As an insurance specialist, it is important to have a well-crafted CV that showcases your skills, experience, and expertise in the insurance industry. In our example CV, we provide a comprehensive guide on how to create a standout resume that will catch the attention of potential employers. From highlighting relevant qualifications to demonstrating a track record of success, our example CV will help you land your next insurance specialist role.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Insurance Specialist do?

An Insurance Specialist is responsible for reviewing and processing insurance claims, verifying policy coverage, and determining the validity of claims. They communicate with clients, healthcare providers, and insurance companies to ensure accurate and timely payment of claims. The specialist may also provide guidance on insurance options and coverage plans to clients, as well as assist with resolving any claim disputes. They play a critical role in ensuring that clients receive the maximum benefits from their insurance policies.

- Clinical Research Assistant CV Sample

- Certified Athletic Trainer CV Sample

- Spa Director CV Sample

- Nutrition Specialist CV Sample

- Periodontist CV Sample

- Enrollment Coordinator CV Sample

- Acute Care Nurse Practitioner CV Sample

- Certified Nurse Assistant CV Sample

- Patient Navigator CV Sample

- Patient Transporter CV Sample

- Clinical Systems Analyst CV Sample

- Physician Assistant CV Sample

- Family Therapist CV Sample

- Rehabilitation Counselor CV Sample

- Kyc Analyst CV Sample

- Exercise Physiologist CV Sample

- Insurance Underwriter CV Sample

- Membership Coordinator CV Sample

- Interpreter CV Sample

- Dermatologist CV Sample

What are some responsibilities of an Insurance Specialist?

- Evaluating insurance policies to ensure they meet clients' needs

- Assisting clients in selecting the most suitable insurance policies

- Providing guidance on insurance claims and handling any issues that arise

- Staying updated on insurance industry trends and changes in regulations

- Building and maintaining relationships with insurance providers

- Assessing clients' risk levels and recommending appropriate coverage

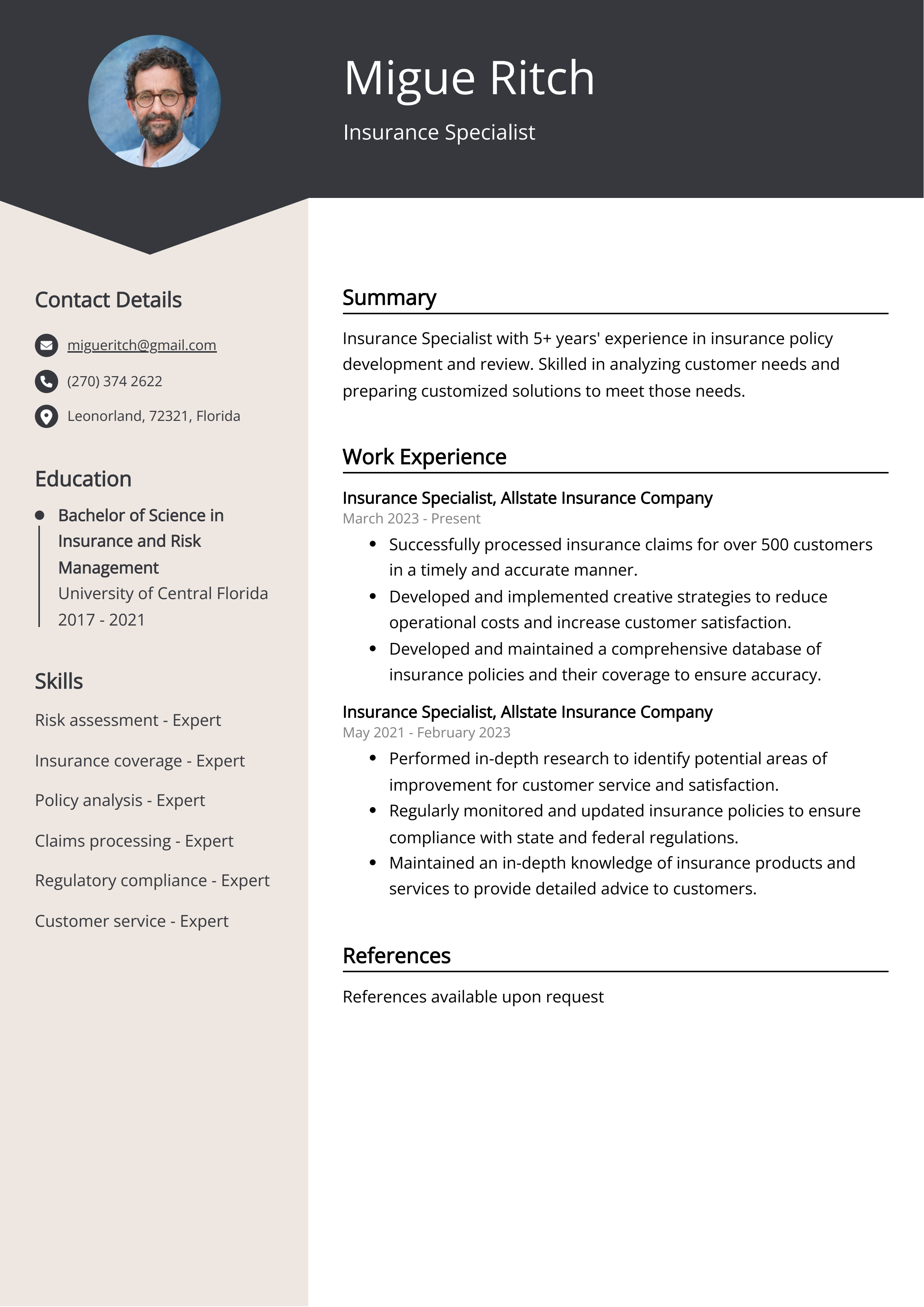

Sample Insurance Specialist CV for Inspiration

Personal Details:

- Name: John Doe

- Address: 123 Main Street, Anytown, USA

- Email: johndoe@email.com

- Phone: 123-456-7890

Summary:

John Doe is a highly experienced Insurance Specialist with a proven track record of providing excellent customer service and consistently meeting sales targets. He is skilled in assessing clients' insurance needs and offering tailored solutions to meet those needs. John is an effective communicator and problem solver who is dedicated to ensuring customer satisfaction.

Work Experience:

- Insurance Specialist at ABC Insurance Company (2017-present)

- Managed a portfolio of 200+ clients, providing them with personalized insurance solutions

- Achieved 20% increase in sales through proactive client outreach and cross-selling

- Collaborated with underwriters to ensure accurate policy issuance and renewal

- Insurance Agent at XYZ Insurance Agency (2015-2017)

- Acquired new clients through networking, referrals, and cold calling

- Provided guidance and support to clients in filing insurance claims

- Developed and delivered presentations on insurance products and services

Education:

- Bachelor's Degree in Business Administration with a concentration in Insurance Management, University of Anytown (2012-2016)

Skills:

- Excellent customer service and interpersonal skills

- Strong sales and negotiation abilities

- Proficient in insurance software and CRM systems

- Attention to detail and accuracy in policy management

Certifications:

- Licensed Insurance Agent in the state of Anytown

- Certified Insurance Specialist (CIS) designation

Languages:

- English (fluent)

- Spanish (conversational)

CV tips for Insurance Specialist

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Insurance Specialist CV pointers.

We've curated top-notch advice from experienced Insurance Specialist individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Clearly outline your experience in the insurance industry, including any relevant certifications or licenses.

- Highlight any accomplishments or successful projects that demonstrate your expertise in insurance management or claims processing.

- Showcase your strong communication skills, as well as your ability to work effectively with both clients and colleagues.

- Include any software or technical skills that are relevant to the insurance industry, such as experience with insurance-specific software or data analysis tools.

- Emphasize your commitment to staying current with industry trends and regulations, as well as any professional development or continuing education you have pursued.

Insurance Specialist CV Summary Examples

An Insurance Specialist CV Summary or CV Objective is used to provide a brief overview of a candidate's skills, experience, and career goals. It helps to quickly highlight key qualifications and professional achievements to potential employers. This section can also demonstrate the candidate's motivation and enthusiasm for the role, as well as their commitment to providing excellent service in the insurance industry.

For Example:

- Dedicated insurance specialist with 5+ years of experience in developing and maintaining strong client relationships

- Proven track record in achieving and exceeding sales targets through effective communication and negotiation skills

- Skilled in analyzing insurance policies and recommending the best coverage options for clients

- Proficient in utilizing insurance software and maintaining accurate client records

- Strong understanding of insurance regulations and compliance requirements

Build a Strong Experience Section for Your Insurance Specialist CV

Building a strong experience section for a Insurance Specialist CV is crucial for showcasing your expertise, skills, and achievements in the insurance industry. It provides potential employers with a clear understanding of your relevant experience, helping you stand out from other candidates. By highlighting your past roles and responsibilities, you can demonstrate your ability to handle a wide range of insurance-related tasks and responsibilities, making you a more attractive candidate for the job.

For Example:

- Performed risk assessments and determined appropriate coverage for clients

- Processed insurance claims and coordinated with adjusters and clients

- Evaluated insurance applications and underwrote policies

- Provided customer service to policyholders and addressed inquiries and concerns

- Developed and maintained relationships with insurance carriers and brokers

- Analyzed and interpreted insurance policies and regulations

- Conducted market research and analyzed industry trends

- Prepared and presented insurance proposals to potential clients

- Collaborated with sales teams to create tailored insurance solutions for clients

- Performed audits and reviewed insurance documents to ensure compliance with regulations

Insurance Specialist CV education example

An insurance specialist typically needs a high school diploma or equivalent and on-the-job training to learn about insurance policies, regulations, and customer service skills. Some employers may prefer candidates with a bachelor's degree in finance, business administration, or a related field. Professional certifications, such as the Chartered Property and Casualty Underwriter (CPCU) or Associate in Insurance Services (AIS), may also be beneficial for career advancement in the insurance industry.

Here is an example of an experience listing suitable for a Insurance Specialist CV:

- Bachelor of Science in Business Administration - XYZ University

- Associate's Degree in Insurance and Risk Management - ABC College

- Certified Insurance Specialist (CIS) - Insurance Institute of America

Insurance Specialist Skills for a CV

It is important to add skills for Insurance Specialist CV to demonstrate to potential employers that you have the necessary abilities to excel in the role. Including a range of skills, such as attention to detail, strong communication, problem-solving, and knowledge of insurance regulations, will showcase your ability to effectively handle insurance-related tasks and provide excellent service to clients. This can help set you apart from other candidates and increase your chances of securing a job in the insurance industry.

Soft Skills:

- Communication skills

- Empathy

- Adaptability

- Problem-solving

- Time management

- Attention to detail

- Customer relation skills

- Teamwork

- Negotiation skills

- Computer proficiency

- Policy Analysis

- Claim Processing

- Underwriting Expertise

- Risk Assessment

- Customer Service

- Legal Compliance

- Data Analysis

- Technical Writing

- Financial Analysis

- Negotiation Skills

Common Mistakes to Avoid When Writing an Insurance Specialist CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Insurance Specialist CV

- Clear and concise summary of professional experience and qualifications

- Highlight specific skills and expertise in insurance industry

- Showcase relevant certifications and accreditations

- Demonstrate experience in analyzing and evaluating insurance policies

- Show ability to communicate effectively with clients and colleagues

- Include measurable achievements and successes in previous roles

- Show willingness to continue professional development in the insurance field