Looking for a top-notch tax professional to join your team? Our Tax Professional Resume Example article provides a comprehensive guide on how to craft a winning resume that will impress potential employers. Whether you're a seasoned tax professional with years of experience or a recent graduate entering the field, our example and accompanying tips will help you stand out in the competitive job market.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Tax Professional do?

- Assist clients with tax planning and compliance

- Prepare and submit tax returns for individuals and businesses

- Stay up to date on changes to tax laws and regulations

- Provide advice on minimizing tax liabilities

- Represent clients in the event of a tax audit

- Help clients with tax-related financial planning

- Cost Accounting Manager Resume Sample

- Financial Business Analyst Resume Sample

- Assistant Bookkeeper Resume Sample

- Mortgage Processor Resume Sample

- Reimbursement Analyst Resume Sample

- Risk Management Specialist Resume Sample

- Audit Associate Resume Sample

- Account Clerk Resume Sample

- Billing Specialist Resume Sample

- Insurance Analyst Resume Sample

- Financial Systems Analyst Resume Sample

- Pricing Analyst Resume Sample

- Equity Research Analyst Resume Sample

- Accounts Receivable Manager Resume Sample

- Real Estate Accountant Resume Sample

- Tax Associate Resume Sample

- Payroll Coordinator Resume Sample

- Corporate Analyst Resume Sample

- Junior Analyst Resume Sample

- Personal Financial Advisor Resume Sample

What are some responsibilities of a Tax Professional?

- Advising clients on tax laws and regulations

- Preparing and filing tax returns

- Researching tax issues and providing solutions

- Assisting with tax planning and minimizing tax liabilities

- Representing clients during tax audits and disputes

- Keeping up-to-date with changes in tax laws and regulations

- Providing guidance on tax implications of financial decisions

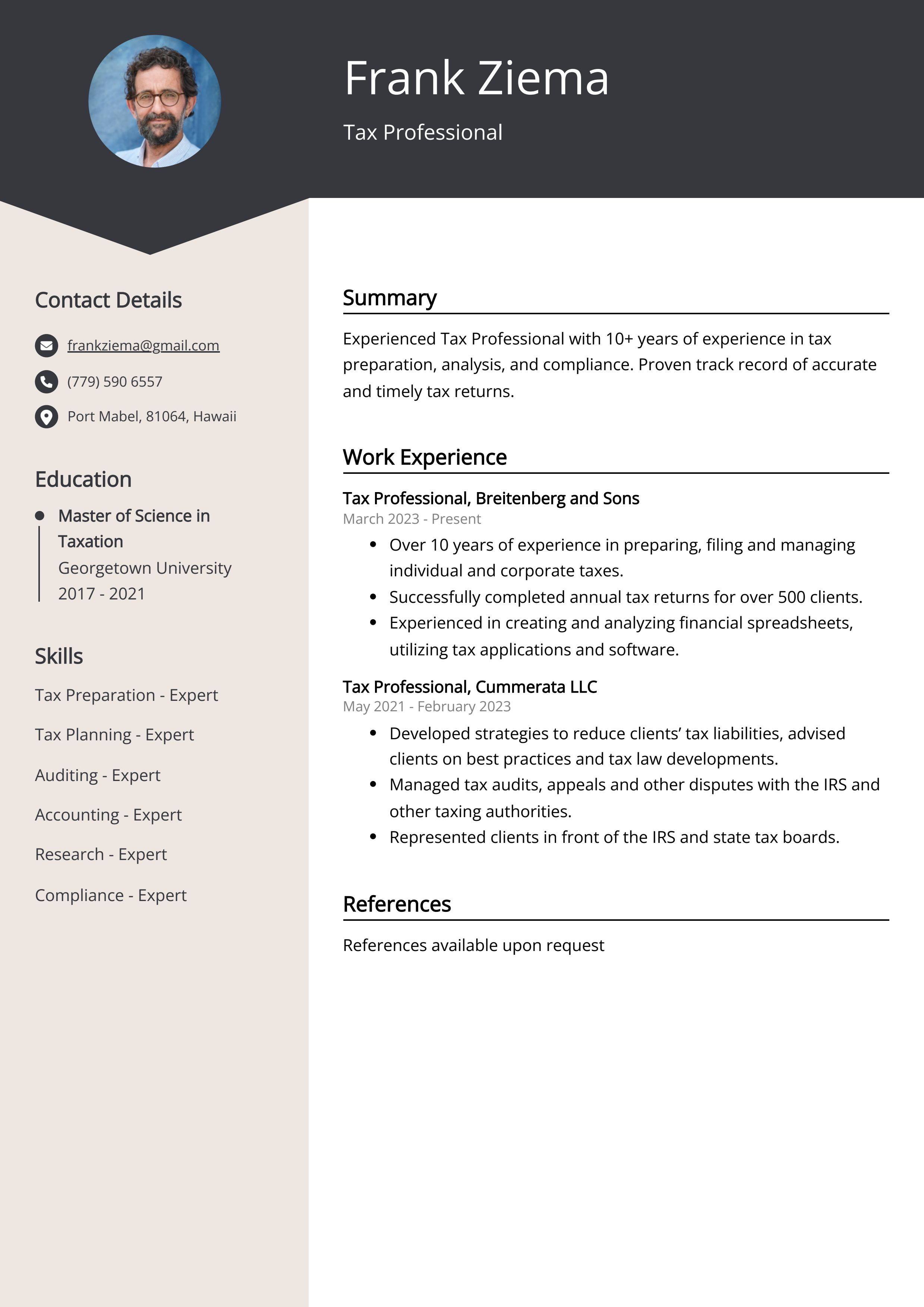

Sample Tax Professional Resume for Inspiration

John Smith

123 Main St, City, State, 12345

(123) 456-7890

johnsmith@email.com

Summary:

Experienced Tax Professional with 10 years of experience in providing tax consulting and preparation services for individuals and businesses. Proficient in tax laws and regulations, with a strong attention to detail and commitment to delivering high-quality service to clients.

Work Experience:

- Tax Consultant, XYZ Tax Services, City, State

- Prepared and reviewed tax returns for individual and corporate clients

- Provided tax planning and consulting services to clients to minimize tax liabilities

- Conducted tax research and analysis to ensure compliance with federal and state tax laws

Education:

- Bachelor of Science in Accounting, University of ABC, City, State

- Master of Business Administration, University of DEF, City, State

Skills:

- Proficient in tax laws and regulations

- Strong attention to detail

- Excellent communication and interpersonal skills

- Knowledge of accounting principles and practices

Certifications:

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

Languages:

- English (Native)

- Spanish (Proficient)

Resume tips for Tax Professional

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Tax Professional resume tips.

We collected the best tips from seasoned Tax Professional - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience and qualifications

- Showcase your knowledge of tax laws and regulations

- Include any certifications or licenses related to tax preparation

- Emphasize your ability to communicate complex tax matters to clients

- Showcase your attention to detail and ability to analyze financial documents

Tax Professional Resume Summary Examples

Using a tax professional resume summary or resume objective is important because it allows you to clearly and concisely communicate your skills, expertise, and career goals to potential employers. A strong summary or objective can help capture the attention of hiring managers and highlight why you are the best candidate for the job. It also provides a quick and easy way for employers to understand your qualifications and experience.

For Example:

- 5 years of experience as a Tax Professional

- Extensive knowledge of federal and state tax laws

- Proven track record of accurately preparing and filing individual and corporate taxes

- Strong communication and interpersonal skills

- Ability to effectively analyze financial data and provide strategic tax planning advice

Build a Strong Experience Section for Your Tax Professional Resume

Building a strong experience section for a tax professional resume is essential in showcasing your expertise and qualifications to potential employers. It allows you to highlight your relevant work experience, accomplishments, and responsibilities in the field of taxation, ensuring that you stand out as a strong candidate. A well-crafted experience section can demonstrate your ability to handle complex tax-related tasks and can ultimately increase your chances of securing a desirable position in the industry.

For Example:

- Performed tax consulting for small businesses and individuals, ensuring compliance with federal and state tax laws and regulations.

- Advised clients on tax planning strategies and helped them maximize their tax savings.

- Prepared and filed tax returns for clients, including income tax, sales tax, and payroll tax returns.

- Researched and analyzed tax laws and regulations to ensure accurate and timely compliance with changing laws.

- Assisted clients with IRS audits and inquiries, representing them and resolving any tax issues.

- Provided tax advice and support to clients on tax implications of business transactions, investments, and retirement planning.

- Collaborated with financial advisors and attorneys to develop comprehensive tax strategies for clients.

- Conducted tax workshops and training sessions for clients and colleagues to improve understanding of tax laws and regulations.

- Developed and maintained strong client relationships, resulting in repeat business and referrals.

- Supported and trained junior tax professionals, providing guidance and expertise in tax practices and procedures.

Tax Professional resume education example

A Tax Professional typically needs to have a bachelor's degree in accounting, finance, or a related field. Many employers also look for candidates with a master's degree in taxation or a related area. Additionally, obtaining a professional certification, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), is often required to practice as a Tax Professional. Continuing education is also important to stay up to date with changing tax laws and regulations.

Here is an example of an experience listing suitable for a Tax Professional resume:

- Bachelor of Science in Accounting - XYZ University (2012-2016)

- Certified Public Accountant (CPA) - State Board of Accountancy (2017)

- Master of Business Administration (MBA) - ABC University (2018-2020)

Tax Professional Skills for a Resume

It is important to add skills for a tax professional resume as it demonstrates the individual's capabilities and expertise in tax-related tasks. Including skills such as tax preparation, financial analysis, and knowledge of tax laws and regulations will showcase the candidate's proficiency in handling complex tax matters, which can be appealing to potential employers.

Soft Skills:

- Organization

- Communication

- Attention to detail

- Adaptability

- Problem-solving

- Time management

- Teamwork

- Customer service

- Analytical thinking

- Ethical judgement

```html

- Accounting Software Knowledge

- Tax Law Expertise

- Auditing Skills

- Financial Analysis Ability

- Record Keeping Proficiency

- Mathematical Competency

- Cost Estimation Accuracy

- Research and Analysis Capabilities

- Strategic Tax Planning

- IRS Regulations Knowledge

Common Mistakes to Avoid When Writing a Tax Professional Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Tax Professional resume

- Strong understanding of tax laws and regulations

- Experience preparing and filing individual and business tax returns

- Proficient in using tax preparation software

- Excellent analytical and problem-solving skills

- Ability to communicate complex tax information in a clear and concise manner

- Detail-oriented and highly organized

- Up-to-date on the latest changes in tax laws

- Exceptional client service and interpersonal skills

- Professional certification (such as CPA or Enrolled Agent) is a plus

- Education in accounting, finance, or a related field

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.