Are you looking for a job as an Insurance Clerk? With this guide, you will learn how to craft a compelling cover letter that will get you noticed and help you stand out from the competition. You'll find tips on how to structure your letter, what to include, and advice on how to make the most of your skills and experience.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder.

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Customer Support Representative Cover Letter Sample

- Dispatch Clerk Cover Letter Sample

- Front Office Receptionist Cover Letter Sample

- Document Clerk Cover Letter Sample

- Supply Manager Cover Letter Sample

- Call Center Agent Cover Letter Sample

- Front Office Coordinator Cover Letter Sample

- Customer Support Manager Cover Letter Sample

- Logistics Administrator Cover Letter Sample

- Portfolio Administrator Cover Letter Sample

- Word Processor Cover Letter Sample

- Reimbursement Specialist Cover Letter Sample

- Administrative Coordinator Cover Letter Sample

- Administrative Specialist Cover Letter Sample

- Fleet Administrator Cover Letter Sample

- Customer Service Clerk Cover Letter Sample

- Administrative Office Manager Cover Letter Sample

- Administrative Secretary Cover Letter Sample

- Business Assistant Cover Letter Sample

- Clerk Typist Cover Letter Sample

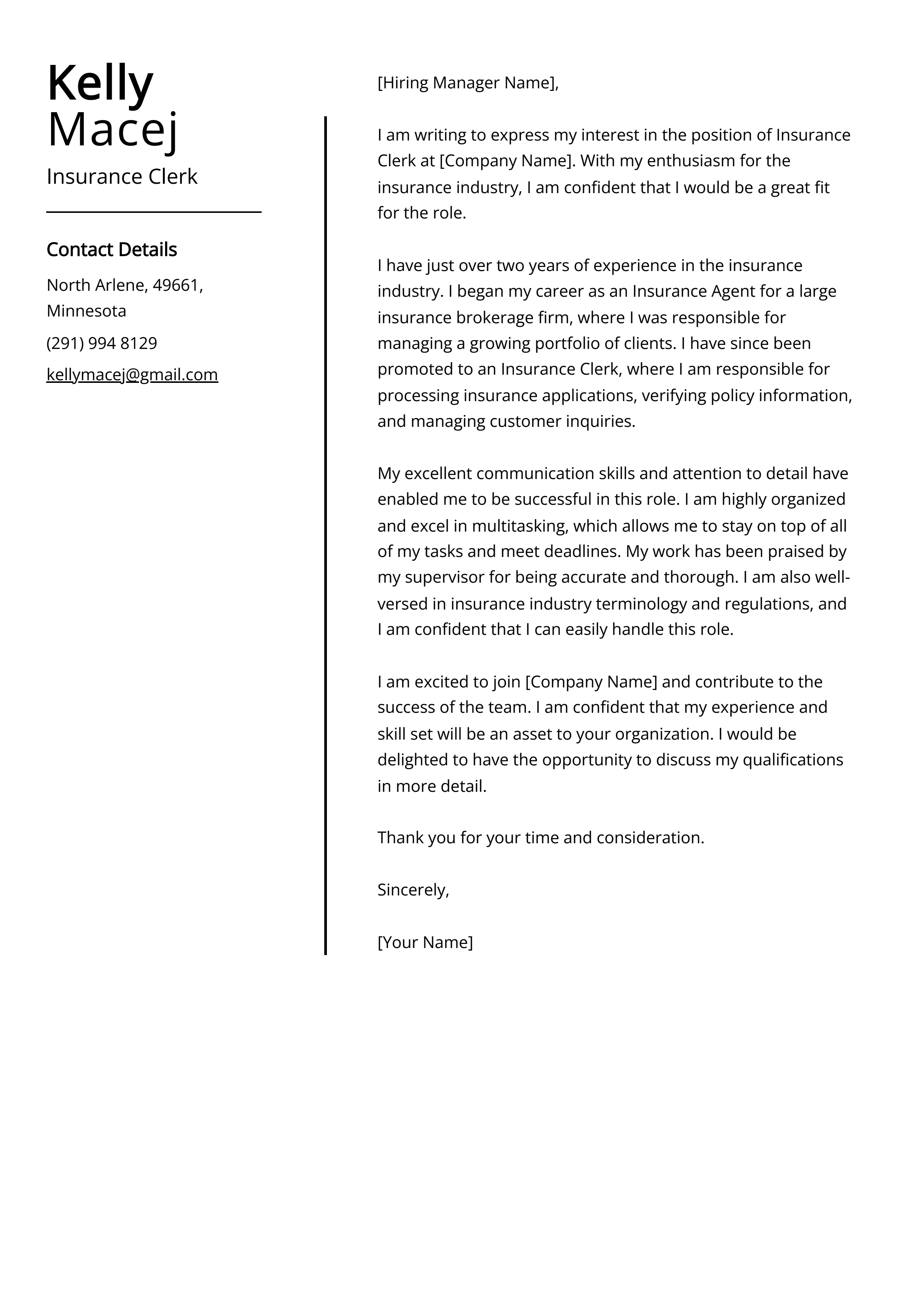

Insurance Clerk Cover Letter Sample

Dear [Hiring Manager],

I am writing in response to your job listing for an Insurance Clerk at [Name of Company]. With my experience in customer service, insurance administration, and data entry, I am confident that I would be an excellent addition to your team.

I have over three years of experience as an Insurance Clerk, including two years at [Name of Company]. I have a deep understanding of both commercial and personal insurance policies and am familiar with a variety of insurance software packages. I am also adept at quickly learning new software, as demonstrated by my ability to seamlessly transition to a new program when my previous employer switched to a new system.

In my current role, I am responsible for data entry and analysis, customer service, and policy administration. On a daily basis, I enter policy information into the system, quickly and accurately. I also provide customer service to policyholders, answering questions, processing payments, and providing general information about their policy. Additionally, I am responsible for verifying and reconciling policy information, ensuring accuracy in the system.

I am highly organized and detail-oriented, and I take pride in my accuracy and efficiency. I am also a strong communicator and I have excellent customer service skills. I am confident that I can bring these valuable skills to your team.

I am excited to learn more about this opportunity and I look forward to discussing my qualifications in more detail. Please feel free to contact me at any time to arrange an interview. Thank you for your time and consideration.

Sincerely,

[Your Name]

Why Do you Need a Insurance Clerk Cover Letter?

- A Insurance Clerk cover letter is necessary to showcase your unique skills and qualifications that make you the ideal candidate for the job.

- It is also important to demonstrate your enthusiasm for and understanding of the job and its requirements.

- Your cover letter should also include details about your professional experience and any special qualifications you possess that could make you a valuable asset to the company.

- Your cover letter should demonstrate your communication skills and your ability to work well with others.

- Finally, your cover letter should provide a brief summary of why you think you are the best candidate for the job.

A Few Important Rules To Keep In Mind

- Start your letter with a formal salutation, such as ‘Dear [Hiring Manager’s Name]’.

- State the exact job you are applying for in the first paragraph.

- In the next paragraph, explain why you’re the best candidate for the position.

- Highlight your relevant experience and qualifications.

- Include a few of your best professional achievements.

- Express your enthusiasm for the company and the role.

- Close your letter with a call to action, such as asking for an interview.

- Proofread your letter for any spelling or grammar errors.

- Include your contact details at the end of the cover letter.

What's The Best Structure For Insurance Clerk Cover Letters?

After creating an impressive Insurance Clerk resume, the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Insurance Clerk cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Insurance Clerk Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

Dear Hiring Manager,

I am writing to express my interest in the Insurance Clerk position at ABC Insurance. With my extensive experience in customer service and data entry, I am confident that I would be a great asset to the team.

I have worked as an insurance clerk for the past five years, where I have acquired a deep understanding of the industry, as well as the associated policies and procedures. I am adept in handling customer inquiries and responding to them in a timely and professional manner. Moreover, I am experienced in performing data entry tasks with utmost accuracy and speed.

In addition to my experience, I also possess excellent organizational and communication skills. My attention to detail, combined with my strong work ethic, allows me to provide the highest level of service to customers. I also have a proven track record of maintaining accurate records and ensuring deadlines are met.

I am confident that I am the ideal candidate for this position. I am eager to apply my knowledge and skills to help ABC Insurance succeed. I look forward to discussing my qualifications in greater detail during an interview.

Thank you for your time and consideration.

Sincerely,

Your Name

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing an Insurance Clerk Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to customize the letter to the position. Each cover letter should be tailored to the specific job you are applying for.

- Using too much industry jargon or acronyms. It’s important that the letter is easily understandable to the reader.

- Not proofreading the letter. Typos and grammatical errors can make you appear careless and unprofessional.

- Not including your contact information. Make sure to include your name, phone number, and email address.

- Including irrelevant information. Keep the letter focused on the qualifications that are applicable to the position.

- Being too generic and not demonstrating interest in the company. Show that you have taken the time to learn about the company and why you are a good fit.

- Using a generic salutation. Make sure to address the letter to the specific person who will be reading it.

Key Takeaways For an Insurance Clerk Cover Letter

- Be sure to include your experience with customer service and administrative tasks.

- Highlight any relevant insurance industry knowledge you may have.

- Emphasize your organizational skills and ability to maintain accurate records.

- Explain why you are interested in a career as an Insurance Clerk.

- Mention any relevant certifications or qualifications that you possess.

- Demonstrate your ability to work in a fast-paced environment.

- Showcase your attention to detail when dealing with customers.

- Provide examples of your success in customer service roles.

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.