Are you looking for tips and advice on how to create an effective insurance resume? Our Insurance Resume Example article provides valuable insight into what it takes to craft a standout resume for an insurance professional. From highlighting relevant skills and experience to understanding the employers’ needs, this article covers the basics of creating a successful resume for this field.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does an Insurance do?

Insurance is a form of risk management designed to protect people and businesses from financial losses. It is a contract between two parties, the insurer and the insured, in which the insurer agrees to pay a predetermined amount of money to the insured in the event of a loss or damage to the insured’s property or person. Insurance provides financial protection from unexpected losses or damages and helps to reduce the financial burden of an unexpected event.

- Lead Pharmacy Technician Resume Sample

- ICU Nurse Resume Sample

- Perfusionist Resume Sample

- Cardiovascular Technologist Resume Sample

- Embryologist Resume Sample

- Veterinary Assistant Resume Sample

- Community Health Worker Resume Sample

- Surgical Nurse Resume Sample

- Experienced Optometrist Resume Sample

- Oncology Nurse Resume Sample

- Experienced Psychiatrist Resume Sample

- General Dentist Resume Sample

- Medical Billing Clerk Resume Sample

- Pharmacy Assistant Resume Sample

- Nursing Attendant Resume Sample

- Experienced Nutritionist Resume Sample

- Ophthalmologist Resume Sample

- Clinical Nurse Educator Resume Sample

- Surgical Assistant Resume Sample

- Registered Respiratory Therapist Resume Sample

What are some responsibilities of an Insurance?

- Evaluating customer applications and determining risk factors

- Researching and analyzing previous claims and loss histories

- Providing advice on insurance policies, coverage, and risk management

- Calculating premiums and explaining policy details

- Reviewing and updating policies and making necessary changes

- Ensuring policy requirements are met, such as verifying documentation

- Processing customer payments and handling related paperwork

- Investigating and resolving customer complaints

- Keeping records of all transactions and policy changes

- Staying up to date on changes in the industry

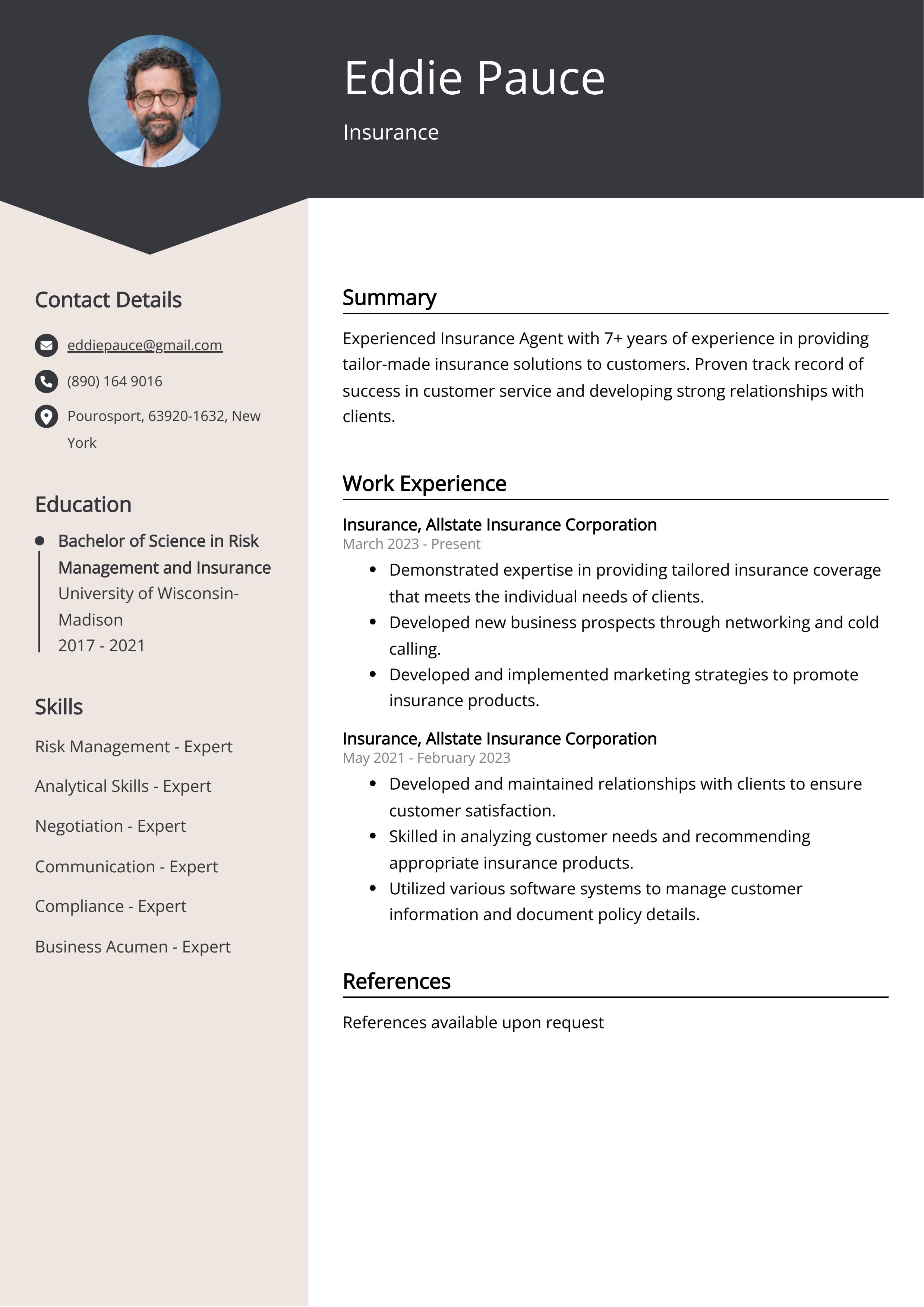

Sample Insurance Resume for Inspiration

Name: John Doe

Address: 123 Main Street, Anytown, CA 12345

E-mail: john.doe@example.com

Phone: (999) 999-9999

Insurance professional with 8+ years of experience in the insurance sector. Proven success in developing creative solutions to customer needs and increasing customer satisfaction. Skilled in analyzing trends and making sound decisions. Adept at utilizing resources to achieve client objectives and goals.

Work Experience:- Insurance Agent, ABC Insurance Company – Anytown, CA (2015-Present)

- Provide customers with professional advice regarding their insurance needs.

- Develop and implement strategies to increase the company’s market share.

- Perform research and analysis to identify customer needs.

- Ensure compliance with state and federal regulations.

- Insurance Specialist, XYZ Insurance Company – Anytown, CA (2010-2015)

- Managed the company’s insurance portfolio.

- Analyzed customer needs and recommended appropriate insurance solutions.

- Developed and maintained relationships with key customers.

- Provided customer service and responded to customer inquiries.

- Bachelor’s Degree in Insurance, Anytown University - Anytown, CA (2005-2009)

- Customer Service

- Research and Analysis

- Insurance Compliance

- Market Analysis

- Risk Management

- Licensed Insurance Agent, State of California (2010)

- English (Native)

- Spanish (Conversational)

Resume tips for Insurance

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Insurance resume tips.

We collected the best tips from seasoned Insurance - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your accomplishments throughout your career.

- Include key words that relate to the insurance industry.

- Focus on relevant skills that are applicable to the job.

- Be specific and include measurable results to show your value.

- Quantify your success, such as number of policies written or sales goals achieved.

Insurance Resume Summary Examples

A resume summary or resume objective is an important part of an insurance resume. It's the first section a potential employer will read, and it gives them a brief overview of your qualifications, experience, and goals. By including a resume summary or objective, you can quickly give employers an idea of why they should consider you for the job. It also helps you stand out amongst other applicants and can help you make a strong impression.

For Example:

- Experienced Insurance Agent with 8 years of experience in providing customers with tailored insurance solutions. Successfully managed over 500 policyholders.

- Skilled Insurance Underwriter with 7 years of experience in assessing risk and determining whether to accept or decline coverage. Experienced in collaboration with agents and customers.

- Dedicated Insurance Professional with 6 years of experience in managing customer accounts, addressing customer inquiries, and providing customer service.

- Efficient Insurance Claims Representative with 5 years of experience in processing and managing insurance claims. Knowledgeable in policy compliance and regulations.

- Competent Insurance Processor with 4 years of experience in data entry and document preparation. Experienced in customer service and policy management.

Build a Strong Experience Section for Your Insurance Resume

Building a strong experience section for an insurance resume is important because it allows employers to quickly identify your key skills and experiences that are relevant to the position. It also gives you the opportunity to showcase your accomplishments in the insurance field. An effective experience section communicates the value you can bring to the role and allows you to stand out from other candidates. It also establishes your credibility to employers by demonstrating your understanding and knowledge of the insurance industry.

For Example:

- Provided strategic guidance to more than 200 clients on their insurance policies.

- Developed and implemented comprehensive insurance policies and procedures.

- Conducted detailed research on insurance companies and products.

- Monitored insurance trends and adjusted policies accordingly.

- Analyzed customer needs to guide the selection of insurance products.

- Processed and tracked insurance claims in a timely manner.

- Cultivated strong relationships with insurance partners.

- Provided advice and counsel to customers on risk management strategies.

- Conducted in-depth market research to identify potential insurance products.

- Assisted with the development of insurance marketing plans and strategies.

Insurance resume education example

The exact educational requirements for a career in insurance vary depending on the position. Most entry-level roles typically require a minimum of a high school diploma or equivalent, although some employers may prefer applicants with an associate or bachelor’s degree in a related field such as business or finance. More advanced positions may require additional certification or licensing, such as a CPCU (Chartered Property Casualty Underwriter) designation or a CFP (Certified Financial Planner) designation.

Here is an example of an experience listing suitable for a Insurance resume:

- B.A. in Business Administration from University of California, Los Angeles (UCLA) - 2020

- Certified Insurance Agent from the National Association of Insurance Commissioners (NAIC) - 2020

- Certified in Life and Health Insurance from the American Institute of Certified Public Accountants (AICPA) - 2020

- Certificate in Risk Management from the Insurance Institute of America (IIA) - 2020

- Certificate in Claims Adjusting from the National Association of Professional Insurance Agents (NAPIA) - 2020

Insurance Skills for a Resume

Adding skills to an Insurance Resume is important because it demonstrates your relevant experiences, abilities, and competencies. Skills provide the potential employer with a clear picture of the knowledge and abilities you possess. It also shows that you have the qualifications to be an effective insurance professional. Examples of skills to highlight on an insurance resume may include customer service, policy writing, claims processing, risk management, and underwriting.

Soft Skills:

- Analytical Thinking

- Organizational Skills

- Time Management

- Problem Solving

- Conflict Resolution

- Interpersonal Skills

- Communication Skills

- Teamwork

- Leadership

- Adaptability

- Insurance Underwriting

- Claims Adjusting

- Risk Management

- Reinsurance Analysis

- Data Analysis

- Policy Writing

- Actuarial Science

- Financial Modeling

- Compliance Knowledge

- Customer Service

Common Mistakes to Avoid When Writing an Insurance Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Insurance resume

- Highlight experience dealing with insurance policies and regulations.

- Demonstrate customer service skills as well as technical know-how.

- Showcase a strong understanding of insurance industry terminology.

- Mention any relevant certifications or licenses.

- Highlight knowledge of software and databases related to insurance.

- List problem-solving skills in order to handle customer inquiries.

- Describe any collaboration with other departments.

- Include any awards or achievements.

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.