Are you looking for a job in private equity and need advice on how to write an effective CV? This article provides an example of a professional CV for an associate working in private equity, along with tips on how to write an effective CV. Read on to learn more about how to make a strong impression with your CV and land the job you want.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Private Equity Associate do?

A Private Equity Associate is responsible for researching and evaluating potential investments, performing due diligence, and helping to manage existing investments. They may be responsible for creating financial models, preparing presentations and reports, and making recommendations to senior management. They also work closely with other members of the investment team in order to identify opportunities, negotiate terms, and close deals. In addition, Private Equity Associates may be involved in the monitoring of existing investments and the development of exit strategies.

- Payroll Representative CV Sample

- Payroll Specialist CV Sample

- Personal Financial Advisor CV Sample

- Portfolio Analyst CV Sample

- Portfolio Manager CV Sample

- Premium Auditor CV Sample

- Private Banker CV Sample

- Private Equity Analyst CV Sample

- Private Equity Associate CV Sample

- Processor CV Sample

- Production Accountant CV Sample

- Project Accountant CV Sample

- Property Accountant CV Sample

- Real Estate Accountant CV Sample

- Reconciliation Analyst CV Sample

- Reconciliation Specialist CV Sample

- Regional Account Manager CV Sample

- Reimbursement Manager CV Sample

- Reimbursement Specialist CV Sample

- Relationship Banker CV Sample

What are some responsibilities of a Private Equity Associate?

- Perform financial analysis and develop financial models to evaluate potential investments

- Conduct due diligence and assess potential investments for quality and profitability

- Develop investment presentations and present to senior management for approval

- Manage portfolio companies and monitor their performance

- Assist in the negotiation and structuring of transactions

- Analyze the market and competitive landscape of portfolio companies

- Perform industry research and competitive analysis

- Prepare financial projections and business plans

- Assist in the preparation of documents for regulatory filings and compliance

- Communicate with external advisors such as lawyers, accountants, and consultants

- Develop relationships with potential investors, partners, and other stakeholders

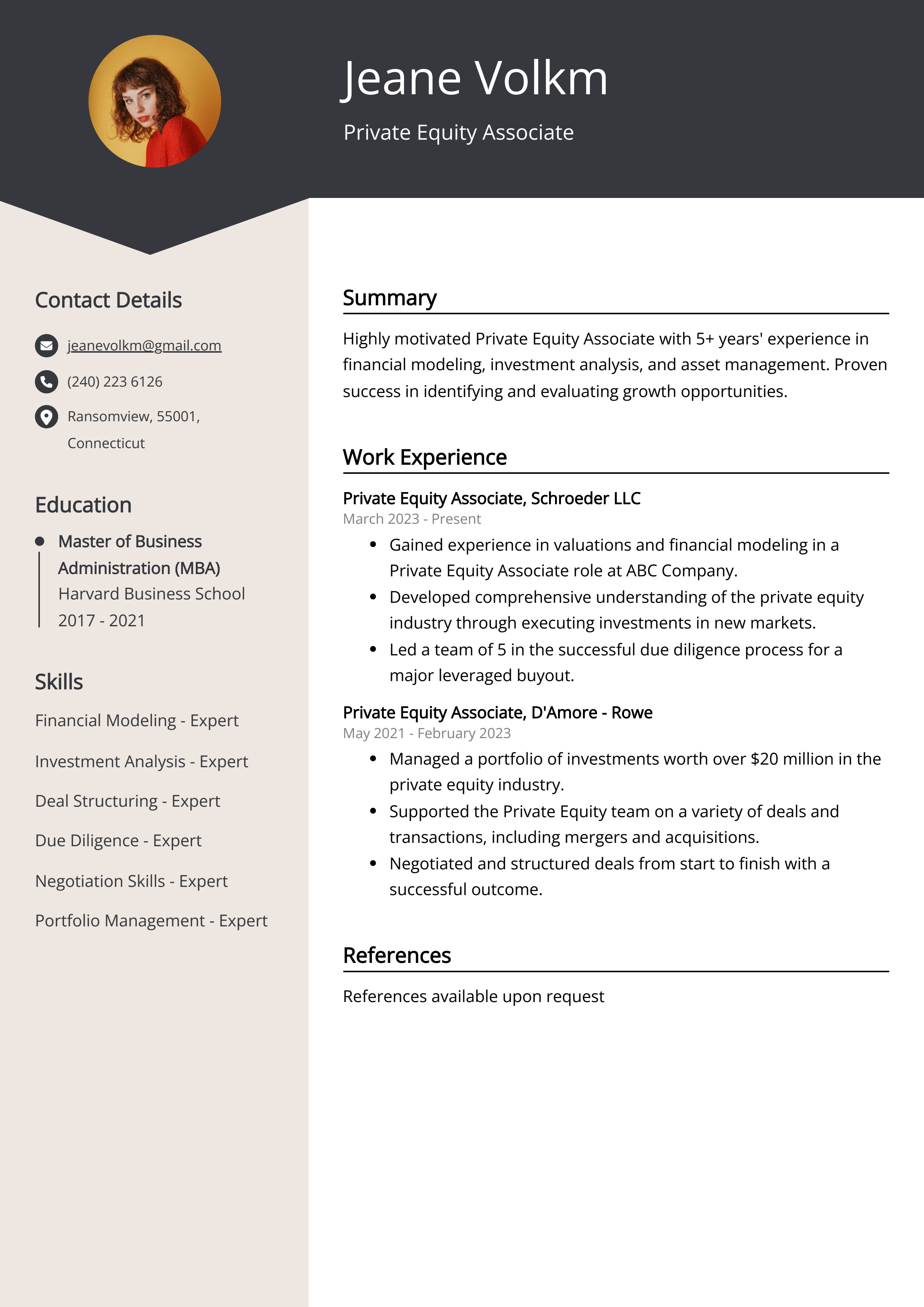

Sample Private Equity Associate CV for Inspiration

Personal Details:

Name: John Smith

Address: 123 Main Street, New York, NY 10001

Phone: 123-456-7890

Email: johnsmith@example.com

Summary:

John Smith is an experienced Private Equity Associate with a proven track record of delivering successful equity investments. He has a deep understanding of the private equity industry, with experience in both fund management and asset management. John is an excellent communicator, with strong analytical skills and a passion for finding successful investment opportunities. He thrives in dynamic environments, and is able to quickly build strong relationships with stakeholders.

Work Experience:

- Private Equity Associate, ABC Capital Partners – New York, NY (2015 – Present)

- Managed investments in real estate, private equity, and venture capital funds.

- Developed and executed strategies to maximize returns on investments.

- Performed due diligence on potential investment opportunities.

- Led negotiations with third parties for acquisitions and exits.

- Provided guidance to junior associates on best practices.

- Investment Analyst, XYZ Asset Management – New York, NY (2011 – 2015)

- Conducted financial analysis and market research for potential investments.

- Managed relationships with clients and external stakeholders.

- Prepared presentations and materials for internal and external meetings.

- Created reports and documents detailing investment performance.

Education:

MBA, Columbia Business School – New York, NY (2016)

Skills:

- Financial Modeling

- Portfolio Management

- Risk Analysis

- Investment Analysis

- Due Diligence

Certifications:

Chartered Financial Analyst (CFA)

Languages:

English (Native), Spanish (Fluent)

CV tips for Private Equity Associate

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Private Equity Associate CV pointers.

We've curated top-notch advice from experienced Private Equity Associate individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your experience in financial analysis and financial modeling.

- Demonstrate your ability to structure complex deals.

- Showcase your knowledge of the PE industry and current trends.

- Outline your network of contacts in the industry.

- Detail your successes in negotiating deals and closing transactions.

Private Equity Associate CV Summary Examples

Private equity associate CV summaries and objectives are important for any job seeker looking to make an impact in the private equity industry. They highlight the individual’s qualifications and achievements, helping them to stand out from the competition. Furthermore, they provide employers with an understanding of the individual’s unique skillset and how it could be applied to the job. In addition, a well-crafted CV summary or objective can help to demonstrate a candidate’s commitment to the industry and their enthusiasm for the position.

For Example:

- Highly motivated Private Equity Associate with 5+ years of experience in financial services and investment banking.

- Experienced in analyzing and executing complex investments, developing financial models and providing financial advice.

- Accomplished in leading due diligence projects, forming strategic partnerships, and building valued client relationships.

- Strong ability to identify growth opportunities and develop comprehensive reports on investment projects.

- Track record of success in increasing returns and mitigating risks in private equity investments.

Build a Strong Experience Section for Your Private Equity Associate CV

Building a strong experience section for a private equity associate CV is important because it allows employers to quickly and easily ascertain the level of your experience and expertise within the private equity field. It provides employers with a snapshot of your skills and accomplishments in the private equity industry, which will allow them to make an informed decision about your application. Additionally, the experience section can showcase your ability to think strategically, identify opportunities, make decisions, and take on responsibility. By highlighting your achievements and successes, you can demonstrate the value that you would bring to a private equity firm.

For Example:

- Provided financial due diligence, industry research, and portfolio company analysis for private equity investments.

- Developed financial models and created investment presentations for potential investments.

- Conducted market and competitive analyses to identify potential risks and opportunities.

- Built financial models for both buy-side and sell-side M&A transactions.

- Developed financial models, including LBO, DCF, and merger models.

- Prepared detailed presentations for potential investors and management teams.

- Managed the due diligence process including financial, legal, and operational aspects.

- Analyzed and monitored financial performance of existing portfolio companies.

- Assisted in the execution of M&A transactions, including deal structuring and negotiations.

- Prepared investment documents, such as term sheets, investment memorandums, and board documents.

Private Equity Associate CV education example

Private equity associates typically possess a bachelor's degree in finance, accounting, business, or economics. They may also have a master's degree in business administration (MBA) with a concentration in finance. In addition, having a Certified Public Accountant (CPA) certification or Chartered Financial Analyst (CFA) certification is beneficial. Private equity associates must have a strong understanding of financial concepts, such as financial forecasting, corporate budgeting, financial modeling, and analysis. They must also have excellent communication and interpersonal skills to work effectively with clients and colleagues.

Here is an example of an experience listing suitable for a Private Equity Associate CV:

- Bachelor of Business Administration with a major in Finance, University of Oxford, 2014-2018

- Master of Business Administration with a concentration in Private Equity, Harvard Business School, 2018-2020

- Certified Chartered Financial Analyst (CFA), CFA Institute, 2019

Private Equity Associate Skills for a CV

Adding skills to a Private Equity Associate CV is important because it helps to demonstrate the candidate's ability and qualifications for the role. Skills can range from technical abilities, such as financial analysis and valuation, to soft skills such as communication and interpersonal skills. By highlighting relevant skills, the candidate can quickly demonstrate how they can contribute to the role. Including skills on a CV also allows employers to quickly identify the candidate's qualifications and capabilities.

Soft Skills:

- Communication Skills

- Analytical Thinking

- Problem-Solving

- Negotiation Skills

- Finance Knowledge

- Leadership Skills

- Organizational Skills

- Time Management

- Teamwork

- Networking

- Financial Modeling

- Valuation Analysis

- Due Diligence

- Financial Analysis

- Investment Analysis

- Portfolio Management

- Negotiation Skills

- Risk Assessment

- Data Analysis

- Business Strategy

Common Mistakes to Avoid When Writing a Private Equity Associate CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Private Equity Associate CV

- Highlight analytical and problem-solving skills

- Showcase any relevant experience or qualifications

- Demonstrate familiarity with financial models and market trends

- Emphasize strong research and organizational skills

- Highlight knowledge of portfolio companies

- Reveal excellent communication and interpersonal skills

- Mention any involvement in relevant professional organizations

- Include any language skills, such as fluency in another language

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.