Are you looking for a resume example for a Private Equity Associate position? Look no further! Our article provides a comprehensive resume sample for a Private Equity Associate, with all the essential elements and formatting tips to help you stand out to potential employers. Whether you are just starting your career in private equity or looking to advance to a higher position, our resume example will guide you in creating a professional and impressive resume.

We will cover:

- How to write a resume, no matter your industry or job title.

- What to put on a resume to stand out.

- The top skills employers from every industry want to see.

- How to build a resume fast with our professional Resume Builder.

- Why you should use a resume template

What does a Private Equity Associate do?

- Conduct market and industry research to identify potential investment opportunities

- Analyze financial statements and performance metrics of target companies

- Assist in due diligence processes to evaluate potential investments

- Create financial models and valuations for potential investments

- Work with portfolio companies to develop and implement growth strategies

- Support senior team members in deal sourcing and negotiation

- Monitor and track the performance of current investments

- Prepare investment memos and presentations for internal and external stakeholders

- Aquatics Director Resume Sample

- Child Psychiatrist Resume Sample

- Clinical Nurse Manager Resume Sample

- Drug Safety Associate Resume Sample

- Psychiatric Technician Resume Sample

- Health Aide Resume Sample

- Mobile Phlebotomist Resume Sample

- Clinical Therapist Resume Sample

- Director Of Nursing Resume Sample

- Healthcare Business Analyst Resume Sample

- Histotechnologist Resume Sample

- Patient Care Manager Resume Sample

- Wellness Director Resume Sample

- Hearing Aid Specialist Resume Sample

- Hospice Aide Resume Sample

- Spanish Interpreter Resume Sample

- Medical Manager Resume Sample

- Home Health Nurse Resume Sample

- Pathologist Assistant Resume Sample

- Nurse Practitioner Resume Sample

What are some responsibilities of a Private Equity Associate?

- Conduct due diligence on potential investment opportunities

- Analyze financial statements and evaluate company performance

- Assist in the development of investment theses and presentations

- Participate in meetings with potential target companies and management teams

- Support senior team members in deal execution and portfolio management

- Monitor and report on the performance of portfolio companies

- Assist in fundraising efforts and investor relations

- Stay updated on market trends and industry developments

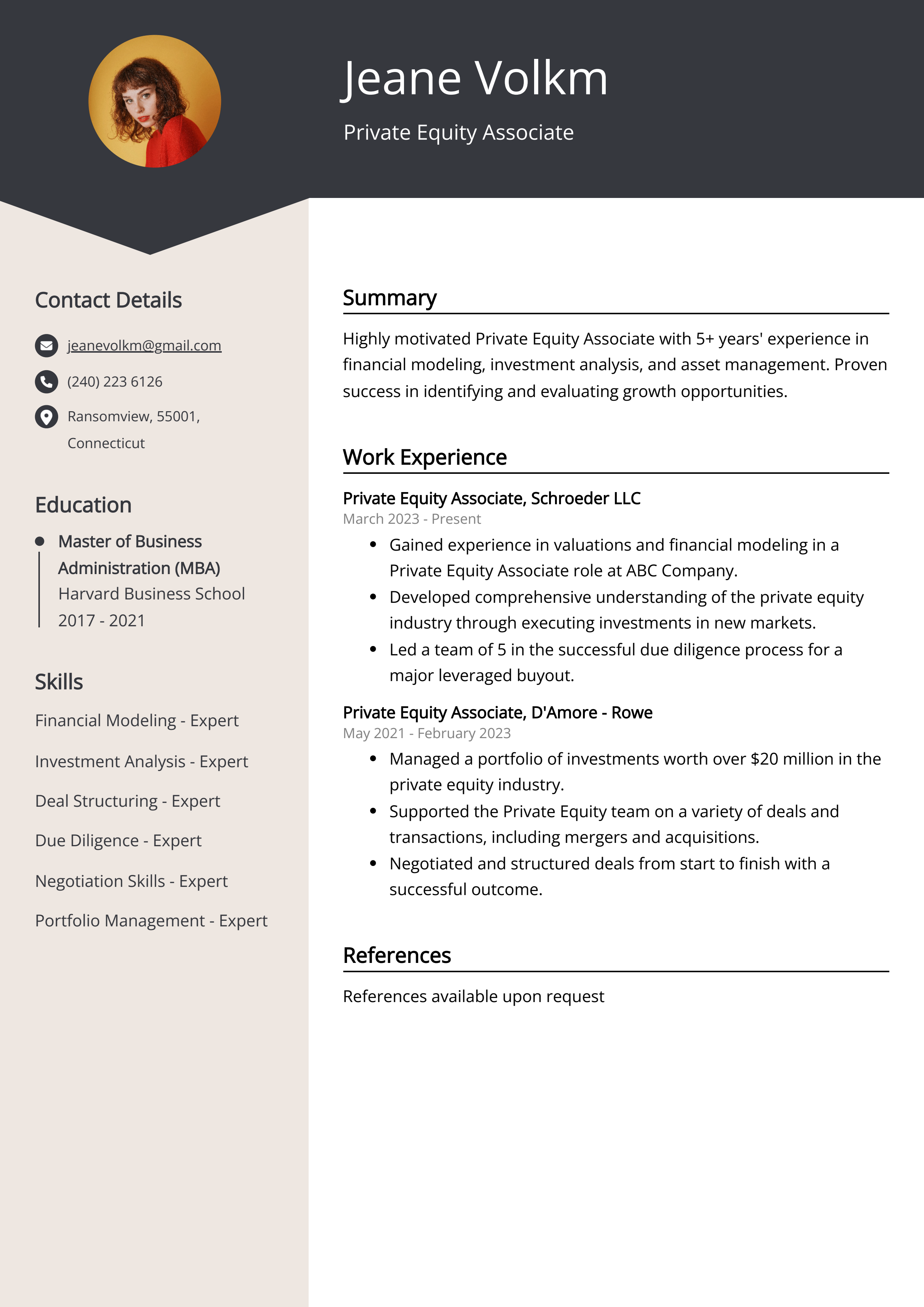

Sample Private Equity Associate Resume for Inspiration

Personal Details:

- Name: John Doe

- Email: johndoe@email.com

- Phone: 123-456-7890

- Address: 123 Main Street, City, State, Zip

Summary:

John Doe is a results-driven Private Equity Associate with over 5 years of experience in financial analysis, due diligence, and deal execution. He has a proven track record of sourcing and evaluating investment opportunities, managing relationships with portfolio companies, and actively participating in all aspects of the investment process. John is passionate about identifying and maximizing value creation within private equity investments and is seeking to leverage his skills and expertise in a dynamic and challenging environment.

Work Experience:

- Private Equity Associate, XYZ Capital Partners, City, State (2017-Present)

- Financial Analyst, ABC Investments, City, State (2015-2017)

Education:

- Master of Business Administration (MBA), University of Business, City, State

- Bachelor of Science in Finance, University of Finance, City, State

Skills:

- Financial Modeling

- Due Diligence

- Investment Analysis

- Portfolio Management

- Valuation

Certifications:

- CFA (Chartered Financial Analyst)

- CPA (Certified Public Accountant)

Languages:

- English (Native proficiency)

- Spanish (Proficient)

Resume tips for Private Equity Associate

Creating a perfect, career-launching resume is no easy task. Following general writing rules can help, but it is also smart to get advice tailored to your specific job search. When you’re new to the employment world, you need Private Equity Associate resume tips.

We collected the best tips from seasoned Private Equity Associate - Check out their advice to not only make your writing process easier but also increase your chances of creating a resume that piques the interest of prospective employers.

- Highlight your financial modeling and valuation skills

- Showcase your experience in due diligence and deal execution

- Emphasize your ability to conduct market research and industry analysis

- Demonstrate your strong communication and presentation skills

- Include any relevant industry certifications or accomplishments

Private Equity Associate Resume Summary Examples

A resume summary or objective is crucial for a Private Equity Associate because it provides a concise overview of their qualifications, skills, and career goals. It offers the opportunity to immediately demonstrate relevant experience and expertise, catching the attention of potential employers. Additionally, a well-crafted summary or objective can set the applicant apart from other candidates and create a strong first impression.

For Example:

- Experience in financial modeling and valuation

- Proficient in researching and analyzing investment opportunities

- Strong understanding of market trends and industry dynamics

- Skilled in due diligence and deal structuring

- Ability to collaborate with cross-functional teams and external stakeholders

Build a Strong Experience Section for Your Private Equity Associate Resume

The experience section is one of the most important parts of a private equity associate resume because it gives potential employers a clear understanding of your skills, accomplishments, and relevant work history. This section should highlight your ability to analyze financial data, conduct due diligence, and execute financial transactions. A strong experience section can demonstrate to employers that you have the necessary expertise and experience to excel in the role of a private equity associate.

For Example:

- Performed financial modeling and analysis on potential investment opportunities

- Conducted due diligence on target companies and industries

- Assisted in the preparation of investment memorandum and presentations

- Participated in meetings with management teams and potential investors

- Supported the evaluation of potential exit strategies for portfolio companies

- Assisted in the monitoring and reporting of portfolio company performance

- Participated in negotiations and deal structuring for new investments

- Contributed to the development and execution of investment strategies

- Collaborated with senior team members on various aspects of the investment process

- Prepared and maintained documentation for regulatory and compliance purposes

Private Equity Associate resume education example

A Private Equity Associate typically needs a bachelor's degree in finance, accounting, economics, or a related field. Some employers may prefer candidates with a master's degree in business administration (MBA) or a related field. Additionally, having a strong understanding of financial modeling, valuation techniques, and experience in investment banking or corporate finance can be advantageous. Continuing education in areas such as financial analysis and market trends is also beneficial.

Here is an example of an experience listing suitable for a Private Equity Associate resume:

- Master of Business Administration (MBA) - Finance, XYZ University, 2016

- Bachelor of Science in Economics, ABC University, 2013

Private Equity Associate Skills for a Resume

Adding skills to a Private Equity Associate Resume is important because it helps demonstrate the candidate's capabilities and qualifications for the role. Highlighting relevant skills such as financial modeling, deal sourcing, due diligence, and communication can help differentiate the candidate from others and increase their chances of securing an interview or job offer. Additionally, having a diverse range of skills can showcase the candidate's ability to handle various responsibilities effectively.

Soft Skills:

- Communication skills

- Team player

- Leadership abilities

- Adaptability

- Problem-solving skills

- Analytical mindset

- Time management

- Negotiation skills

- Attention to detail

- Interpersonal skills

- Financial Analysis

- Valuation Modeling

- Due Diligence

- Market Research

- Financial Modeling

- Deal Structuring

- Investment Analysis

- Excel Modeling

- Company Valuation

- LBO Analysis

Common Mistakes to Avoid When Writing a Private Equity Associate Resume

In this competitive job market, employers receive an average of 180 applications for each open position. To process these resumes, companies often rely on automated applicant tracking systems, which can sift through resumes and eliminate the least qualified applicants. If your resume is among the few that make it past these bots, it must still impress the recruiter or hiring manager. With so many applications coming in, recruiters typically give each resume only 5 seconds of their attention before deciding whether to discard it. Considering this, it's best to avoid including any distracting information on your application that could cause it to be thrown away. To help make sure your resume stands out, review the list below of what you should not include on your job application.

- Not including a cover letter. A cover letter is a great way to explain why you are the best candidate for the job and why you want the position.

- Using too much jargon. Hiring managers do not want to read a resume full of technical terms that they do not understand.

- Omitting important details. Make sure to include your contact information, educational background, job history, and any relevant skills and experiences.

- Using a generic template. Take the time to customize your resume to the job you are applying for. This will show the employer that you are serious about the position.

- Spelling and grammar errors. Always double-check your resume for typos, spelling mistakes, and grammar errors.

- Focusing too much on duties. Make sure to include accomplishments and successes to show the employer that you are a great candidate.

- Including personal information. Avoid including any personal information such as age, marital status, or religious beliefs.

Key takeaways for a Private Equity Associate resume

- Strong financial modeling and analysis skills

- Experience with due diligence and deal origination

- Proven track record of successful investment evaluations

- Excellent communication and presentation abilities

- Proficiency in industry research and market analysis

- Ability to work in fast-paced, high-pressure environments

- Demonstrated team collaboration and leadership capabilities

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.