If you're an experienced trader looking to update your CV, you've come to the right place. In this article, we provide a comprehensive example of a trader CV to help you showcase your skills and expertise in the financial markets. Whether you're a stock trader, forex trader, or commodities trader, our example CV will guide you in crafting a winning resume that highlights your achievements and sets you apart from the competition.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Trader do?

A trader is an individual, financial institution, or brokerage firm that buys and sells financial instruments such as stocks, bonds, commodities, or currencies in a financial market. Their goal is to make a profit by taking advantage of short-term price movements in the market. Traders use various strategies, including technical and fundamental analysis, to make informed decisions about when to buy or sell assets. They may also engage in hedging and speculation to manage risk and maximize returns.

- Python Developer CV Sample

- Communications Specialist CV Sample

- Release Engineer CV Sample

- Business Relationship Manager CV Sample

- Digital Marketing Specialist CV Sample

- Key Account Manager CV Sample

- Market Manager CV Sample

- Leasing Associate CV Sample

- Remedy Developer CV Sample

- National Sales Manager CV Sample

- Email Marketing Specialist CV Sample

- Media Buyer CV Sample

- Ecommerce Manager CV Sample

- Communications Manager CV Sample

- Sales Engineer CV Sample

- Yacht Broker CV Sample

- Senior Sales Executive CV Sample

- Automotive Sales Manager CV Sample

- Insurance Sales Agent CV Sample

- Machine Learning Engineer CV Sample

What are some responsibilities of a Trader?

- Buying and selling financial products such as stocks, bonds, and commodities

- Analyzing market trends and making informed trading decisions

- Managing risk and ensuring compliance with regulations

- Building and maintaining relationships with clients and other traders

- Monitoring and executing trades on behalf of clients or a trading firm

- Keeping up-to-date with market developments and news

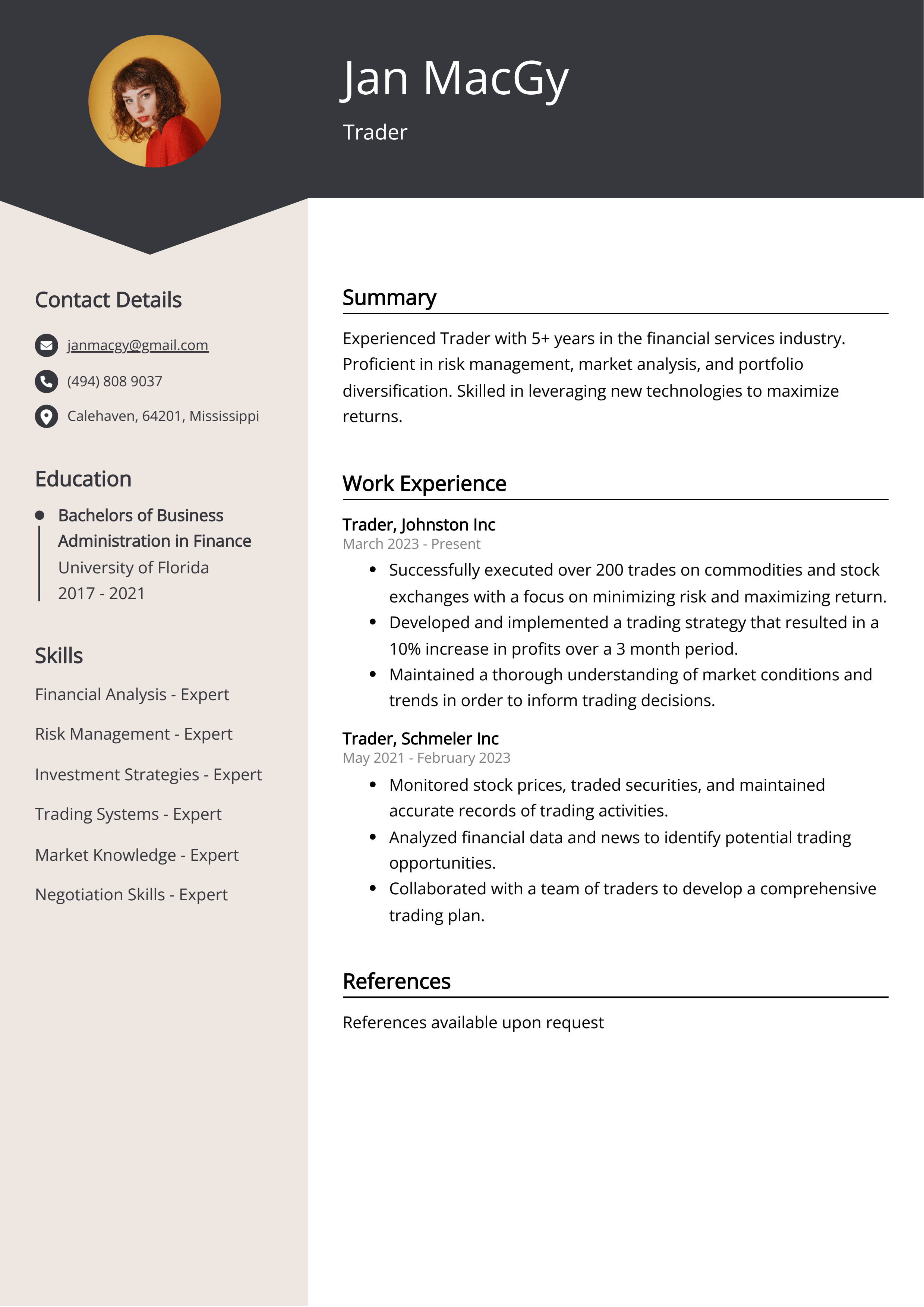

Sample Trader CV for Inspiration

Trader CV John Doe

123 Trader Lane, New York, NY | johndoe@email.com | 123-456-7890

Summary

John Doe is a highly motivated and results-driven Trader with over 5 years of experience in the financial markets. Known for his strong analytical skills and ability to make quick and effective decisions in high-pressure environments.

Work Experience-

Senior Trader

XYZ Investment Firm, New York, NY

January 2017 - Present

- Managed a portfolio of equities, options, and futures

- Executed trades and monitored market trends to maximize profits

- Collaborated with research analysts to develop trading strategies

-

Junior Trader

ABC Trading Company, Chicago, IL

June 2015 - December 2016

- Assisted senior traders in executing trades and analyzing market data

- Conducted research on potential investment opportunities

- Developed proficiency in various trading platforms and tools

-

Bachelor of Science in Finance

University of Illinois, Urbana-Champaign

Graduated May 2015

- Strong analytical and critical thinking skills

- Ability to make quick decisions in high-stress situations

- Excellent understanding of financial markets and trading strategies

- Proficiency in trading platforms such as Bloomberg Terminal and E*TRADE

- Series 7 and 63 licenses

- CFA (Chartered Financial Analyst) designation

- English - Native proficiency

- Spanish - Conversational proficiency

CV tips for Trader

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Trader CV pointers.

We've curated top-notch advice from experienced Trader individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your trading experience and expertise prominently at the beginning of your CV.

- Include specific examples of successful trades or investments you have made.

- Use numbers to quantify your achievements, such as the percentage increase in portfolio value or the ROI on certain trades.

- Demonstrate your knowledge of market trends and analysis techniques, including any specific strategies or tools you utilize.

- Showcase your ability to work under pressure and make quick, effective decisions in volatile trading environments.

Trader CV Summary Examples

Using a Trader CV summary or objective can help grab the attention of potential employers and highlight the candidate's key skills and experience. It provides a brief overview of the candidate's background, qualifications, and career goals, making it easier for employers to quickly assess whether the candidate is a good fit for the role. A well-written summary or objective can also demonstrate the candidate's enthusiasm and motivation for the position.

For Example:

- Experienced trader with a strong track record of consistent profits in various markets including equities, forex, and commodities.

- Proven ability to analyze market trends and make informed decisions to maximize returns.

- Strong risk management skills and the ability to thrive in high-pressure situations.

- Excellent communication and negotiation skills for building and maintaining client relationships.

- Adept at utilizing a variety of trading platforms and tools to execute successful trades.

Build a Strong Experience Section for Your Trader CV

A strong experience section is essential for a trader's CV as it showcases the candidate's relevant expertise, skills, and achievements in the financial markets. This section provides evidence of the trader's ability to make successful investment decisions, manage risk, and generate profits. Additionally, a robust experience section can help differentiate the candidate from other applicants and demonstrate their track record in navigating volatile market conditions. Overall, it can greatly enhance the trader's credibility and marketability to potential employers.

For Example:

- Managed a portfolio of stocks and commodities, executing trades based on market analysis and research.

- Developed and implemented trading strategies to maximize profits and minimize risk.

- Monitored market trends and news to identify potential trading opportunities.

- Worked closely with research teams to gather and analyze market data.

- Utilized technical analysis tools and software to make informed trading decisions.

- Collaborated with other traders and brokers to execute trades and manage risk.

- Maintained up-to-date knowledge of market regulations and compliance requirements.

- Provided regular reports and analysis to senior management and clients.

- Managed trading accounts and handled client communications regarding trades and transactions.

- Participated in industry conferences and training to stay updated on the latest market trends and techniques.

Trader CV education example

A trader typically needs a bachelor's degree in finance, economics, business, or a related field. Additional education in trading, such as specialized courses or certifications, can also be beneficial. Strong mathematical and analytical skills are important, as well as a deep understanding of financial markets and trading strategies. Many traders continue their education with advanced degrees or professional certifications to stay current in the fast-paced world of trading.

Here is an example of an experience listing suitable for a Trader CV:

- Bachelor of Business Administration in Finance - University of Toronto

- Certified Financial Analyst (CFA) - CFA Institute

- Series 7 and Series 63 Securities Licenses - Financial Industry Regulatory Authority (FINRA)

Trader Skills for a CV

Adding skills to a Trader CV is important because it demonstrates the candidate's ability to actively manage portfolio and execute trades effectively. This can include proficiency in technical analysis, fundamental analysis, risk management, and financial modeling. Skills also showcase the trader's ability to adapt to changing market conditions and to use different trading platforms and software. Overall, these skills help the employer to understand the candidate's suitability for the trading role.

Soft Skills:

- Decision making

- Adaptability

- Problem solving

- Time management

- Communication

- Teamwork

- Critical thinking

- Emotional intelligence

- Stress management

- Leadership

```html

- Financial analysis

- Data analysis

- Risk management

- Quantitative research

- Programming (Python, R, etc.)

- Econometric modeling

- Algorithmic trading

- Options pricing

- Market analysis

- Technical analysis

Common Mistakes to Avoid When Writing a Trader CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Trader CV

- Highlight relevant trading experience

- Showcase successful trades and investment strategies

- Demonstrate strong analytical and research skills

- Emphasize ability to work under pressure and make quick decisions

- Include any relevant certifications or licenses

- Show quantifiable results and achievements in previous roles

- Provide evidence of risk management and compliance experience