Are you looking for a Retirement Specialist position and need some guidance on how to craft a strong resume? Look no further! Our Retirement Specialist Resume Example article is here to help you showcase your skills and experience in the best light possible. With a carefully crafted resume, you can increase your chances of landing your dream job in the field of retirement planning and financial management.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Retirement Specialist do?

- Helps individuals plan and prepare for retirement

- Assists with setting financial goals for retirement

- Provides advice on retirement savings and investment strategies

- Evaluates pension and Social Security benefits

- Creates personalized retirement plans

- Offers guidance on healthcare and long-term care options during retirement

- Assists with understanding tax implications of retirement income

- Health Information Technician Resume Sample

- Licensed Practical Nurse Lpn Resume Sample

- Spanish Interpreter Resume Sample

- Experienced Psychiatrist Resume Sample

- Insurance Coordinator Resume Sample

- Nurse Consultant Resume Sample

- Addiction Counselor Resume Sample

- Life Insurance Agent Resume Sample

- Physician Liaison Resume Sample

- Medical Laboratory Technologist Resume Sample

- Medical Transcriptionist Resume Sample

- Blood Bank Technologist Resume Sample

- Claim Adjuster Resume Sample

- Clinical Trial Assistant Resume Sample

- Physician Assistant Resume Sample

- Dialysis Nurse Resume Sample

- Graduate Nurse Resume Sample

- Clinician Resume Sample

- Clinical Research Assistant Resume Sample

- Podiatrist Resume Sample

What are some responsibilities of a Retirement Specialist?

- Educating clients about retirement planning options

- Creating personalized retirement plans

- Assisting clients in selecting appropriate retirement accounts

- Monitoring and adjusting retirement plans as needed

- Providing guidance on retirement income strategies

- Staying informed about changes in retirement laws and regulations

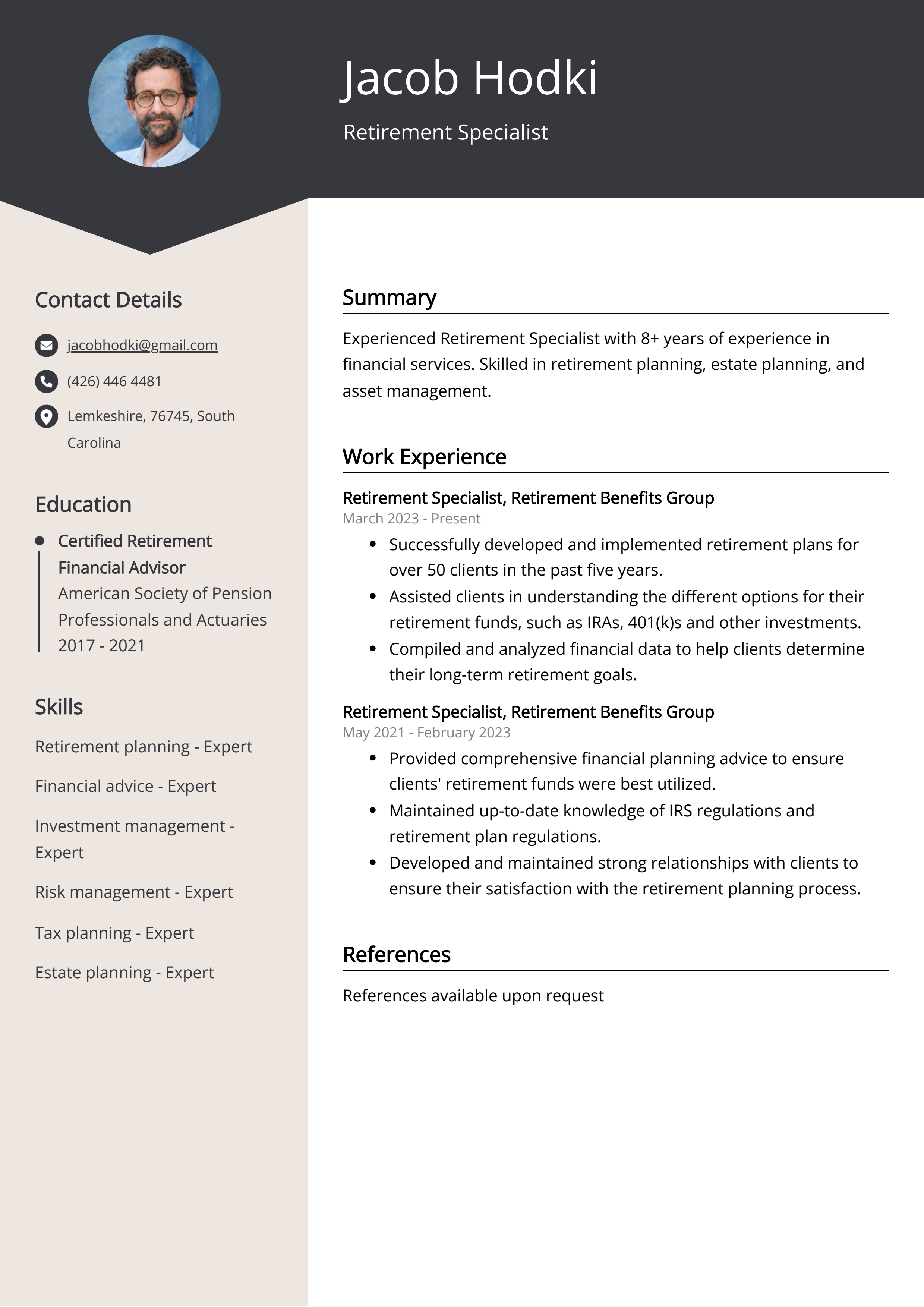

Sample Retirement Specialist Resume for Inspiration

Personal Details:

Name: John Smith

Email: johnsmith@email.com

Phone: (123) 456-7890

Address: 123 Main Street, Anytown, USA

Summary:John Smith is a dedicated Retirement Specialist with 8 years of experience in the finance industry. He is skilled in providing financial guidance and support to individuals and families planning for retirement. John excels in building strong relationships with clients and guiding them through the complexities of retirement planning. He is committed to helping clients achieve their retirement goals and secure their financial future.

Work Experience:- Retirement Specialist, ABC Financial Services (2015-2021)

- Financial Advisor, XYZ Investments (2012-2015)

Bachelor of Science in Finance, University of Anytown (2012)

Skills:- Financial planning and analysis

- Retirement income strategies

- Investment management

- Customer relationship management

- Strong communication and presentation skills

- Certified Retirement Planning Counselor (CRPC)

- Series 7 and Series 66 licenses

- Life and Health Insurance License

Resume tips for Retirement Specialist

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Retirement Specialist resume tips.

We collected the best tips from seasoned Retirement Specialist - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your experience in retirement planning and advising

- Showcase your knowledge of retirement products and investment strategies

- Demonstrate your ability to develop customized retirement plans for clients

- Include any relevant certifications or licenses such as Certified Retirement Counselor (CRC)

- Emphasize your strong communication and interpersonal skills for building client relationships

Retirement Specialist Resume Summary Examples

Using a Retirement Specialist Resume Summary or Resume Objective is essential to quickly capture the attention of potential employers. It highlights your skills, experience, and accomplishments in a concise manner, showcasing why you are the ideal candidate for the position. This section sets the tone for the rest of your resume and can help you stand out from other applicants. A well-crafted summary or objective can increase your chances of landing an interview and ultimately securing the job.

For Example:

- Over 10 years of experience in retirement planning and financial advising

- In-depth knowledge of retirement accounts, including 401(k) and IRA

- Proven track record in creating customized retirement plans for clients

- Strong communication and presentation skills to effectively educate and advise clients

- Dedicated to staying updated on current retirement laws and regulations

Build a Strong Experience Section for Your Retirement Specialist Resume

Building a strong experience section for a retirement specialist resume is crucial because it showcases the depth of expertise and knowledge in retirement planning, investment strategies, and financial advising. This section provides potential employers with a clear understanding of the candidate's track record and achievements in the field, demonstrating their ability to provide valuable guidance and support to clients in planning for their retirement years.

For Example:

- Developed retirement planning strategies for clients based on their individual financial goals and risk tolerance.

- Managed a portfolio of over 100 retirement accounts, regularly reviewing and adjusting investment options as needed.

- Provided personalized retirement counseling to clients, offering guidance on Social Security, pension plans, and IRA options.

- Collaborated with financial planners and tax professionals to create comprehensive retirement plans for clients.

- Conducted regular performance reviews of retirement accounts and adjusted investment strategies to meet client objectives.

- Advised clients on Medicare enrollment and supplemental insurance options to ensure comprehensive healthcare coverage in retirement.

- Presented retirement planning workshops and seminars to educate clients on the importance of early savings and investment diversification.

- Assisted clients in creating retirement income streams through annuities, dividend-paying stocks, and other investment vehicles.

- Managed and resolved client inquiries and concerns regarding their retirement accounts, ensuring high levels of customer satisfaction.

- Stayed current on retirement planning industry trends and regulations to provide clients with accurate and up-to-date advice.

Retirement Specialist resume education example

A Retirement Specialist typically needs a bachelor's degree in finance, economics, business, or a related field. Many employers also prefer candidates with a Certified Financial Planner (CFP) certification or a Chartered Retirement Planning Counselor (CRPC) certification. Additionally, gaining experience in the financial industry through internships or entry-level positions can be beneficial for a career as a Retirement Specialist. Ongoing education and training in retirement planning, investment strategies, and tax laws are also important for staying current in the field.

Here is an example of an experience listing suitable for a Retirement Specialist resume:

- Bachelor of Business Administration in Finance - University of California, Los Angeles (UCLA)

- Certified Retirement Counselor (CRC) - International Foundation for Retirement Education (InFRE)

- Series 7 and 63 Licenses - Financial Industry Regulatory Authority (FINRA)

Retirement Specialist Skills for a Resume

It is important to add skills for a Retirement Specialist resume because it demonstrates a strong understanding of retirement planning and financial management. By including relevant skills, such as knowledge of retirement accounts, investment strategies, and regulatory compliance, it showcases the ability to provide effective guidance and support to clients as they plan for their future. This can make the candidate more attractive to potential employers in the financial services industry.

Soft Skills:

- Communication

- Empathy

- Active listening

- Problem-solving

- Time management

- Teamwork

- Flexibility

- Adaptability

- Customer service

- Organization

- Financial Planning

- Investment Management

- Tax Strategies

- Estate Planning

- Retirement Income

- Social Security

- Long-term Care

- Insurance knowledge

- Employee Benefits

- Market Trends

Common Mistakes to Avoid When Writing a Retirement Specialist Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Retirement Specialist resume

- Experience in providing retirement planning and investment advice

- Strong understanding of different retirement accounts and plans

- Knowledge of tax implications and regulations related to retirement planning

- Excellent communication and interpersonal skills

- Ability to develop personalized retirement strategies for clients

- Proven track record of helping clients achieve their retirement goals

- Certifications or licenses related to retirement planning (e.g. Certified Retirement Counselor, Series 65)

- Proficiency in retirement planning software and tools

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.