Welcome to our Insurance Specialist Resume Example article. Here you will find a comprehensive guide to crafting an effective resume for an Insurance Specialist. Our article includes tips on highlighting your experience, skills, and accomplishments, as well as formatting and layout suggestions. With this information, you can create an impressive resume that will help you stand out from other applicants and land the job you desire.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does an Insurance Specialist do?

An Insurance Specialist is a professional who provides advice and assistance to individuals and businesses in understanding and selecting the most appropriate insurance products to meet their financial needs. They understand the complexities of insurance, including how to compare insurance products and coverage options. They also help clients understand the legal and regulatory requirements of insurance and provide advice on how to minimize risk and maximize value.

- Project Control Analyst Resume Sample

- Finance Analyst Resume Sample

- Banking Analyst Resume Sample

- Risk Management Specialist Resume Sample

- Accounting Manager Resume Sample

- Appraiser Resume Sample

- CFO Resume Sample

- Junior Analyst Resume Sample

- Financial Business Analyst Resume Sample

- Real Estate Salesperson Resume Sample

- Finance Associate Resume Sample

- Accounting Assistant Resume Sample

- Analyst Resume Sample

- Trader Resume Sample

- Trading Analyst Resume Sample

- Broker Resume Sample

- Business Analyst Resume Sample

- Finance Assistant Resume Sample

- Personal Banker Resume Sample

- Chief Investment Officer Resume Sample

What are some responsibilities of an Insurance Specialist?

- Develop and implement insurance plans.

- Analyze customer needs and provide appropriate coverage.

- Calculate premiums and establish payment methods.

- Monitor insurance claims and ensure timely payments.

- Provide customer service and answer inquiries.

- Ensure compliance with insurance regulations.

- Maintain updated records of insurance plans.

- Review and update existing insurance policies.

- Assess the risk level of potential clients.

- Negotiate with insurance providers for better rates.

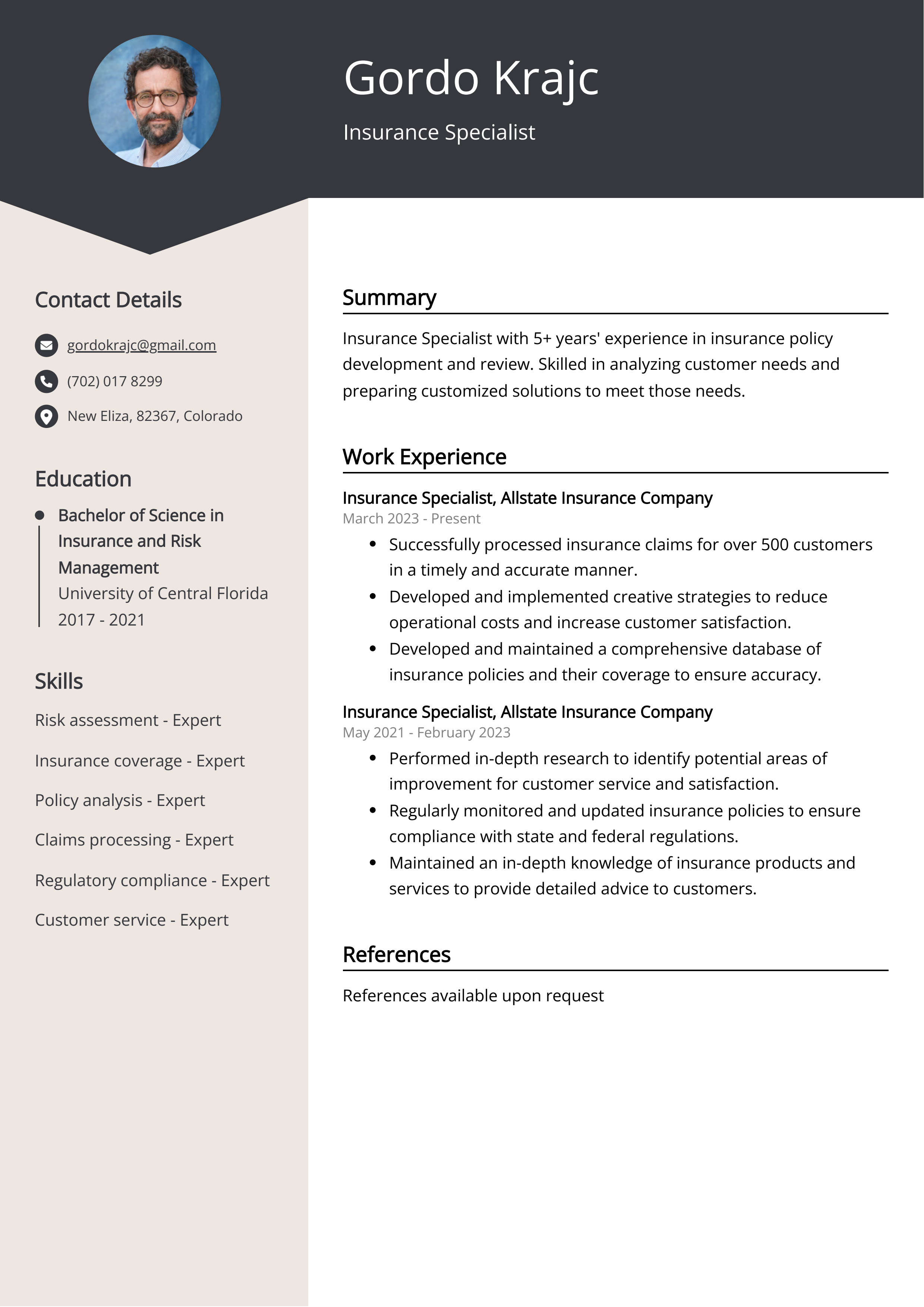

Sample Insurance Specialist Resume for Inspiration

John Smith

Address: 123 Street, City, ST 12345

Phone: 555-555-5555

Email: johnsmith@example.com

Summary

John Smith is a dedicated insurance specialist with more than 10 years of experience in the industry. He is an expert in insurance policy development, risk assessment, and customer service. With knowledge and expertise in various facets of the insurance industry, John is adept at delivering effective solutions to customers.

Work Experience

- Insurance Specialist, Insure Inc., City, ST, 2011-Present

- Provide advice and guidance to customers on insurance policies.

- Calculate insurance premiums and analyze policy data.

- Develop insurance policies and keep track of customer contracts.

- Develop and implement strategies to improve customer service.

- Account Manager, Secure Insurance, City, ST, 2006-2011

- Oversaw customer accounts and provided insurance advice.

- Managed customer relationships and implemented sales strategies.

- Conducted research on new insurance products and services.

Education

Bachelor of Science in Business Administration, City University, City, ST, 2004-2006

Skills

- Risk assessment

- Customer service

- Insurance policy development

- Contract management

- Sales strategies

Certifications

Certified Insurance Specialist, 2006

Languages

English, Spanish

Resume tips for Insurance Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Insurance Specialist resume tips.

We collected the best tips from seasoned Insurance Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight Your Relevant Experience: Be sure to emphasize your relevant experience and skills related to the insurance specialist position. This includes any experience with customer service, data entry, insurance underwriting, and any other relevant fields.

- Quantify Your Achievements: When possible, use numbers to quantify your achievements in order to give the reader a better understanding of the scope of your work.

- Include a Professional Summary: Start your resume off strong by including a professional summary that briefly describes your background and qualifications.

- Use Action Verbs: Use action verbs such as “developed”, “organized”, “coordinated” and “administered” to describe your work experience and accomplishments.

- Proofread Your Resume: Make sure to review your resume for any typos or mistakes. It is important to make a good impression with a well-written and error-free resume.

Insurance Specialist Resume Summary Examples

A resume summary or resume objective is an important part of a resume for an insurance specialist. It provides a brief overview of the applicant's qualifications, experience, and skills that make them a good candidate for the job. It also highlights any special skills or knowledge that the applicant has that could be beneficial to the insurance company. A resume summary or resume objective helps the employer quickly evaluate the applicant's qualifications and decide whether they are the right fit for their company.

For Example:

- Recent college graduate with a degree in finance and experience in insurance sales. Highly organized and detail-oriented, with excellent customer service skills.

- Experienced Insurance Specialist with five years of experience in product management and customer service. Skilled in customer needs assessment and risk analysis.

- Highly motivated Insurance Specialist with a track record of successful customer service and policy management. Seeking to leverage expertise to benefit a new organization.

- Enthusiastic Insurance Specialist with extensive knowledge of insurance products and services. Experienced in developing client relationships and resolving customer complaints.

- Organized and detail-oriented Insurance Specialist with five years of experience working with clients to provide comprehensive insurance solutions. Proven track record of meeting customer expectations.

Build a Strong Experience Section for Your Insurance Specialist Resume

Building a strong experience section for a insurance specialist resume is important because it allows potential employers to gain a better understanding of your qualifications, skills, and abilities. It also provides employers with a way to measure your potential as an insurance specialist. By highlighting your professional experience, you can demonstrate your knowledge of the industry and the various aspects of the job. Additionally, a strong experience section can help you stand out from other candidates and show your commitment to the field.

For Example:

- Managed a portfolio of over 100 diverse insurance contracts and ensured compliance with all applicable laws.

- Developed and implemented a comprehensive risk management program to guide insurance selection and renewal processes.

- Analyzed insurance policies and contracts to identify areas of risk.

- Negotiated contracts with insurance carriers to ensure the most cost-effective coverage.

- Provided education and training in the area of insurance and risk management to department staff.

- Coordinated with other departments to ensure proper transfer of risk.

- Developed and maintained relationships with insurance brokers and carriers.

- Conducted regular reviews of insurance policies to ensure coverage is adequate and up-to-date.

- Provided assistance in the resolution of insurance claims.

- Prepared and presented reports to management on insurance related activities.

Insurance Specialist resume education example

Insurance specialists typically need at least a high school diploma, though many employers prefer candidates who have an associate's or bachelor's degree in a field related to business, finance, or insurance. Additionally, many states require insurance specialists to become licensed. Licensing requirements vary by state, but often include passing an exam and completing continuing education credits.

Here is an example of an experience listing suitable for a Insurance Specialist resume:

- Associate of Science in Financial Services, University of Houston, Houston, TX - 2018

- Bachelor of Business Administration in Insurance, University of Texas, Austin, TX - 2021

- Certified Insurance Professional, Insurance Institute of America, Austin, TX - 2022

Insurance Specialist Skills for a Resume

Adding skills to an Insurance Specialist Resume is important because it provides employers with an overview of your abilities and qualifications, which can help them determine if you are a good fit for the position. It also helps demonstrate your proficiency in the field and shows that you possess the specific knowledge and experience to perform the job. Examples of skills that may be included on an Insurance Specialist Resume include customer service, problem solving, technical knowledge, regulatory compliance, and data analysis.

Soft Skills:

- Communication Skills

- Organizational Skills

- Problem Solving

- Negotiation Skills

- Time Management

- Risk Assessment

- Data Analysis

- Customer Service

- Leadership

- Teamwork

- Risk Management

- Data Analysis

- Insurance Underwriting

- Claims Processing

- Policy Writing

- Regulatory Compliance

- Auditing Procedures

- Financial Reporting

- Customer Service

- Claims Adjustment

Common Mistakes to Avoid When Writing an Insurance Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Insurance Specialist resume

- Highlight relevant experience in the insurance industry

- Include any specialized certifications or qualifications

- Showcase problem-solving skills and customer service experience

- Describe any experience with data management or analytics

- Mention any awards or recognition received for job performance

- Demonstrate strong communication and interpersonal abilities

- Highlight any experience with claims processing

- Detail any experience with sales and marketing of insurance products

- Showcase any leadership roles or management experience

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.