This article provides a comprehensive guide to writing a Mortgage Processor CV. It outlines best practices for writing a CV, and includes a comprehensive example that provides guidance on format and content. By following the tips and example presented here, you will be well-positioned to create a CV that will stand out to employers and increase your chances of getting the job.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does a Mortgage Processor do?

A mortgage processor is responsible for completing the administrative tasks involved in processing a mortgage loan. This includes verifying and reviewing customer information, ordering credit reports, verifying that all of the necessary documents have been collected, and preparing the loan package for submission to underwriting. The mortgage processor must keep accurate records, review loan contracts and communicate with customers, lenders and other interested parties throughout the process.

- Loss Prevention Specialist CV Sample

- Management Accountant CV Sample

- Mortgage Assistant CV Sample

- Mortgage Closer CV Sample

- Mortgage Consultant CV Sample

- Mortgage Loan Closer CV Sample

- Mortgage Loan Officer CV Sample

- Mortgage Loan Underwriter CV Sample

- Mortgage Originator CV Sample

- Mortgage Processor CV Sample

- Mortgage Specialist CV Sample

- Mortgage Underwriter CV Sample

- Pawnbroker CV Sample

- Payment Processor CV Sample

- Payroll CV Sample

- Payroll Analyst CV Sample

- Payroll Associate CV Sample

- Payroll Consultant CV Sample

- Payroll Coordinator CV Sample

- Payroll Processor CV Sample

What are some responsibilities of a Mortgage Processor?

- Verify and collect all loan documentation necessary to complete loan files.

- Review loan documents for accuracy and completeness.

- Order and review third-party documentation, including appraisal, title and credit reports.

- Calculate income, debt and assets to determine loan eligibility.

- Identify and resolve any discrepancies in the file.

- Maintain communication with loan officers, customers and other relevant parties throughout the loan process.

- Adhere to all applicable laws and regulations.

- Submit complete and accurate loan packages to underwriting.

- Provide customer service to loan applicants.

- Keep accurate records and documentation of all loan activities.

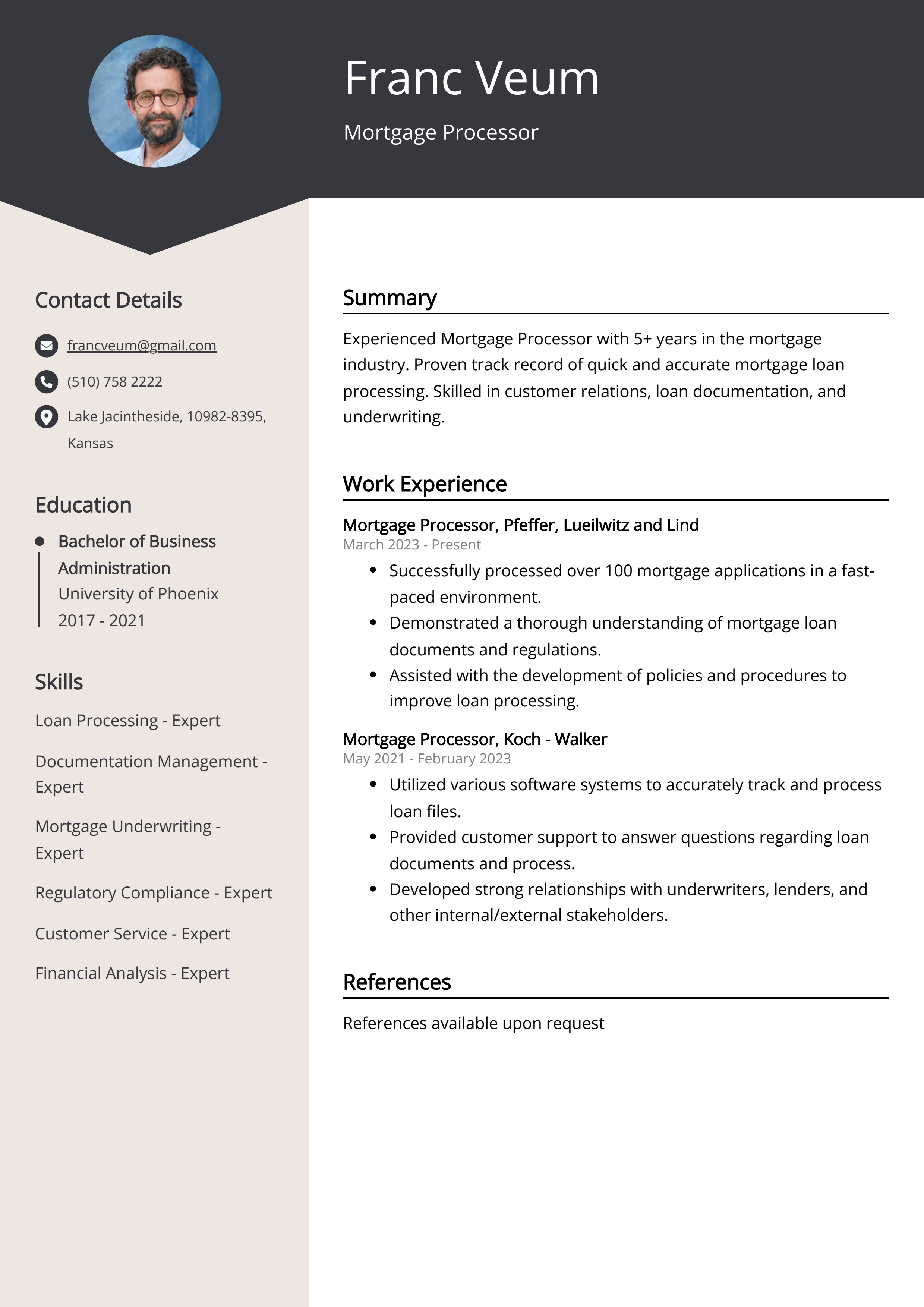

Sample Mortgage Processor CV for Inspiration

Personal Details:

Name: Joe Smith

Address: 123 Main Street, City, State, Zip Code

Phone: 123-456-7890

Email: joesmith@gmail.com

Summary:

Joe Smith is an experienced Mortgage Processor with 10+ years in the banking industry. He has a strong understanding of the mortgage process and is proficient in analyzing loan documents and auditing loan files. He is certified in mortgage processing and has excellent customer service, communication, and problem-solving skills.

Work Experience:

- Banker, ABC Bank, City, State (2018-Present)

- Process loan applications, verify credit, and review documents.

- Review and verify loan documents to ensure accuracy.

- Assist customers with loan application process.

- Maintain detailed records of customer accounts.

- Mortgage Processor, XYZ Bank, City, State (2010-2018)

- Analyze financial data to determine loan eligibility.

- Review and process mortgage applications.

- Communicate with customers to verify information and documents.

- Audit loan files to ensure accuracy and compliance.

Education:

Bachelor of Science in Business Administration, ABC University, City, State (2006-2010)

Skills:

- Customer Service

- Mortgage Processing

- Financial Analysis

- Auditing

- Problem Solving

- Communication

Certifications:

Mortgage Processor Certification, XYZ Institute, City, State (2010)

Languages:

English (Native)

CV tips for Mortgage Processor

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Mortgage Processor CV pointers.

We've curated top-notch advice from experienced Mortgage Processor individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Highlight any experience with mortgage processing software and technology.

- Describe your understanding of financial regulations and laws that apply to mortgage processing.

- Demonstrate your organizational skills by providing a clear list of achievements.

- Provide specific examples of how you have improved operations, such as automation or streamlining processes.

- Include any certifications or licenses related to mortgage processing.

Mortgage Processor CV Summary Examples

Mortgage Processor CV Summary or CV Objective can be very helpful for applicants looking to enter the mortgage processing field. By outlining their professional background, experience, skills, and qualifications, these summaries or objectives can give potential employers a better idea of the applicant's capabilities and potential fit for the job. Additionally, they can also showcase the applicant's unique strengths and abilities that may make them stand out from other applicants.

For Example:

- Motivated Mortgage Processor with 5+ years of experience in loan origination and underwriting.

- Proven track record of successfully closing more than 250 loans in the past year.

- Well-versed in loan processing, from pre-qualification to loan closing.

- Excellent communication skills to effectively work with lenders, borrowers, and real estate agents.

- Proficient in FHA, VA, and conventional loan products.

Build a Strong Experience Section for Your Mortgage Processor CV

Building a strong experience section for a mortgage processor CV is essential, because it gives recruiters and hiring managers an opportunity to get a better understanding of your skills, qualifications, and capabilities as a mortgage processor. This section should include a list of your previous job titles and job descriptions, as well as any relevant certifications or awards you have earned. Additionally, it should highlight any special projects you have completed, as well as any unique skills you possess that could be beneficial to the organization you are applying to. By providing a comprehensive overview of your experience and qualifications, you can demonstrate to employers why you would be the best candidate for the job.

For Example:

- Processed mortgage applications for a variety of clients for over 3 years.

- Reviewed loan documents for accuracy and completeness.

- Provided customer service to mortgage applicants and loan officers throughout the loan process.

- Assisted with loan origination, underwriting and closing.

- Maintained accurate and complete loan files.

- Performed in-depth analysis of customer financial information.

- Adhered to all regulatory and compliance requirements.

- Worked with a team of loan processors to ensure timely processing of loans.

- Processed a high volume of loans on a daily basis.

- Provided assistance to loan officers in obtaining loan documents and verifying information.

Mortgage Processor CV education example

A mortgage processor typically needs at least a high school diploma or equivalent, although some employers prefer applicants with an associate's or bachelor's degree in finance or a related field. Mortgage processors must also have strong organizational and time-management skills and be able to work well under pressure to meet deadlines. In addition, they must be knowledgeable about the Federal Truth in Lending Act and other laws related to mortgage loan processing.

Here is an example of an experience listing suitable for a Mortgage Processor CV:

- Bachelor's Degree in Finance from University of XYZ, 2016

- Associate's Degree in Business Administration from ABC College, 2014

- Certified Mortgage Processor from XYZ Training Institute, 2018

Mortgage Processor Skills for a CV

It is important to add skills for a Mortgage Processor CV because it gives potential employers an indication of the abilities and experience the applicant has. It also allows employers to quickly assess whether the applicant is the right fit for the job. Skills can include knowledge of loan processing, customer service, financial analysis, and understanding of regulatory and compliance requirements within the mortgage industry.

Soft Skills:

- Communication

- Organization

- Problem-solving

- Time-management

- Attention-to-detail

- Adaptability

- Conflict-resolution

- Interpersonal

- Multi-tasking

- Leadership

- Loan Origination

- Financial Analysis

- Risk Assessment

- Credit Evaluation

- Document Verification

- Regulatory Compliance

- Process Automation

- Data Entry

- Customer Service

- Time Management

Common Mistakes to Avoid When Writing a Mortgage Processor CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Mortgage Processor CV

- Highlight all relevant experience in the mortgage industry

- Detail proficiency in all aspects of loan processing

- Include details of any awards or certifications

- Mention any special software knowledge

- Demonstrate excellent customer service skills

- Showcase strong organizational and communication skills

- Detail any knowledge of compliance and regulations

- Highlight ability to work efficiently under pressure

Embark on your job search journey with confidence. Secure your next position by presenting your best self, all with the assistance of Resumaker.ai.