Looking to land a new mortgage banker position? A strong CV is essential for making a positive impression on potential employers. Our mortgage banker CV example provides a template and tips for crafting a professional and polished document that showcases your experience and qualifications. Whether you’re a seasoned mortgage banker or just starting out in the industry, our example can help you create a winning CV that sets you apart from the competition.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Mortgage Banker do?

A Mortgage Banker is responsible for helping borrowers secure financing for the purchase of a home or other real estate properties. They work with clients to determine their financial situation and find the best mortgage options available to them. Mortgage Bankers also assist with the application process, including gathering required documentation, and may ultimately approve or deny a loan based on the borrower's financial circumstances and credit history.

- Revenue Analyst CV Sample

- Senior Staff Accountant CV Sample

- Bookkeeping Clerk CV Sample

- Revenue Agent CV Sample

- Lending Manager CV Sample

- Portfolio Manager CV Sample

- Intermediate Accountant CV Sample

- Insurance Processor CV Sample

- Payroll Accountant CV Sample

- Revenue Officer CV Sample

- Loan Manager CV Sample

- Project Accountant CV Sample

- Budget Manager CV Sample

- Chief Financial Officer CV Sample

- Reporting Analyst CV Sample

- Senior Auditor CV Sample

- Loan Officer CV Sample

- Mortgage Loan Closer CV Sample

- Environmental Analyst CV Sample

- Mortgage Closer CV Sample

What are some responsibilities of a Mortgage Banker?

- Evaluate and recommend mortgage options to clients

- Assist clients in the mortgage application process

- Keep current with industry regulations and guidelines

- Build and maintain relationships with potential clients and referral sources

- Analyze financial and credit data to determine feasibility of granting loans

- Negotiate terms and conditions of loans with clients

- Ensure all paperwork is completed accurately and in a timely manner

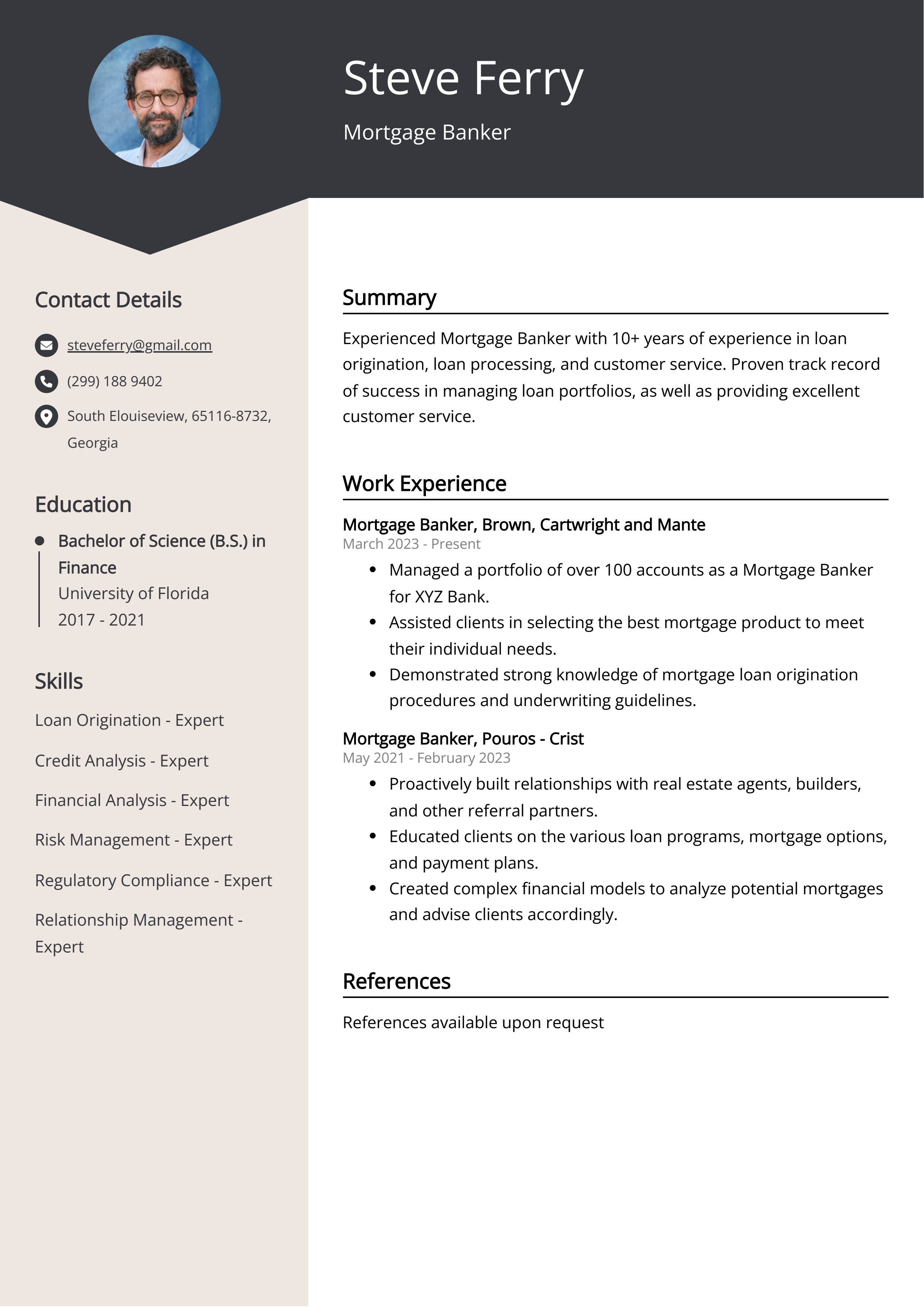

Sample Mortgage Banker CV for Inspiration

```html CV Example Personal Details

Name: John Smith

Email: john.smith@gmail.com

Phone: 123-456-7890

SummaryJohn is an experienced Mortgage Banker with a proven track record of providing exceptional customer service and finding the best mortgage solutions for clients. He is dedicated to helping individuals and families achieve their homeownership dreams.

Work Experience- Mortgage Banker - XYZ Bank (2018-Present)

- Senior Mortgage Loan Officer - ABC Mortgage (2015-2018)

- Mortgage Loan Officer - DEF Financial Services (2012-2015)

- Bachelor of Business Administration - University of XYZ (2012)

- Strong knowledge of mortgage products and industry regulations

- Excellent communication and negotiation skills

- Ability to analyze financial information and provide suitable mortgage options

- Proficient in utilizing CRM and mortgage processing software

- Licensed Mortgage Loan Originator (MLO) - State of XYZ

English (Native), Spanish (Proficient)

```CV tips for Mortgage Banker

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Mortgage Banker CV pointers.

We've curated top-notch advice from experienced Mortgage Banker individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight your sales experience and success in meeting mortgage lending targets.

- Showcase your knowledge of mortgage products and regulations in the financial industry.

- Emphasize your ability to build and maintain strong relationships with clients and industry partners.

- Demonstrate your expertise in analyzing financial and credit data to determine loan eligibility.

- Include any relevant certifications or licenses, such as NMLS certification or state-specific mortgage licensing.

Mortgage Banker CV Summary Examples

A mortgage banker CV summary or CV objective can help grab the attention of hiring managers and showcase your relevant skills and experience in a concise and impactful manner. It provides a quick overview of your qualifications and career goals, making it easier for employers to understand your potential fit for the role. This can ultimately increase your chances of securing an interview and landing the job.

For Example:

- 10 years of experience as a Mortgage Banker

- Demonstrated track record of closing complex deals

- Strong understanding of mortgage underwriting guidelines

- Proven ability to build and maintain client relationships

- Skilled at analyzing financial documents and assessing risk

Build a Strong Experience Section for Your Mortgage Banker CV

Building a strong experience section for a Mortgage Banker CV is crucial because it showcases your expertise, skills, and achievements in the industry. It helps potential employers understand the depth and breadth of your experience, giving them confidence in your ability to handle their mortgage needs effectively. A comprehensive work history can also demonstrate your familiarity with different loan programs and regulations, making you a more attractive candidate for the position.

For Example:

- Over 5 years of experience in mortgage banking

- Successfully closed over 100 transactions

- Managed a portfolio of high net worth clients

- Consistently met and exceeded sales targets

- Developed and maintained relationships with industry contacts

- Provided exceptional customer service to clients

- Negotiated and structured complex mortgage deals

- Trained and mentored junior bankers

- Collaborated with underwriters to ensure timely processing of loans

- Advised clients on mortgage options and financial planning

Mortgage Banker CV education example

A mortgage banker typically needs a college degree in finance, economics, business, or a related field. Some employers may also require a master's degree in finance or a related discipline. Additionally, mortgage bankers must complete a state-approved mortgage loan originator licensing course and pass the National Mortgage Loan Originator Test. Ongoing education and training in mortgage lending, banking regulations, and financial analysis are also important for success in this field.

Here is an example of an experience listing suitable for a Mortgage Banker CV:

- Bachelor of Science in Finance, University of Texas - Austin

- Completed Mortgage Lending Certification Program, American Bankers Association

- Participated in Continuing Education courses in Mortgage Lending and Compliance

Mortgage Banker Skills for a CV

It is important to add skills to a Mortgage Banker CV as it helps to demonstrate the candidate's qualifications and capabilities for the role. Including relevant skills such as sales, communication, financial analysis, and customer service can showcase the candidate's ability to succeed in the position. This can help recruiters and hiring managers to quickly assess the candidate's suitability for the job.

Soft Skills:

- Communication skills

- Problem-solving abilities

- Customer service

- Time management

- Team player

- Adaptability

- Negotiation skills

- Attention to detail

- Empathy

- Salesmanship

- Financial analysis

- Loan origination

- Credit assessment

- Underwriting

- Regulatory compliance

- Risk management

- Client relationship management

- Documentation management

- Market analysis

- Negotiation skills

Common Mistakes to Avoid When Writing a Mortgage Banker CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Mortgage Banker CV

- Highlight relevant work experience in the mortgage industry

- Showcase knowledge of mortgage regulations and processes

- Demonstrate strong sales and customer service skills

- Emphasize ability to analyze financial data and assess risk

- Include any relevant education or certifications in the mortgage field