Are you looking for a new job as a Property Claims Adjuster? A well-crafted CV is essential to showcasing your skills and experience to potential employers. Our Property Claims Adjuster CV Example is designed to provide you with inspiration and guidance as you create your own professional document. Whether you are an experienced claims adjuster or just starting out in the field, our example can help you highlight your qualifications and stand out in the job application process.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Property Claims Adjuster do?

A Property Claims Adjuster evaluates claims for damages to homes, buildings, and other property. They investigate the cause of the damage, review policy coverage, and determine the appropriate amount of compensation to be awarded. They may also inspect damaged property, interview witnesses, and negotiate settlements with policyholders and other involved parties. Additionally, Property Claims Adjusters may also prepare reports and document their findings for insurance companies.

- Certified Nurse Assistant CV Sample

- Claims Adjuster CV Sample

- Lease Administrator CV Sample

- Provider Relations Representative CV Sample

- Patient Care Associate CV Sample

- Social Service CV Sample

- CRNA CV Sample

- Clinical Data Coordinator CV Sample

- Phlebotomy Technician CV Sample

- Patient Access Manager CV Sample

- Certified Nursing Assistant CV Sample

- Patient Access Specialist CV Sample

- Patient Service Specialist CV Sample

- Dietitian CV Sample

- Nurse CV Sample

- Hearing Aid Specialist CV Sample

- Orthodontic Assistant CV Sample

- Regulatory Affairs Associate CV Sample

- Care Provider CV Sample

- Head Nurse CV Sample

What are some responsibilities of a Property Claims Adjuster?

- Investigate and evaluate property damage claims

- Visit and inspect properties to assess the extent of damage

- Interview witnesses and claimants to gather information

- Review policy coverage and determine the validity of claims

- Negotiate settlements with claimants, contractors, and other stakeholders

- Prepare and file reports documenting findings and recommendations

- Stay updated on industry regulations and best practices

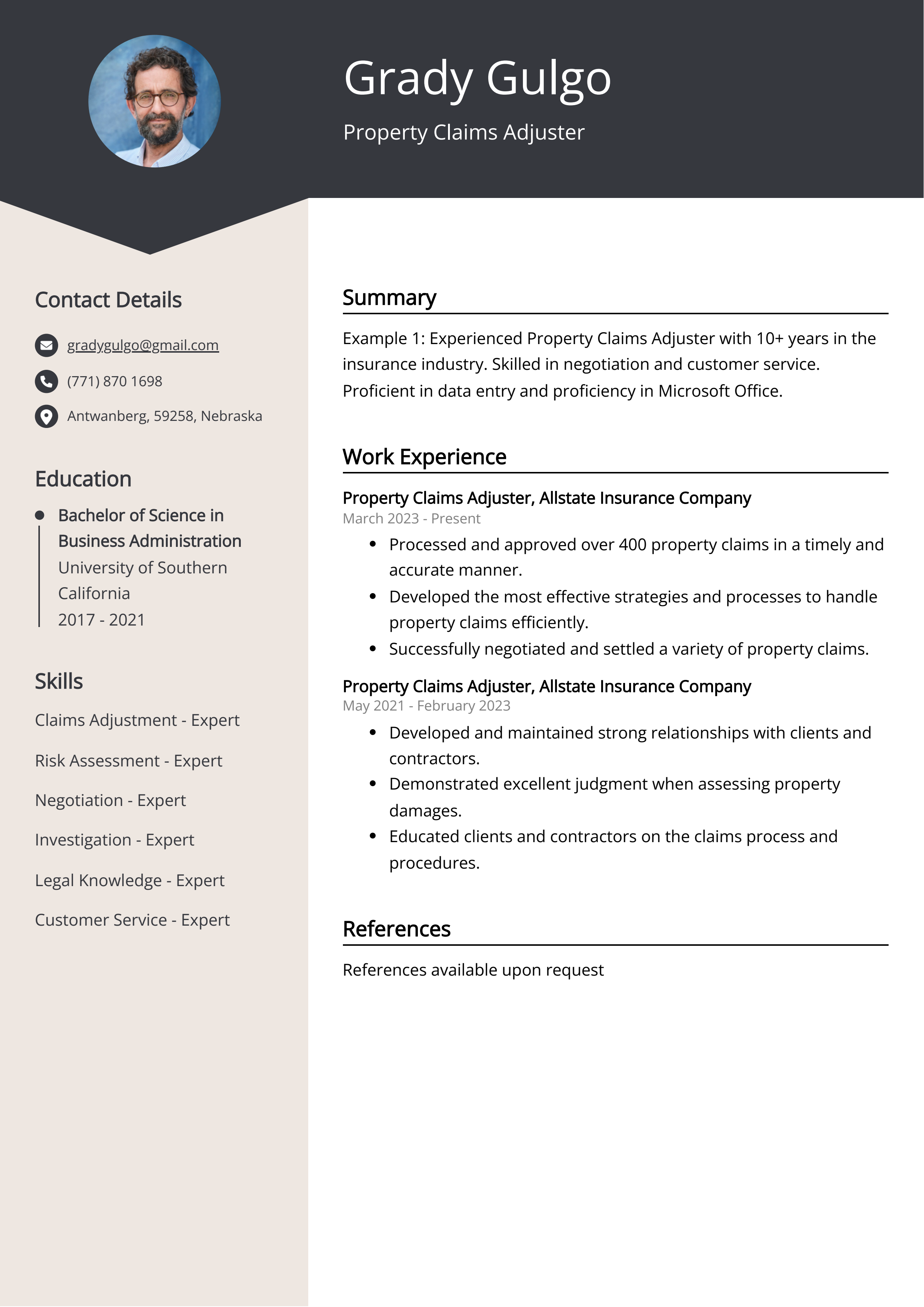

Sample Property Claims Adjuster CV for Inspiration

Name: John Smith

Email: john.smith@email.com

Phone: 123-456-7890

Summary: John is an experienced Property Claims Adjuster with over 8 years of experience in assessing and processing property claims. He has a proven track record of providing exceptional customer service while ensuring accurate and timely claim settlements.

Work Experience:

- Senior Property Claims Adjuster, ABC Insurance Company (2016- Present)

- Assessed and evaluated property damage claims, conducted site inspections, and negotiated settlements with customers.

- Managed a team of claims professionals and provided training and mentorship to junior adjusters.

- Utilized industry software to accurately estimate repair costs and make fair claim settlements.

- Property Claims Adjuster, XYZ Insurance Agency (2012-2016)

- Investigated property damage claims, analyzed insurance policies, and determined coverage eligibility.

- Worked closely with policyholders, contractors, and vendors to ensure seamless claims processing and resolution.

- Developed and maintained relationships with local repair shops and contractors to facilitate timely inspections and repairs.

Education:

- Bachelor's Degree in Business Administration, University of ABC (2012)

- Associate's Degree in Insurance Claims Processing, Community College XYZ (2008)

Skills:

- Exceptional customer service and interpersonal skills

- Proficient in insurance claim processing software

- Strong negotiation and conflict resolution abilities

- Excellent time management and organizational skills

Certifications:

- Licensed Property & Casualty Insurance Adjuster (State ABC)

- Certified Claims Professional (CCP)

Languages: Fluent in English and Spanish

CV tips for Property Claims Adjuster

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Property Claims Adjuster CV pointers.

We've curated top-notch advice from experienced Property Claims Adjuster individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

```html

- Highlight your experience in handling property claims effectively and efficiently.

- Showcase your knowledge of insurance policies, laws, and regulations related to property claims.

- Provide specific examples of successful property claim settlements and negotiations.

- Emphasize your strong communication and negotiation skills when dealing with clients, contractors, and other stakeholders.

- Demonstrate your ability to use relevant software and technology for claims processing and documentation.

Property Claims Adjuster CV Summary Examples

A Property Claims Adjuster CV Summary or CV Objective is essential because it provides a brief overview of the candidate's skills, experience, and career goals. This helps hiring managers quickly understand the candidate's suitability for the role and decide whether or not to continue reading the rest of the CV. By highlighting key qualifications and career aspirations in a concise manner, the CV Summary or Objective can grab the attention of potential employers and increase the candidate's chances of landing an interview.

For Example:

- Experienced Property Claims Adjuster with 8+ years of experience in handling and adjusting property damage claims for residential and commercial properties.

- Demonstrated ability to investigate and evaluate claims, negotiate settlements, and communicate effectively with clients and other stakeholders.

- Proficient in utilizing industry-specific software and technology to process claims and maintain accurate documentation.

- Strong knowledge of insurance policies, regulations, and industry best practices, ensuring compliance and delivering fair and efficient claims resolutions.

- Proven track record of achieving high customer satisfaction ratings and consistently meeting or exceeding performance targets.

Build a Strong Experience Section for Your Property Claims Adjuster CV

A strong experience section is essential for a Property Claims Adjuster CV because it demonstrates a candidate's expertise in assessing property damage and determining insurance claims. It showcases their ability to efficiently handle claims, negotiate settlements, and communicate with clients and other parties involved. A robust experience section can set a candidate apart from others and show potential employers that they have the skills and knowledge necessary to excel in the role.

For Example:

- Conducted on-site inspections of properties to assess damage and determine coverage eligibility

- Negotiated settlements with policyholders and third-party claimants for property damage claims

- Reviewed and analyzed documentation, including photos, repair estimates, and policy information

- Communicated with internal teams, insured parties, and external vendors to facilitate claim resolution

- Managed a caseload of property claims, ensuring timely and accurate processing

- Investigated fraudulent claims and implemented measures to detect and prevent future occurrences

- Collaborated with legal professionals to handle complex property damage disputes and litigation

- Provided exceptional customer service by addressing inquiries and concerns related to property claims

- Trained new team members on claim handling processes and best practices

- Utilized claim management software to document and track claim progress and updates

Property Claims Adjuster CV education example

A Property Claims Adjuster typically needs a high school diploma or equivalent, and some employers may prefer candidates with an associate's or bachelor's degree in a related field such as insurance, business, or finance. Additionally, completing coursework or certification in insurance, claims adjustment, or a related area may be beneficial. On-the-job training and experience are also important for this role.

Here is an example of an experience listing suitable for a Property Claims Adjuster CV:

- Bachelor's degree in Business Administration

- Certification in Property and Casualty Insurance

- Training in negotiation and settlement of claims

- Continuing education in property insurance laws and regulations

Property Claims Adjuster Skills for a CV

It is important to include skills for a Property Claims Adjuster CV in order to showcase the applicant's abilities and qualifications for the position. Including relevant skills demonstrates the candidate's knowledge and expertise in handling property insurance claims, which can help them stand out to potential employers. Additionally, listing specific skills relevant to the role can help match the candidate with the right job opportunities.

Soft Skills:

- Communication Skills

- Customer Service

- Problem-Solving

- Negotiation Skills

- Empathy

- Attention to Detail

- Time Management

- Adaptability

- Conflict Resolution

- Teamwork

- Damage assessment

- Claims negotiation

- Policy analysis

- Construction knowledge

- Estimating software

- Property inspection

- Loss evaluation

- Legal regulations

- Report writing

- Customer service

Common Mistakes to Avoid When Writing a Property Claims Adjuster CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Property Claims Adjuster CV

- Highlight relevant experience and skills in property claims adjusting

- Showcase accomplishments in settling claims accurately and efficiently

- Emphasize knowledge of insurance policies and regulations

- Demonstrate strong communication and negotiation skills

- Show ability to handle high volume of claims and work well under pressure

- Include any relevant certifications or specialized training in the field