Are you looking for a proficient Loss Mitigation Specialist resume example to help you stand out in the job market? Look no further! Our article provides a comprehensive guide and a sample resume to assist you in crafting a winning application. A Loss Mitigation Specialist plays a crucial role in helping individuals and businesses navigate through financial hardships, and our resume example can help showcase your skills and experience effectively.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Loss Mitigation Specialist do?

- Review and analyze delinquent accounts

- Negotiate with borrowers to find alternatives to foreclosure

- Work with lenders to develop and implement cost-effective solutions for delinquent loans

- Develop and maintain relationships with borrowers and lenders

- Assist in the drafting and submission of loan modification requests

- Drug And Alcohol Counselor Resume Sample

- Associate Veterinarian Resume Sample

- Housing Coordinator Resume Sample

- Clinical Nurse Educator Resume Sample

- Direct Care Worker Resume Sample

- Vascular Technologist Resume Sample

- Medical Billing Clerk Resume Sample

- Mental Health Specialist Resume Sample

- Sleep Technician Resume Sample

- Life Insurance Agent Resume Sample

- Home Health Nurse Resume Sample

- Speech Language Pathologist Resume Sample

- Pharmacy Technician Trainee Resume Sample

- Nursing Supervisor Resume Sample

- Quality Improvement Specialist Resume Sample

- Experienced Physical Therapist Resume Sample

- Assistant Spa Manager Resume Sample

- Mri Technician Resume Sample

- Experienced Occupational Therapist Resume Sample

- X Ray Technician Resume Sample

What are some responsibilities of a Loss Mitigation Specialist?

- Reviewing and analyzing financial documents

- Negotiating with clients to find alternatives to foreclosure

- Assessing the financial situation of borrowers

- Guiding borrowers through the loan modification process

- Collaborating with lenders and other professionals to explore workout options

- Educating clients on available alternatives and programs

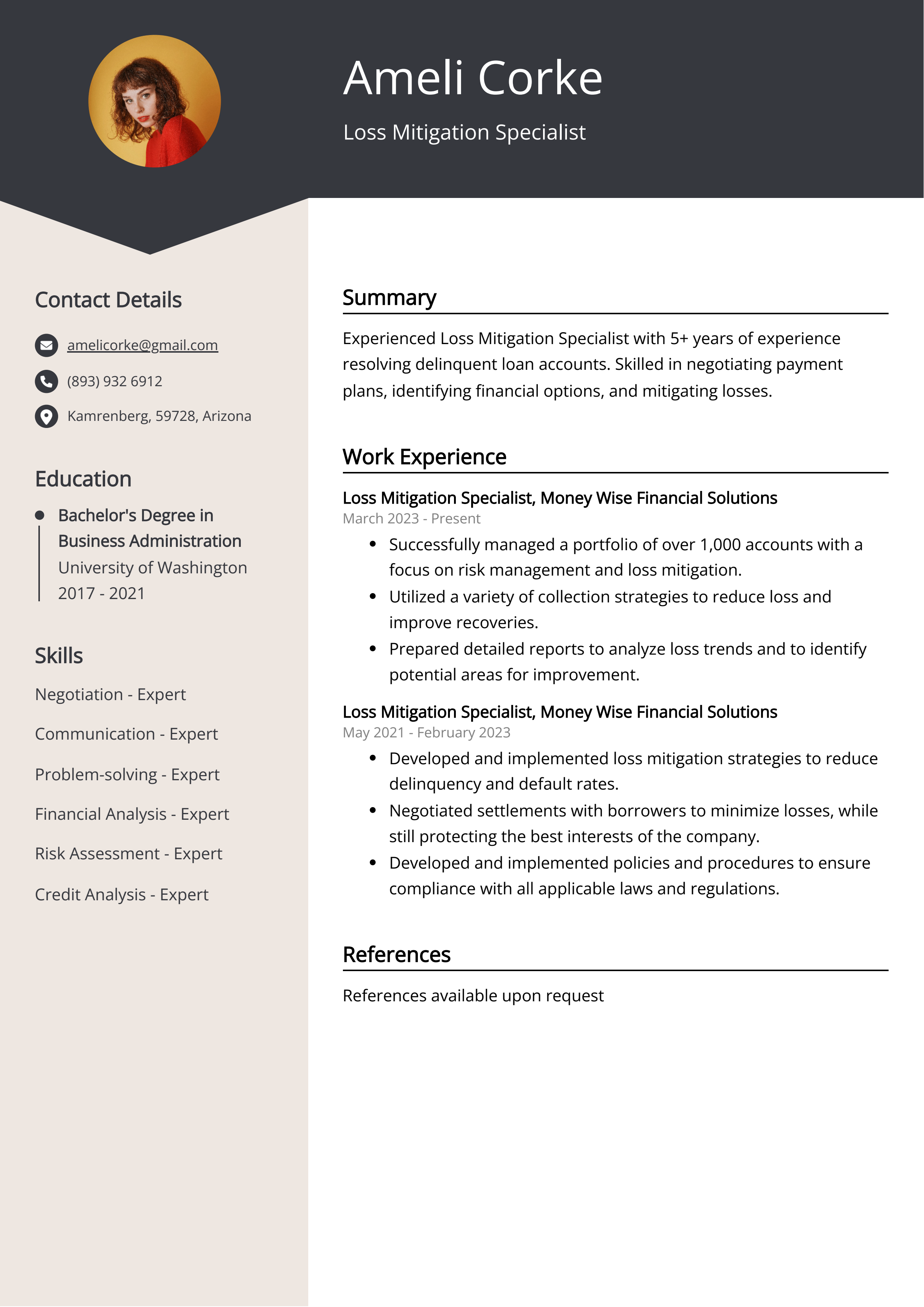

Sample Loss Mitigation Specialist Resume for Inspiration

Personal Details

- Name: John Smith

- Email: johnsmith@email.com

- Phone: 123-456-7890

- Address: 123 Main St, Anytown, USA

Summary

John Smith is a dedicated and results-driven Loss Mitigation Specialist with 5+ years of experience in the banking industry. He has a proven track record of successfully negotiating loan workouts and implementing loss mitigation strategies to prevent foreclosure. John excels in analyzing financial documents and developing customized solutions to help borrowers overcome financial hardships.

Work Experience

- Loss Mitigation Specialist, XYZ Bank, Anytown, USA (2016- Present)

- Negotiated loan modifications, short sales, deeds in lieu, and repayment plans to prevent foreclosure.

- Analyzed financial documents and conducted in-depth financial interviews with borrowers to assess their eligibility for loss mitigation options.

- Collaborated with internal and external stakeholders, including underwriters, attorneys, and real estate agents, to facilitate successful loan workouts.

- Managed a portfolio of delinquent loans and consistently met or exceeded targets for preventing foreclosure.

- Loan Officer, ABC Mortgage, Anytown, USA (2014-2016)

- Assisted clients in obtaining mortgage loans by evaluating their financial situations and recommending suitable loan products.

- Conducted thorough credit and income assessments to determine loan eligibility and affordability for potential borrowers.

- Provided exceptional customer service and maintained strong relationships with clients throughout the loan application process.

Education

- Bachelor of Science in Finance, University of Anytown, USA (2014)

Skills

- Strong negotiation and communication skills

- Proficient in financial analysis and loan workout strategies

- Knowledge of mortgage lending regulations and compliance guidelines

- Ability to multitask and prioritize in a fast-paced environment

Certifications

- Certified Mortgage Banker (CMB)

Languages

- English (Fluent)

Resume tips for Loss Mitigation Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Loss Mitigation Specialist resume tips.

We collected the best tips from seasoned Loss Mitigation Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in loss mitigation and foreclosure prevention

- Showcase your skills in negotiating with borrowers and lenders

- Include any relevant certifications or training in loss mitigation strategies

- Emphasize your ability to analyze financial documents and create repayment plans

- Demonstrate your track record of successfully resolving delinquent mortgage accounts

Loss Mitigation Specialist Resume Summary Examples

Using a resume summary or objective on a Loss Mitigation Specialist resume is essential to grab the attention of potential employers. It provides a brief overview of your qualifications, skills, and career goals, helping recruiters quickly understand what you can offer. Whether you are an experienced professional or entry-level candidate, a well-crafted summary or objective can help you stand out from the competition and increase your chances of landing your desired job.

For Example:

- Experienced loss mitigation specialist with a proven track record of negotiating and executing successful loan modifications

- Skilled in analyzing financial documents and determining the best course of action for borrowers facing foreclosure

- Proficient in guiding clients through the loss mitigation process and providing them with personalized solutions

- Strong knowledge of government programs and regulations surrounding loss mitigation and foreclosure prevention

- Adept at building and maintaining relationships with clients, attorneys, and loan servicers to achieve positive outcomes

Build a Strong Experience Section for Your Loss Mitigation Specialist Resume

Building a strong experience section for a Loss Mitigation Specialist resume is essential because it showcases the candidate's expertise in negotiating loan modifications and mitigating financial loss for the company. It helps to demonstrate the candidate's skills in analyzing financial documents, working with borrowers, and collaborating with various stakeholders. A strong experience section can differentiate the candidate from others and increase their chances of securing a job in the competitive field of loss mitigation.

For Example:

Loss Mitigation Specialist resume education example

A Loss Mitigation Specialist typically needs a minimum of a high school diploma or GED. Some employers may prefer candidates with an associate's or bachelor's degree in finance, economics, business administration, or a related field. In addition, relevant work experience in banking, finance, or real estate may also be required. Specialized training or certification in loss mitigation or loan modification may also be beneficial.

Here is an example of an experience listing suitable for a Loss Mitigation Specialist resume:

- Bachelor's Degree in Business Administration - University of Washington

- Certification in Mortgage Specialist - American Institute of Banking

- Advanced Certificate in Financial Planning - New York University

Loss Mitigation Specialist Skills for a Resume

It is important to add skills for a Loss Mitigation Specialist resume because these skills demonstrate the candidate's ability to effectively manage and minimize losses for a company. Additionally, showcasing specific skills related to mortgage servicing, loan modification, negotiation, and communication can set the candidate apart from others and prove their proficiency in the role.

Soft Skills:

- Communication skills

- Negotiation skills

- Empathy

- Problem-solving abilities

- Decision-making skills

- Time management

- Customer service

- Adaptability

- Attention to detail

- Resilience

- Financial Analysis

- Loan Modification

- Foreclosure Prevention

- Risk Management

- Credit Counseling

- Default Recovery

- Bankruptcy Process

- Legal Compliance

- Mortgage Servicing

- Debt Restructuring

Common Mistakes to Avoid When Writing a Loss Mitigation Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Loss Mitigation Specialist resume

- Strong knowledge of loss mitigation processes and procedures

- Experience in negotiating with clients to find suitable solutions for loan repayment

- Ability to analyze financial documentation to determine an appropriate course of action

- Proficient in using loss mitigation software and tools

- Excellent communication and interpersonal skills

- Proven track record of successful loss mitigation outcomes

- Familiarity with industry regulations and compliance standards

- Detail-oriented and able to manage multiple cases simultaneously

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.