Are you looking to land your dream job as an Insurance Representative? Look no further! Our Insurance Representative Resume Example article is here to provide you with the tools and tips you need to create a standout resume. Whether you're new to the field or have years of experience, our tips and example will help you showcase your skills and qualifications to potential employers. Let's get started on crafting the perfect resume for your next career move.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does an Insurance Representative do?

- Explain various insurance policies and coverage options to potential clients

- Assist clients in selecting the most suitable insurance plans for their needs

- Process insurance applications and handle policy renewals

- Collect and verify information to determine the risk involved in providing insurance coverage

- Handle customer inquiries and complaints

- Calculate and provide quotes for insurance premiums

- Provide assistance with filing insurance claims

- Stay updated on industry trends and regulations to provide accurate information to clients

- Digital Account Executive Resume Sample

- Customer Sales Representative Resume Sample

- Assistant Product Manager Resume Sample

- Account Representative Resume Sample

- Regional Sales Manager Resume Sample

- Digital Marketing Analyst Resume Sample

- Experienced Event Planner Resume Sample

- Junior Buyer Resume Sample

- Marketing Professional Resume Sample

- Digital Marketing Manager Resume Sample

- Associate Brand Manager Resume Sample

- Sales Assistant Resume Sample

- Independent Sales Representative Resume Sample

- Sales Contractor Resume Sample

- Founder Resume Sample

- Business Coordinator Resume Sample

- Proposal Writer Resume Sample

- Director of Communications Resume Sample

- Customer Account Representative Resume Sample

- Sales Advisor Resume Sample

What are some responsibilities of an Insurance Representative?

- Educating customers about various types of insurance policies

- Assisting clients in selecting the most appropriate insurance coverage

- Processing insurance applications and claims

- Researching and staying informed about industry trends and changes in insurance laws

- Providing excellent customer service and maintaining client relationships

- Preparing and presenting insurance proposals to potential clients

- Adhering to ethical and legal standards in the insurance industry

- Participating in training and professional development opportunities to enhance knowledge and skills

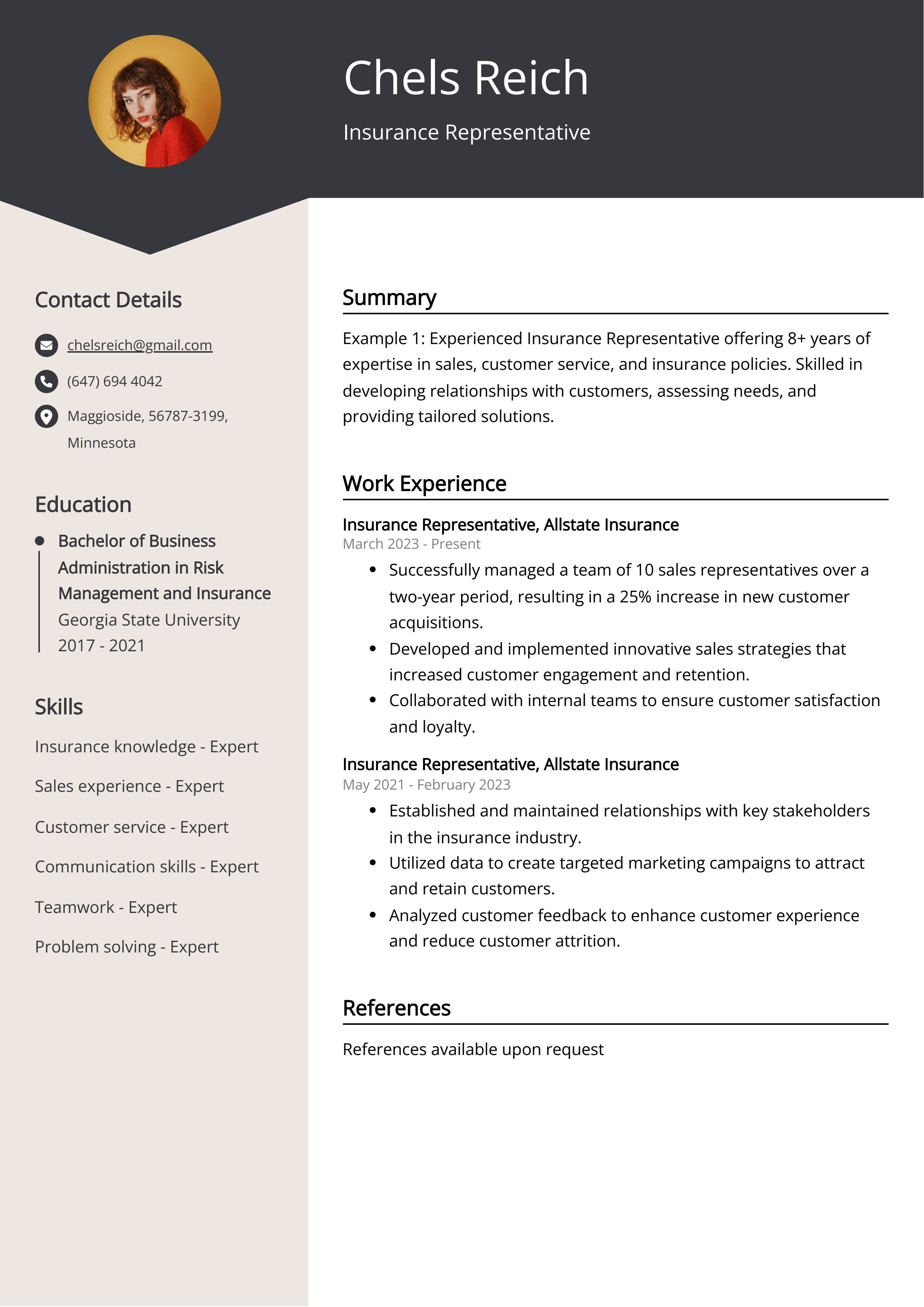

Sample Insurance Representative Resume for Inspiration

John Smith

123 Main Street, Anytown, USA

Phone: 555-5555, Email: jsmith@email.com

Summary:

John Smith is an experienced Insurance Representative with a proven track record in sales and customer service. He is skilled in building relationships and providing tailored insurance solutions to clients.

Work Experience:

- Insurance Representative, ABC Insurance Co. (2015-present)

- Responsible for cultivating and maintaining client relationships, generating new leads, and providing comprehensive insurance solutions. Exceeded sales targets by 20% in the last fiscal year.

- Insurance Agent, XYZ Insurance Agency (2012-2015)

- Managed a portfolio of clients and developed customized insurance plans to meet their specific needs. Consistently ranked as a top performer in sales and customer satisfaction.

Education:

- Bachelor's Degree in Business Administration, Anytown University, 2012

- Associate's Degree in Insurance Services, Anytown Community College, 2010

Skills:

- Excellent communication and interpersonal skills

- Strong sales and negotiation abilities

- Proficient in Microsoft Office suite

- Knowledge of various insurance products and policies

Certifications:

- Licensed Insurance Producer (Life, Health, and Property/Casualty)

- Certified Insurance Counselor (CIC)

Languages:

- English (Fluent)

- Spanish (Basic proficiency)

Resume tips for Insurance Representative

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Insurance Representative resume tips.

We collected the best tips from seasoned Insurance Representative - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your expertise in different types of insurance, such as life, health, and property and casualty.

- Showcase your strong communication and negotiation skills to help clients understand and choose the right insurance plans.

- Emphasize your sales experience and track record of meeting or exceeding sales targets.

- Demonstrate your knowledge of insurance regulations and compliance requirements.

- Include any certifications or licenses relevant to the insurance industry, such as a Property and Casualty license or a Certified Insurance Counselor (CIC) designation.

Insurance Representative Resume Summary Examples

A resume summary or objective for an insurance representative can quickly highlight your skills, experience, and career goals to potential employers. It can help to grab the attention of hiring managers and make a strong first impression. A well-written summary or objective can also demonstrate your commitment to the insurance industry and showcase your enthusiasm for serving clients and achieving business goals.

For Example:

- Dedicated Insurance Representative with 5+ years of experience in assessing insurance needs, providing quotes, and selling policies.

- Excellent communication and customer service skills, consistently meeting and exceeding sales targets.

- Proficient in various insurance products including life, health, and property insurance.

- Strong knowledge of insurance laws and regulations, ensuring compliance and accuracy in policy issuance.

- Proven track record of building and maintaining strong client relationships, resulting in high customer retention rates.

Build a Strong Experience Section for Your Insurance Representative Resume

Building a strong experience section for an insurance representative resume is essential to demonstrate to potential employers your relevant skills, knowledge, and accomplishments in the industry. It allows you to highlight your expertise in client communication, negotiating policies, and sales techniques. A well-crafted experience section can set you apart from other candidates and increase your chances of landing a desirable position in the competitive insurance field.

For Example:

- Managed and processed insurance claims for clients

- Provided customer service and support to policyholders

- Sold and promoted insurance policies to potential clients

- Conducted risk assessments and recommended appropriate insurance coverage

- Assisted clients with policy modifications and updates

- Handled billing inquiries and facilitated premium payments

- Collaborated with underwriters to review and approve policy applications

- Participated in training programs to stay updated on insurance products and regulations

- Utilized CRM software to maintain client records and process policy changes

- Developed and maintained relationships with insurance brokers and agents

Insurance Representative resume education example

Insurance Representatives typically need a high school diploma or equivalent. Some employers may prefer candidates with a bachelor's degree in business, finance, or a related field. Additionally, many employers provide on-the-job training for new hires to learn about insurance policies, sales techniques, and industry regulations. Some insurance representatives may also choose to pursue professional certifications or licenses to demonstrate their expertise in the field.

Here is an example of an experience listing suitable for a Insurance Representative resume:

- Bachelor's degree in Business Administration

- Completed Insurance Licensing Exam

- Participated in ongoing insurance-specific training and professional development programs

Insurance Representative Skills for a Resume

Adding skills to an Insurance Representative resume is important as it showcases the candidate's ability to effectively communicate with clients, analyze insurance needs, and negotiate terms. It also demonstrates their proficiency in using relevant computer software, managing administrative tasks, and understanding the intricacies of insurance policies and regulations. These skills highlight the candidate's potential to excel in the role and contribute positively to the organization.

Soft Skills:

- Communication Skills

- Customer Service

- Problem Solving

- Time Management

- Adaptability

- Empathy

- Negotiation Skills

- Teamwork

- Organization Skills

- Attention to Detail

- Claims processing

- Underwriting analysis

- Risk assessment

- Policy interpretation

- Customer service

- Sales negotiation

- Data analysis

- Regulatory compliance

- Loss prevention

- Financial reporting

Common Mistakes to Avoid When Writing an Insurance Representative Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Insurance Representative resume

- Effective communication skills to explain policy details to clients

- Demonstrated ability to assess client needs and recommend appropriate coverage

- Sales and negotiation skills to close deals and upsell additional products

- Proficient in using insurance software and databases to manage client information

- Strong understanding of insurance regulations and compliance requirements

- Detail-oriented with excellent organizational abilities to keep track of client policies and payments

- Customer service focus to address client inquiries and resolve issues

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.