Are you a Loan Document Specialist looking to polish up your resume? Look no further! In this article, we provide a sample resume for a Loan Document Specialist that you can use as a guide to showcase your skills and experience in the best possible light. Whether you're a seasoned professional or just starting out in the field, our example resume will help you stand out to potential employers.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Loan Document Specialist do?

- Review and analyze loan documents for accuracy and completeness

- Ensure all necessary documentation is properly prepared and submitted

- Verify the authenticity and integrity of loan documents

- Coordinate with loan officers, underwriters, and other stakeholders to resolve any discrepancies

- Maintain detailed records and documentation of loan files

- Adhere to regulatory and compliance guidelines

- Provide support and assistance to loan processing and closing teams

- Administrative Professional Resume Sample

- Administrative Specialist Resume Sample

- Office Manager Resume Sample

- Administrative Services Manager Resume Sample

- Program Administrator Resume Sample

- Support Coordinator Resume Sample

- Office Secretary Resume Sample

- Portfolio Administrator Resume Sample

- Operations Coordinator Resume Sample

- Office Coordinator Resume Sample

- Assistant Office Manager Resume Sample

- Word Processor Resume Sample

- Office Administrative Assistant Resume Sample

- Ward Clerk Resume Sample

- Customer Service Clerk Resume Sample

- Meeting Coordinator Resume Sample

- Purchasing Buyer Resume Sample

- Billing Coordinator Resume Sample

- Branch Office Administrator Resume Sample

- Billing Clerk Resume Sample

What are some responsibilities of a Loan Document Specialist?

- Reviewing and verifying loan documents for accuracy and completeness

- Ensuring compliance with banking regulations and guidelines

- Preparing and organizing loan documentation

- Communicating with borrowers and lenders to obtain necessary information

- Maintaining accurate and up-to-date records of loan documents

- Coordinating with other departments to facilitate the loan process

- Assisting in resolving any discrepancies or issues with loan documents

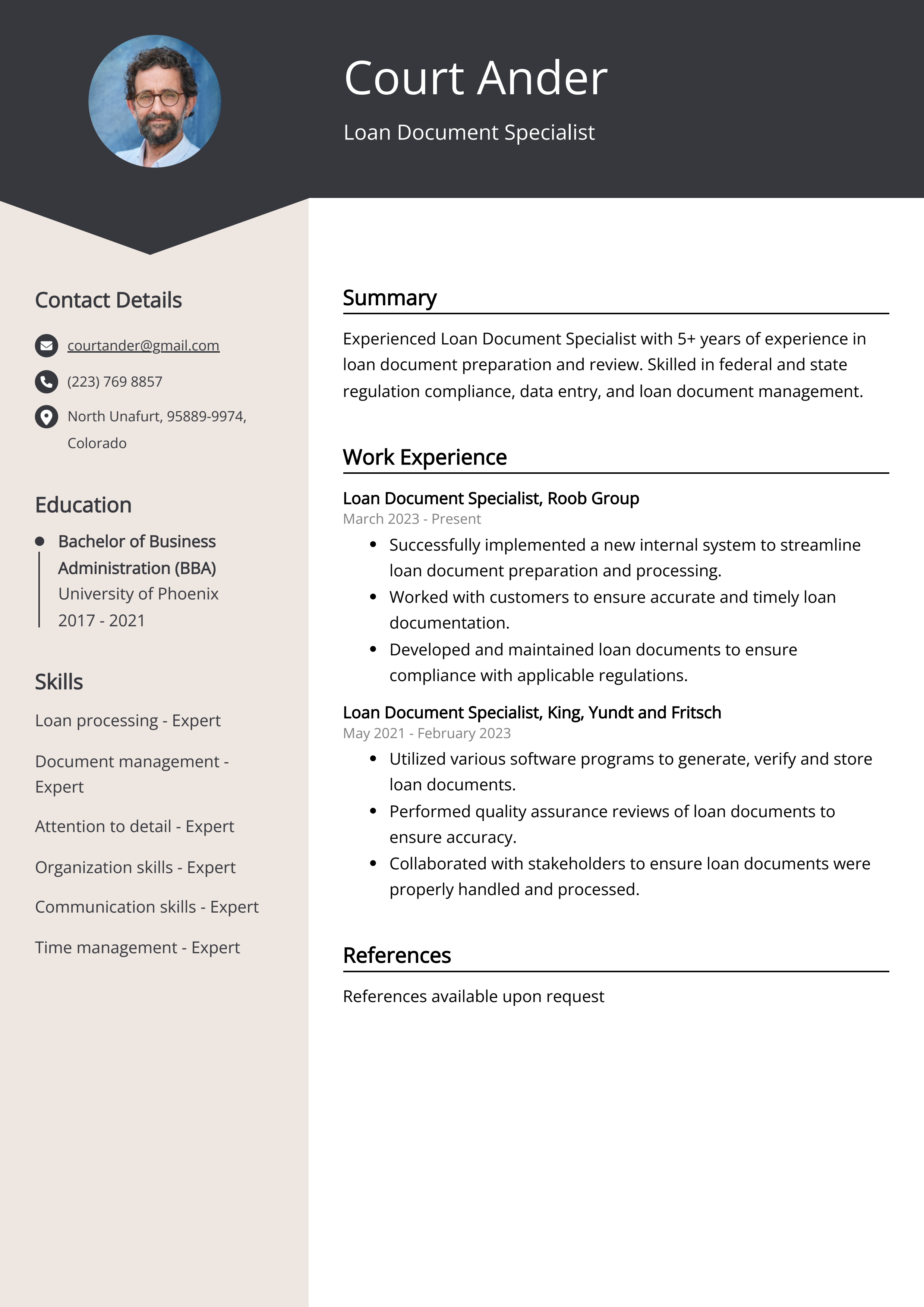

Sample Loan Document Specialist Resume for Inspiration

Personal Details

- Name: John Doe

- Address: 123 Main Street, Anytown, USA

- Email: johndoe@email.com

- Phone: (123) 456-7890

Summary

John Doe is a detail-oriented Loan Document Specialist with 5 years of experience in the financial industry. He possesses strong analytical and communication skills, and is proficient in managing loan documentation processes from application to closing.

Work Experience

- Loan Document Specialist, ABC Bank (2017-present)

- Review and process loan applications, ensuring accuracy and compliance with regulatory requirements

- Prepare and organize loan documents for underwriting and approval

- Communicate with clients to gather necessary information and resolve documentation discrepancies

- Collaborate with loan officers and underwriters to expedite the loan approval process

- Loan Processor, XYZ Credit Union (2015-2017)

- Handled document verification, data entry, and loan file maintenance

- Coordinated with borrowers, title companies, and other relevant parties to ensure timely and accurate closing of loans

- Assisted in the preparation of loan packages for submission to underwriting and closing departments

Education

- Bachelor of Science in Finance, University of ABC (2011-2015)

Skills

- Proficient in loan processing software such as Encompass and Calyx Point

- Familiar with regulatory requirements and guidelines for loan documentation

- Strong attention to detail and organizational abilities

- Excellent verbal and written communication skills

Certifications

- Certified Loan Documentation Specialist (CLDS)

Languages

- English (native proficiency)

- Spanish (intermediate proficiency)

Resume tips for Loan Document Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Loan Document Specialist resume tips.

We collected the best tips from seasoned Loan Document Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight relevant experience with loan document preparation and processing

- Showcase strong attention to detail and organizational skills

- Demonstrate proficiency with loan software and document management systems

- Emphasize ability to meet tight deadlines and work well under pressure

- Include any certifications or training related to loan documentation and processing

Loan Document Specialist Resume Summary Examples

A Loan Document Specialist Resume Summary or Objective can help to highlight your relevant skills, experience, and career goals to potential employers. It can offer a quick overview of your qualifications and what you can bring to the role, helping to make a strong first impression. Whether you are an experienced professional or just starting out in the field, a well-crafted summary or objective can showcase your value and suitability for the position.

For Example:

- Strong background in reviewing and verifying loan documents

- Proficient in data entry and document management systems

- Skilled in identifying discrepancies and resolving issues

- Detail-oriented and able to work efficiently in a fast-paced environment

- Excellent communication and organizational skills

Build a Strong Experience Section for Your Loan Document Specialist Resume

Building a strong experience section for a Loan Document Specialist resume is crucial in showcasing relevant skills and expertise in processing loan documents, analyzing financial information, and ensuring compliance with regulations. A robust experience section can impress recruiters by demonstrating proficiency in managing loan portfolios, E-sign documents, and maintaining accurate records. It also highlights a candidate's ability to effectively communicate with clients and financial institutions, ultimately increasing the chances of being considered for the desired position.

For Example:

- Processed and reviewed loan documents for accuracy and completeness

- Verified borrower information and employment history

- Managed a high volume of loan documents while maintaining accuracy and attention to detail

- Collaborated with underwriters to ensure loan files met all necessary requirements

- Communicated with borrowers, lenders, and other parties to resolve any discrepancies in loan documents

- Organized and maintained electronic and physical loan files

- Assisted with loan funding and closing processes

- Provided support to loan officers and processors as needed

- Stayed informed of industry regulations and updates related to loan documentation

- Participated in training and professional development opportunities to enhance skills and knowledge

Loan Document Specialist resume education example

A Loan Document Specialist typically needs at least a high school diploma or equivalent. Many employers prefer candidates with a bachelor's degree in business, finance, or a related field. Additionally, specialized training or certification in loan processing or mortgage documentation may be required. Strong knowledge of financial regulations, loan processing procedures, and attention to detail are essential skills for this role.

Here is an example of an experience listing suitable for a Loan Document Specialist resume:

- Bachelor of Science in Finance from XYZ University - 2012

- Certification in Loan Processing from ABC Institute - 2013

- Completed training in Document Management Systems - 2014

Loan Document Specialist Skills for a Resume

Adding skills to a Loan Document Specialist Resume is important because it demonstrates to potential employers that the candidate has the necessary abilities to perform the job effectively. Including skills related to document management, attention to detail, customer service, and financial analysis can showcase the candidate's proficiency in key areas required for the position, making them a more attractive candidate for the role.

Soft Skills:

- Attention to Detail

- Time Management

- Communication Skills

- Customer Service

- Problem Solving

- Organizational Skills

- Adaptability

- Critical Thinking

- Teamwork

- Flexibility

- Mortgage Processing

- Document Review

- Regulatory Compliance

- Loan Underwriting

- Legal Document Analysis

- Financial Analysis

- Loan Documentation

- Information Gathering

- Loan Closing

- Loan Servicing

Common Mistakes to Avoid When Writing a Loan Document Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Loan Document Specialist resume

- Proficiency in reviewing and analyzing loan documents

- Extensive experience in ensuring accuracy and completeness of loan applications

- Strong knowledge of federal and state lending regulations

- Ability to collaborate with loan officers, underwriters, and other stakeholders

- Excellent attention to detail and organizational skills

- Proven ability to meet tight deadlines and work under pressure

- Experience in maintaining and updating loan files

- Familiarity with loan origination systems and software

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.