Welcome to our Cash Teller Resume Example article! This article provides a comprehensive guide on how to prepare an effective and comprehensive cash teller resume. We will provide tips and advice on what should be included in a cash teller resume, as well as what should be excluded. We will also provide an example of a cash teller resume to help you get started. By the end of this article, you will have a better understanding of how to create a powerful and effective cash teller resume.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- What a resume template is, and why you should use it.

What does a Cash Teller do?

A cash teller is responsible for managing and processing customer transactions, including deposits, withdrawals, check cashing, and other financial services. They are also responsible for providing excellent customer service, resolving customer inquiries, and ensuring the accuracy and security of all transactions. Cash tellers may also be responsible for counting and balancing the cash drawer, verifying customer information, and answering questions related to banking services and products.

- Customer Service Agent Resume Sample

- Customer Service Analyst Resume Sample

- Customer Service Consultant Resume Sample

- Customer Service Coordinator Resume Sample

- Customer Service Director Resume Sample

- Customer Service Manager Resume Sample

- Customer Service Operator Resume Sample

- Customer Service Professional Resume Sample

- Customer Service Supervisor Resume Sample

- Customer Service Trainer Resume Sample

- Customer Support Analyst Resume Sample

- Customer Support Specialist Resume Sample

- Director Of Customer Service Resume Sample

- Gas Station Attendant Resume Sample

- Bank Teller Resume Sample

- Cash Teller Resume Sample

- Cashier Clerk Resume Sample

- Dog Groomer Resume Sample

- Dog Walker Resume Sample

- Dental Receptionist Resume Sample

What are some responsibilities of a Cash Teller?

- Provide customer service

- Process customer deposits and withdrawals

- Balance cash drawers

- Answer customer inquiries

- Verify customer identification

- Count and organize currency

- Reconcile transactions

- Sell money orders, traveler's cheques, and other financial services

- Maintain up-to-date knowledge of banking regulations

- Refer customers to other banking services

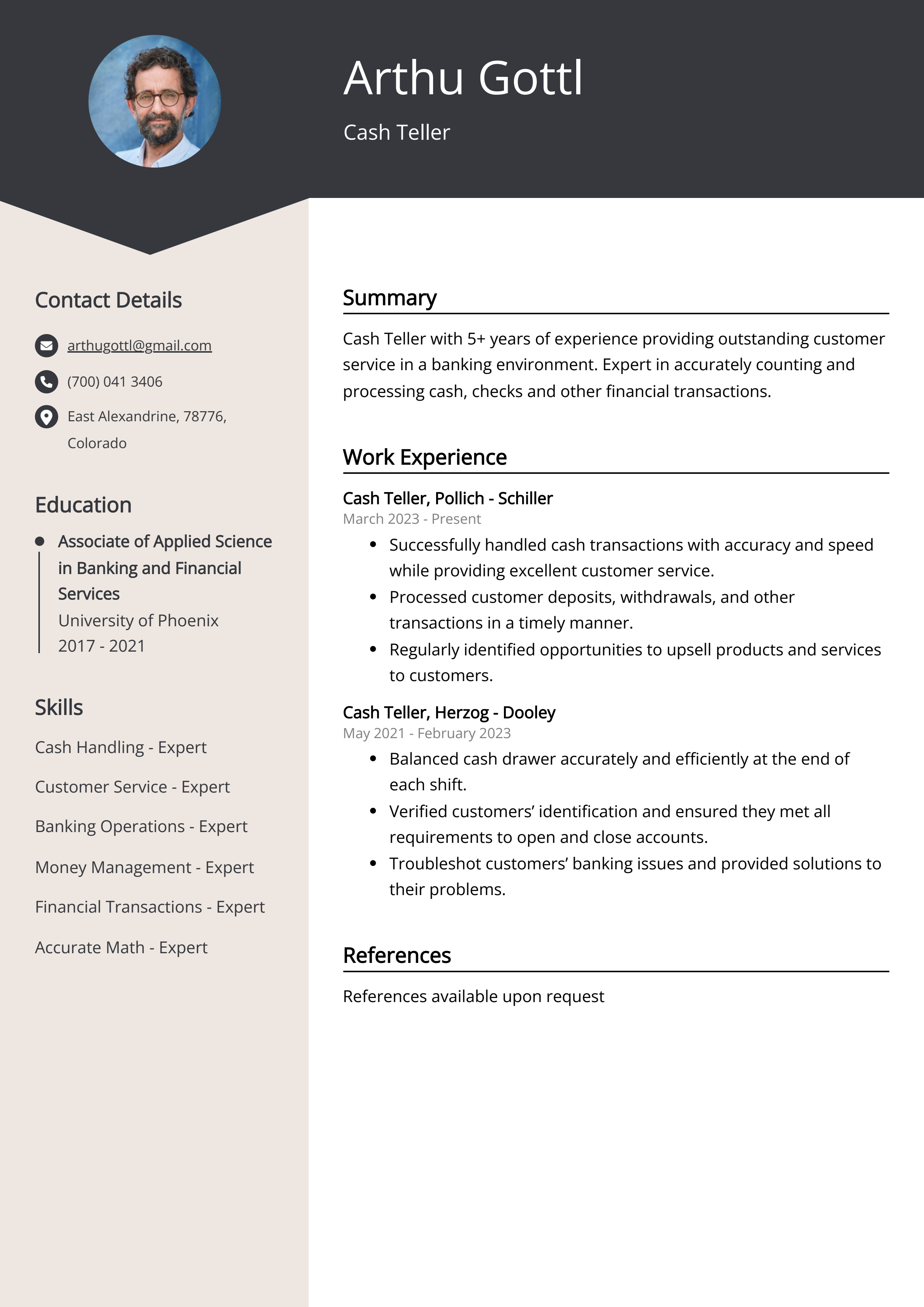

Sample Cash Teller Resume for Inspiration

Personal Details:

Name: John Doe

Address: 123 Fake Street, City, State, Zip

Phone: (123) 456-7890

Email: john@example.com

Summary:

John Doe is an experienced Cash Teller with a demonstrated history of working in the banking industry. He is skilled in cash handling, customer service, and banking operations. John is a highly organized and motivated professional with a commitment to customer satisfaction.

Work Experience:

- Cash Teller, Bank of America – City, State (May 2018 – Present)

- Perform daily customer service functions and respond to customer inquiries

- Process all types of customer transactions, including deposits, withdrawals, transfers, and loan payments

- Ensure accurate cash balancing and reconciliation

- Cashier, ABC Grocery Store – City, State (Jan 2016 – Apr 2018)

- Operated cash register, processed credit/debit cards, and issued change

- Assisted customers with product selection, pricing, and returns

- Balanced cash drawer and reconciled discrepancies

Education:

High School Diploma, City High School, City, State (May 2016)

Skills:

- Cash Handling

- Customer Service

- Banking Operations

- Data Entry

- Cash Balancing & Reconciliation

Certifications:

- CRC Certification, Bank of America (June 2018)

- Cashier Certification, ABC Grocery Store (April 2016)

Languages:

English (Native)

Resume tips for Cash Teller

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Cash Teller resume tips.

We collected the best tips from seasoned Cash Teller - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight relevant skills and experience related to cash handling

- Include customer service experience, such as working with a point-of-sale system

- List experience with auditing, reconciling and verifying cash transactions

- Mention any experience with shipments or inventory stocking

- Include knowledge of banking procedures and security policies

Cash Teller Resume Summary Examples

A cash teller resume summary or resume objective is an important part of a resume, as it provides employers with a short overview of the applicant’s experience and qualifications. It is essential to ensure that the summary or objective is tailored to the job for which the applicant is applying, to give the employer an understanding of how the applicant may benefit their business. It also helps to highlight the applicant's strengths and demonstrate their ability to handle the role.

For Example:

- Highly organized Cash Teller with 5+ years of experience. Skilled in providing excellent customer service and handling money efficiently.

- Experienced Cash Teller with 6+ years in the banking industry. Adept in accurately processing transactions, balancing cash drawers, and resolving customer inquiries.

- Motivated Cash Teller with 7+ years of experience. Knowledgeable in operating cash register, managing customer accounts and resolving customer complaints.

- Efficient Cash Teller with 8+ years of experience. Capable of accurately processing payments, resolving customer issues and balancing cash drawers.

- Reliable Cash Teller with 10+ years of experience. Skilled in processing payments, providing customer service and accurately balancing cash drawers.

Build a Strong Experience Section for Your Cash Teller Resume

Building a strong experience section on a cash teller resume is important for a few reasons. First, it demonstrates to potential employers that you have the necessary skills and experience for the job. Second, it provides employers with concrete examples of how you have used those skills to effectively manage cash transactions. Finally, it shows employers that you are organized and detail-oriented, as well as reliable and dependable. Having a strong experience section on your resume can help you stand out from the competition and increase your chances of getting hired.

For Example:

- Processed customer transactions, including deposits, withdrawals, check cashing, and loan payments.

- Verified customers’ identification and account information.

- Counted and balanced cash drawers at the start and end of shifts.

- Answered customers’ questions regarding account balances and bank policies.

- Promoted bank products and services, such as credit cards and savings accounts.

- Resolved customer complaints in a timely and professional manner.

- Recorded customer transactions accurately in the computer system.

- Adhered to all bank policies and procedures.

- Maintained a high degree of confidentiality with customer information.

- Provided excellent customer service in a fast-paced environment.

Cash Teller resume education example

Cash Tellers typically need a high school diploma or equivalent. Some employers may require additional education such as a certificate or degree in accounting, banking, or business. Cash Tellers should also have basic math skills, strong customer service skills, and the ability to pay attention to detail.

Here is an example of an experience listing suitable for a Cash Teller resume:

- University of California, Riverside - Bachelor of Science in Business Administration, June 2019

- Cash Teller Certification, ABC Institute, July 2019

- Financial Management Certificate, XYZ Institute, August 2019

Cash Teller Skills for a Resume

Adding skills to a Cash Teller Resume is important because it allows potential employers to quickly assess a candidate's qualifications for a position. Skills demonstrate a candidate's knowledge, expertise, and understanding of a job's requirements. Demonstrating skills in a resume also helps employers identify a candidate's potential for success and growth in their role. Examples of skills for a Cash Teller Resume could include: cash handling/balancing, customer service, mathematical proficiency, problem-solving, organizational skills, and computer literacy.

Soft Skills:

- Customer Service

- Cash Handling

- Problem Solving

- Interpersonal Skills

- Attention to Detail

- Time Management

- Organization

- Communication

- Multi-tasking

- Adaptability

- Cash Handling

- Financial Recordkeeping

- Customer Service

- Account Management

- IT Proficiency

- Mathematical Skills

- Data Entry

- Check Processing

- Regulatory Compliance

- Security Procedures

Common Mistakes to Avoid When Writing a Cash Teller Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Cash Teller resume

- Highlight cash-handling experience.

- Demonstrate your customer service skills.

- Include your relevant qualifications.

- Showcase your problem-solving skills.

- Mention your accuracy and speed.

- Describe your ability to work in a team.

- Discuss your knowledge of banking regulations.

- Highlight your ability to handle customer complaints.

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.