Looking to land a new job as a Collections Specialist? Our expertly-crafted resume example and writing tips will help you stand out to potential employers. As a Collections Specialist, it's crucial to showcase your skills in negotiating payment terms, analyzing financial records, and communicating effectively with clients. With our resume example, you can demonstrate your expertise in these areas and land the job you've been dreaming of.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Collections Specialist do?

- Review and analyze delinquent accounts

- Communicate with customers to negotiate payment plans

- Monitor accounts and identify issues that may cause non-payment

- Document all communication with customers

- Recommend accounts for legal action if necessary

- Accounting Technician Resume Sample

- Accounting Analyst Resume Sample

- Accounting Manager Resume Sample

- Collection Analyst Resume Sample

- Finance Manager Resume Sample

- Commission Analyst Resume Sample

- Financial Business Analyst Resume Sample

- Accounts Receivable Coordinator Resume Sample

- Finance Analyst Resume Sample

- Banking Assistant Resume Sample

- Regulatory Analyst Resume Sample

- Audit Director Resume Sample

- Mortgage Loan Processor Resume Sample

- Accounting Coordinator Resume Sample

- Associate Business Analyst Resume Sample

- Financial Risk Analyst Resume Sample

- Finance Specialist Resume Sample

- Financial Planner Resume Sample

- Report Writer Resume Sample

- Finance Director Resume Sample

What are some responsibilities of a Collections Specialist?

- Reviewing and managing overdue accounts

- Contacting customers to arrange payment

- Negotiating payment plans or settlements

- Documenting all communication and payment arrangements

- Researching and resolving billing discrepancies

- Providing customer service and support regarding outstanding balances

- Working with legal and collections departments to escalate overdue accounts

- Developing and implementing collection strategies

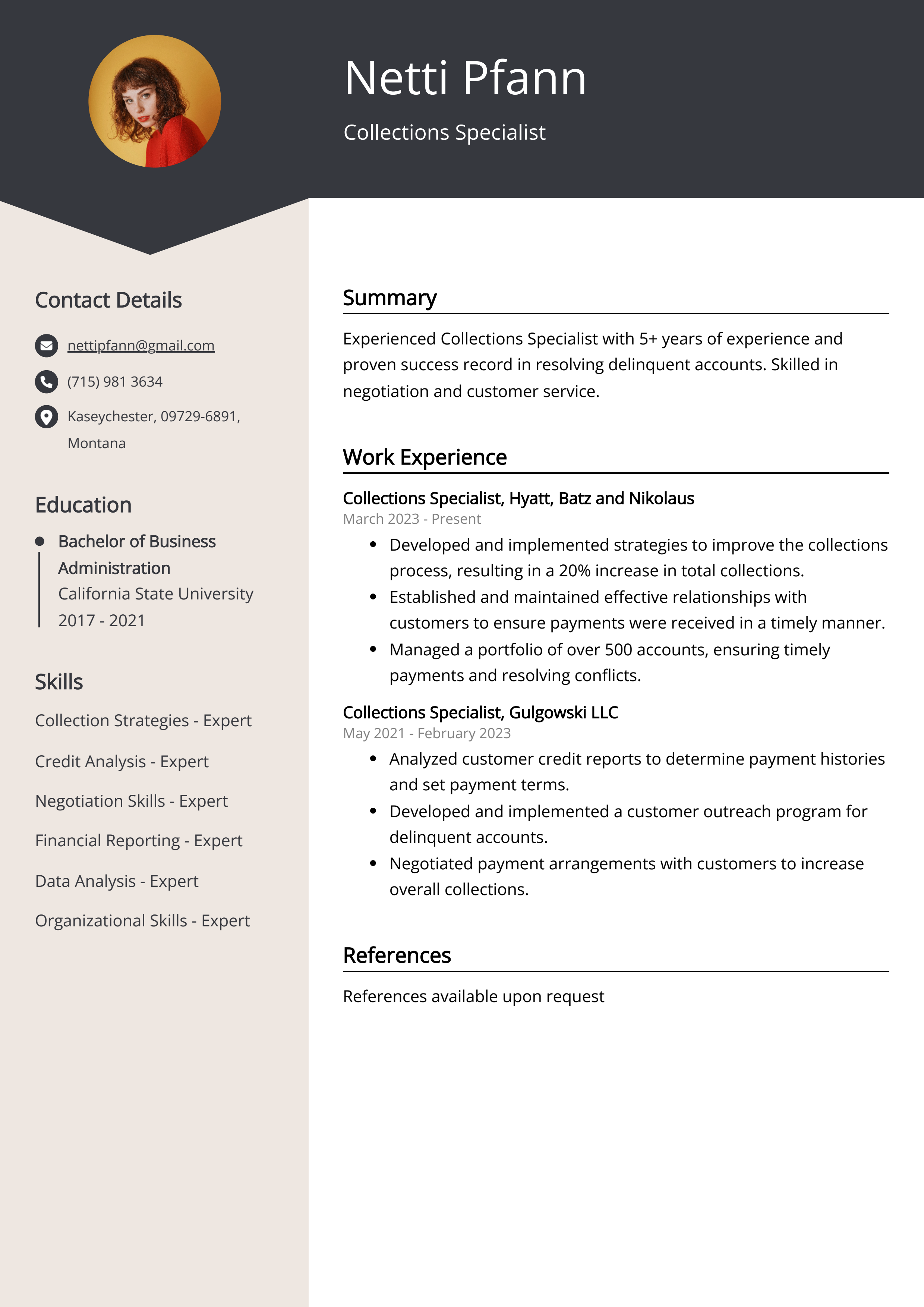

Sample Collections Specialist Resume for Inspiration

Personal Details:

Name: John Smith

Address: 123 Main Street, Anytown, USA

Phone: 555-123-4567

Email: john@email.com

Summary:

John is an experienced Collections Specialist with a proven track record of successfully recovering outstanding debts. He is skilled in negotiating payment arrangements, analyzing credit reports, and resolving customer disputes. John is detail-oriented and excels in meeting deadlines while maintaining professionalism and customer satisfaction.

Work Experience:

- Collections Specialist at ABC Financial Services (2017-present)

- Recovery Agent at XYZ Collections Agency (2014-2017)

- Credit Analyst at 123 Bank (2012-2014)

Education:

- Bachelor's Degree in Finance, University of Anytown (2012)

Skills:

- Strong negotiation skills

- Proficient in credit analysis

- Excellent communication and interpersonal skills

- Ability to multitask and prioritize workload

Certifications:

- Certified Credit and Collection Professional (CCCP)

- Fair Debt Collection Practices Act (FDCPA) Certification

Languages:

- English (fluent)

- Spanish (conversational)

Resume tips for Collections Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Collections Specialist resume tips.

We collected the best tips from seasoned Collections Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight experience in managing and maintaining accounts receivable

- Showcase strong negotiation and communication skills

- Quantify achievements in reducing outstanding debts and increasing collection rates

- Demonstrate proficiency in using collection software and financial databases

- Emphasize ability to analyze credit risk and make sound judgement calls on repayment options

Collections Specialist Resume Summary Examples

A Collections Specialist resume summary or objective can effectively highlight the candidate's experience and skills in the areas of collections, credit management, and customer service. It serves as a brief introduction to the candidate's qualifications, demonstrating their suitability for the position and grabbing the attention of the hiring manager. Whether it's a summary for an experienced professional or an objective for someone new to the field, it can provide a strong opening statement for the resume.

For Example:

- Experienced Collections Specialist with a proven track record of reducing delinquency rates and increasing cash flow

- Skilled in analyzing accounts, negotiating payment plans, and maintaining accurate records of collections activities

- Proficient in utilizing collection software and conducting skip tracing to locate hard-to-reach debtors

- Excellent communication and interpersonal skills to effectively interact with customers and resolve payment issues

- Adept at collaborating with internal teams to implement best practices for collections processes

Build a Strong Experience Section for Your Collections Specialist Resume

A strong experience section is crucial for a Collections Specialist resume because it showcases your expertise and proficiency in handling debt collection processes. It allows you to highlight your relevant work history, responsibilities, and accomplishments, which can demonstrate your ability to effectively manage and resolve collection issues. A robust experience section can make you stand out as a highly qualified candidate and increase your chances of securing job interviews.

For Example:

- Implemented collection strategies resulting in a 30% increase in on-time payments.

- Negotiated payment plans with delinquent customers, resulting in a 10% increase in overall collections.

- Developed relationships with key accounts to facilitate better communication and faster resolution of payment issues.

- Analyzed customer payment trends to identify at-risk accounts and prioritize collection efforts.

- Utilized various collection tools and software to track and manage overdue accounts.

- Prepared and presented reports on collection activities and outstanding balances to management on a regular basis.

- Resolved customer inquiries and disputes related to their accounts in a professional and timely manner.

- Collaborated with internal teams to streamline the collections process and improve overall efficiency.

- Assisted in the development of new collection policies and procedures to ensure compliance and maximize recovery.

- Trained and mentored new collections team members on best practices and company policies.

Collections Specialist resume education example

A Collections Specialist typically needs at least a high school diploma or equivalent. Some employers may prefer candidates with an associate's or bachelor's degree in finance, accounting, or a related field. In addition to formal education, on-the-job training or experience in collections, customer service, and financial analysis is also highly valued. Strong communication and negotiation skills are essential for success in this role.

Here is an example of an experience listing suitable for a Collections Specialist resume:

- Bachelor of Science in Finance, University of XYZ, 2010-2014

- Certification in Advanced Collections Techniques, Institute of ABC, 2015

- Continuing education in finance and debt collection

Collections Specialist Skills for a Resume

It is important to add skills for a Collections Specialist resume to demonstrate the ability to effectively communicate with clients, negotiate payment arrangements, and handle difficult situations with professionalism. Having a diverse set of skills also shows potential employers that the candidate is capable of efficiently managing accounts and resolving outstanding balances.

Soft Skills:

- Communication

- Negotiation

- Problem-solving

- Attention to detail

- Empathy

- Time management

- Adaptability

- Persuasion

- Resilience

- Customer service

- Negotiation skills

- Skip tracing

- Data analysis

- Financial reporting

- Risk assessment

- Compliance knowledge

- Proficiency in Excel

- Account reconciliation

- Legal process

- Software proficiency

Common Mistakes to Avoid When Writing a Collections Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Collections Specialist resume

- Proficiency in managing accounts receivable and collections processes

- Strong understanding of collection laws and regulations

- Proven track record of meeting and exceeding collection targets

- Excellent negotiation and communication skills

- Ability to analyze and interpret financial statements

- Experience with collection software and CRM systems

- Detail-oriented with strong organizational and time management skills

- Ability to work independently and as part of a team

- Strong problem-solving and decision-making abilities

- Ability to remain calm and professional in high-pressure situations

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.