Planning for retirement is a critical aspect of financial independence. Retirement specialists play a vital role in advising individuals on how to prepare for this stage of life with strategic planning and investment options. A robust CV highlighting the correct blend of skills and experience can demonstrate your ability to help clients navigate this complex process successfully. In this article, we provides you an example of a retirement specialist CV, which will guide you in crafting your own standout CV and enhance your chance of landing the ideal job.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Retirement Specialist do?

A Retirement Specialist assists clients in planning and preparing for retirement. This includes advising on retirement income strategies, investments, pension plans, social security benefits, tax and estate planning, and retirement savings accounts like 401(k), IRA, etc. They also closely monitor client's retirement plans and adjust them as necessary based on changes in the financial market or client's personal circumstances. Their goal is to ensure that clients have a financially secure and comfortable retirement.

- Inside Sales Associate CV Sample

- Penetration Tester CV Sample

- Regional Sales Manager CV Sample

- National Account Manager CV Sample

- Commercial Sales Manager CV Sample

- Salesforce Developer CV Sample

- Digital Account Manager CV Sample

- Brand Ambassador CV Sample

- Relationship Manager CV Sample

- Community Manager CV Sample

- Real Estate Broker CV Sample

- Rails Developer CV Sample

- Business Development Representative CV Sample

- Ruby Developer CV Sample

- Sales Representative CV Sample

- Product Marketing Manager CV Sample

- Php Web Developer CV Sample

- Multimedia Developer CV Sample

- Commodity Buyer CV Sample

- Product Consultant CV Sample

What are some responsibilities of a Retirement Specialist?

- Advising clients on retirement saving strategies.

- Performing periodic assessments of client's retirement plans and adjusting them according to changes in their financial status or goals.

- Keeping up-to-date with the latest financial products and legislation that may affect retirement planning.

- Assisting clients with the set-up and management of individual retirement accounts (IRAs) or employer-sponsored retirement plans.

- Providing educational materials and conducting seminars on retirement planning.

- Work closely with clients to create personalized investment strategies to meet their retirement objectives.

- Collaborating with other financial advisors or professionals (such as lawyers or accountants) to ensure a comprehensive approach to client's retirement plans.

- Helping clients to understand the potential tax implications of different retirement saving strategies.

- Provide regular updates and reports to clients on the progress of their retirement plans.

- Managing and resolving any client concerns or issues related to their retirement plans.

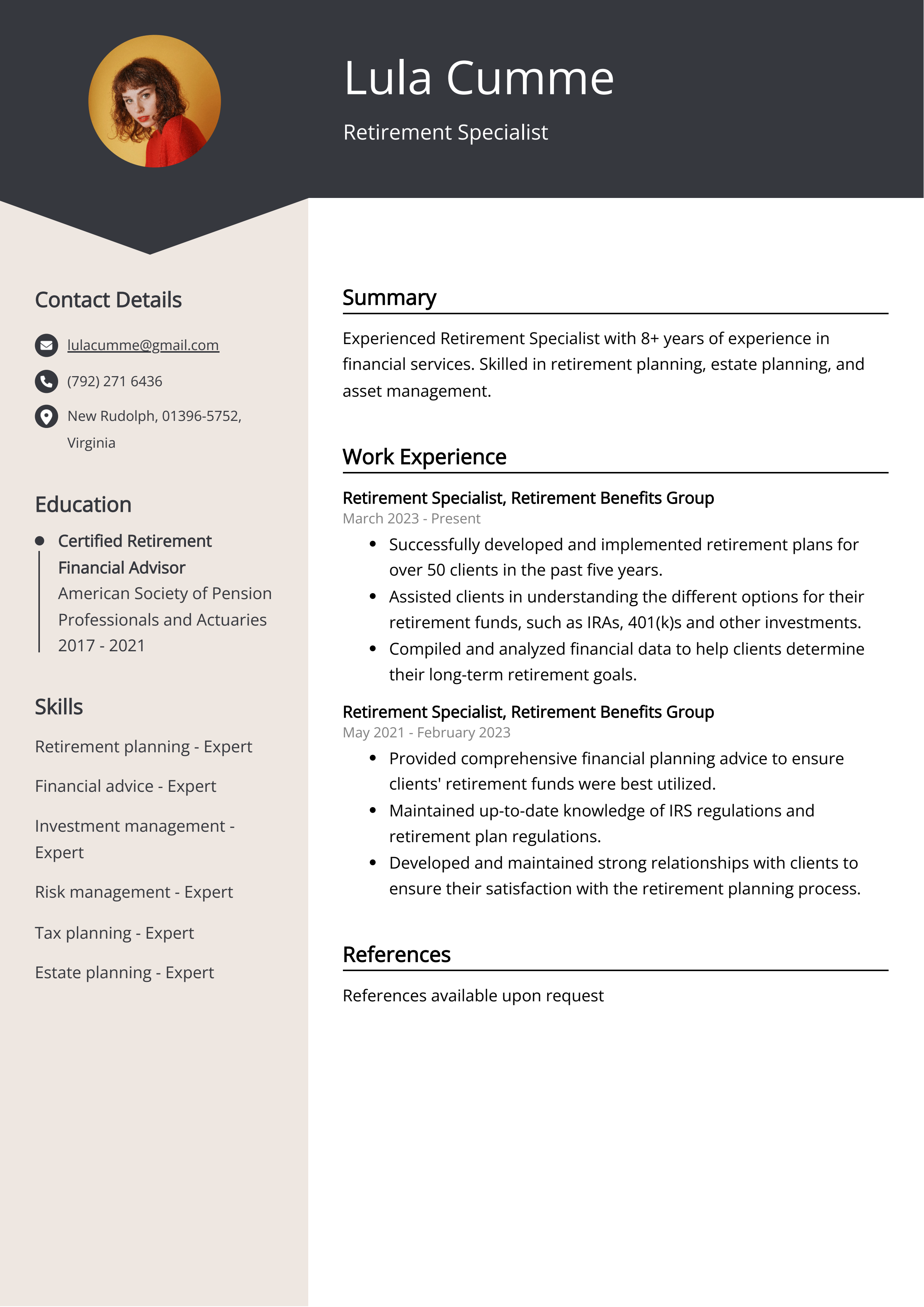

Sample Retirement Specialist CV for Inspiration

Personal Details:

John Doe

123 Main Street, Sydney, Australia

Phone: (123) 456-7890

Email: john.doe@example.com

Summary:

John is a seasoned Retirement Specialist with over 10 years of experience. He has an unrivaled ability to provide clients with retirement planning strategies tailored to their individual needs. John has always been praised for his exceptional communication skills, attentive listening abilities, and proficiency in deciphering complex financial concepts into easily understandable terms for clients. He is known for his outstanding attention to detail, integrity, and dedication to helping clients achieve financial stability for their retirement years.

Work Experience:

- Retirement Specialist, XYZ Financial Services, Sydney - 2015-Present

John managed a portfolio of clients, providing them with personalised retirement strategies. He also conducted multiple client meetings to review financial goals and provide appropriate recommendations. - Financial Advisor, ABC Financial Group, Sydney - 2010-2015

John worked with clients to create comprehensive financial plans. He was highly praised for his detailed approach and ability to break down complex information for clients.

Education:

- Advanced Diploma in Financial Planning, University of Sydney, Sydney - 2010

- Bachelor's Degree in Finance, University of Sydney, Sydney - 2007

Skills:

- Exceptional communication skills

- Strong understanding of retirement planning and financial concepts

- Ability to tailor financial strategies to individual client needs

- Detail-oriented work approach

- Adept at breaking down complex information into understandable terms

Certifications:

- Certified Financial Planner (CFP) - Financial Planning Standards Board, 2010

Languages:

- English (Native)

CV tips for Retirement Specialist

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Retirement Specialist CV pointers.

We've curated top-notch advice from experienced Retirement Specialist individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight Relevant Skills: Be sure to highlight your skills related to retirement planning. This could include fiscal management, client communication, understanding of retirement laws and regulations, and problem-solving capabilities.

- Detail Past Experiences: Provide detailed descriptions of your prior work experiences in the retirement planning or financial services sectors. Include specific duties, achievements, and how your role contributed to the company or client's financial health.

- Showcase Certifications: If you have any certifications such as a Certified Retirement Specialist (CRS) or Certified Financial Planner (CFP), highlight these prominently on your CV. They lend credibility to your expertise and dedication to your profession.

- Use Quantifiable Achievements: Wherever possible, use numbers and facts to demonstrate your accomplishments. For instance, instead of saying 'Helped clients with retirement planning,' you could say 'Advised 200+ clients on retirement investment strategies, resulting in an average of 15% increase in their retirement savings.'

- Include Customer Service Skills: Excellent customer service skills are crucial for a Retirement Specialist position since it involves a great deal of client interaction. Mention your ability to empathize with clients, solve their issues in a timely manner, and provide clear, understandable advice.

Retirement Specialist CV Summary Examples

A Retirement Specialist CV Summary or CV Objective gives an overview of your professional experience, skills, and strengths relevant to the role. It acts as a brief introduction that immediately grabs the recruiter's attention – letting them know you're a quality candidate for the job.

By using a CV summary or CV objective, you can:

1. Tailor your application to the specific retirement specialist role.

2. Highlight your most relevant skills and accomplishments.

3. Set yourself apart from other candidates.

4. Show the employer why you’re a perfect fit for the position.

5. Increase the chance of your CV being noticed and read more thoroughly.

It's a way of selling yourself in a concise and focused manner.

For Example:

- Seasoned Retirement Specialist with over 10 years of experience in financial planning and retirement services. Expert in optimizing retirement plans and building lasting client relationships whilst displaying excellent communication skills.

- Knowledgeable Retirement Specialist, specializing in providing strategic retirement solutions for employees. Equipped with strong analytical skills and proven track record in addressing complex retirement concerns, guiding clients towards a secure future.

- Efficient Retirement Specialist with comprehensive expertise in pension management and retirement plan administration. Renowned for providing personalized financial advice and excellent customer service, leading to enhanced client satisfaction levels.

- Astute Retirement Specialist with a strong foundation in the retirement and financial services industry. Expert in innovative retirement plan designs and regulatory compliance. Renowned for exceptional attention to detail and problem-solving abilities.

- Retirement Specialist with a proactive approach in retirement planning and financial management. Known for providing excellent client service while effectively handling a range of retirement products. Skilled in creating and maintaining client relationships to ensure a secure retirement.

Build a Strong Experience Section for Your Retirement Specialist CV

1. Demonstrates Expertise: Along with your qualifications, the experience section shows your expertise in retirement planning. It provides evidence that you can do the job you’re applying for.

2. Shows Practical Skills: This section showcases your practical skills which you have gained over time. You could have gotten those skills from past workplaces, internships, or apprenticeships.

3. Proves Value: By quantifying your accomplishments in former roles, you prove that your work can bring value to the company. For example, you could mention the number of successful retirement plans you have created or the total amount of money you've saved clients in the past.

4. Enhances Credibility: Practical experience enhances the credibility of the retirement specialist. It reveals you have been in the job and know what it entails.

5. Gives a Hiring Advantage: For competitive roles, having a well-articulated experience section can set your CV apart from others. It can make you a preferable candidate for the job.

6. Gives Insight to your Career Progression: This section also tells your career story by showing your journey through different roles, tasks and achievements.

7. Relevant Skills: The experience section gives a chance to highlight relevant skills that specifically fit the retirement specialist role, even if they were acquired in a different industry or job role.

For Example:

- Served as a Retirement Specialist at XYZ Financial Inc. for over five years, providing valuable insights on retirement solutions and pension plans to clients.

- Responsible for assisting over 2,000 clients to ensure seamless transition into retirement by developing customized financial strategies.

- Worked at ABC Financial Services as a Retirement Specialist, handling complex retirement plans and delivering high-quality customer service.

- Played a significant role in nurturing client relationships, managing retirement accounts and increasing customer satisfaction by 30% at DEF Corp.

- As a Retirement Specialist at GHI Corporation, successfully administered over 500 retirement plans, including 401(k), IRA, and Roth IRA plans.

- Achieved a track record of consistently exceeding sales targets by selling retirement plans and annuities at JKL Insurance Company.

- Managed the day-to-day activities of retirement planning at MNO Corp., ensuring compliance with company policies and federal regulations.

- Specialized in providing informative seminars and individual consultations on various retirement options at PQR Financial Group.

- Developed and implemented a comprehensive retirement planning program, resulting in a 25% increase in client retention, while working as a Retirement Specialist at STU Investment Firm.

- Served as a trusted advisor to clients, assisting with enrollment processes, plan changes, and distributions in my role as a Retirement Specialist at VWX Pension Services.

Retirement Specialist CV education example

1. Bachelor's Degree: The minimum requirement for retirement specialists is usually a bachelor's degree. Fields of study may vary but finance, economics, business administration, or even mathematics can provide a solid foundation for this career.

2. Certifications: While not always mandatory, many employers prefer retirement specialists who hold a certification in the field. Popular certifications include Certified Financial Planner (CFP), Certified Employee Benefits Specialist (CEBS), or Chartered Retirement Plans Specialist (CRPS).

3. Ongoing Education: Because tax, retirement, or investment rules can frequently change, retirement specialists often need to undertake ongoing education to stay up-to-date with the latest information and regulations.

4. On-The-Job Training: Most retirement specialists receive additional training upon hiring. The duration and type of training can vary but may include a detailed overview of retirement plans, their administration, and relevant laws or regulations.

Remember that each employer may have different education requirements. Thus, it is crucial to review job postings in order to gain a good understanding of what specific roles require.

Here is an example of an experience listing suitable for a Retirement Specialist CV:

- Master of Business Administration (MBA) in Finance - Stanford University, California, 2014 - 2016

- Certified Retirement Services Professional (CRSP) - The Institute of Banking and Finance, 2013

- Bachelor of Science in Financial Planning - New York University, New York, 2008 - 2012

- Certificate in Retirement Planning - The Wharton School, University of Pennsylvania, 2011

Retirement Specialist Skills for a CV

Adding skills to a Retirement Specialist CV is important for several reasons. Firstly, it shows potential employers the candidate’s competencies and abilities to handle the duties and responsibilities of the job role. Secondly, it helps the candidate stand out from other applicants, as they showcase their unique skill set. Additionally, many employers use software that scans CVs for specific keywords, including skills, so adding them increases chances of the CV being seen. Also, the skills section can compensate for any lack of work experience. Overall, adding skills exhibits candidate’s professional expertise, increases visibility of their CV and enhances their chances of getting hired.

Soft Skills:

- Communication Skills

- Client Relationship Management

- Problem Solving Ability

- Negotiation Skills

- Interpersonal Competence

- Financial Counselling Expertise

- Planning and Organization

- Attention to Detail

- Decision-making Skills

- Empathy and Patience

- Retirement Planning

- Asset Management

- Tax Planning

- Estate Planning

- Financial Analysis

- Investment Strategies

- Risk Management

- Customer Service

- Database Management

- Regulatory Compliance

Common Mistakes to Avoid When Writing a Retirement Specialist CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Retirement Specialist CV

- A Retirement Specialist CV should highlight detailed knowledge of retirement planning, tax laws, and investment strategies. It should show your ability to assist clients in making informed decisions about their retirement funds.

- The CV should exhibit your experience in conducting retirement seminars or webinars, and creating customized retirement plans for individuals and companies.

- List any specialized certifications related to retirement planning, such as Certified Retirement Counselor (CRC) or Chartered Retirement Planning Counselor (CRPC).

- Include demonstrated experience with financial software and systems, such as CRM software, or financial planning software, to show your technical skills.

- Communication and customer service skills are also key attributes for a Retirement Specialist. Your CV should include examples of your ability to explain complex financial matters in an understandable way.

- On a Retirement Specialist CV, include sales skills, as the role often involves recommending and selling retirement products and services to clients.

- Don't forget to show your ability to maintain up-to-date knowledge of retirement plans, market trends, and federal regulations.

- If you have any experience in providing guidance on estate planning or life insurance planning, this could be a significant asset to your CV, so make sure to include it.

- The CV should also show your analytical ability to assess clients’ financial status, goals, risk tolerance and provide appropriate advice.

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.