Navigating the world of insurance can be complex and challenging. Yet, insurance analysts play a vital role in deciphering and simplifying this industry. If you are ready to launch or elevate your career in this field, a high-impact resume is a crucial starting point. In this article, you'll find some smartly designed insurance analyst resume examples that can inspire your own. These examples, coupled with our insightful tips, will help you create a compelling resume that highlights your skills, experiences, and value to potential employers in the insurance world. Let's get started!

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does an Insurance Analyst do?

An insurance analyst is a professional who provides analytical support to the insurance industry. They review insurance applications to determine coverage amounts and premiums, evaluate existing policies and make recommendations for changes or improvements. This may involve studying data to identify trends, risk assessment, and forecasting potential costs. They also participate in the development and implementation of underwriting policies. They may work for insurance companies, consultancy firms, or as independent contractors. They also may assist in the resolution of complex insurance claims or litigation. They need to stay updated with the changing rules and regulations in the insurance industry.

- Finance Associate Resume Sample

- Junior Analyst Resume Sample

- Billing Manager Resume Sample

- Finance Coordinator Resume Sample

- Accounting Manager Resume Sample

- Claims Auditor Resume Sample

- Financial Data Analyst Resume Sample

- Real Estate Appraiser Resume Sample

- Finance Officer Resume Sample

- Credit Manager Resume Sample

- Junior Financial Analyst Resume Sample

- Analyst Resume Sample

- Fraud Analyst Resume Sample

- Accounts Receivable Supervisor Resume Sample

- Assistant Bookkeeper Resume Sample

- Insurance Specialist Resume Sample

- Audit Director Resume Sample

- Tax Clerk Resume Sample

- Cash Manager Resume Sample

- Pricing Specialist Resume Sample

What are some responsibilities of an Insurance Analyst?

- Evaluating and analyzing insurance policies, procedures, and performance.

- Assessing risk factors and potential liabilities for the company.

- Interpreting insurance data to aid towards in making informed decisions.

- Assisting in the creation and implementation of insurance plans and policy changes.

- Producing financial forecasts and analyzing trends in the insurance industry.

- Conducting cost-benefit analyses for potential insurance programs.

- Developing strategies to maximize profit margins while maintaining customer satisfaction.

- Communicating with and advising company executives and clients on insurance-related matters.

- Ensuring the company complies with governmental regulations and standards related to insurance.

- Organizing claims information and managing claims databases.

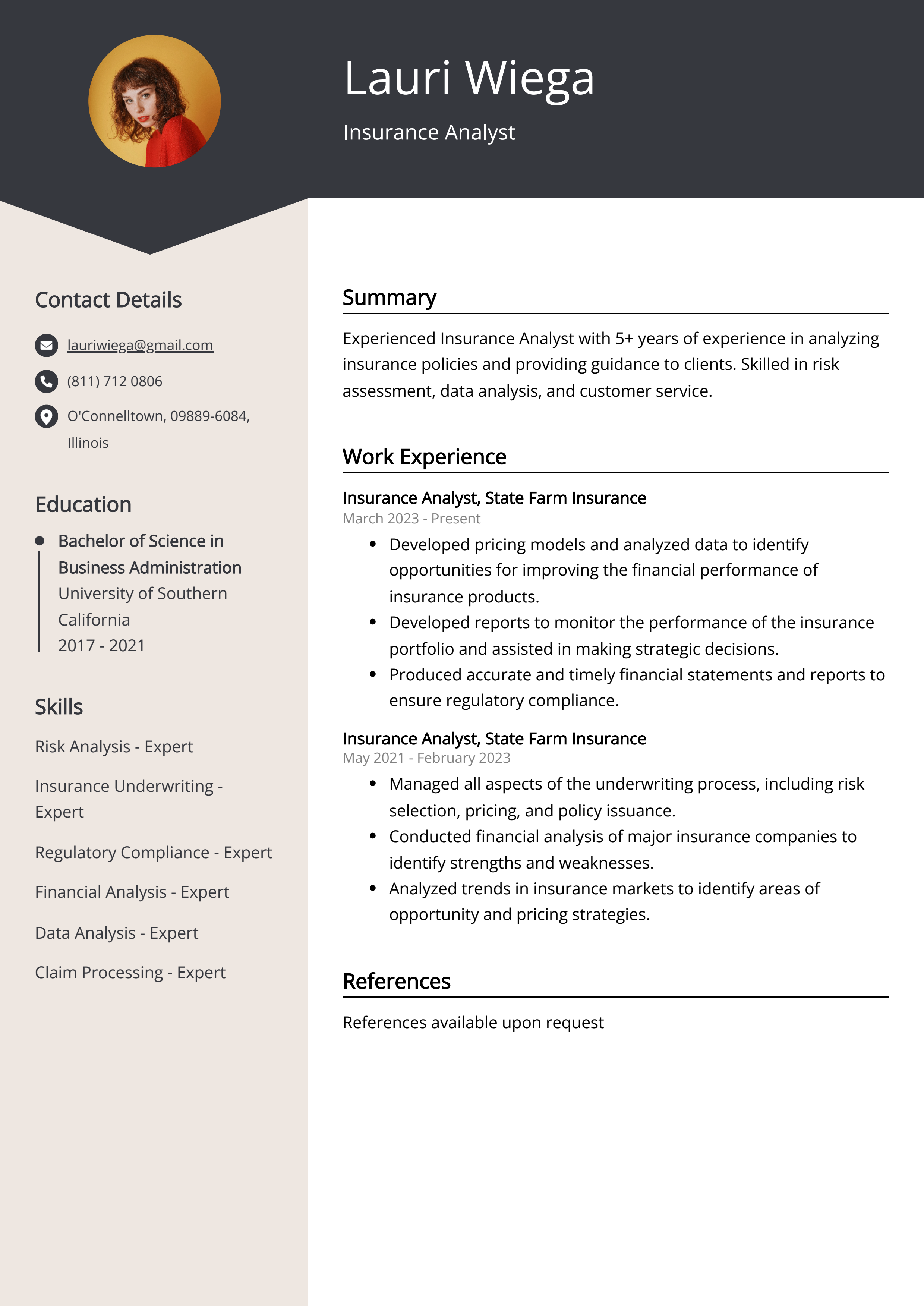

Sample Insurance Analyst Resume for Inspiration

Name: John Doe

Address: 123 Main Street, Los Angeles, CA, 90001

Email: johndoe@email.com

Phone: (123) 456-7890

John Doe is a customer-focused and detail-orientated Insurance Analyst with over 10 years of experience within the insurance industry. His skills include risk evaluation, policy administration, and financial forecasting. He is known for his ability to analyze complex data, develop comprehensive reports, and implement strategic business solutions to drive profit and growth.

Work Experience:

- Senior Insurance Analyst, ABC Insurance Company (2015 - Present)

Responsible for evaluating insurance softwares, predicting insurance trends, and optimizing policy administration. - Insurance Analyst, XYZ Insurance Company (2010 - 2015)

Managed risk assessment measures, developed pricing models, and provided insurance recommendations to management team.

Education:

- Bachelor of Science in Risk Management and Insurance, University of XYZ (2006 - 2010)

Skills:

- Risk Assessment and Management

- Data Analysis and Interpretation

- Financial Forecasting

- Policy Administration

- Knowledge of Insurance Softwares

Certifications:

- Certification in Risk Management (CRM)

- Chartered Property Casualty Underwriter (CPCU)

Languages: English (Native), Spanish (Intermediate)

Resume tips for Insurance Analyst

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Insurance Analyst resume tips.

We collected the best tips from seasoned Insurance Analyst - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight Relevant Skills: Make sure to include key skills required by insurance analysts such as statistical analysis, data interpretation, knowledge of insurance policies and regulations, and excellent communication abilities.

- Mention Relevant Certifications: List any certifications relating to the insurance industry, such as Chartered Property Casualty Underwriter (CPCU) or Associate in Risk Management (ARM), which can make you stand out from other candidates.

- Quantify Achievements: Don't just list your duties from previous roles. Instead, demonstrate your impact on the organization by using numbers. For example, "Reduced risk by analyzing and updating 30+ outdated insurance policies, resulting in a 15% decrease in claims."

- Include Technical Expertise: Detail your familiarity with industry-specific software, like risk management information systems (RMIS) or predictive modeling software, as this can show your ability to adapt to different digital tools.

- Use Relevant Keywords: Include keywords from the job description in your resume. These can range from specific skills, such as risk assessment or financial projecting, to broader themes like problem solving or teamwork.

Insurance Analyst Resume Summary Examples

Resume summary or objective is crucial in an Insurance Analyst's Resume for several reasons:

1. To Catch the Employer's Attention: Hiring managers must go through numerous resumes. A well-written summary or objective can quickly draw the attention of employers, making them more interested in your resume.

2. To Showcase Relevant Skills and Experiences: The summary or objective allows insurance analysts to highlight their most relevant skills and experiences right at the start.

3. To Express Career Goals: These sections can convey your career aspirations to the potential employer, demonstrating how your goals align with their organization.

4. To Stand Out from Others: A compelling summary or objective can help distinguish your insurance analyst resume from the rest, increasing your chances of landing an interview.

5. To Summarize your Value Proposition: These sections can serve as a snapshot of what you bring to the table, allowing potential employers to quickly understand your value proposition.

6. Increases Chances for an Interview: Hiring managers who are short on time might not read beyond the first few lines of your resume. Having an appealing summary or objective increases your chances of landing an interview.

7. To demonstrate your understanding of the industry: For roles such as Insurance Analysts, showing a clear understanding of the industry in your objective or summary can give you an edge over other applicants.

Remember to customize your summary or objective for each job application, ensuring it aligns with the job description and the needs of the employer.

For Example:

- Highly analytical Insurance Analyst with a proven background in assessing risk, pricing insurance products, and monitoring market trends. Possess deep understanding of financial data interpretation and regulatory guidelines.

- Detail-oriented Insurance Analyst with 6+ years of experience in conducting in-depth data analysis, policy comparison and risk assessment. Specialized in developing claims-reserving methods and studying present insurance coverage trends.

- Certified Insurance Analyst adept at forecasting and monitoring industry trends to help clients navigate dynamic markets. Expert in financial modeling, risk evaluation and premium determination using advanced statistical tools.

- Experienced Insurance Analyst skilled in reviewing and analyzing insurance policies for compliance and risk, assisting in the design of insurance plans, and providing financial forecasting. Specialized in life and health insurance sectors.

- Enthusiastic Insurance Analyst with expertise in interpreting and analyzing insurance data to provide risk assessment and underwriting support. Excel in competitive market analysis. Holds Series 7 and 66 licenses.

Build a Strong Experience Section for Your Insurance Analyst Resume

Building a strong experience section for an insurance analyst resume is essential for several reasons:

1. Shows Expertise: It clearly demonstrates your expertise in the field and shows potential employers that you are competent in the relevant areas. It details the roles you've played, technical skills you've used, and the outcomes achieved.

2. Proves Your Value: Providing insightful details about past experiences can illustrate your value, especially if you share the results accomplished in each position. It can help employers see your potential contribution to their company.

3. Showcases Your Skills: Practical application is often more powerful than theory. By demonstrating where and how you applied your skills gives potential employers a sense of your aptitude and expertise in action. Also, it clarifies the extent of your adaptability and understanding of the insurance industry.

4. Fulfills Recruitment Requirements: Most job applications require a detailed list of previous work experience. Through your experiences, employers can confirm whether you meet the job's criteria or not.

5. Provides References: A strong experience section indicates employers that can be contacted for references. Such references can validate your skills, abilities and work ethics.

6. Increases Trust: It can build a sense of trust in employers, by proving that you have experience in the field and are not a risky hire.

7. Career Progression: Shows employers your career journey and how you've gained experience over time. It can help them understand your career ambitions and if your future aligns with their company.

For Example:

- Led the analysis and assessment of various insurance policies, effectively reducing company risk by 15%.

- Collaborated with underwriters to evaluate and propose amendments for insurance policies to fit company budget.

- Facilitated quarterly reviews of insurance policies to identify areas for improvement, leading to a 20% reduction in claim denials.

- Generated comprehensive reports on insurance trends and forecasts, assisting company leadership in strategic decision making.

- Designed a strategic risk management plan, resulting in a 25% decrease in company liabilities.

- Conducted detailed financial and underwriting analyses contributing to increased client risk understanding.

- Played a key role in launching a new insurance product line, which increased company's market share by 10%.

- Utilized data analysis tools to identify potential areas of insurance fraud, reducing its incidence by 30%.

- Supported the negotiation of favorable insurance rates and coverage, resulting in net savings of $200,000 annually.

- Developed & implemented policies and procedures for the insurance department, ultimately improving process efficiency by 18%.

Insurance Analyst resume education example

The minimum educational requirement for an Insurance Analyst is typically a Bachelor's degree in Business, Finance, Economics, or a related field. Some also pursue postgraduate degrees in these areas for better job prospects. Additionally, they could obtain certifications from organizations like The Institutes Risk and Insurance Knowledge Group or the Insurance Institute of America. Relevant courses and skills include mathematics, statistics, financial planning, business strategies, and computer science since analysts need to be proficient in databases and spreadsheets. Communication skills and financial acumen are also important. Some jobs may require insurance-specific knowledge, so courses, experience, or education in healthcare, property insurance, or life insurance could be beneficial.

Here is an example of an experience listing suitable for a Insurance Analyst resume:

- Bachelor of Science in Finance — Northwestern University, Evanston, IL, 2016-2020

- Concentration in Risk Management and Insurance

- Coursework highlights: Property and Liability Insurance, Life and Health Insurance, Estate Planning

- Cumulative GPA: 3.9/4.0

- Certified Risk Analyst (CRA) Certification — Global Academy of Finance and Management, 2020

- Certified Insurance Data Analyst (CIDA) Certification — The Institute of Certified Professional Managers, 2021

Insurance Analyst Skills for a Resume

Adding skills to an Insurance Analyst Resume is important for several reasons:

1. Highlight Expertise: It allows the applicant to highlight their expertise, training, and knowledge relevant to the job. These can include industry-specific skills, technical abilities, or transferrable skills that can contribute to their performance as an Insurance Analyst.

2. Demonstrate Competency: The skills section shows potential employers the candidate's competency in different aspects of the role such as data analysis, risk assessment, financial forecasting, etc.

3. Stand Out from Competitors: Outlining these skills helps the candidate stand out from other applicants that may have similar educational qualifications or job experiences.

4. Meet Job Requirements: Many job postings list specific skills as prerequisites. Including these in the resume can show hiring managers the applicant meets the job criteria.

5. Easy Assessment: It offers an at-a-glance look at the applicant's capabilities which can help hiring managers during the initial screening process.

6. Expectations: By including skills relevant to the job, candidates can also set expectations about their role and responsibilities, making it easier to fit into the position.

7. Compatibility: It shows the candidate's compatibility with the job role and the company culture. Some skills like teamwork, communication, problem-solving, etc., may denote the candidate's potential to navigate work relationships and resolve workplace challenges.

Therefore, including skills in an Insurance Analyst Resume plays a crucial role in the applicant's chances of securing the job.

Soft Skills:

- Effective Communication.

- Problem Solving.

- Teamwork Capacity.

- Detail Orientation.

- Negotiation Skills.

- Time Management.

- Critical Thinking.

- Customer Service.

- Adaptability.

- Decision Making.

- Financial Management

- Risk Assessment

- Data Analysis

- Policy Evaluation

- Statistical Reasoning

- Claims Handling

- Policy Underwriting

- Microsoft Office Proficiency

- Quantitative Modelling

- Regulatory Compliance

Common Mistakes to Avoid When Writing an Insurance Analyst Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Insurance Analyst resume

- An insurance analyst resume must illustrate comprehensive knowledge of insurance principles, risk assessment, insurance products, and industry regulations.

- The resume should highlight the applicant’s strong analytical and problem-solving skills, as insurance analysis often involves data interpretation and decision-making based on that data.

- It should showcase the individual's ability to manage multiple projects simultaneously, handling stress effectively, and meeting tight deadlines.

- Emphasize on excellent communication skills as the job requires interacting with other departments, clients, and occasionally presenting reports to higher management.

- It's important for the resume to reflect the candidate's proficiency in using insurance data analysis software and other relevant technology such as Microsoft Excel, databases, or statistical software packages.

- Work experience section should include specific achievements or contributions made in previous roles, such as cost savings through optimized insurance plans, implementation of risk management strategies, etc.

- Key qualifications like a degree in finance, statistics, business administration, or a related field, additional certifications such as Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Analyst (CIA) are often essential; these should be highlighted in the resume.

- Insurance analysts must constantly stay updated about changes in the insurance industry; therefore, ongoing professional development or participation in industry associations can be illustrated as a significant advantage.

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.