Looking for a new job in the insurance industry? A strong CV is essential to showcase your skills, experience, and qualifications. Our Insurance CV Example article provides a detailed template and tips to help you create a standout resume that will impress potential employers. Whether you're a seasoned insurance professional or just starting out in the industry, our example CV will guide you in crafting a compelling document to land your next job.

We will cover:

- How to write a CV, no matter your industry or job title.

- What to put on a CV to stand out.

- The top skills employers from every industry want to see.

- How to build a CV fast with our professional CV Builder.

- What a CV template is, and why you should use it.

What does an Insurance do?

Insurance is a financial product that provides protection against potential future risks. By paying a premium, individuals or businesses can transfer the risk of financial loss to an insurance company. In the event of an unforeseen event such as an accident, illness, natural disaster, or death, the insurance company will provide financial compensation or coverage for the related expenses. This helps to provide peace of mind and protection for the insured party.

- Ultrasound Technician CV Sample

- Head Nurse CV Sample

- Pharmacy Assistant CV Sample

- Pension Administrator CV Sample

- Licensed Practical Nurse CV Sample

- Optician CV Sample

- Specimen Processor CV Sample

- Care Provider CV Sample

- Diagnostic Medical Sonographer CV Sample

- Chief Investment Officer CV Sample

- Clinical Trial Associate CV Sample

- Infusion Nurse CV Sample

- Hospital Administrator CV Sample

- Rehabilitation Specialist CV Sample

- Clinical Research Manager CV Sample

- Registered Dietitian CV Sample

- Family Nurse Practitioner CV Sample

- Dialysis Rn CV Sample

- Care Manager CV Sample

- Medical Consultant CV Sample

What are some responsibilities of an Insurance?

- Evaluating and assessing risk factors for potential clients

- Developing and implementing insurance policies

- Processing and investigating insurance claims

- Advising clients on insurance coverage options

- Providing excellent customer service to clients

- Staying up-to-date on industry regulations and best practices

- Calculating insurance premiums and setting appropriate rates

- Negotiating with insurance underwriters on behalf of clients

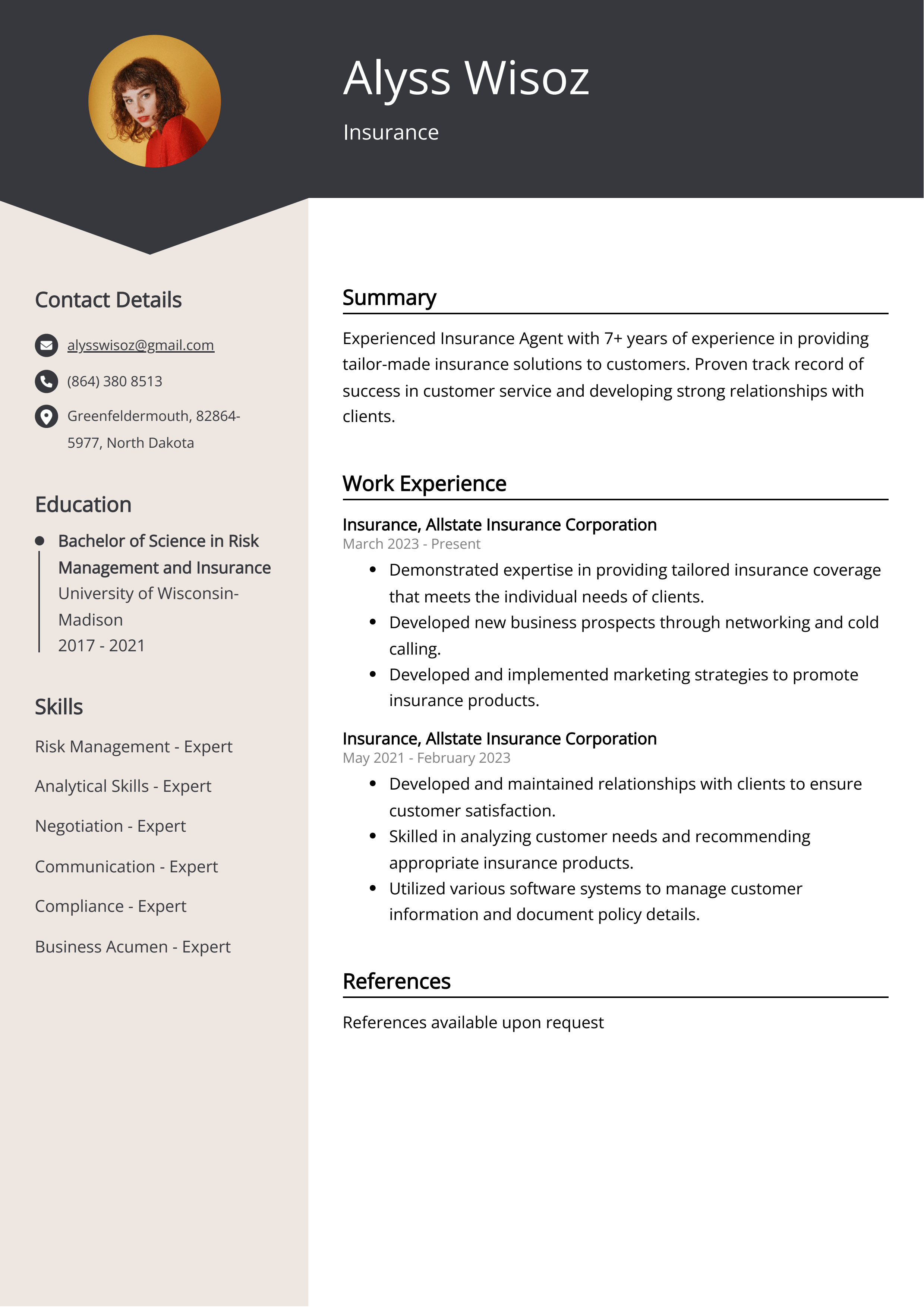

Sample Insurance CV for Inspiration

Insurance CV Personal Information

Name: John Smith

Date of Birth: January 1, 1985

Email: johnsmith@email.com

Phone: 123-456-7890

Address: 123 Main Street, City, State, Zip Code

SummaryJohn Smith is a dedicated and results-driven Insurance professional with 10 years of experience in the industry. He is detail-oriented and has a strong understanding of risk management and underwriting practices.

Work Experience- Insurance Agent at ABC Insurance Company (2016-present)

Responsibilities:- Develop and maintain client relationships

- Provide insurance solutions tailored to individual client needs

- Negotiate and finalize insurance contracts

- Underwriter at XYZ Underwriting Agency (2012-2016)

Responsibilities:- Analyze and assess risk in insurance applications

- Make underwriting decisions to accept, reject, or modify policies

- Ensure compliance with underwriting guidelines and regulations

- Bachelor's Degree in Business Administration - University of State (2008-2012)

- Insurance Certification - Insurance Institute (2012)

- Proficient in insurance underwriting and risk management

- Excellent communication and negotiation skills

- Strong understanding of insurance policies and regulations

- Ability to analyze and assess complex data

- Chartered Property Casualty Underwriter (CPCU)

- Licensed Insurance Agent in State

- English (Native)

- Spanish (Proficient)

CV tips for Insurance

Crafting an impeccable CV that kickstarts your career is a challenging endeavor. While adhering to fundamental writing principles is beneficial, seeking guidance customized for your unique job pursuit is equally prudent. As a newcomer to the professional realm, you require Insurance CV pointers.

We've curated top-notch advice from experienced Insurance individuals. Explore their insights to streamline your writing journey and enhance the likelihood of fashioning a CV that captivates potential employers' attention.

- Be specific about your insurance industry experience and any related qualifications or certifications.

- Showcase your knowledge of insurance products and services, as well as your understanding of insurance regulations and laws.

- Highlight your sales, negotiation, and communication skills, as well as your ability to build and maintain client relationships.

- Include any relevant software or technology skills, especially those related to insurance industry tools and systems.

- Demonstrate your commitment to professional development and ongoing education within the insurance industry.

Insurance CV Summary Examples

A well-crafted Insurance CV summary or objective can help to grab the attention of potential employers and highlight your relevant skills and experience. It provides a quick snapshot of your key qualifications, allowing hiring managers to quickly assess whether you are a good fit for the position. Additionally, it can help to set you apart from other candidates and showcase your unique strengths and career goals in the insurance industry.

For Example:

- Experienced insurance professional with 10+ years in the industry

- Proven track record of meeting and exceeding sales targets

- Strong knowledge of various insurance products and policies

- Excellent customer service and relationship-building skills

- Proficient in using insurance industry software and tools

Build a Strong Experience Section for Your Insurance CV

Building a strong experience section for an insurance CV is essential to showcase your relevant skills, industry knowledge, and accomplishments. It helps demonstrate your expertise in underwriting, claims handling, risk assessment, and customer service. A well-crafted experience section also highlights your track record of success and sets you apart from other applicants. It is crucial for impressing potential employers and securing job interviews in the competitive insurance industry.

For Example:

- Managed and processed insurance claims for a diverse range of clients.

- Assisted in underwriting and risk assessment for new insurance policies.

- Collaborated with agents and brokers to provide efficient and timely customer service.

- Analyzed and interpreted policy language and coverage to respond to customer inquiries.

- Implemented and enforced insurance company policies and procedures to ensure compliance with regulations.

- Developed and maintained strong relationships with clients to ensure customer satisfaction and retention.

- Conducted research and analysis to identify and mitigate potential risks and losses.

- Participated in the development and implementation of new insurance products and services.

- Examined and evaluated insurance applications and documentation to determine coverage and eligibility.

- Prepared and presented insurance reports and analysis to management and stakeholders.

Insurance CV education example

An insurance agent typically needs a high school diploma or its equivalent, although some may require a bachelor's degree. They also need to obtain an insurance license by passing a state-mandated exam. Continuing education is often required to maintain licensure and stay up-to-date on industry developments. Specialized training and certifications in areas such as underwriting, risk management, or specific types of insurance may also be beneficial for career advancement.

Here is an example of an experience listing suitable for a Insurance CV:

- Bachelor of Science in Business Administration - University of XYZ

- Master of Business Administration in Insurance and Risk Management - University of ABC

Insurance Skills for a CV

It is important to add skills to an insurance CV because it demonstrates to potential employers that you have the necessary abilities to excel in the insurance industry. Including relevant skills on your CV will show that you have the expertise and knowledge needed to effectively handle insurance claims, assess risks, communicate with clients, and analyze data. This can make you a more attractive candidate for insurance positions.

Soft Skills:

- Communication

- Problem-solving

- Customer service

- Negotiation

- Teamwork

- Adaptability

- Time management

- Attention to detail

- Organization

- Empathy

- Underwriting analysis

- Claim processing

- Actuarial modeling

- Risk assessment

- Policy coding

- Loss prevention

- Statistical analysis

- Legal compliance

- Customer service

- Data management

Common Mistakes to Avoid When Writing an Insurance CV

In today's competitive job market, an average of 180 applications floods employers' inboxes for each vacant position. To streamline this influx of CVs, companies frequently employ automated applicant tracking systems that weed out less qualified candidates. If your CV manages to surpass these digital gatekeepers, it must still captivate the attention of the recruiter or hiring manager. Given the sheer volume of applications, a mere 5 seconds is typically allocated to each CV before a decision is reached. With this in mind, it's crucial to eliminate any extraneous information that might relegate your application to the discard pile. To ensure your CV shines, consult the list below for elements to avoid including in your job application.

- Skipping the cover letter: A well-crafted cover letter is an opportunity to showcase your suitability for the role and express your enthusiasm for it.

- Excessive jargon: CVs laden with technical terms can alienate hiring managers who lack specialized knowledge.

- Neglecting vital details: Incorporate your contact information, education, work history, and pertinent skills and experiences.

- Relying on generic templates: Tailoring your CV to the specific job exhibits your commitment to the position and company.

- Errors in spelling and grammar: Proofreading is essential to eliminate typos, spelling errors, and grammatical blunders.

- Overemphasizing duties: Highlight accomplishments to underline your candidacy's value.

- Sharing personal information: Steer clear of revealing personal details like age, marital status, or religious affiliations.

Key takeaways for a Insurance CV

- Highlight relevant experience and skills in the insurance industry

- Showcase achievements and key contributions in previous roles

- Emphasize certifications and relevant education

- Demonstrate strong attention to detail and analytical skills

- Include specific examples of successful client interactions and problem-solving

- Show evidence of sales or negotiation abilities