager Resume Sample

- Delivery Manager Resume Sample

What are some responsibilities of a Registered Representative?

- Advising clients on investments and financial planning strategies

- Assisting clients in making suitable investment decisions

- Staying abreast of financial trends and developments

- Providing clients with information on tax planning, retirement planning, and estate planning

- Keeping detailed records of client accounts and transactions

- Preparing reports for clients and supervisors

- Complying with all applicable laws and regulations

- Conducting research on investments and making recommendations

- Developing and implementing strategies to help clients meet their financial goals

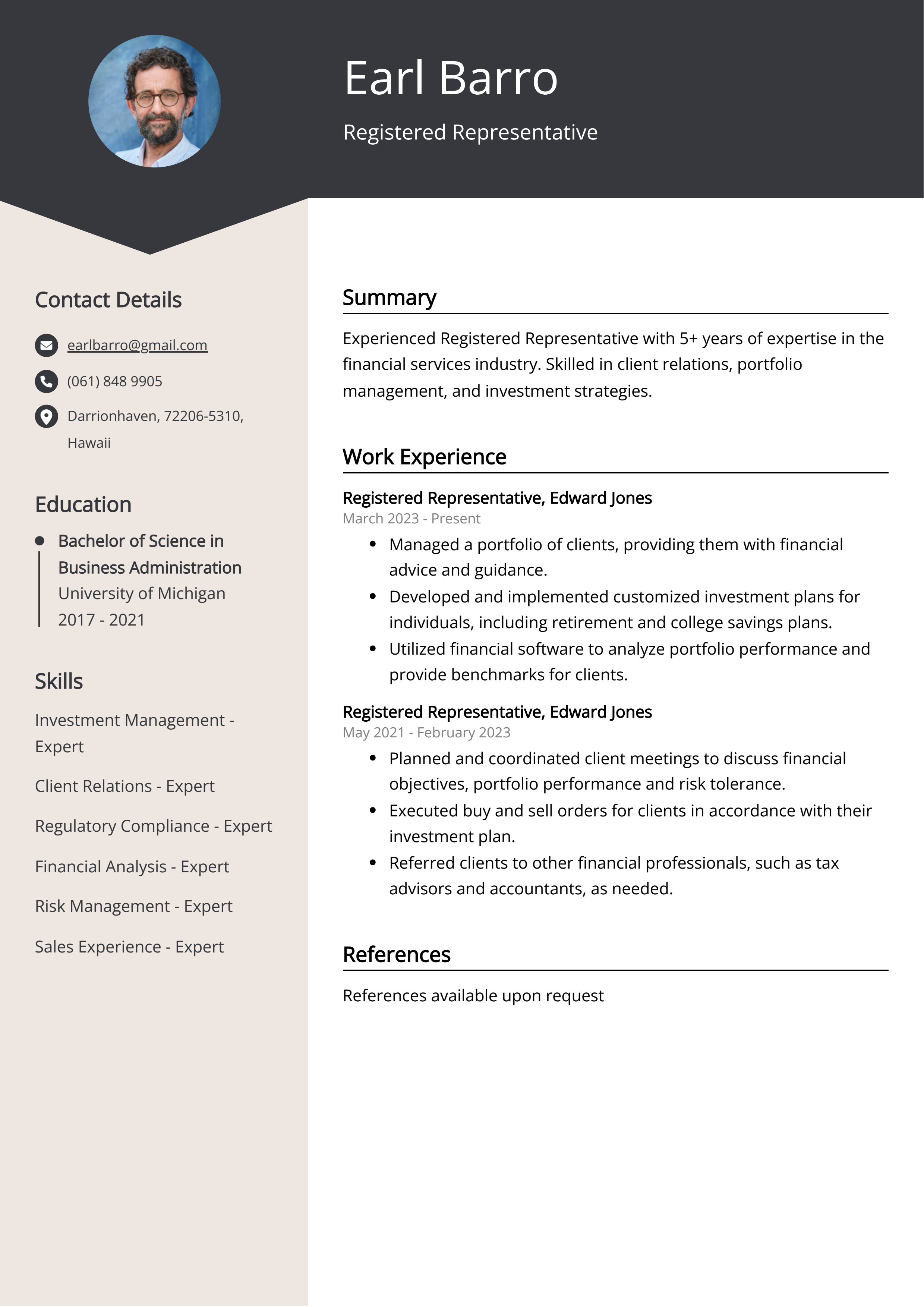

Sample Registered Representative Resume for Inspiration

John Smith

Address: 1234 Main Street, Anytown, State 12345

Phone: (123)456-7890

Email: johnsmith@example.com

Registered Representative

John is an experienced Registered Representative with over 10 years in the financial services industry. He has a proven track record of success in developing and maintaining relationships with clients and providing superior customer service. He is reliable, proactive, and strives to exceed expectations.

Work Experience

- ABC Financial Services – Senior Registered Representative (2011-present)

- Provide financial advice and services to individual clients

- Develop and maintain relationships with clients

- Assist clients in making investment decisions

- Analyze financial data and make recommendations to clients

- XYZ Financial Services – Registered Representative (2008-2011)

- Provided financial advice and services to individual clients

- Developed and maintained relationships with clients

- Assisted clients in making investment decisions

- Analyzed financial data and made recommendations to clients

Education

- Bachelor of Science in Finance – Anytown University (2004-2008)

Skills

- Customer Service

- Relationship Management

- Financial Analysis

- Investment Strategies

- Risk Management

Certifications

- Series 7 License

- Series 8 License

- Series 63 License

Languages

- English (fluent)

- Spanish (conversational)

Resume tips for Registered Representative

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Registered Representative resume tips.

We collected the best tips from seasoned Registered Representative - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight key skills and experience in a clear, concise manner.

- Include relevant education and certifications.

- Include relevant financial industry experience.

- Describe accomplishments in a quantifiable way.

- Demonstrate knowledge of the latest regulations and compliance issues.

Registered Representative Resume Summary Examples

A Registered Representative resume summary or resume objective is a great way to showcase your skills, experience, and qualifications in a clear and concise way. It is important to use a resume summary or resume objective when applying for any job as a registered representative in order to make a positive first impression. This statement should highlight your most relevant qualifications and experiences that make you the ideal candidate for the role. It should also demonstrate that you have the necessary skills and knowledge to serve clients in a professional manner. By including a resume summary or resume objective, you can set yourself apart from the competition and show potential employers that you are the right person for the job.

For Example:

- Motivated Registered Representative with 8 years of experience in the financial services industry. Excellent customer service and problem-solving skills.

- Diligent Registered Representative with a comprehensive understanding of securities and investments. Excellent communication skills and strong customer service orientation.

- Highly organized Registered Representative with 5 years of experience handling complex financial transactions. Adept at developing innovative solutions to client needs.

- Experienced Registered Representative with a deep understanding of the financial markets. Proven ability to provide excellent customer service and adhere to strict regulations.

- Enthusiastic Registered Representative with a strong background in securities and investments. Skilled in providing sound financial advice and delivering exceptional service.

Build a Strong Experience Section for Your Registered Representative Resume

Building a strong experience section for a registered representative resume is essential for showing potential employers that you have the skills and experience necessary to work in the financial services industry. An impressive experience section will demonstrate to employers that you understand the financial markets, can effectively interact with clients, and have knowledge of industry regulations. Additionally, it will show that you have the initiative to stay up-to-date with the latest trends and developments in the industry. Ultimately, a strong experience section will help you stand out from other job seekers and make you a more attractive candidate for the position.

For Example:

- Successfully completed two years of experience as a Registered Representative for a financial services company.

- Developed a comprehensive knowledge of financial products and services.

- Provided clients with comprehensive financial advice and education.

- Assisted clients in developing and implementing effective financial strategies.

- Maintained client records, updated information and handled customer inquiries.

- Developed and managed a portfolio of clients.

- Analyzed clients’ financial situations and created customized investment plans.

- Identified potential new investments and evaluated risk associated with them.

- Advised clients on financial planning strategies and tax implications of various investments.

- Built and maintained strong relationships with clients to ensure satisfaction and trust.

Registered Representative resume education example

A Registered Representative is required to have a Series 7 license, which is a General Securities Representative (GS) exam administered by the Financial Industry Regulatory Authority (FINRA). They must also have a Series 63 (Uniform Securities Agent State Law Examination) and a Series 66 (Uniform Combined State Law Examination). In addition to the required exams, many firms require the Series 24 (General Securities Principal Exam) and Series 79 (Investment Banking Representative Exam). Depending on the firm, a Registered Representative may also need additional licenses or certifications, such as the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA).

Here is an example of an experience listing suitable for a Registered Representative resume:

- Bachelor of Business Administration in Financial Services, XYZ University

- Licensed as a Registered Representative with the Financial Industry Regulatory Authority (FINRA)

- Completed Series 7 and 66 exams

- Certified Financial Planner (CFP)

- Certified Investment Management Analyst (CIMA)

- Securities Industry Essentials (SIE) Exam

Registered Representative Skills for a Resume

Adding relevant skills to your resume as a Registered Representative is important because it allows potential employers to quickly and easily identify the skills and qualifications that you possess. It also helps them to determine if you are a good fit for the role. Examples of skills to include on a resume for a Registered Representative are financial analysis, customer service, sales, communication, and compliance.

Soft Skills:

- Communication

- Interpersonal

- Problem Solving

- Time Management

- Organizational

- Leadership

- Negotiation

- Teamwork

- Adaptability

- Conflict Resolution

- Financial Analysis

- Investment Strategies

- Risk Management

- Regulatory Compliance

- Client Relations

- Portfolio Management

- Asset Allocation

- Market Research

- Performance Reporting

- Data Analysis

Common Mistakes to Avoid When Writing a Registered Representative Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Registered Representative resume

- Highlight relevant experience and certifications

- Include professional summary and skills section

- Provide a detailed description of job responsibilities

- Include any awards or recognitions received

- Include any relevant education/training

- Demonstrate customer service and relationship-building skills

- Showcase financial planning and investment analysis know-how

- Showcase ability to successfully manage a portfolio

- Highlight ability to explain complex financial topics to clients

- Include any relevant special projects or initiatives

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.