As a Teller Supervisor, you play a crucial role in managing the day-to-day operations of a bank or financial institution. Your leadership and organizational skills are essential for ensuring that tellers provide exemplary customer service and accurate transaction processing. In our Teller Supervisor resume example, we showcase the qualifications, experience, and accomplishments needed to excel in this pivotal role. Whether you are seeking a new Teller Supervisor position or looking to advance your career, our resume example can help guide you in creating a standout application.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Teller Supervisor do?

- Supervise tellers and ensure efficient day-to-day operations of the teller line

- Provide training and guidance to tellers on customer service and banking procedures

- Monitor and maintain cash levels in the branch

- Address customer inquiries and resolve escalated issues

- Assist with scheduling and performance evaluations of teller staff

- Ensure compliance with bank policies and procedures

- Handle end-of-day balancing and reporting

- Assist in implementing and enforcing security measures

- May also perform teller duties as needed

- Valet Resume Sample

- Customer Service Consultant Resume Sample

- Overnight Stocker Resume Sample

- Retail Store Manager Resume Sample

- Manicurist Resume Sample

- Customer Service Agent Resume Sample

- Customer Service Operator Resume Sample

- Florist Resume Sample

- Retail Sales Resume Sample

- Reset Merchandiser Resume Sample

- Customer Support Specialist Resume Sample

- Laundry Attendant Resume Sample

- Nail Technician Resume Sample

- Retail Cashier Resume Sample

- Front Desk Receptionist Resume Sample

- Customer Service Director Resume Sample

- Guest Service Agent Resume Sample

- Liquor Store Manager Resume Sample

- Store Clerk Resume Sample

- Service Representative Resume Sample

What are some responsibilities of a Teller Supervisor?

- Overseeing and managing a team of tellers

- Ensuring accuracy and reliability of all financial transactions

- Providing training, guidance, and support to tellers

- Handling customer inquiries and resolving issues

- Maintaining and balancing cash drawers and ATMs

- Adhering to all banking regulations and procedures

- Performing performance evaluations and providing feedback to tellers

- Implementing security measures to prevent fraudulent activities

- Collaborating with other departments to optimize operational processes

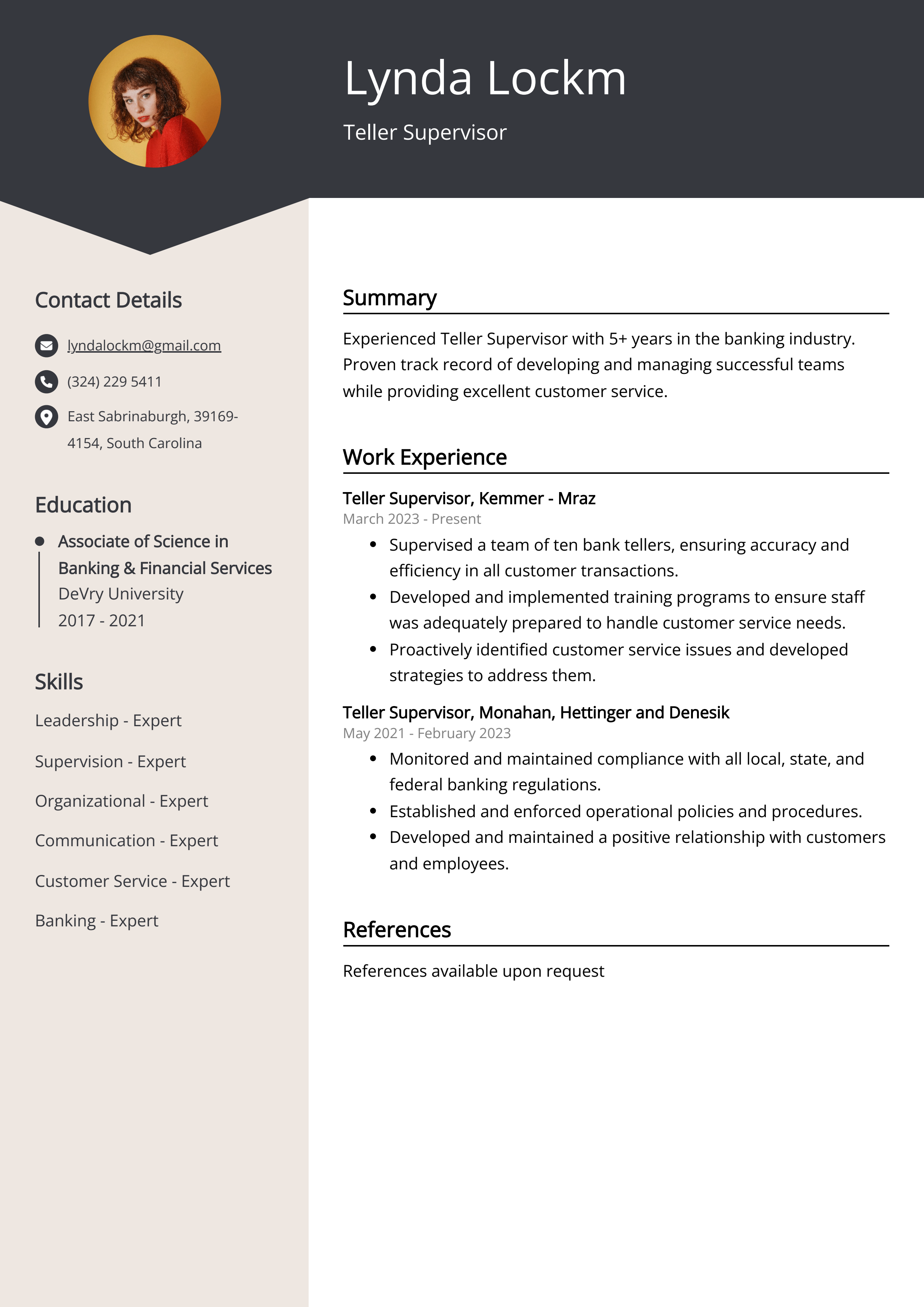

Sample Teller Supervisor Resume for Inspiration

Personal Details:

- Name: John Doe

- Email: johndoe@email.com

- Phone: (123) 456-7890

- Address: 123 Main Street, Anytown, USA

Summary:

John Doe is an experienced and dedicated Teller Supervisor with a proven track record of leading and motivating teams to exceed customer service and sales goals. He is detail-oriented and has a strong ability to multitask while maintaining a high level of accuracy and efficiency in a fast-paced banking environment.

Work Experience:

Teller Supervisor

ABC Bank, Anytown, USA

January 2016 - Present

- Lead and supervise a team of tellers to ensure efficient and accurate transaction processing

- Handle customer inquiries and resolve issues in a professional and timely manner

- Perform cash audits and train new tellers on bank policies and procedures

- Assist with opening and closing procedures and ensure compliance with regulatory requirements

Education:

Bachelor of Science in Finance

XYZ University, Anytown, USA

Graduated: May 2015

Skills:

- Leadership and team management

- Customer service and sales experience

- Proficient in Microsoft Office and banking software

- Strong attention to detail and time management

Certifications:

- Certified Teller Manager (CTM)

- Anti-Money Laundering (AML) certification

Languages:

- English (Fluent)

- Spanish (Conversational)

Resume tips for Teller Supervisor

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Teller Supervisor resume tips.

We collected the best tips from seasoned Teller Supervisor - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your leadership experience in bank teller operations.

- Showcase your ability to manage and motivate teller staff.

- Demonstrate your proficiency in cash handling and balancing responsibilities.

- Include any training or certifications related to teller supervision or management.

- Show your success in improving efficiency or customer service in previous roles.

Teller Supervisor Resume Summary Examples

Teller supervisor resume summary or resume objective is a great way to succinctly highlight your skills and experience to potential employers. It provides a quick overview of your professional background and career goals, making it easier for hiring managers to assess your qualifications and suitability for the role. Additionally, including a well-written summary or objective can help you stand out from other candidates and increase your chances of landing an interview.

For Example:

- Overseen and managed teller staff to maintain a smooth and efficient operation.

- Trained and supervised tellers on customer service, and cash handling procedures.

- Handled escalated customer inquiries and resolved issues in a professional manner.

- Ensured compliance with banking regulations and internal policies.

- Managed scheduling, performance evaluations, and daily operations of the teller team.

Build a Strong Experience Section for Your Teller Supervisor Resume

Having a strong experience section on a teller supervisor resume is crucial because it demonstrates your expertise and capability in managing a team of tellers, handling customer transactions, and ensuring the smooth operation of the bank's teller services. This section allows you to highlight your leadership skills, problem-solving abilities, and familiarity with banking regulations and procedures, all of which are essential for success in the role of a teller supervisor.

For Example:

- Oversaw and managed a team of tellers, ensuring efficient and accurate customer service.

- Developed and implemented training programs for new tellers to ensure compliance with company policies and procedures.

- Managed cash levels and performed audits to maintain proper funds for daily bank transactions.

- Handled customer inquiries and resolved account issues in a professional and timely manner.

- Assisted tellers with complex transactions and ensured compliance with banking regulations.

- Generated reports and analyzed data to identify areas for improvement and implement operational changes.

- Participated in the hiring and onboarding process for new tellers, conducting interviews and training sessions.

- Ensured tellers followed security protocols and maintained a safe work environment for staff and customers.

- Collaborated with other department managers to improve cross-departmental communication and teamwork.

- Assisted with branch operations and provided support to the branch manager as needed.

Teller Supervisor resume education example

A Teller Supervisor typically needs a high school diploma or GED as a minimum education requirement. However, many employers prefer candidates with an associate's or bachelor's degree in a relevant field such as business, finance, or accounting. Additionally, experience working as a teller and knowledge of banking regulations and procedures are valuable qualifications for this position. Strong leadership and communication skills are also important for success as a Teller Supervisor.

Here is an example of an experience listing suitable for a Teller Supervisor resume:

- Bachelor's degree in Finance or relevant field from an accredited institution

- Completed courses or certifications in banking, financial management, or customer service

- Any additional relevant training or workshops related to financial transactions, compliance, or leadership

Teller Supervisor Skills for a Resume

Adding skills to a Teller Supervisor resume is important because it showcases the specific abilities and knowledge that make a candidate qualified for the role. These skills demonstrate the candidate's ability to effectively manage and lead a team of tellers, handle financial transactions, understand banking regulations, and provide excellent customer service. Highlighting relevant skills can make a candidate more competitive in the job market and increase their chances of being hired for the position.

Soft Skills:

- Leadership

- Problem-solving

- Communication

- Customer service

- Teamwork

- Time management

- Adaptability

- Conflict resolution

- Mentoring

- Dependability

- Cash Handling

- Customer Service

- Team Leadership

- Risk Management

- Banking Operations

- Regulatory Compliance

- Financial Reporting

- Sales Support

- Fraud Prevention

- Audit Coordination

Common Mistakes to Avoid When Writing a Teller Supervisor Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Teller Supervisor resume

- Excellent leadership and team management skills

- Ability to train, mentor, and oversee teller staff

- Strong knowledge of banking processes and procedures

- Exceptional customer service and communication skills

- Proficient in cash handling and transaction processing

- Ability to identify and resolve customer concerns and issues

- Experience in enforcing security measures and protocols

- Proven track record of meeting and exceeding sales targets

- Efficient in handling and maintaining operational reports

- Detail-oriented and organized with excellent multitasking abilities

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.